Naphthalene Sulfonate Market Outlook:

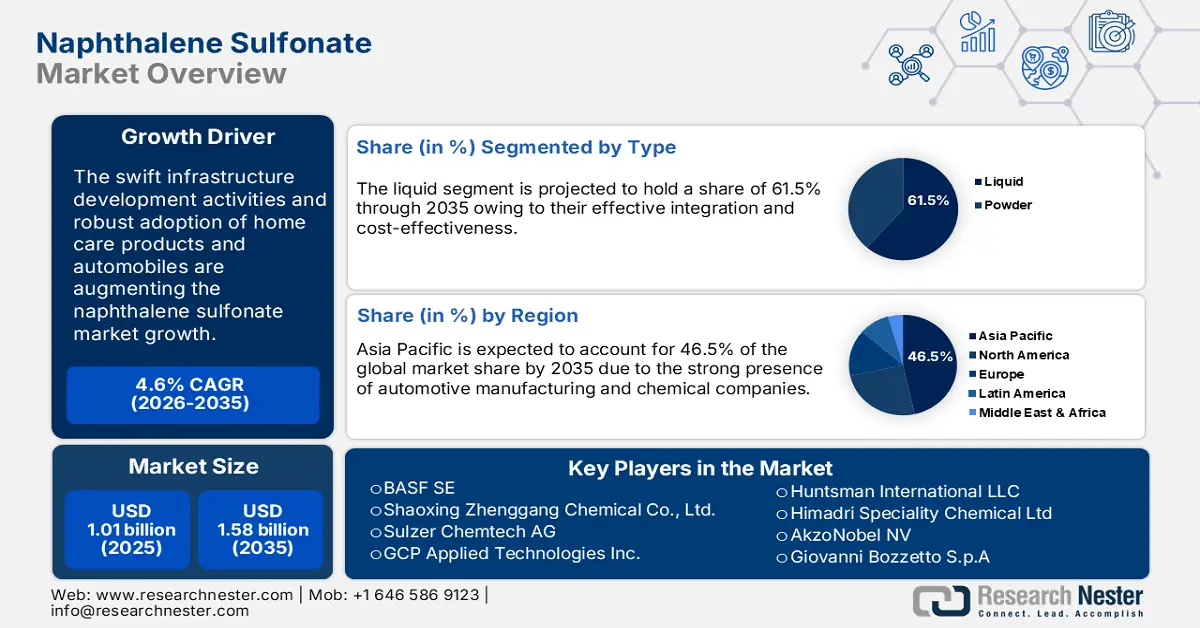

Naphthalene Sulfonate Market size was valued at USD 1.01 billion in 2025 and is likely to cross USD 1.58 billion by 2035, expanding at more than 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of naphthalene sulfonate is assessed at USD 1.05 billion.

The increasing demand for high-performance chemicals is driving naphthalene sulfonate as a highly sought-after ingredient in industrial applications. High urban and industrial activities are fueling the use of naphthalene sulfonates in industrial and household detergents owing to its dispersing and wetting properties. The growth in the demand for high-quality and performance detergents and cleaning agents is set to directly augment the sales of naphthalene sulfonates in the coming years. For instance, the report by the Observatory of Economic Complexity (OEC) states that in 2022, cleaning products hold the 107th position as the most-traded product globally. Expanding at a CAGR of 4.01% between 2021 and 2022, the total trade was calculated to be USD 44.2 billion, in 2022. The market dynamics were highly concentrated in China (USD 570.0 million) and Kuwait (USD 556.0 million), in terms of export value growth and import value growth, respectively.

|

Cleaning Products |

|||

|

Country |

Export Value in USD Billion |

Country |

Import Value in USD Billion |

|

Germany |

5.11 |

Germany |

2.79 |

|

U.S. |

4.57 |

U.S. |

2.45 |

|

China |

3.52 |

France |

2.23 |

|

France |

2.68 |

China |

2.19 |

|

Italy |

2.32 |

Canada |

2.03 |

Source: OEC

Naphthalene sales are gaining boom due to their widespread application areas, as per the OEC analysis naphthalene trade registered a CAGR of 23.5% between 2021 and 2022. The total trade was valued at USD 397.0 million, holding the 3191st rank as the most-traded product. In terms of export value growth and import value growth, the market dynamics were saturated across Angola (USD 118.0 million) and the Netherlands (USD 221.0 million), respectively. Market concentration amounted to 2.5 using Shannon Entropy, in 2022, highlighting the export dominance by 5 countries.

