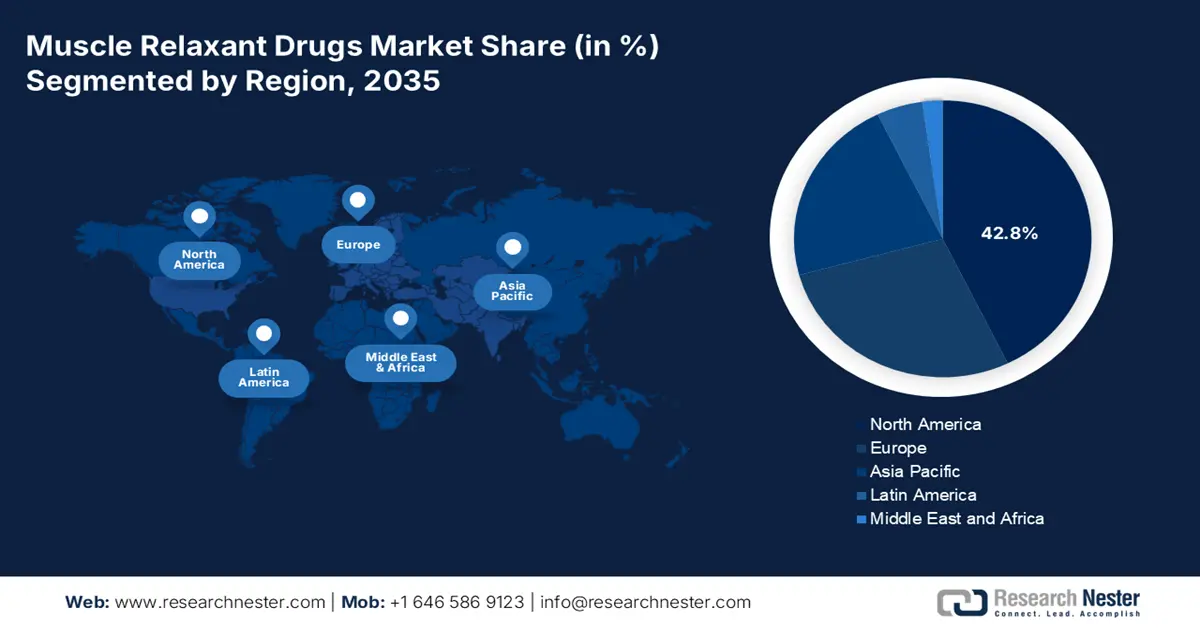

Muscle Relaxant Drugs Market - Regional Analysis

North America Market Insights

North America is dominating the global market and is expected to hold the highest revenue share of 42.8% during the analyzed tenure. As per the CDC report in February 2024, the prevalence of diagnosed arthritis in adults aged 18 and older was 18.9%, with women being 21.5% more likely to have arthritis compared to men, 16.1%. This demography was primarily attributed to the arthritis occurrence rate and a large volume of spinal injury cases, according to a CDC report. The region's dominance is also solidified by adequate reimbursement coverage and globally concentrated finished drug production.

The U.S. commands a strong dominance over the regional market on account of being the origin of revenue generation in North America. The rising population is the factor driving the demand for muscle relaxant medications. In the U.S., as per the PRB report in January 2024, 58 million people are aged above 65. Further, this population mostly suffers from various diseases, including strained muscles, back pain, and spasms, mainly those caused by spine injuries.

The Canada market is poised to hold a notable share in the region by 2035. The country's contribution to this merchandise is sourced from its universal healthcare coverage. Ontario's recent 2025 budget documents and Health Canada reports emphasize broad investments in healthcare, primary care, and hospital services, with total healthcare spending running into billions, such as USD 1.1 billion for hospitals in 2025–26 and multi-billion dollar allocations over the coming decade for infrastructure and services. This highlights the growing consumer base and need for supplier cultivation in Canada for this sector.

Age-Wise Percentage of People with Arthritis

|

Age |

Percentage |

|

18-34 |

3.6 |

|

35-49 |

11.5 |

|

50-64 |

29 |

|

65-74 |

44.0 |

|

75 and above |

53.9 |

Source: CDC, February 2024

APAC Market Insights

Asia Pacific is expected to become the fastest-growing region in the global muscle relaxant drugs market by the end of 2035. The rapidly aging populations and expanding healthcare access are the growth engines behind the region's accelerated propagation in this sector. Further, the rising R&D investment by governments and rapid healthcare infrastructure development are boosting the market. For example, in November 2022, Eisai announced its agreement to divest its rights for muscle relaxant Myonal to a subsidiary of DKSH Holding Ltd. in Asia. On the other hand, the rising prevalence of musculoskeletal disorders and surgical procedures in developing countries is further boosting the market.

China is the leading regional player in the pharmaceutical industry. The total pharmaceutical spending during 2022 amounted to 8,532.749 billion yuan, representing nearly 7.05% of overall health expenditures, with increasing emphasis on cost-saving outpatient and retail medications, according to the NLM article of September 2024. The nation's massive population is fueling consistent demand for medicine products, including non-opioid muscle relaxant medications. In 2023, NMPA continued strengthening oversight, with chemical pharmaceuticals classified as generics and successive approvals for new products, although the number of new generics varies in reports.

India is emerging as the epicenter of localized manufacturing and a large consumer base in the APAC muscle relaxant drugs market. Rheumatoid arthritis is driving the market based on the genetic and epigenetic factors. As per the NLM report in February 2025, the average annual medical expenditure for treating rheumatoid arthritis was 44,700 rupees (USD543). Moreover, the landscape is thriving on local API production, which has already reduced costs and is supporting the efforts to maintain affordability for mass populations.

Europe Market Insights

The Europe-based muscle relaxant drugs market is anticipated to augment the second-largest revenue share during the timeline between 2026 and 2035. The aging demographics and rise in neurological disorder incidences are setting a viable and sustainable demand for this sector. France holds the highest revenue share in this landscape by prioritizing cost-effective generics of health budget allocation, as reported by the National Authority for Health (HAS). The European Medicines Agency (EMA) also supported the region's consistent expansion by releasing fast-tracked clearances for non-opioid medicines.

Germany leads the Europe muscle relaxant drugs market with a considerable revenue share in the forecast period. The major factor driving this growth is the high prevalence of musculoskeletal disorders across age groups. As per the Frontiers report in 2025, 49% of people aged under 35 years to 68% of those over 50 years are experiencing musculoskeletal disorders. This growing disease burden, with robust healthcare infrastructure makes Germany hold the leading position in the market. Furthermore, ongoing clinical advancements and supportive reimbursement policies are expected to reinforce Germany’s dominance in the European market.

The UK holds the largest regional share in the Europe muscle relaxant drugs market. The country's significance in this sector is backed by adequate financial backing and ongoing innovations in formulations. For instance, the National Health Service (NHS) expanded its reimbursement coverage to prescriptions. In addition, in 2024, the National Institute for Health and Care Excellence (NICE) issued guidelines extending access to tizanidine ER, increasing the annual demand. In the same year, non-opioid use also rose from 2022, as per the Association of the British Pharmaceutical Industry (ABPI), the industry invested more in the development of novel relaxants.