Mycoplasma Testing Market Outlook:

Mycoplasma Testing Market size was over USD 850.7 million in 2024 and is estimated to reach USD 2.7 billion by the end of 2034, expanding at a CAGR of 10.8% during the forecast timeline, i.e., 2025-2034. In 2025, the industry size of mycoplasma testing is assessed at USD 940.5 million.

The market is remarkably influenced by the increasing need for biologics, cell therapies, and vaccines. Testifying to the same, in 2023, the World Health Organization (WHO), every year, more than 20.6 million patients rely on biologics such as monoclonal antibodies and recombinant proteins. As all of these therapies require stringent contamination testing during production, the expansion of these industries is fueling this sector. This can be exemplified by the U.S. FDA requiring mycoplasma testing for all cell-based therapies, affecting over 507 clinical trials worldwide in 2024. This dual expansion in patient pool and strict compliance requirements underscores the future increase in the use of this technology in drug safety and efficacy.

However, the rising occurrence of financial exhaustion among manufacturers and consumers is hindering affordability and hence the adoption rate in the market. For instance, from 2023 to 2024, the Bureau of Labor Statistics (BLS) recorded a 4.6% year-over-year (YoY) rise in the producer price index (PPI) for essential components. Elevation in supply chain challenges and R&D expenditures was the major reason behind this inflation, which concurrently caused a 4.1% increase in the consumer price index (CPI) for diagnostic services. Moreover, the growing demand for contamination-free production is underscoring the urgent need for optimization of the compliance processes and biopharmaceutical manufacturing.

Mycoplasma Testing Market - Growth Drivers and Challenges

Growth Drivers

-

Targeted allocations to improve access: The market is highly pledged to massive public investments and accessibility efforts. As evidence, in 2023, the governing body of the U.S. increased its expenditure on this category, totaling $950.6 million, reflecting a 7.7% YoY increase. Besides, in 2024, the European Commission (EC) committed €220.6 million under the Horizon Europe initiative to advance microbial detection technologies. Moreover, the growing trend of prioritization of contamination prevention in healthcare is directly escalating the scale of research, adoption, and compliance capabilities of this sector.

-

Extensive R&D investment and participation: Continuous financial backing for research and innovation is cumulatively expanding the pipeline of the market. Exemplifying the same, the National Institute of Health (NIH) dedicated $120.7 million specifically to develop and deploy advanced microbial detection technologies in biomanufacturing in 2024. In the same year, the EC committed €85.4 million to cultivate rapid forms of such systems. These R&D expenditures are accelerating technological advances, enhancing accuracy and efficiency, and expanding applications across key industries, positioning this technology as a pivotal component of modern quality control in pharmacology.

-

Strategic commercial operations: Alongside the government efforts, the planned moves of pharma leaders are also helping the market curate cutting-edge products with extended capabilities. For instance, in 2024, Thermo Fisher Scientific launched AI-driven qPCR kits that can reduce detection times by 50.8%. During the same time, Sartorius formed alliances with 10 contract research organizations (CROs) in Asia to expand its territory in this field, which further earned a 25.5% revenue boost for the company. These events are not only improving the technology's efficacy but also enhancing accessibility in the sector and reinforcing its significance in the worldwide pharmaceutical industry.

Historical Patient Growth (2010-2020) and Its Impact on Future Market Expansion

Historical Patient Growth Data (2010-2020)

|

Country |

2010 Patients (Million) |

2020 Patients (Million) |

CAGR (2010-2020) |

Key Growth Driver |

|

U.S. |

0.88 |

1.75 |

7.6% |

FDA biologics testing mandates |

|

Germany |

0.45 |

0.94 |

8.4% |

EU GMP compliance |

|

France |

0.41 |

0.82 |

7.9% |

Biosimilar production surge |

|

Spain |

0.24 |

0.51 |

8.9% |

Clinical trial outsourcing boom |

|

Australia |

0.15 |

0.32 |

9.5% |

TGA-regulated cell therapy approvals |

|

Japan |

0.56 |

1.08 |

7.3% |

PMDA enforcement of contamination controls |

|

India |

0.21 |

0.78 |

15.6% |

Local vaccine/biologic production |

|

China |

0.38 |

1.65 |

16.9% |

NMPA biologics registration surge |

Source: FDA, EMA, CDSCO, NMPA, and TGA

Feasible Expansion Models Shaping the Market

Revenue Feasibility Models

|

Region |

Strategy |

Revenue Impact (2022-2024) |

|

U.S. |

Medicare-covered testing |

+9.3% revenue growth |

|

Germany |

Automated PCR adoption |

+11.8% lab efficiency |

|

India |

Local CRO partnerships |

+12.5% market share |

|

China |

NMPA-fast-tracked kits |

+18.4% production volume |

Source: CMS, EMA, CDSCO, and NMPA

Challenges

-

Limitations in profitability: The pressures induced by stringent reimbursement policies are one of the evident roadblocks in the market. Exemplifying the same, in 2023, the Federal Joint Committee (G-BA) reported that the IQWiE capped reimbursements at €25.4 for each assessment performed in Germany. This further forced Merck KGaA to reduce its profit margins by 15.7%, reflecting the impact of price controls as a constraint on innovation investments while limiting market expansion in cost-sensitive healthcare systems.

