Nanocellulose Market Outlook:

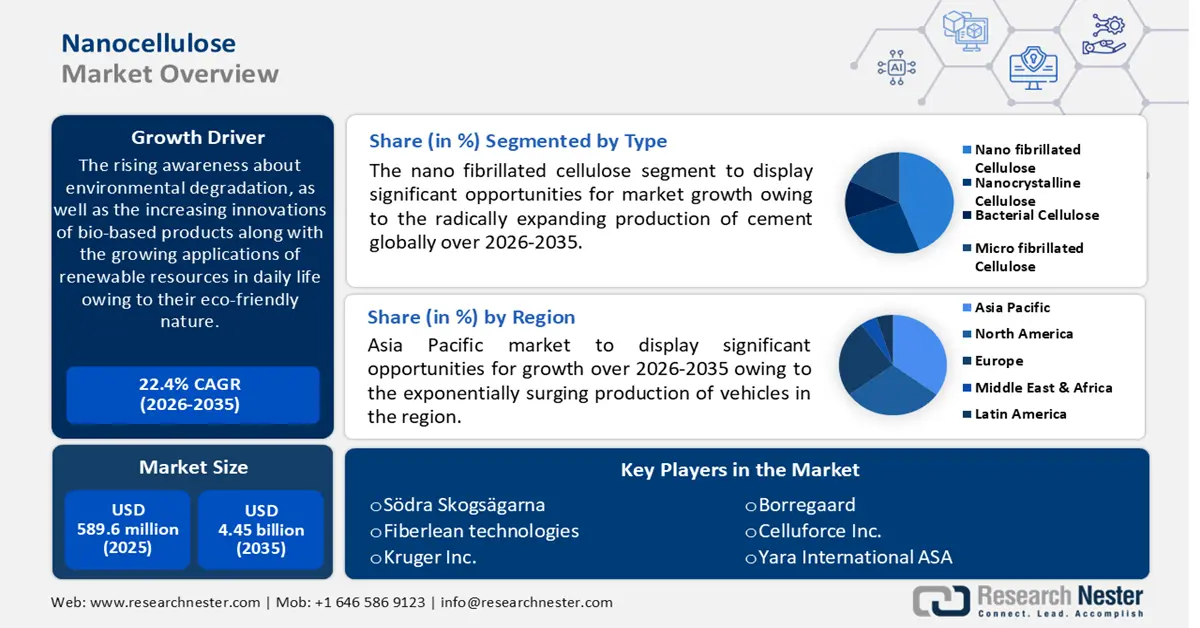

Nanocellulose Market size was valued at USD 589.6 million in 2025 and is set to exceed USD 4.45 billion by 2035, registering over 22.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of nanocellulose is estimated at USD 708.46 million.

The rising awareness about environmental degradation, as well as the increasing innovations of bio-based products along with the growing applications of renewable resources in daily life owing to their eco-friendly nature, is anticipated to propel the market growth in the forecast period. As per a global survey in 2021, out of the chosen number of participants for their opinion on the packaging, 35% of respondents said they chose sustainable products to help protect the environment, while 37% said they looked for products with environmentally friendly packaging.

Nanocellulose types include two broad categories viz., nanostructured materials (cellulose microfibrils) and nanofibers (cellulose nanofibrils, and bacterial cellulose). The difference between nanocellulose and cellulose is that the former are natural materials with at least one dimension in the nano-scale and combine important cellulose properties with the features of nanomaterials. This opens new horizons for these materials’ science and their applications. The application of nanocellulose is vast and expanding as it can be used in various fields such as biomedical products, nanocomposite materials, textiles, and so on as the application of green, renewable, and sustainable materials has gained momentum for producing various high-value products with low environmental impact.

Cellulose, being the most abundant biomass material is the source of extraction for nanocellulose, whose applications are gaining high attraction in both research and industrial areas owing to their attractive properties with 100% environmental friendliness as well as the higher potential to evoke important advantages, such as elevated use of natural resources, enhanced health, and reduced environmental pollution leading to a green revolution. Hence, with the rising advancement & investment in nanotechnology worldwide the global nanocellulose market is anticipated to the uptrend in the forecast period. According to the report, the United States requested more than USD 1.7 billion from the President's 2021 Budget for the National Nanotechnology Initiative (NNI).

