Neopentyl Glycol Market Outlook:

Neopentyl Glycol Market size was valued at USD 1.62 billion in 2025 and is set to exceed USD 2.77 billion by 2035, registering over 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of neopentyl glycol is estimated at USD 1.7 billion.

The neopentyl glycol market is expanding mainly due to rising demand from several industries, including transportation, building & construction, and the automotive sector. This substance has a high oxidation resistance and is non-polar. Also, increased demand for sophisticated sealants and adhesives with low volatile organic compounds (VOCs) and easy functionality, economic growth by regional authorities, rising housing subsidies, and the manufacture of various industrial chemicals are some other factors escalating the neopentyl glycol (NPG) market growth.

BASF SE is expanding its production capacity for NPG to meet growing demand across various sectors. In 2022, BASF announced plans for a new NPG factory at its Zhanjiang Verbund location in China, set to produce 80,000 metric tons annually, increasing its global NPG capacity from 255,000 to 335,000 metric tons by 2025. Additionally, BASF expanded its NPG factory in Ludwigshafen, Germany, by 10,000 metric tons, allowing its combined production across several locations to reach 215,000 metric tons. The company also increased NPG production capacity in Nanjing by 40,000 tons, available from 2020. Notably, BASF offers a ZeroPCF form of NPG, indicating a net-zero Product Carbon Footprint.

Key Neopentyl Glycol Market Insights Summary:

Regional Highlights:

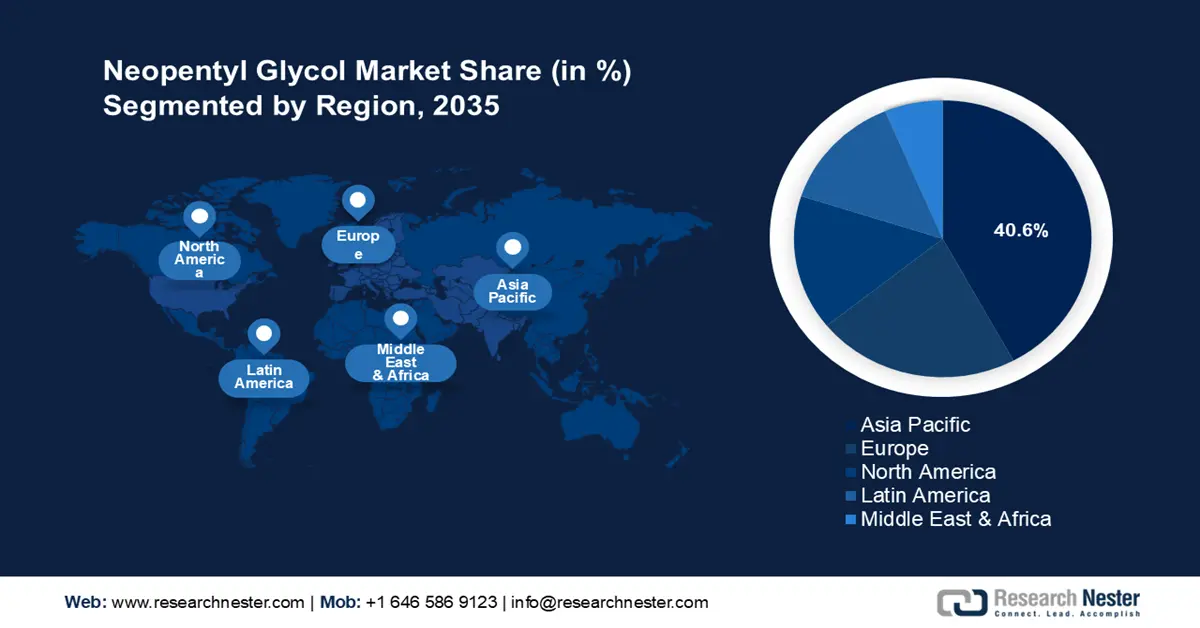

- Asia Pacific dominates the Neopentyl Glycol Market with a 40.6% share, fueled by growing demand for eco-friendly coatings and rapid industrialization, supporting strong growth through 2026–2035.

- Europe's Neopentyl Glycol Market is expected to maintain a significant share by 2035, attributed to expanding powder-coating demand and rising production capacity.

Segment Insights:

- The Flakes segment is anticipated to command a 71.80% market share by 2035, propelled by the increasing need for premium adhesives and sealants in construction and automotive sectors.

- The automotive segment of the Neopentyl Glycol Market is poised for substantial share from 2026-2035, fueled by the sector’s growing need for durable, lightweight materials and advanced coatings to improve fuel efficiency and reduce emissions.

