Nanosensors Market Outlook:

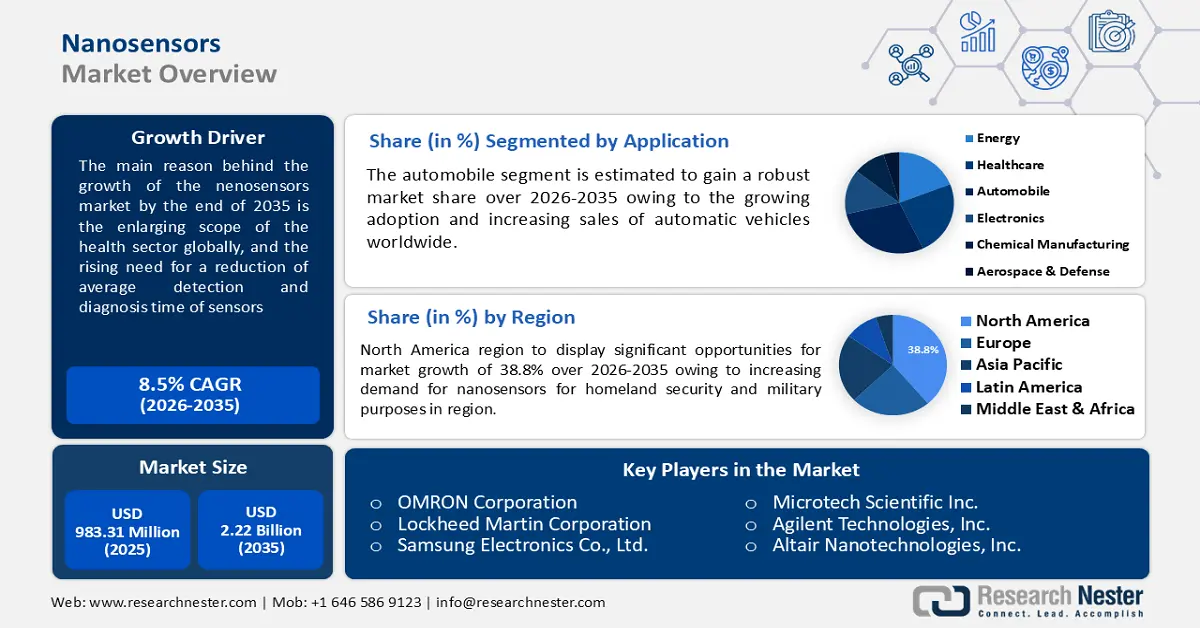

Nanosensors Market size was over USD 983.31 million in 2025 and is anticipated to cross USD 2.22 billion by 2035, witnessing more than 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of nanosensors is estimated at USD 1.06 billion.

The growth of the market is primarily attributed to the enlarging scope of the health sector globally, and the rising need for a reduction of average detection and diagnosis time of sensors is also expected to serve as a growth driver for the market shortly. According to the World Bank, the total health expenditure amounted to 9.83% of the world’s total GDP share in 2019. The percentage rose from 9.7% of the global GDP in 2018. Moreover, an escalating trend of usage of miniaturized products across the world is evaluated to offer abundant opportunities for market expansion in the forecast period.

Nanosensors are small chemical, and biological sensors capable of detecting and detecting nanoparticles. Given its ability to communicate information about nanoparticles, the nanosensor industry is gaining more and more attention. Nano-sensors typically measure between a nanometer and 100 nanometers. Furthermore, the rising utilization of nanosensors in various sectors such as forensics, cancer detection, military and security, aerospace, and others, increasing demand for premium quality products, affordability of nanosensors, technological advancements coupled with development and launch of innovative products by key manufacturers are anticipated to drive global nanosensors market growth over the forecast period. For Instance, in September 2021, Honeywell International Inc. announced the latest technologically advanced robots designed to aid warehouses and distribution centers automate the manual pallet offloading process, reducing operational risks of potential injuries and labor shortages.

