Natural Gas Filters Market Outlook:

Natural Gas Filters Market size was over USD 1.37 billion in 2025 and is projected to reach USD 2.62 billion by 2035, witnessing around 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of natural gas filters is evaluated at USD 1.45 billion.

The global natural gas filters market is witnessing steadfast growth as a result of the increasingly stringent environmental regulations to reduce emissions and promote cleaner air quality. Natural gas filters are becoming necessary to maintain the purity and quality of the gas as its use rises across diverse industries, including transportation, industry, and power generation. Natural gas extraction, processing facilities, pipelines, distribution networks, power generation, residential and commercial gas systems, and natural gas-powered automobiles are just a few of the industries that depend on its filters.

The Gas Exporting Countries Forum 2024 report revealed that the demand for natural gas is growing mostly in the power generation sector, which accounts for 37% of the total growth and 500 cm of the expansion. Therefore, the extensive use of natural gas in the power generation sector is significantly driving the growth of these filters. By eliminating solid particles, liquid droplets, oil mists, moisture, sulfur compounds, and other impurities, these filters preserve the efficiency and quality of natural gas.

Impurities, pollutants, and particle matter in natural gas can negatively impact equipment performance and lifespan. These contaminants can lead to abrasive wear, corrosion, and clogging, which lowers productivity, increases maintenance expenses, and increases the risk of equipment failure. Additionally, the need for natural gas filters is driven by the cost savings linked to equipment longevity and protection.

Additionally, the growing production of natural gas is boosting the natural gas filters market by increasing the demand for filtration solutions to ensure gas quality, efficiency, and equipment longevity. The International Energy Agency (IEA) reported that global natural gas production reached 146,644,918 TJ in 2022. Natural gas is extracted from subterranean or seafloor sources, just like oil. After being extracted, gas needs to be processed before being delivered via pipelines to final consumers like homes and power plants. Innovations such as hydraulic fracturing have made it possible to extract natural gas from previously unprofitable locations in recent decades.

|

Rank |

Country |

Natural Gas Production Capacity (in TJ) |

|

1 |

U.S. |

35,785,346 |

|

2 |

Russia |

23,707,403 |

|

3 |

Iran |

9,428,854 |

|

4 |

China |

7,712,209 |

|

5 |

Canada |

7,201,078 |

|

6 |

Qatar |

6,319,295 |

|

7 |

Australia |

5,452,937 |

|

8 |

Norway |

4,571,552 |

|

9 |

Saudi Arabia |

3,621,479 |

|

10 |

Algeria |

3,611,549 |

Source: World Energy Balances

Key Natural Gas Filters Market Insights Summary:

Regional Highlights:

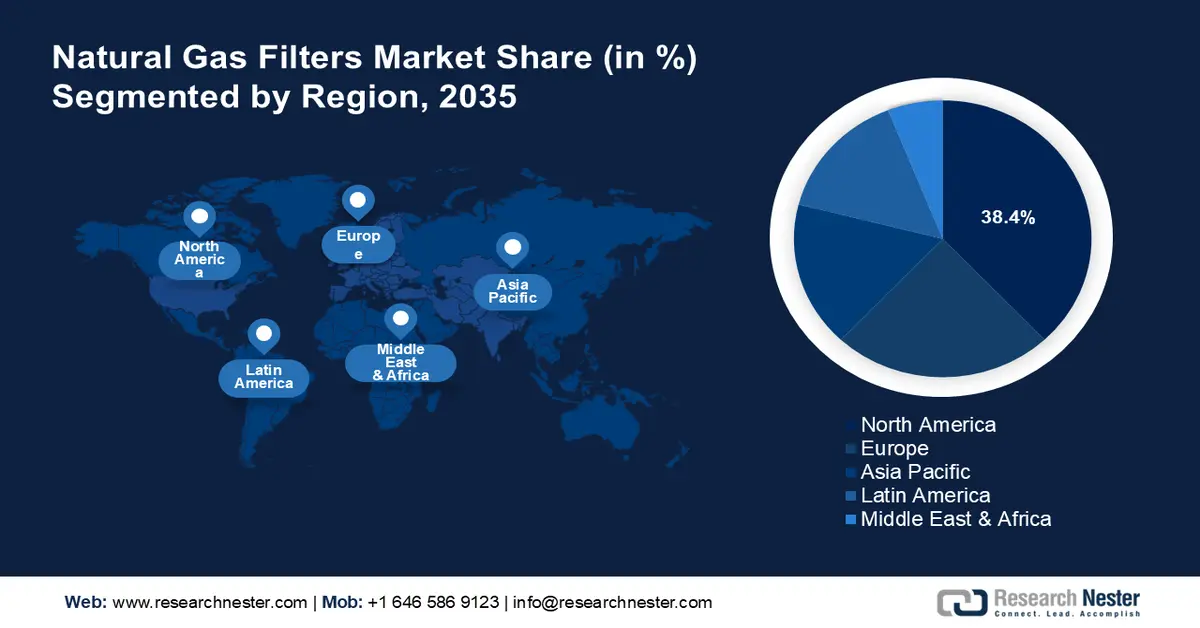

- North America is expected to command over 38.4% share in the natural gas filters market by 2035 as the region strengthens its vast gas infrastructure and emphasizes advanced filtration to ensure operational efficiency and regulatory compliance, underpinned by expanding industrial and power generation applications.

- Europe is set to grow notably through 2035 as stringent emissions norms and sustained investments in natural gas and renewable infrastructure boost the deployment of high-performance filtration systems, supported by ongoing technological advancements.

Segment Insights:

- By 2035, the petroleum segment in the natural gas filters market is projected to capture more than 32.3% share as operators integrate sophisticated filtration solutions to safeguard upstream and refining assets, propelled by rising exploration and production activities.

- The coalescing segment is poised to attain a significant share by 2035 as its capability to remove fine particles and aerosols enhances gas purity and equipment reliability across industries, owing to its effectiveness in ensuring high-quality natural gas output.

Key Growth Trends:

- Increasing deployment of natural gas infrastructure

- Booming popularity of CNG fueled vehicles

Major Challenges:

- Fluctuating natural gas prices

- High cost of advanced filtration systems

Key Players: Parker Hannifin Corporation, Eaton Corporation, Mann+Hummel Group, Camfil AB, Filtration Group Corporation, Atlas Copco AB, FLSmidth & Co. A/S, GE Vernova Inc., SPX FLOW, Inc., Porvair Filtration Group.

Global Natural Gas Filters Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.37 billion

- 2026 Market Size: USD 1.45 billion

- Projected Market Size: USD 2.62 billion by 2035

- Growth Forecasts: 6.7%

Key Regional Dynamics:

- Largest Region: North America (38.4% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, Canada

- Emerging Countries: India, Brazil, Mexico, Indonesia, South Korea

Last updated on : 3 December, 2025

Natural Gas Filters Market - Growth Drivers and Challenges

Growth Drivers

-

Increasing deployment of natural gas infrastructure: The need for natural gas filters is driven by the adoption of natural gas infrastructure, such as distribution networks, processing facilities, and pipelines. The Global Energy Monitor revealed that these pipelines stretch more than 1 million kilometers across the globe easing the import and export of gas worldwide. Another 8.5% is still in the development process. Since the mid-1990s, the pace of gas transmission pipeline construction and startup has remained relatively stable.

Maintaining the integrity of the gas and shielding downstream equipment from impurities and particle matter are also crucial elements of these infrastructure systems. Utilizing natural gas filters is essential for maintaining the gas filters' cleanliness, improving equipment efficiency, reducing maintenance expenses, and prolonging the life of vital parts. Additionally, governments and businesses worldwide are significantly investing in greener energy sources and encouraging the use of efficient filtration systems. As the infrastructure for effective filtration systems and distribution networks expands, the need for natural gas filters is anticipated to rise to meet the demands. -

Booming popularity of CNG-fueled vehicles: In transportation, compressed natural gas (CNG) is becoming a popular alternative fuel, especially for automobiles, trucks, and buses. According to the Climate Technology Center and Network (CTCN), compared to similar passenger cars fueled by gasoline, CNG vehicles release 5–10% less CO2. Also, there are about 15,000 CNG refueling stations spread across 75 countries and nearly 10 million natural gas-powered automobiles worldwide.

Effective filtration systems are necessary for CNG cars to rid the compressed gas of pollutants, moisture, and impurities before it enters the engine. Natural gas filters are essential for maintaining the purity and caliber of CNG, safeguarding the engine, and guaranteeing peak vehicle performance. Additionally, compared to conventional gasoline or diesel vehicles, CNG vehicles frequently offer cost benefits. - Augmenting international natural gas trade: The increased international natural gas supplies result from expanded production in key regions, advancements in extraction technologies such as hydraulic fracturing, and rising liquified natural gas exports to meet growing global energy demands. Countries are boosting production to reduce reliance on specific suppliers, leading to higher natural gas trade volumes.