-

Talent shortages and training gaps: The market often witnesses notable restrictions in global scale utilization following the absence of skilled professionals. Evidencing the same, the American Society for Microbiology (ASM) published the findings from a survey conducted in 2024, which revealed that 40.6% of laboratories in the U.S. lack personnel who are qualified to perform ISO 17025-compliant testing. The situation is even more critical in emerging economies, such as India, where only 12.5% of CROs employ staff trained in GMP-compliant testing, according to the Central Drugs Standard Control Organisation (CDSCO).

Mycoplasma Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

10.8% |

|

Base Year Market Size (2024) |

USD 850.7 million |

|

Forecast Year Market Size (2034) |

USD 2.7 billion |

|

Regional Scope |

|

Mycoplasma Testing Market Segmentation:

Technology Segment Analysis

The PCR segment is expected to command the highest share of 42.8% in the market over the assessed period. Being the gold standard for regulatory mandates, this technology has become an essential part of biopharmaceutical innovation. This can be exemplified by the FDA's requirement for qPCR validation in biologics testing, which solidified this method's industry dominance. The segment is further levitated by the 15.4% CAGR growth in cell and gene therapy-related clinical trials, as they need highly sensitive contamination screening. These dual forces of regulatory compliance and wide therapeutic utilization ensure PCR technology remains the most preferred method for pharmaceutical quality control.

Application Segment Analysis

The biopharmaceutical manufacturing is predicted to be the largest application segment in the market by the end of 2034, with a 38.7% share. The tightening of global quality standards in this industry is making it the source of greater revenue generation in this sector. For instance, in 2023, the WHO issued prequalification criteria mandating mycoplasma testing for all vaccines. This field of utilization is further fueled by the projected $1.6 trillion industry size of the global biopharma market by 2030, as per the NIH observations. As a result, the expanding biologic production continues to make microbial detection solutions indispensable for this category. These factors position biopharmaceutical manufacturing as a long-term growth factor in this sector.

Product Segment Analysis

The kits & reagents are poised to dominate the product segment while holding 50.4% share throughout the discussed timeframe. Being one of the fundamental components for contamination detection across laboratories and biopharmaceutical facilities, these commodities are procured at a larger scale than others. This proprietorship is also attributed to the recurring need for standardized testing materials that deliver consistent and reliable results and performance during the assessments. Moreover, these core testing supplies form the backbone of mycoplasma workflows, which maintain a substantial demand base by both routine testing requirements and expanding biopharmaceutical production worldwide.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Application |

|

|

End user |

|

|

Product |

|

|

Method |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mycoplasma Testing Market - Regional Analysis

North America Market Insights

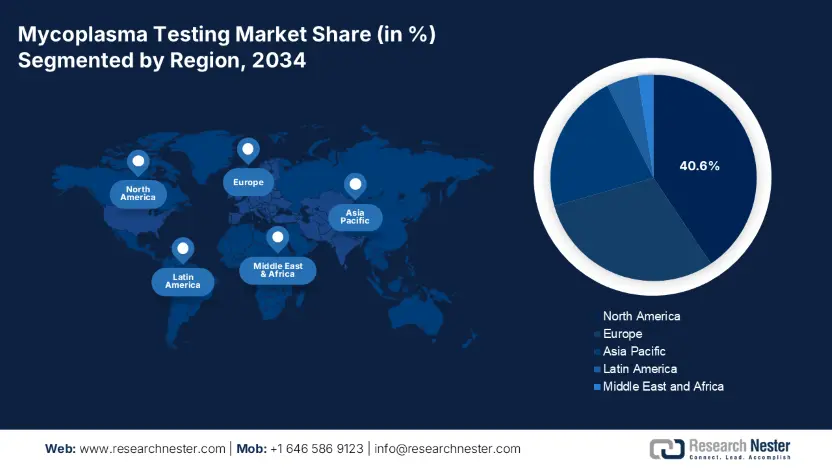

North America is anticipated to capture the highest share of 40.6% in the mycoplasma testing market during the analyzed timeline. The region is strongly backed by its stringent regulatory framework and substantial biotech R&D investments in this sector. Besides, the enlarging patient pool is also a propeller of biopharma production, which ultimately benefits the landscape. As evidence, in 2024, the NIH revealed that North America consists of approximately an annual 500.4 thousand patient population, who rely on cell and gene therapies that require mandatory mycoplasma screening. Furthermore, due to being the global epicenter of automated detection system manufacturing, the region is highly focused on bringing innovation in this field through advanced robotics and AI-driven quality control.