Key Nanosensors Market Insights Summary:

Regional Highlights:

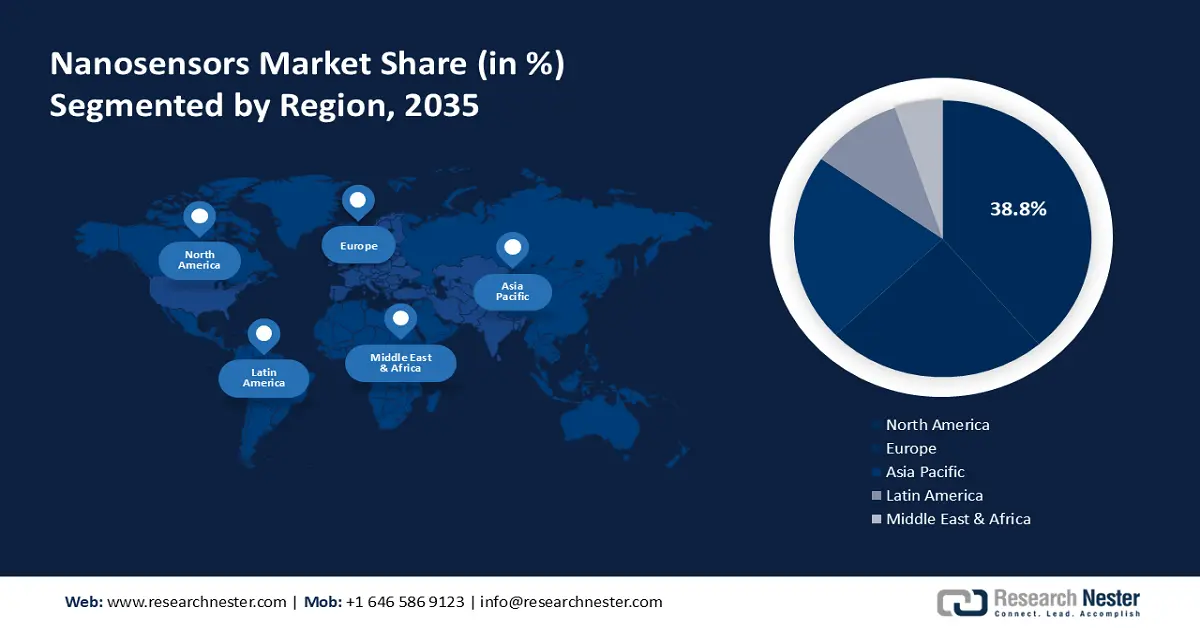

- North America nanosensors market is poised to capture 38.8% share by 2035, driven by military demand and rising prevalence of diabetes.

Segment Insights:

- The automobiles segment in the nanosensors market is expected to maintain the largest share by 2035, driven by the increasing adoption of autonomous vehicles and nanotech-enhanced performance.

Key Growth Trends:

- Growing Prevalence of Skin Cancer Worldwide

- Rapid Expansion of the Electronics Devices Sector Worldwide

Major Challenges:

- Growing Prevalence of Skin Cancer Worldwide

- Rapid Expansion of the Electronics Devices Sector Worldwide

Key Players: Honeywell International Inc., OMRON Corporation, Lockheed Martin Corporation, Samsung Electronics Co., Ltd., Texas Instruments Incorporated, Thermo Fisher Scientific Inc., Microtech Scientific Inc., Agilent Technologies, Inc., Altair Nanotechnologies, Inc., Kleindiek Nanotechnik GmbH.

Global Nanosensors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 983.31 million

- 2026 Market Size: USD 1.06 billion

- Projected Market Size: USD 2.22 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 8 September, 2025

Nanosensors Market Growth Drivers and Challenges:

Growth Drivers

- Growing Prevalence of Skin Cancer Worldwide - For instance, nearly 9,400 people get affected by skin cancer every day in the United States, and over 2 people die of skin cancer each hour. A nanomedicine application is used to treat skin cancer. In this way, medications and other medicinal treatments can be administered efficiently to specific tumor areas and target cells with minimal side effects. Nanomedicine is used to determine a new method of detecting cancerous cells in the blood, called Nano Flares. Thus, the rising utilization of nanosensors in medicines for the treatment of skin cancers is expected to drive market growth during the forecast period.