Below is a table showing the global supply of natural gas in 2022:

|

Rank |

Country |

Supply Volume in TJ |

Share (%) |

|

1 |

U.S. |

32,292,088 |

22.4 |

|

2 |

Russia |

17,722,981 |

12.3 |

|

3 |

China |

12,449,865 |

8.7 |

|

4 |

Iran |

8,793,237 |

6.1 |

|

5 |

Canada |

5,140,101 |

3.6 |

|

6 |

Saudi Arabia |

3,621,479 |

2.5 |

|

7 |

Japan |

3,467,011 |

2.5 |

|

8 |

Mexico |

2,922,948 |

2.0 |

|

9 |

Germany |

2,795,241 |

1.9 |

|

10 |

UK |

2,519,362 |

1.8 |

Source: World Energy Balances

Challenges

-

Fluctuating natural gas prices: Businesses and investors in the natural gas filtration industry are facing significant uncertainty driven by the volatility of natural gas prices. Trading Economics’ Predictions indicate that by the end of the first quarter of 2025, natural gas prices will settle at around 3.17 USD/MMBtu, with expectations of rising to 3.56 USD/MMBtu within the following year. This price fluctuation complicates the estimation of future demand and makes planning for production capacity and research and development challenging. The unpredictability of the natural gas filters market discourages companies from making long-term commitments, hindering overall growth and expansion opportunities.

In addition to price volatility, external factors such as escalating tensions in the Middle East, the ramifications of Russia's invasion of Ukraine, and the potential disruption of essential infrastructure, including pipelines, contribute to a landscape of instability. The lengthy planning and execution times for major projects, such as pipeline construction and natural gas processing facilities, further compound these challenges. As a result, businesses in this sector are caught in a web of uncertainty that impacts their strategic decisions and long-term viability. - High cost of advanced filtration systems: Some end users may find the initial investment and ongoing maintenance expenses of these systems exorbitant, especially in emerging natural gas filters markets, despite their greater performance and efficiency. Furthermore, the total demand for filtration systems may be impacted by changes in the price of natural gas. Both manufacturers and end users may face difficulties as a result of market uncertainty caused by economic downturns and geopolitical events influencing the supply and prices of natural gas.

Natural Gas Filters Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 1.37 billion |

|

Forecast Year Market Size (2035) |

USD 2.62 billion |

|

Regional Scope |

|

Natural Gas Filters Market Segmentation:

Application Segment Analysis

Petroleum segment is poised to account for natural gas filters market share of more than 32.3% by the end of 2035. The market is expanding as natural gas filters are extensively employed in the petroleum sector to eliminate contaminants and impurities from natural gas before its usage in processing, transportation, and refining. These systems, for instance, are employed to filter impurities out of natural gas during oil refining operations, avoiding the accumulation of particles that could harm valves, pipelines, and other machinery. Furthermore, gas filtration systems are essential for safeguarding delicate parts of gas compressors, drilling rigs, and other upstream machinery. Furthermore, the need for sophisticated filtration solutions is being driven by the oil and gas industry's growing exploration and production activities. High-efficiency filters are gaining popularity among businesses to improve operational performance and dependability, accelerating market expansion in this sector.

Type Segment Analysis

The coalescing segment in natural gas filters market is expected to garner a significant share during the assessed period. The purpose of these filters is to rid natural gas streams of tiny particles and liquid aerosols. Coalescing filters’ high demand is ascribable to their capacity to improve natural gas quality and purity, which is crucial for several industrial uses. Coalescing filters are highly effective at preventing corrosion and damage to downstream equipment, which lowers maintenance expenses and downtime. Because of this, they are exceptionally appealing to sectors including power generating, chemical processing, and oil & gas.

Our in-depth analysis of the global natural gas filters market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Natural Gas Filters Market - Regional Analysis

North America Market Insights

North America in natural gas filters market is expected to hold more than 38.4% revenue share by 2035. Throughout the estimated period, the region is expected to see significant expansion in the market due to several factors, including the expanding natural gas sector with its extensive pipelines and processing facilities, as well as a growing need for natural gas filters. Additionally, the natural gas filters market is growing due to its developed natural gas industry and strict environmental restrictions. To maintain operational effectiveness and regulatory compliance, the U.S., in particular, has a strong natural gas infrastructure that calls for sophisticated filtering technologies. The need for high-performance filtering systems is being driven by the growing use of natural gas in industrial and power production applications. Furthermore, the natural gas filters market in North America is expanding due to the presence of major industry players and technical breakthroughs.