The U.S. leads the regional mycoplasma testing market, which is pledged to stringent FDA policies (21 CFR 610.30) mandating biologics testing. With a $5.4 billion fund allocated to support compliance efforts, the country secured a stable cash inflow in this category, according to the 2023 CDC report. Besides, from 2020 to 2024, Medicare increased spending on these solutions by 15.3%, totaling $800.7 million, to provide financial backing for qPCR assessments for older residents, as unveiled by the Centers for Medicare & Medicaid Services (CMS). Following the same, in 2024, Medicaid also dedicated $1.5 billion to enable access to an additional 10.8% of patients.

Canada is also poised to augment robust growth in the market on account of provincial government allocations. For instance, in 2023, Health Canada allocated $3.5 billion to support nationwide diagnostic initiatives, as per the Canadian Institute for Health Information (CIHI). Besides, from 2021 to 2024, the governing body of Ontario is also boosting adoption in this sector by reaching 200.4 thousand patients with expanded testing access. Furthermore, in 2024, the Public Health Agency of Canada (PHAC) enacted new mandates regarding rigorous screening for cell therapies, which accelerated demand in this category, as reported by the PHAC.

APAC Market Insights

Asia Pacific is poised to become the fastest-growing region in the mycoplasma testing market by the end of 2034, while exhibiting an 11.8% CAGR. The booming biopharmaceutical industry, stringent regulatory mandates, and increasing infectious disease burdens are collectively establishing a sustainable consumer base for this sector. As evidence, the PMDA enacted strict GMP compliance across Japan, with the allocation of 12.6% of its healthcare budget to mycoplasma testing. Besides, the Ministry of Food and Drug Safety (MFDS) of South Korea also supports this cohort by fast-tracking approvals. Moreover, the National Pharmaceutical Regulatory Agency (NPRA) invested $200.6 million in laboratory upgrades, boosting cash inflow in this sector.

China dominates the Asia Pacific mycoplasma testing market with an estimated 45.4% revenue share by 2034. The country's augmentation in this field is primarily stimulated by the stringent biologics and vaccine testing mandates from the National Medical Products Administration (NMPA). Additionally, the government of China allocated $5.5 billion in funding for this category. The country's global significance is further established by its dominance over supplies, accounting for approximately 28.7% of global mycoplasma testing raw materials.

India is emerging as the growth engine of the APAC mycoplasma testing market with a 15.6% CAGR. Its accelerated propagation in this sector is supported by robust local vaccine production and the strict testing guidelines from the Central Drugs Standard Control Organisation (CDSCO). With a potential to acquire 18.6% regional revenue share by 2034, the country’s expanding biopharmaceutical sector and active pharmaceutical ingredient (API) manufacturing further drive demand in this sector. Moreover, evidencing the presence of a large patient pool, in 2023 alone, 2.7 million eligible patients were treated by mycoplasma-tested medicine.

Government Investments & Policies (2024-2025)

|

Country |

Government Initiative / Policy |

Budget/Funding (Million) |

Key Impact |

|

Australia |

National Health Priority (Diagnostics Expansion) |

$40.5 (projected) |

Aimed at doubling testing capacity for biopharma |

|

South Korea |

Ministry of SMEs Start-up Grants |

$18.8 |

Boosted 10 local mycoplasma testing startups |

|

Malaysia |

MOH National Lab Modernization Initiative |

$20.3 (allocated) |

Upgrading 5 regional labs with automated test systems |

Source: TGA, MFDS, and NPRA

Europe Market Insights

The Europe mycoplasma testing market is expected to grow at an 8.1% CAGR under the influence of the strict GMP compliance and increasing biopharmaceutical R&D investments. France leads the landscape with a €2.1 billion budget allocation in 2023 and National Authority for Health (HAS) reimbursement policies. On the other hand, in 2024, the Health Data Space invested €2.8 billion to standardize testing protocols. Moreover, such regulatory and financial support reinforce the region’s position as the second-largest shareholder in the global market.

