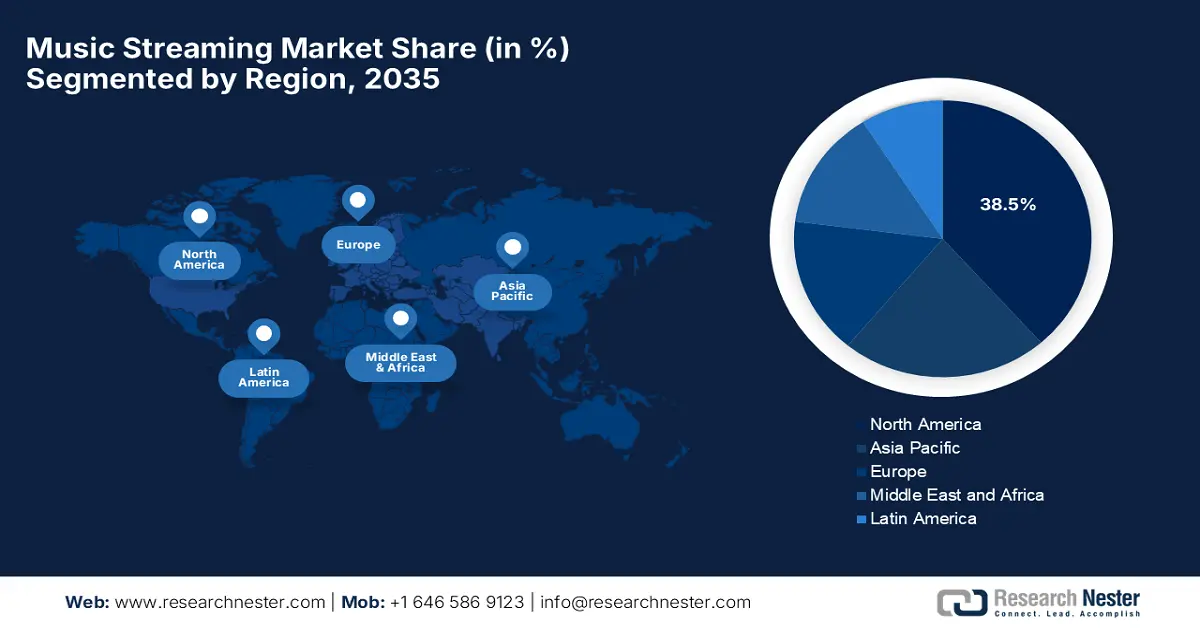

Music Streaming Market - Regional Analysis

North America Market Insights

North America is expected to lead the entire global dynamics of the music streaming market, capturing the largest revenue share of 38.5% during the forecasted duration. The region’s dominance in this field is effectively subject to high digital adoption, widespread smartphone usage, and the presence of leading streaming platforms. In November 2025, Stingray Group Inc. announced that it had entered into a definitive agreement to acquire TuneIn, which marks a major expansion of its digital audio presence and advertising capabilities. This alliance will combine the firm’s extensive content distribution with TuneIn’s large listener base and strong device partnerships, thereby positioning the company as a leading force in connected audio experiences across home, automotive, and mobile environments. Furthermore, with this acquisition, Stingray aims to create a unified audio ecosystem that boosts audience reach, strengthens advertiser offerings, and accelerates market growth in the upcoming years.

The U.S. has gained a leading position in the regional music streaming market, backed by the presence tech-forward consumer base and the prominence of major record labels and streaming companies. The country’s market also benefits from strong cultural diversity, which fuels demand for varied genres and artists. In November 2025, KLAY Vision Inc. announced that it had secured AI licensing agreements with major industry leaders, which include UMG, SME, and WMG, enabling it to develop interactive, AI-powered music experiences built entirely on licensed content. Besides, KLAY positions itself as an artist-centered platform that readily enhances creativity, protects copyright, and ensures fair recognition for creators. Furthermore, with support from key music companies and a leadership team experienced in AI, digital business, and music innovation, the company aims to establish trusted frameworks.

Canada is also representing strong progress in the music streaming market, propelled by the presence of both domestic and international platforms, which are offering listeners a mix of global and homegrown music. In June 2025, Spotify reported that artists in the country are witnessing unprecedented success with its platform, wherein creators are earning about USD 460 million in 2024, which marks almost double their earnings when compared to 5 years earlier. It also stated that the vast majority of this income now comes from international listeners, underscoring Canada’s role as a major exporter of music across languages, genres, and cultures. Hence, this global success of the country’s artists demonstrates the strongest market’s potential for international audience growth, boosting streaming revenues and subscriber engagement in the music streaming industry.

