Naphthalene Derivatives Market Outlook:

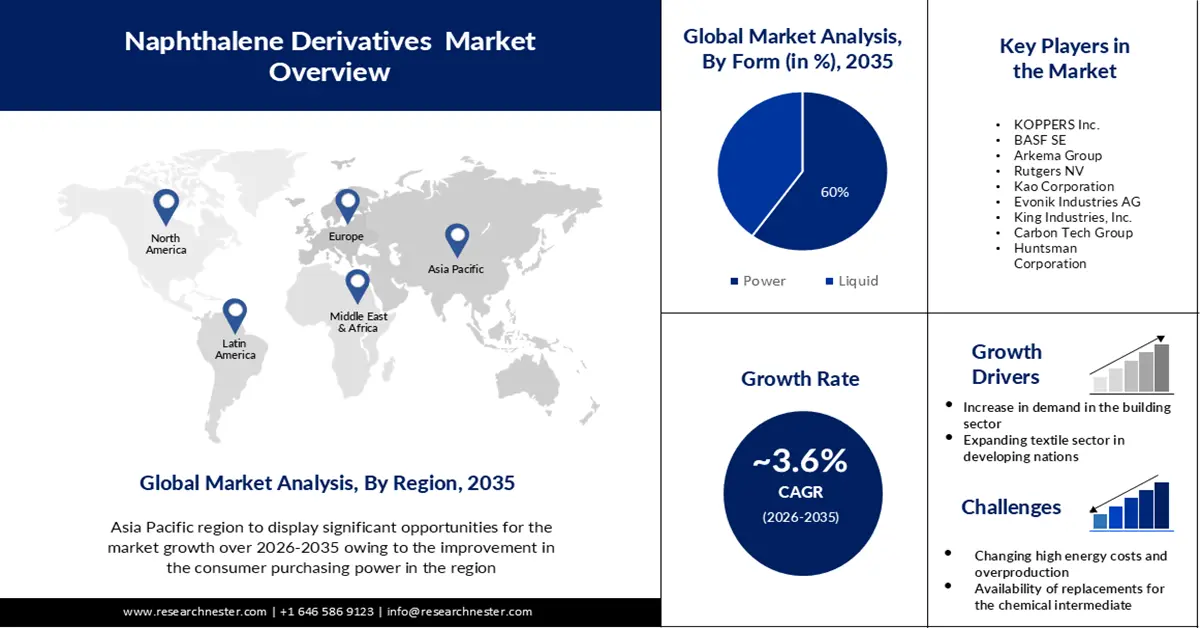

Naphthalene Derivatives Market size was over USD 2.37 billion in 2025 and is anticipated to cross USD 3.38 billion by 2035, witnessing more than 3.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of naphthalene derivatives is assessed at USD 2.45 billion.

Agrochemical companies frequently use naphthalene derivatives because of their low volatility and lack of scent. Due to their extended range of industrial uses, the availability of naphthalene derivatives in a number of compositions, such as salts, alcohols, and others, is anticipated to drive market growth. According to study, the global market for agrochemicals was expected to be valued around USD 217.24 billion dollars in 2021. In 2030, this is anticipated to rise to about USD 279 billion dollars.

Another factor projected to fuel expansion of the global naphthalene derivatives market over the forecast period is the growing use of naphthalene derivatives in manufacturing facilities across a variety of sectors, including paints & coatings, is a key reason fueling the market's expansion.

Key Naphthalene Derivatives Market Insights Summary:

Regional Highlights:

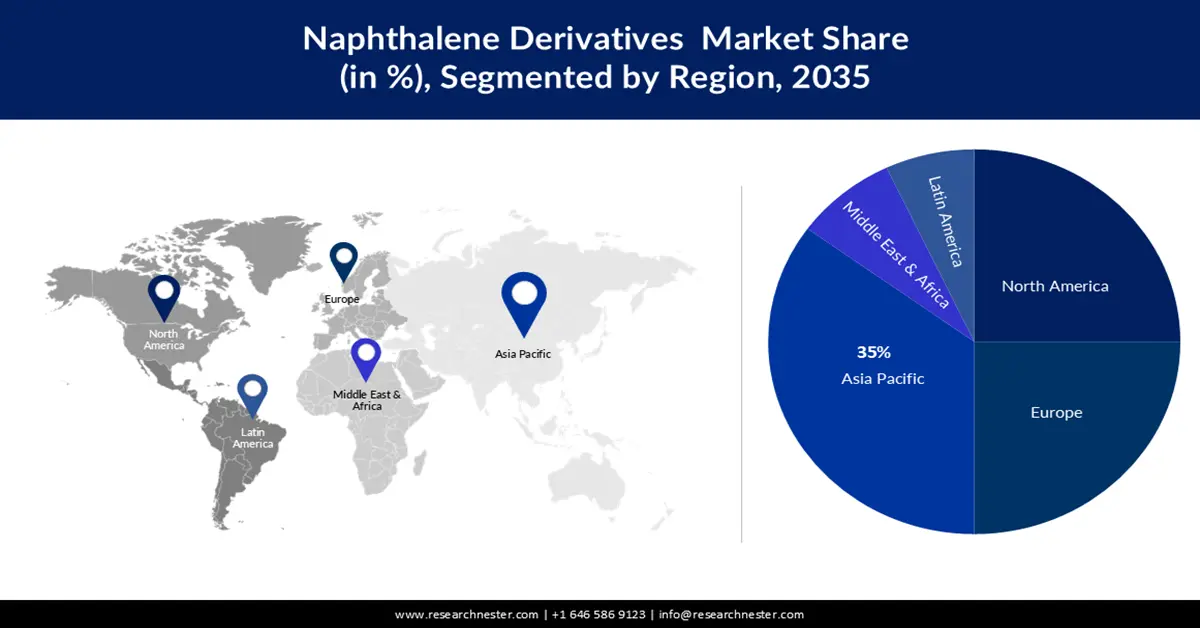

- Asia Pacific naphthalene derivatives market is poised to capture 35% share by 2035, driven by economic progress and rising textile consumption.