Key Nanocellulose Market Insights Summary:

Regional Highlights:

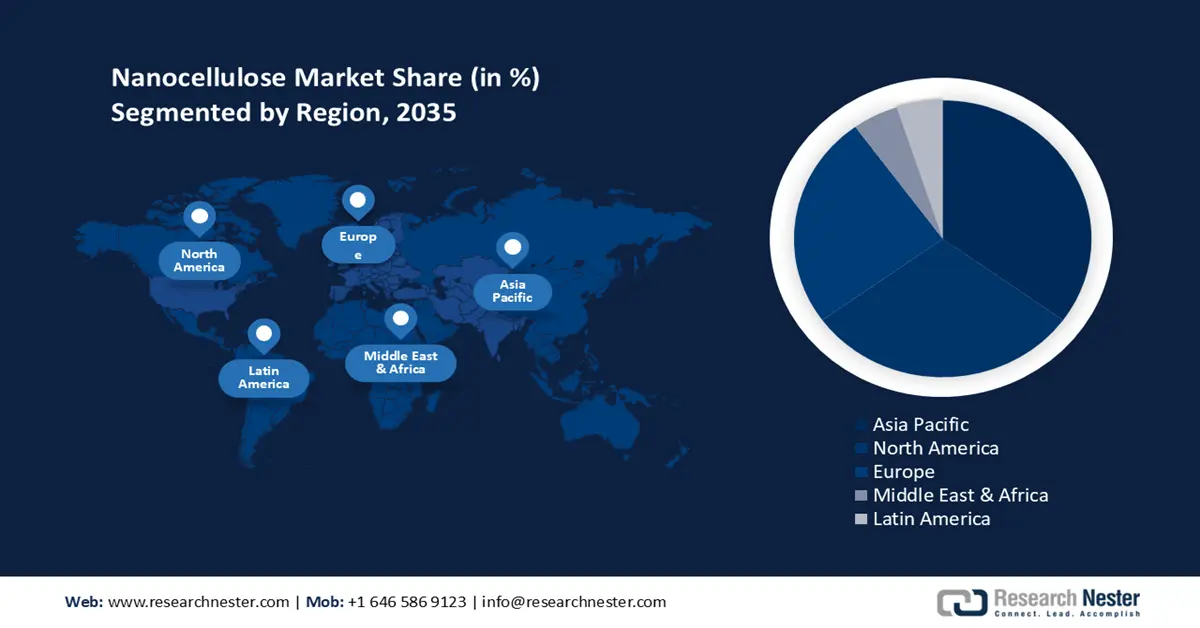

- The Asia Pacific nanocellulose market holds the largest share by 2035, driven by surging vehicle production and demand for lightweight automotive materials.

- The North America market is poised for robust growth with the second largest share by 2035, attributed to increasing biomedical sector adoption and healthcare spending.

Segment Insights:

- The biomedical segment in the nanocellulose market is expected to dominate with the highest market share by 2035, influenced by surging investment in materials, therapies, and devices for disease understanding and treatment.

- The nano-fibrillated cellulose segment in the nanocellulose market is anticipated to secure the largest share by 2035, driven by the radically expanding production of cement globally and growing utilization of nano-fibrillated cellulose.

Key Growth Trends:

- Expanding Healthcare Sector

- Rising Global Initiatives to Reduce Carbon Footprint

Major Challenges:

- High Cost & Complex Process

- High Competition from Cheaper Alternatives like Rubber & Plastic

Key Players: Nippon Paper Industries Co. Ltd., Oji Holdings Corporation, Stora Enso Biomaterials, Södra Skogsägarna, Fiberlean technologies, Kruger Inc., Borregaard, Celluforce Inc., Yara International ASA, Sappi Limited.

Global Nanocellulose Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 589.6 million

- 2026 Market Size: USD 708.46 million

- Projected Market Size: USD 4.45 billion by 2035

- Growth Forecasts: 22.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, China, Canada

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 9 September, 2025

Nanocellulose Market Growth Drivers and Challenges:

Growth Drivers

- Expanding Healthcare Sector – The healthcare sector is flourishing globally. For instance, in the U.S. economy, the healthcare sector accounted for nearly 18% of the gross domestic product (GDP) in 2020. This expansion is anticipated to propel the demand for nanocelloluse as it has widespread utilization in the medical, biomedical, and biotechnological industries. For instance, it is used in nanomedicine, biomedical implants, drug delivery, cartilage replacements, and tissue engineering, besides the use of freeze-dried nanocellulose aerogels in sanitary napkins, tampons, diapers, wound dressing, and much more.

- Rising Global Initiatives to Reduce Carbon Footprint – The use of nanocellulose in many end-use industries may help in reducing the overall carbon emission worldwide. For instance, advances in nanocellulose are anticipated to cut the carbon footprint of paper nearly by more than 15%.

- Growing Packaging Industry – the growing innovations and inventions in flexible packaging, have fueled the production of lightweight, convenient, and sustainable packaging solutions pushing the growth of the packaging sector. For instance, the expansion of this industry is estimated to hike by almost 3% per annum, reaching more than USD 1.2 trillion between 2018 and 2028. Moreover, the use of nanocellulose in the packaging industry is anticipated to fuel the nanocellulose market growth.