Key Growth Trends:

- Emerging as an alternative solvent

- Advanced synthesis and expanding applications

Major Challenges:

- Fluctuation in raw material prices

- Growing environmental concerns

- Key Players: BASF SE, Eastman Chemical Company, LG Chem, OXEA GmbH, Perstorp GmbH, Poliloli S.p.A., Oleon N.V., Shandong Dongchen New Technology Co., Ltd., Zouping Fenlian Biotech Co., Ltd., Hefei TNJ Chemical Industry Co., Ltd..

Global Neopentyl Glycol Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.62 billion

- 2026 Market Size: USD 1.7 billion

- Projected Market Size: USD 2.77 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, India, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

Neopentyl Glycol Market Growth Drivers and Challenges:

Growth Drivers

- Emerging as an alternative solvent: The increase in global plastic production and waste has prompted the search for recyclable methods, with poly (ethylene terephthalate) (PET) being a prominent recyclable polymer due to its lightweight, transparency, and mechanical strength. According to the Organization for Economic Co-operation and Development (OECD), plastics accounted for 3.4% of global greenhouse gas emissions and the world's plastics production rose to 460 million tons between 2000 and 2019. Additionally, the amount of plastic waste generated globally has more than doubled, amounting to 353 million tons.

Most waste PET is typically incinerated or sent to landfills, with a significant amount ending in oceans. While mechanical recycling is common, it can degrade product quality, and more complex waste streams are challenging to recycle. Recent studies by the Royal Society of Chemistry have explored chemical recycling technologies, highlighting NPG as an effective glycolysis agent that can depolymerize various PET waste forms into the BHNT monomer. Optimal conditions for high conversion were found at a 6:1 NPG/PET molar ratio and 200 °C. A purification process using active carbon further increased the purity of BHNT from 60% to 95%, demonstrating the potential for replacing fossil-based NPG in resin or coating synthesis. - Advanced synthesis and expanding applications: The neopentyl glycol market is expected to increase due to the application of highly industrialized synthesis, such as the green catalytic process, advanced industrial synthesis, and shifting trends in the production of chemicals using organic molecules. Additionally, a growing supply of raw materials, strict federal rules on volatile organic compounds (VOC) emissions, and the use of neopentyl glycol in various industrial and commercial applications will accelerate the neopentyl glycol market.

In recent years the neopentyl glycol demand has been driven by the growing global internet penetration and the growing preference for electronics. According to the International Telecommunication Union (ITU) 5.5 billion people, or 68% of the global population, used the Internet in 2024. With an expected 1.3 billion individuals going online in 2019, this is an increase from 53%. Neopentyl glycol is used in the etching procedures, which are essential for printed circuit boards.

Challenges

- Fluctuation in raw material prices: NPG is mostly made from petrochemical feedstocks, and the price volatility of crude oil has a significant impact on the cost of production. The cost of producing NPG is directly impacted by abrupt increases or decreases in oil prices, making it difficult for producers to maintain steady profit margins and pricing policies. In addition, supply chain interruptions and geopolitical unpredictability lead to irregular raw material supplies impeding neopentyl glycol market expansion.

- Growing environmental concerns: Although NPG is more environmentally benign than traditional chemicals, some chemicals and energy-intensive processes may still be used in its manufacture, which has an effect on the environment. NPG manufacturers must comply with strict laws governing emissions, waste management, and chemical use, which raises manufacturing costs and complicates operations. Stricter adherence to environmental norms is also required due to rising public awareness and pressure for sustainable practices, which makes NPG manufacturers' attempts to expand their neopentyl glycol market even more difficult.

Neopentyl Glycol Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 1.62 billion |

|

Forecast Year Market Size (2035) |

USD 2.77 billion |

|

Regional Scope |

|

Neopentyl Glycol Market Segmentation:

Form (Flakes, Molten, Slurry)

Flakes segment is expected to hold more than 71.8% neopentyl glycol market share by 2035. The segment growth is driven by the increasing need for premium adhesives and sealants in the construction and automotive industries. These uses benefit from neopentyl glycol's exceptional thermal stability and resistance to environmental deterioration. Also, flakes are used in various industrial applications since they are easy to measure and combine, and they offer constant quality. Additionally, due to their exceptional durability, chemical resistance, and aesthetic qualities, neopentyl glycol flakes are essential to the coatings and resins industry's production of high-performance polyester resins used in can coatings, car paints, and other industrial coatings.