|

Naphthalene |

|||

|

Country |

Export Value in USD Million |

Country |

Import Value in USD Million |

|

Angola |

236.0 |

Netherlands |

223.0 |

|

Japan |

19.3 |

Egypt |

15.6 |

|

Denmark |

18.5 |

Brazil |

15.3 |

|

China |

15.0 |

Belgium |

14.4 |

|

Germany |

14.0 |

India |

12.6 |

Source: OEC

Key Naphthalene Sulfonate Market Insights Summary:

Regional Highlights:

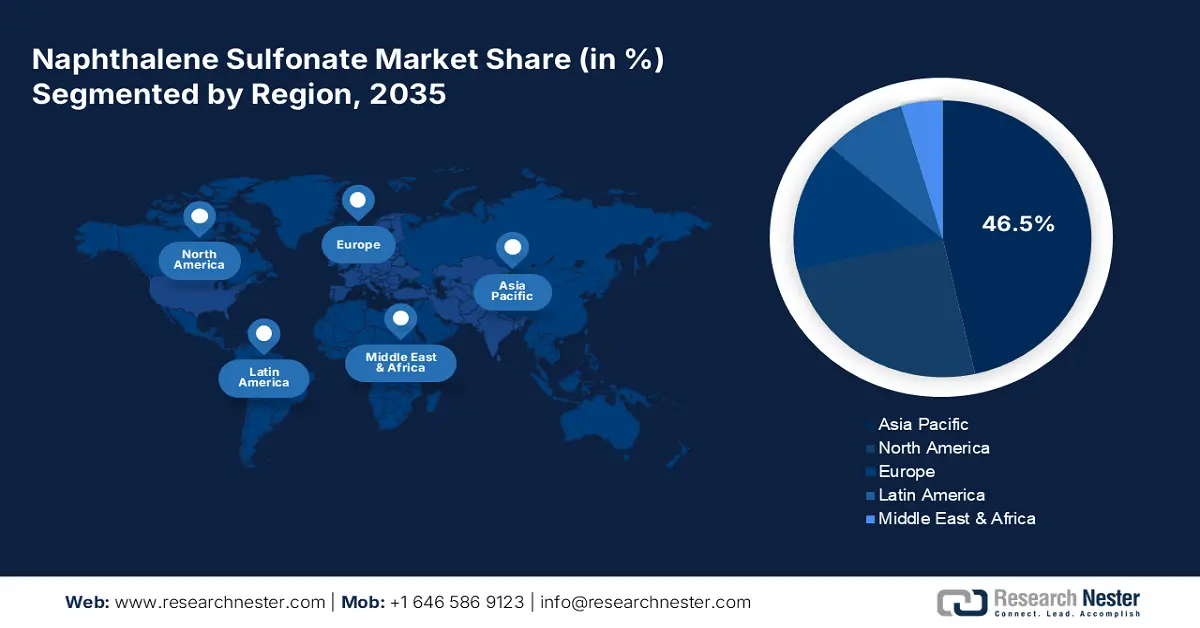

- Asia Pacific leads the Naphthalene Sulfonate Market with a 46.5% share, propelled by the expanding agrochemical industry, booming construction activities, and high market for consumer goods and home care products, ensuring robust growth through 2026–2035.

- North America's naphthalene sulfonate market is set for the fastest growth by 2035, attributed to growing construction activities, high use of detergent and cleaning products, and high automobile ownership.

Segment Insights:

- Dispersant & Wetting Agent applications segment are poised for significant growth from 2026-2035, driven by rising demand in paints, coatings, and agriculture.

- The Liquid form segment of the Naphthalene Sulfonate Market is projected to achieve a 61.50% share from 2026 to 2035, driven by its easy integration, cost-effectiveness, and stability.

Key Growth Trends:

- Infrastructure development

- Rising demand for efficient dispersants in paints & coatings

Major Challenges:

- Regulatory challenges

- Competition from alternative solutions

- Key Players: BASF SE, Shaoxing Zhenggang Chemical Co., Ltd., Sulzer Chemtech AG, and GCP Applied Technologies Inc.

Global Naphthalene Sulfonate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.01 billion

- 2026 Market Size: USD 1.05 billion

- Projected Market Size: USD 1.58 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

Naphthalene Sulfonate Market Growth Drivers and Challenges:

Growth Drivers

-

Infrastructure development: The construction industry is backing the sales of naphthalene sulfonates as it is used in concrete admixtures. The rise in urbanization coupled with growth in construction and infrastructure development activities are increasing the consumption of naphthalene sulfonates. The Regional Environmental Sewer Conveyance Upgrade Program (RESCU) project, NEOM, Grand Paris Express, High-Speed Connections for a Greener UK (HS2), and Brenner Base Tunnel are some of the largest infrastructure development projects across the world influencing the sales of naphthalene sulfonates. The U.S. Department of Commerce predicts that the global need for all types of infrastructure is projected to increase by over USD 53.0 trillion between 2020 and 2030.

-

Rising demand for efficient dispersants in paints & coatings: Naphthalene sulfonates used as dispersing agents in paints and coatings to ensure uniform consistency and performance are contributing to their sales growth. The expanding global market for paints and coatings is significantly fueling the demand for naphthalene sulfonates. Asia Pacific leads the global naphthalene sulfonate market by capturing over 45% of the share. Ongoing residential, commercial, industrial, and government building projects in the region are driving the sales of paints & coatings and subsequently naphthalene sulfonates.

Challenges

-

Regulatory challenges: The strict regulations on chemical safety and environmental impact are challenging the naphthalene sulfonate market growth. Stringent regulations on chemical emissions, waste disposal, and product safety are limiting manufacturing capabilities and increasing product costs. Also, they are the primary reason for delayed naphthalene sulfonate market entry, which majorly hampers the revenues of naphthalene sulfonate producers.

-

Competition from alternative solutions: The naphthalene sulfonate manufacturers are witnessing high competition from alternative solutions such as synthetic and bio-based materials, and colloidal or non-ionic surfactants. The significant number of key players is also creating internal competition in the naphthalene sulfonate market, which is leading to lower profit margin rates. New companies find it challenging to enter and survive in the competitive landscape.

Naphthalene Sulfonate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 1.01 billion |

|

Forecast Year Market Size (2035) |

USD 1.58 billion |

|

Regional Scope |

|

Naphthalene Sulfonate Market Segmentation:

Type (Liquid, Powder)

Liquid form segment is expected to capture over 61.5% naphthalene sulfonate market share by 2035. Easy integration and cost-effectiveness are major factors fueling the sales of liquid form naphthalene sulfonates. The better dispersion of particles, low viscosity, and enhanced stability in cement mixtures are some characteristics contributing to the naphthalene sulfonate sales growth. Liquid naphthalene sulfonates are widely used in construction projects as a superplasticizer in concrete production and in detergent and cleaning products owing to its ability to disperse dirt and stains. The growth in these sectors is directly augmenting the sales of naphthalene sulfonates, leading to high trade activities.

Application (Dispersant & Wetting Agent, Plasticizer, Surfactant, Others)

The dispersant & wetting agent segment is foreseen to hold a dominant naphthalene sulfonate market share throughout the study period. Wetting agents and dispersants important in paint formulations are boosting the sales of naphthalene sulfonates. The high demand for paints and coatings in automotive, construction, and consumer goods is creating lucrative opportunities for naphthalene sulfonate producers. The increasing use of dispersant & wetting agents in the agriculture sector to enhance the efficacy of pesticides, herbicides, and fertilizers is further augmenting the sales of naphthalene sulfonates. For instance, as per a study by OEC, the pesticides global trade stood at USD 49.2 billion in 2022. China (USD 12.0 billion) and Brazil (USD 7.06 billion) dominated the trade activities as top exporters and importers of pesticides.