- Growing Demand from Multiple Industries - Cellulose is the most abundant polymer on earth, and 1.5 trillion tons of cellulose is produced annually, whereas nanocellulose, which can currently be produced on an industrial scale at tons per day, is gaining popularity owing to its rising use in several fields, such as nanocomposite materials, wood adhesives, supercapacitors, biomedical products, batteries, template for electronic components, catalytic supports, electroactive polymers, food coatings, barrier/separation membranes, antimicrobial films, continuous fibers and textiles, paper products, cosmetic, cement, and many other emerging uses. Hence, its augmenting demand is expected to boost market growth.

Challenges

- High Cost & Complex Process - typical methods for nanocellulose extraction from cellulosic materials have limitations such as the high amount of acid wastewater generation for acid hydrolysis, high energy consumption for mechanical process, and long reaction time for enzymatic hydrolysis. Hence, the complexity involves in the extraction of these biomaterials raises its cost, hampering the market growth.

- High Competition from Cheaper Alternatives like Rubber & Plastic

- Lack of Awareness About the Product

Nanocellulose Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

22.4% |

|

Base Year Market Size (2025) |

USD 589.6 million |

|

Forecast Year Market Size (2035) |

USD 4.45 billion |

|

Regional Scope |

|

Nanocellulose Market Segmentation:

Type Segment Analysis

The nano-fibrillated cellulose segment is estimated to gain the largest market share in the year 2035. The growth of the segment can be attributed to the radically expanding production of cement globally as well as the growing utilization of nano-fibrillated cellulose in the cement industry, owing to their easy availability, higher tensile strength, large surface area, and potential to enhance the durability of cement composites. China the largest producer of the most cement in the world produced around 2.1 billion metric tons in 2022. Moreover, the heightening demand for NFC from numerous end-use industries including food and beverage, oil & gas, aerospace, automotive, and personal care industries which are expanding exponentially.

End-user Segment Analysis

The pulp & paper segment is expected to garner a significant share in the year 2035. The factors applicable for growth of the segment include the growing demand for paper globally owing to its increasing demand for end-products such as books, diapers, paper towels, napkins, newspapers, magazines, maps, toilet tissue and from many end-use industries such as the packaging industry, just to name a few. The data from the International Energy Agency (IEA) revealed that paper production worldwide is forecasted to grow by 1.2% annually.

The biomedical segment is estimated to garner the highest share in the forecast period owing to the radically surging investment in the development of materials, therapies, devices, technology, systems, methods, and processes to facilitate the understanding of human disease, or its, monitoring, prevention, diagnosis, and treatment.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nanocellulose Market Regional Analysis:

APAC Market Insights

The Asia Pacific nanocellulose market is projected to hold the largest market share by the end of 2035. The growth of the market can be attributed majorly to the exponentially surging production of vehicles as well as the rising demand for nanocellulose in the automotive industry besides other end-user industries, owing to the increasing demand for lightweight vehicles with higher tensile strength and better fuel economy. As per research, it was found that using nano cellulose for parts of cars, like bumpers, side panels, and dashboards makes them 3-4 times stronger and around 30% lighter. Moreover, it was observed that the production of cars and commercial vehicles in China reached nearly 21.41 million and 4.67 million in 2021 respectively, depicting the prospering automotive industry.

North American Market Insights

The North American nanocellulose market is projected to hold the second largest share during the forecast period. The growth of the market can be attributed majorly to the augmenting biomedical sector along with the increasing adoption of advanced technology, owing to increasing spending on healthcare with increasing chronic diseases. It was found that U.S. healthcare spending increased by 2.7% in 2021, reaching approximately USD 4.3 trillion. Therefore, the growing adoption of biomaterial in cartilage replacements, cardiovascular applications, and many medical implants owing to its unique nanostructure is expected to propel the market growth.

Europe Market Insights

Europe region is expected to observe significant growth till 2035. The growth of the market can be attributed majorly to the raised standard of living of people in the region together with the increasing demand for green and sustainable food packaging material by the growing food & beverages industry in the region

Nanocellulose Market Players:

- Nippon Paper Industries Co. Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Oji Holdings Corporation

- Stora Enso Biomaterials

- Södra Skogsägarna

- Fiberlean technologies

- Kruger Inc.

- Borregaard

- Celluforce Inc.

- Yara International ASA

- Sappi Limited

Recent Developments

-

Oji Holdings Corporation a Japanese manufacturer of paper products developed cosmetic quality commercial nano cellulose fiber ‘AUROVISCO CS’ together with Nikko Chemicals Co., Ltd. a global supplier of ingredients for cosmetics, pharmaceuticals, food, and industrial applications.

-

Stora Enso Group the renewable materials company acquired the specialist in applications-based cellulose company, Cellutech AB, to expand the company’s portfolio worldwide.

- Report ID: 3576

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nanocellulose Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.