- Rapid Expansion of the Electronics Devices Sector Worldwide - It was observed that the global electronic devices market accounted for USD 2.8 Trillion in the year 2020. India's share in the electronics devices sector rose by 3.5% in 2019 up from 1.2% in 2012.

- Surge In Number of Laboratory Tests Conducted in Medical Settings - As per the centers for disease control and prevention, nearly 14 billion laboratory tests are carried out every year. These tests play an important role in taking out 70% of medical decisions.

- Rising Spending on Research and Development Activities – According to World Bank data, global expenditure on research and development accounted for 2.63% of total GDP in the year 2020, up from 2.2% in the year 2018.

- Increasing Personal Disposable Income- As per the data by the Bureau of Economic Analysis, disposable personal income grew to USD 37.6 billion (0.2%) in July 2022, whereas personal consumption spending rose by USD 47 billion (0.2%).

Challenges

- High Costs Associated with Hi-Tech Nanosensors - The commercial success of nanosensors was already severely impacted by the lack of understanding about the health consequences of nanomaterials and the high costs of certain fresh ingredients. As per recent data, produce nanosensors with a total yielding capacity of 1 million units per year for less than USD 5.2 each, and conduct client demos.

- Issues Regarding the Deployment of Nanodevices in Unfavorable Conditions

- Complexities in the Development of the Product

Nanosensors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 983.31 million |

|

Forecast Year Market Size (2035) |

USD 2.22 billion |

|

Regional Scope |

|

Nanosensors Market Segmentation:

Application Segment Analysis

The global nanosensors market is segmented and analyzed for demand and supply by application into electronics, chemical manufacturing, aerospace & defense, energy, healthcare, and automobile. Among these segments, the automobile segment is anticipated to capture the largest market size in the global nanosensors market owing to the growing adoption and increasing sales of automatic vehicles worldwide. For instance, the number of Tesla vehicles sold in the United States in 2018 was nearly 1,95,500, up 275% from 47,000 units sold in 2017. The nanotechnology applied in automobiles enhances safety and gives better user performance. Moreover, increasing purchasing power and desire for a luxury lifestyle are expected to augment segment growth over the forecast period.

Our in-depth analysis of the global nanosensors Market includes the following segments:

|

By Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nanosensors Market Regional Analysis:

North America Market Insights

North America region is expected to account for more than 38.8% market share by 2035, driven by military demand and rising prevalence of diabetes. Along with these, the surge in medical spending and the presence of key market players are also projected to boost the market growth in the region. According to the Organization for Economic Co-operation and Development (OECD), the United States accounted for the highest health spending in 2019. The amount totaled an estimated value of USD 11,072/per capita. Further, the increasing prevalence of diabetes in the region, which in turn is foreseen to bring a hike in the demand for effective disease detection techniques. This is also considered to result in the market growth in North America in the coming years.

Nanosensors Market Players:

- Honeywell International Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- OMRON Corporation

- Lockheed Martin Corporation

- Samsung Electronics Co., Ltd.

- Texas Instruments Incorporated

- Thermo Fisher Scientific Inc.

- Microtech Scientific Inc.

- Agilent Technologies, Inc.

- Altair Nanotechnologies, Inc.

- Kleindiek Nanotechnik GmbH

Recent Developments

-

Honeywell International Inc., announced a collaboration with leading healthcare providers by offering sensors and advanced digital technology aiming to improve patient outcomes.

-

OMRON Corporation., The B5WC Color Sensor from OMRON Corporation, which also detects minute color variations and changes worldwide, was made available for industrial embedding on November 1st, 2022, the company stated today. Using colors to track the state of the oil, this color sensor continuously tracks oil degradation in hydraulic machinery used in industrial technology.

- Report ID: 3083

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nanosensors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.