In the U.S., the natural gas filters market is expanding owing to the increasing demand for clean energy, stricter environmental regulations, and advancements in filtration technology. As the country shifts towards natural gas for power generation and industrial applications, the need for efficient filtration systems to remove contaminants has risen. The U.S. Energy Information Administration (EIA) has reported that approximately 40% of total natural gas consumption in the nation during 2023 originated from the electric power sector.

Additionally, natural gas constitutes roughly 42% of the primary energy utilized by the electric power sector in the nation. In the industrial sector, around 32% of total natural gas consumption was recorded, with natural gas representing approximately 42% of the end-use energy consumption within the same sector for the year. Furthermore, the growth in industries such as chemicals, manufacturing, and transportation further boosts the natural gas filters market, as these sectors require high-purity gas for optimal performance.

Moreover, Canada is a major natural gas producer, with rising exports to the U.S. and growing LNG projects driving the need for advanced filtration systems to ensure gas quality and pipeline efficiency. The Canada Energy Regulator reported that in 2023, the average daily output of natural gas in Canada climbed to 17.9 billion cubic feet (Bcf/d). Production reached 18.8 Bcf/d in December 2023. For eight months in 2023, Canadian production averaged above 18 Bcf/d. Additionally, the shift towards cleaner energy and technological advancements in gas processing further boost demand for high-performance natural gas filters in the country.

Europe Market Insights

Europe natural gas filters market is expected to grow at a significant rate during the projected period. The region's strict waste management and emissions restrictions have increased the adoption of advanced filtration systems. The market for natural gas filters is expected to develop as a result of investments made in renewable energy projects and natural gas infrastructure by nations such as France, Germany, and the UK. It is anticipated that the European natural gas filters market will expand gradually due to ongoing expenditures in sustainable energy and advancements in filtration system technology.

The UK’s natural gas filters market is expanding as a result of rising energy security concerns, increasing LNG imports, and a strong focus on clean energy solutions. The Government of the UK revealed that LNG imports to the UK increased 74% from the previous year to a record high of 25.6 bcm in 2022. Over the year, LNG imports made up 35% of demand and 45% of natural gas imports. To expand natural gas imports to mainland Europe as it shifted away from Russian gas, the UK used its LNG infrastructure to serve as a land bridge. Moreover, the growing production of hydrogen blending with natural gas also fuels the demand for high-performance filters, supporting the transition to a low-carbon energy future.

Moreover, with Germany reducing its reliance on coal and phasing out nuclear energy, natural gas remains a key part of its energy mix, requiring efficient filtration systems to ensure gas quality and reduce emissions. The IEA stated that the framework for achieving net zero emissions by 2045 is outlined in Germany's Climate Law. The ambitious Energiewende promotes the total phase-out of coal and the requirement that 80% of all electricity supply originate from renewable energy sources by 2030 (and 100% by 2035). Additionally, industries such as power generation, chemicals, and manufacturing require high-quality natural gas for optimal performance, boosting the need for reliable filtration systems. This growing reliance on natural gas as a transitional energy source continues to support natural gas filters market growth.

Natural Gas Filters Market Players:

- Parker Hannifin Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eaton Corporation

- Mann+Hummel Group

- Camfil AB

- Filtration Group Corporation

- Atlas Copco AB

- FLSmidth & Co. A/S

- GE Vernova Inc.

- SPX FLOW, Inc.

- Porvair Filtration Group

Many companies are vying for market share in the fiercely competitive natural gas filters market. The existence of both well-established businesses and up-and-coming competitors defines the competitive environment. To improve their natural gas filters market position, businesses are focusing on strategic alliances, product innovation, and mergers and acquisitions. As manufacturers strive to create cutting-edge filtration solutions with increased efficiency and cost-effectiveness, a strong emphasis is placed on research and development. End consumers in a variety of industries are benefiting from the ongoing enhancements in product performance and quality brought about by the natural gas filters market's competitiveness.

Some of the leading natural gas filters companies include:

Recent Developments

- In September 2024, FLSmidth launched AFP2525, a large-scale, cost-effective filter press for the mining industry. The AFP2525 established itself as the leading solution in its field because it combined fast and safe maintenance, lower costs, and a minimal environmental footprint.

- In March 2023, GE Gas Power, a subsidiary of GE Vernova, and Svante today signed a joint development agreement to develop and test solid sorbent-based carbon capture technology for natural gas power generation applications. In addition, GE made an equity investment in Svante as part of the company's USD 318 million Series E funding round in December 2022.

- Report ID: 7213

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Natural Gas Filters Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.