End use (Paints & Coatings, Automotive, Construction)

The automotive segment in neopentyl glycol market will garner a substantial share during the forecast period. The market is significantly influenced by the automobile sector's need for durable plastic components and premium coatings. It provides improved durability, gloss, and resilience to adverse environmental conditions, making it an essential component of automotive coatings. The automotive sector seeks materials that are resistant to mechanical wear, high temperatures, and UV radiation—all of which neopentyl glycol-based coatings can provide. NPG's importance is further highlighted by the rising need for lightweight materials in automobile design to improve fuel economy and lower emissions. Vehicle weight reductions of 10% can increase fuel efficiency by 6% to 8%. Its application in lightweight components and sophisticated composite materials aids in achieving these objectives without sacrificing performance or safety requirements.

|

Lightweight Material |

Mass Reduction |

|

Magnesium |

30-70% |

|

Carbon Fiber Composites |

50-70% |

|

Aluminum and AI Matrix Composites |

30-60% |

|

Titanium |

40-55% |

|

Glass Fiber Composites |

25-35% |

|

Advanced High Strength Steel |

15-25% |

|

High Strength Steel |

10-28% |

Source: U.S. Department of Energy

Our in-depth analysis of the global market includes the following segments:

|

Form |

|

|

Production Method |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Neopentyl Glycol Market Regional Analysis:

APAC Market Statistics

Asia Pacific neopentyl glycol market is predicted to dominate revenue share of over 40.6% by 2035. The expanding Asia Pacific automotive sector is anticipated to increase demand for environmentally friendly powder coatings and resins, propelling the market. NPG is a crucial ingredient that contributes durability and dependability to cement and concrete production. Therefore, the expanding construction industry in developing nations will accelerate regional neopentyl glycol (NPG) market expansion.

India is now a major manufacturer worldwide due to its booming economy and rapid industrialization. In recent years, the nation's industrial capabilities have significantly improved. According to the Press Information Bureau, 2023-2035 witnessed a robust industrial growth of 9.5%. In addition to providing over 50% of the inputs utilized in all productive activities (agriculture, industry, and services), manufacturing activities also comprise around 50% of inter-industry consumption. Aside from this, India's growth in NPG sales is anticipated due to the rising need for paints and coatings and the presence of significant domestic manufacturers.

In China, NPG's strong chemical and thermal stability makes it appropriate for industrial use. Due to this, the sales will continue to rise due to the growing use of NPG as an intermediate in the manufacturing of medicines and industrial chemicals. According to the Information Technology & Innovation Foundation, producers have a significant edge in their market since China is already the world's largest market for chemicals. Furthermore, in 2022, China accounted for 44% of the world's chemical production and 46% of capital expenditure.

Europe Market Analysis

Europe neopentyl glycol market will expand with a significant share by 2035. The region's growing use of powder-coating chemicals is driving the market's expansion. The market for neopentyl glycol is also expanding as a result of the use of NPG as an ingredient in powder coating for stability and resistance. Growing production capacity is the main factor driving the neopentyl glycol market's expansion in Europe.

In the UK, NPG’s unique properties, including high chemical and thermal stability, make it a preferred component in high-performance coatings and resins. Also, the country’s emphasis on sustainable and eco-friendly products further boosts NPG’s adoption, especially in low-VOC coatings. The coatings industry in the country is dedicated to lowering the amount of solvent in paints since volatile organic compounds (VOCs) contribute to global warming. For several years, the industry has responded to this by launching new and alternative products with lower volatile organic compounds. Since 84% of decorative paints marketed are water-based, the industry has already made excellent strides toward this objective.

Key Neopentyl Glycol Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eastman Chemical Company

- LG Chem

- OXEA GmbH

- Perstorp GmbH

- Poliloli S.p.A.

- Oleon N.V.

- Shandong Dongchen New Technology Co., Ltd.

- Zouping Fenlian Biotech Co., Ltd.

- Hefei TNJ Chemical Industry Co., Ltd.

The neopentyl glycol market will expand as a result of major players investing heavily in R&D to expand their product ranges. Key market developments include new product releases, contractual agreements, mergers and acquisitions, higher investments, and cooperation with other organizations. Market participants are also implementing a variety of strategic efforts to expand their global footprint. In order to grow and thrive in a neopentyl glycol market that is becoming competitive, competitors in the Neopentyl are offering affordable products.

Recent Developments

- In July 2023, BASF SE and Zhejiang Guanghua Technology Co., Ltd. (KHUA) signed a Letter of Intent (LoI) to supply Neopentyl Glycol (NPG) from BASF's Zhanjiang Verbund plant to KHUA. This agreement represents a key milestone in the long-term collaboration between the two organizations.

- In January 2022, LG Chem announced the shipment of its first shipments of Bio-balanced NPG. This product, which is made from bio-resources such as waste cooking oil and palm byproducts, received ISCC PLUS (International Sustainability & Carbon Certification PLUS), a global sustainable eco-friendly material certification.

- Report ID: 6995

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Neopentyl Glycol Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.