Key Statistics on Canadian Artists’ Global Success on Spotify (2024)

|

Category |

Statistic |

|

Canadian artist royalties on Spotify (2024) |

Nearly 460 million CAD |

|

Year-over-year royalty growth (2023-2024) |

5% increase |

|

Share of royalties from outside Canada (2024) |

92% |

|

Daily global listening of Canadian artists |

15 million hours |

|

Number of global playlists featuring Canadian music |

2.4 billion |

|

Recorded music revenue growth in Canada (2014-2024) |

129% increase |

|

Recorded music revenue in 2024 |

909 million CAD |

|

Share of recorded music revenue from audio streaming |

Nearly 79% |

|

Share of royalties earned by indie artists/labels |

~40% |

|

Growth in global streams for Canadian women (since 2020) |

Nearly doubled |

|

Share of artists earning over CAD 1 million who are women or mixed-gender groups (2024) |

Over 40% |

Source: Spotify

APAC Market Insights

Asia Pacific is expected to expand at a rapid pace in the music streaming market from 2026 to 2035. The region’s pace of progress in this field effectively catered to the rising mobile connectivity and a young and active listener base. Local platforms in the region are proactively competing with the global pioneers attributable to the different linguistic as well as cultural preferences. On the other hand, the growing investments in terms of digital entertainment are pushing streaming deeper into everyday media consumption. In addition, the proliferation of data plans is making streaming more accessible across both urban and rural areas. Strategic partnerships with telecom providers and device manufacturers are readily accelerating user adoption. Furthermore, presence of this dynamic ecosystem is fostering innovation in terms of content formats and monetization models across the region.

China continues to elevate its potential in the regional music streaming market, leveraging the consumer base who prefer social-integrated features, enabling sharing, fan engagement, and community-building. The country also benefits from rising interest in original and independent music content since it shapes the market’s unique direction. In March 2025, Tencent Music Entertainment Group reported strong 2025 for the first quarter results, with total revenues of RMB 7.36 billion (USD 1.01 billion), up 8.7% YoY, highly influenced by 16.6% growth in music subscription revenue to RMB 4.22 billion and 122.9 million paying users. It also mentioned that the company’s net profit surged 201.8% YoY to RMB 4.29 billion (USD 591 million), supported by gains from strategic investments reflecting the presence of strong demand for music offerings in the country.

India hosts a very rich, culturally active music streaming market, which is primarily fueled by the heightened demand for multilingual content and a mobile-first listener base. Local and global platforms compete by offering extensive regional catalogues and affordable digital access in the country. In addition, the popularity of film music and rapidly shifting digital habits make streaming a central part of media consumption in the country, hence attracting more players to make investments in this field. For instance, in March 2022, Warner Music India and JioSaavn announced that they had launched Spotted, which is an artist discovery program in partnership with Rolling Stone India, aimed at uncovering and promoting new musical talent across the country. The program allows aspiring artists to submit original tracks, with one artist selected each month by industry veterans and featured on JioSaavn playlists and Rolling Stone India stories.

Europe Market Insights

Europe has a strong scope to revolutionize the music streaming market, which is characterized by a blend of different cultural traditions and strong regulatory frameworks that extensively support digital services. On the other hand, continuous advancements in terms of platform usability and discovery tools help maintain steady market growth. As per an article published by ECSA in November 2023 European Parliament’s CULT Committee adopted a report on music streaming, which emphasizes fair remuneration for music creators in the region. The report encourages accurate metadata, transparency, ethical AI use, and alternative revenue models to address current imbalances for authors and performers. It also stated that ECSA supports these measures and looks forward to collaborating with the European Commission, Member States, and the industry to implement a strategy, including a European Music Observatory, to ensure a more equitable streaming ecosystem.

The preference for high-quality audio experiences and strong music culture has positioned Germany as the key growth contributor in the regional music streaming market. The industry represents a blend of international hits with support for domestic artists, thereby enriching platform catalogues. In December 2022, Believe reported that it achieved a landmark performance in Germany in 2022, becoming the third-largest company in the local streaming sector by supporting artists and labels across diverse genres, from urban to metal. The company leverages its digital expertise, local teams, and tailored services, which range from TuneCore for emerging artists to Premium Artist Services for established acts, to drive growth and chart success for talent like Theo Junior, KAFFKIEZ, and Milky Chance. Hence, with consistent revenue growth, the company’s support for diverse local artists and digital services drives streaming adoption, audience expansion, and overall growth in the market.

The U.K. also represents a dynamic landscape of the music streaming market, which is supported by its influential tracks and tech-savvy consumers. In this context, streaming plays a crucial role in shaping listening trends, particularly among younger audiences. On the other hand, strong integration with smart home devices and evolving content formats enables the country to remain competitive as well as innovative. In September 2025, ERALTD reported that in the UK, music streaming services are actively supporting the domestic music industry through more than 60 initiatives, with a third specifically targeting new and emerging British talent. It also mentioned that these programs encompass artist development, education, diversity, and inclusion, providing encouraging opportunities for funding, exposure, and training, hence contributing to market expansion.