Segment Insights:

- The powder segment in the naphthalene derivatives market is projected to achieve substantial growth during 2026-2035, driven by the availability and ease of transportation of powdered naphthalene derivatives.

Key Growth Trends:

- Expanding Textile Sector in Developing Nations

- An Increase in Demand in the Building Sector

Major Challenges:

- High Concentration of Dangerous, Damaging Compounds

- Changing Energy Costs and Overproduction

Key Players: Clariant AG, KOPPERS Inc., BASF SE, Arkema Group, Rutgers NV, Kao Corporation, Evonik Industries AG, King Industries, Inc., Carbon Tech Group, Huntsman Corporation, JFE Chemical Corporation, Kao Corporation, Nippon Paper Group, Sugai Chemical Industry Co., Ltd., Mitsui Chemicals, Inc.

Global Naphthalene Derivatives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.37 billion

- 2026 Market Size: USD 2.45 billion

- Projected Market Size: USD 3.38 billion by 2035

- Growth Forecasts: 3.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, United States, Germany, Japan

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 8 September, 2025

Naphthalene Derivatives Market Growth Drivers and Challenges:

Growth Drivers

-

Expanding Textile Sector in Developing Nations- Alkyl naphthalene sulfonates are commonly employed in the textile industry for bleaching and dying treatments due to their soaking and defoaming qualities. The textile industry uses azo dyes, which account for a sizeable share of commercial dyes, extensively. Different hues employ alkyl naphthalene sulfonates as a precursor.

- An Increase in Demand in the Building Sector- The building industry is the one where naphthalene compounds are most frequently employed due to their low volatility and absence of scent. The construction industry's substantial use of naphthalene to improve the smoothness of solid mixes in concrete and enhance the structure's framework.

- Usage is Expanding in the Pharmaceutical Sector- Naphthalene derivatives are utilized in the pharmaceutical sector to develop novel medications and treatments. Acute neurological conditions like cerebral impairments following cardiac bypass surgery and grafting, stroke, cerebral ischemia, and spinal cord damage as a result of trauma or other diseases are among the neurological issues that naphthalene derivatives are used to treat in mammals.

Challenges

-

High Concentration of Dangerous, Damaging Compounds- Mothballs, cigarette smoke, wood burning, and unintentional spills all release naphthalene and its derivatives into the air, posing environmental dangers. Naphthalene and its derivatives are readily absorbed by soil particles into water. Due to their volatility, they may vaporise into the atmosphere with ease. Naphthalene is easily converted into 1- or 2-naphthol in the presence of moisture and sunshine, which may increase air toxicity and provide a range of health hazards.

-

Changing Energy Costs and Overproduction

-

The Availability of Substitutes

Naphthalene Derivatives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.6% |

|

Base Year Market Size (2025) |

USD 2.37 billion |

|

Forecast Year Market Size (2035) |

USD 3.38 billion |

|

Regional Scope |

|

Naphthalene Derivatives Market Segmentation:

Form Segment Analysis

Powder segment is poised to account for around 60% naphthalene derivatives market share by 2035..The primary factors behind the increased demand for powdered form of naphthalene derivatives are their simple availability in powdered form at room temperature and their ease of transportation and packaging in compared to liquid form.

End User Segment Analysis

Construction segment is expected to account for around 28% naphthalene derivatives market share by 2035.The demand from the construction sector is being driven by the growing usage of naphthalene derivatives such as SNF and phthalic anhydride, which are employed as superplasticizers in concrete and the production of PVC plastics in the development of infrastructure. For instance, the world’s production of PVC in volume accounted for more than 44 million metric tons in the year 2018.

Our in-depth analysis of the global naphthalene derivatives market includes the following segments:

Form |

|

Product |

|

Source |

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Naphthalene Derivatives Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to hold largest revenue share of 35% by 2035, with the largest population in the world and a high concentration of garment sectors, APAC. The improvement in consumer purchasing power brought about by the economy's progress has increased per-capita consumption of goods, including textiles, which is fueling the expansion of the APAC textiles sector. In Asia Pacific region, consumer expenditure on apparel is anticipated to reach USD 756.84 billion in 2021, up 18% from the USD 647.26 billion spent in 2020.

Europe Market Insights

The naphthalene derivatives market in Europe is anticipated to have a 25% revenue share during the forecasted year due to the significant presence of the medical and agrochemical industries in the area. Furthermore, market would expand as a result of the region's strict norms and restrictions regarding the use of naphthalene derivatives.

Naphthalene Derivatives Market Players:

- Clariant AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- KOPPERS Inc.

- BASF SE

- Arkema Group

- Rutgers NV

- Kao Corporation

- Evonik Industries AG

- King Industries, Inc.

- Carbon Tech Group

- Huntsman Corporation

- JFE Chemical Corporation

- Kao Corporation

- Nippon Paper Group

- Sugai Chemical Industry Co., Ltd.

- Mitsui Chemicals, Inc.

Recent Developments

- Clariant announced the divestment of its global QACs business as the company sold its QACs business to Global Amines Company in August 2022.

- Koppers Performance Chemicals, a subsidiary of Koppers Holdings, announced an investment of USD 40 million for the expansion of its business.

- Report ID: 1128

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Naphthalene Derivatives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.