Our in-depth analysis of the global naphthalene sulfonate market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Naphthalene Sulfonate Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific naphthalene sulfonate market is projected to hold revenue share of over 46.5% by the end of 2035. The expanding agrochemical industry, booming construction activities, and high market for consumer goods and home care products are augmenting the sales of naphthalene sulfonates. India and China are offering high-profit opportunities for naphthalene sulfonate producers owing to rapid urbanization and industrialization. South Korea and Japan are witnessing innovations in naphthalene sulfonates due to the presence of advanced chemical manufacturers.

China’s rapid industrial activities leading to infra developments are fueling the sales of naphthalene sulfonates. Construction and large-scale public projects are boon to naphthalene sulfonate producers. The boasting automotive industry is also fueling the demand for naphthalene sulfonates. High use of naphthalene sulfonates in paints and coatings is augmenting their sales in various sectors including construction, consumer goods, and automotive.

India’s agriculture sector is majorly driving the sales of naphthalene sulfonates owing to their increasing use in agrochemicals. The supportive government policies and schemes are further supporting the naphthalene sulfonate market growth. For instance, according to the India Brand Equity Foundation (IBEF) study the Union Budget 2024-25 allotted USD 18.26 billion for agriculture and allied sectors. The advancements in the chemical industry are also set to offer lucrative opportunities for naphthalene sulfonate producers. The same source also reveals that between April FY24 and September FY24, the organic and inorganic chemical exports totaled USD 14.09 billion. The strong presence of end use industries such as construction, paints and coatings, automotive, and agriculture are set to propel the sales of naphthalene sulfonates in the coming years.

North America Market Statistics

The North America naphthalene sulfonate market is estimated to expand at the fastest pace during the assessed period. The growing construction activities, high use of detergent and cleaning products, and high automobile ownership are propelling the sales of naphthalene sulfonates. Both in the U.S. and Canada, high investments in infrastructure development projects are augmenting the demand for naphthalene sulfonates.

In the U.S. the boom in construction activities in both residential and commercial segments is creating lucrative opportunities for naphthalene sulfonate manufacturers. Naphthalene sulfonate’s high use as water water-reducing agent in concrete is contributing to their sales growth. For instance, according to a report by Associated General Contractors of America (AGC), over 919,000 structures were developed in Q1’FY23 in the U.S. The construction industry creates around 8.0 million job opportunities and develops USD 2.1 trillion of structures, annually.

Canada’s expanding paints and coatings industry is augmenting the sales of naphthalene sulfonates. The strong presence of manufacturing units related to automotive, consumer goods, and construction fuels the sales of paints and coatings and ultimately naphthalene sulfonates. According to IBISWorld, the Canadian paint manufacturing industry generated revenues of around USD 1.9 billion in 2023. The increasing trade of paints reflects the sales growth in the naphthalene sulfonate market.

Key Naphthalene Sulfonate Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Shaoxing Zhenggang Chemical Co., Ltd.

- Sulzer Chemtech AG

- GCP Applied Technologies Inc.

- Huntsman International LLC

- Himadri Speciality Chemical Ltd

- AkzoNobel NV

- Giovanni Bozzetto S.p.A

- Monument Chemical

- Bilbaína de Alquitranes, S.A.

- Akshar Chemical India Private Limited

Leading companies in the naphthalene sulfonate market are employing several organic and inorganic strategies to earn high profits and increase their market reach. Some of the tactics are new product launches, technological innovations, mergers & acquisitions, strategic collaborations & partnerships, and global expansions. The key players are entering into strategic partnerships with others to develop innovative solutions and maximize their reach. To grab high-earning opportunities from untapped naphthalene sulfonate markets, industry giants are also employing expansion strategies. New companies are more focused on innovations and for that, they are investing heavily in R&D activities.

Some of the key players include:

Recent Developments

- In November 2022, Sulzer Chemtech AG revealed that it is offering engineering and key equipment to the PT. Dongsuh Indonesia (DSI) for its expansion in the naphthalene downstream sector. This move is expanding the production of high-purity naphthalene, which can be used for applications with stringent quality requirements.

- In May 2022, Shaoxing Zhenggang Chemical Co., Ltd. announced the release of Naphthalene Sulfonate Formaldehyde Condensate (FDN) an anionic surfactant with a water-phobic structure. It is finding high application in concrete, dye dispersant, and coal water slurry dispersant.

- Report ID: 7045

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Naphthalene Sulfonate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.