Germany is poised to maintain dominance over the Europe mycoplasma testing market with a predicted 30.8% share by 2034. The country's position is consolidated by €4.6 billion in federal funding for biopharmaceutical testing, as unveiled by the Federal Ministry of Health (BMG). Besides, more than 503 laboratories operating across the nation now use EMA-compliant PCR kits, which have already reduced false negatives by 20.8%. Further, to support self-sufficiency, Thermo Fisher set its aim to produce 50.5 million tests every year till 2026 with its Leipzig plant, helping the company attain 15.4% market share in Europe.

The UK is expected to command a 25.4% regional share in the Europe market till the end of 2034. The country is highly supported by government financial backing and the emergence of contractual pharma operations. As evidence of the stable capital influx, in 2023, the National Health Service (NHS) invested £2.9 billion in diagnostics. The country is further pledged to a 30.6% surge in CRO outsourcing, as per the Association of the British Pharmaceutical Industry (ABPI). Moreover, in 2024, the Medicines and Healthcare products Regulatory Agency (MHRA) fast-tracked clearances for more than 12 tests, indicating the country's significance as both a source of regulatory support and an innovation hub.

Country-wise Government Provinces (2024-2025)

|

Country |

Government Initiative / Policy |

Budget/Funding (Million) |

Key Impact |

|

Spain |

National Biopharma Strategy |

€40.3 (allocated) |

Includes mycoplasma testing mandates for cell therapies |

|

Italy |

Ministry of Health GMP Enforcement Program |

€20.7 |

Strengthened QC requirements for biologics manufacturers |

|

Russia |

Eurasian Economic Union (EAEU) Standardization |

~$27.5 |

Harmonized testing protocols with CIS countries |

Source: AEMPS, AIFA, and Minzdrav.gov

Key Mycoplasma Testing Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The mycoplasma testing market is consolidated by the leadership of Thermo Fisher and Charles River Labs, gained through strategic acquisitions and investments in automation. Other key players, such as Merck KGaA and Sartorius, are capitalizing on their strong emphasis on GMP-compliant solutions, while firms in gaining competency via cost-effective outsourcing. Testifying to these market characteristics, in 2024, Lonza allied with Moderna to leverage its capabilities in cultivating advanced screening tools for cell therapies. Moreover, the competition is intensifying due to the growing interest in localized production, AI integration, and regulatory harmonization.

The cohort of these pioneers include:

|

Company Name (Country) |

Market Share (2024) |

Industry Focus |

|

Thermo Fisher Scientific (U.S.) |

22.6% |

PCR kits, automated testing systems for biopharma & diagnostics |

|

Charles River Laboratories (U.S.) |

18.3% |

End-to-end testing services for cell/gene therapies |

|

Merck KGaA (Germany) |

12.7% |

ELISA kits & cell culture contamination solutions |

|

Lonza Group (Switzerland) |

10.8% |

cGMP-compliant testing for contract manufacturing |

|

Sartorius AG (Germany) |

8.4% |

Automated microbial detection systems |

|

Becton Dickinson (U.S.) |

xx% |

Molecular diagnostics & lab automation tools |

|

Bio-Rad Laboratories (U.S.) |

xx% |

qPCR reagents & validation kits |

|

F. Hoffmann-La Roche (Switzerland) |

xx% |

NGS-based mycoplasma detection for biologics |

|

Agilent Technologies (U.S.) |

xx% |

Nucleic acid extraction kits & lab instruments |

|

WuXi AppTec (China) |

xx% |

Outsourced testing services for global CROs |

|

BioMérieux (France) |

xx% |

Culture-based detection systems |

|

Danaher Corporation (U.S.) |

xx% |

Integrated diagnostics platforms (Cepheid) |

|

PerkinElmer (U.S.) |

xx% |

High-throughput screening solutions |

|

Cell Signaling Technology (U.S.) |

xx% |

Antibodies & assays for research labs |

|

Promega Corporation (U.S.) |

xx% |

Luminescence-based detection kits |

|

Biocon (India) |

xx% |

Affordable ELISA kits for emerging markets |

|

InQpharm Group (Malaysia) |

xx% |

Rapid tests for Southeast Asian hospitals |

Below are the areas covered for each company in the mycoplasma testing market:

Recent Developments

- In May 2024, Sartorius launched its groundbreaking Virosart Myco Air Monitor, marking the first real-time airborne mycoplasma detection system for cleanroom environments. This innovative solution reduces contamination risks by an impressive 40.4%, addressing a critical need in biomanufacturing quality control.

- In March 2024, Thermo Fisher introduced its AccuPrime Mycoplasma Detection Kit, featuring high-sensitivity qPCR technology capable of detecting 24+ mycoplasma species in under two hours. The kit meets stringent regulatory standards, being fully validated per FDA 21 CFR 610.30 and EMA GMP guidelines.

- Report ID: 4969

- Published Date: Aug 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mycoplasma Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert