Municipal Pump Market Outlook:

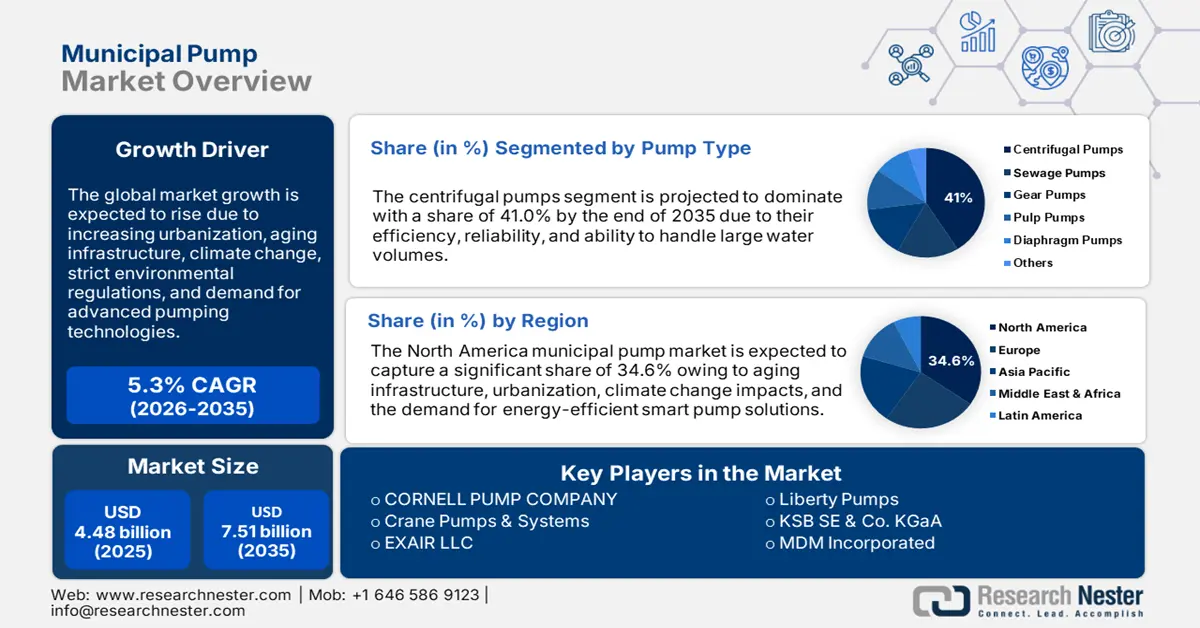

Municipal Pump Market size was over USD 4.48 billion in 2025 and is projected to reach USD 7.51 billion by 2035, growing at around 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of municipal pump is evaluated at USD 4.69 billion.

As urban areas expand rapidly, the demand for efficient water supply, sewage handling, and drainage systems intensifies. This growth requires reliable and scalable pump solutions to ensure a continuous flow of clean water, proper wastewater management, and effective stormwater drainage. For instance, the U.S. government stated in February 2024 that it will invest USD 6.0 billion in wastewater and clean drinking water infrastructure. Municipal pumps are essential in supporting this infrastructure, as they help maintain a balanced and sustainable urban environment. This trend is driving the increased adoption of pumps designed for high capacity and long-term efficiency and propelling the municipal pump market.

Additionally, ongoing and planned upgrades to aging water and sewage infrastructure are crucial to maintaining efficient and uninterrupted service in growing urban areas. In a survey conducted by American Water Works Association (AWWA) in June 2024, 73% of utility participants stated they adopted asset management programs, and 81% indicated they executed or were in the process of implementing capital improvement strategies. Many existing systems are outdated, leading to inefficiencies and increased risk of breakdowns. To address these issues, municipalities are investing in modern, reliable pumps that offer enhanced performance, durability, and energy efficiency, driving the growth of the market.

Key Municipal Pump Market Insights Summary:

Regional Highlights:

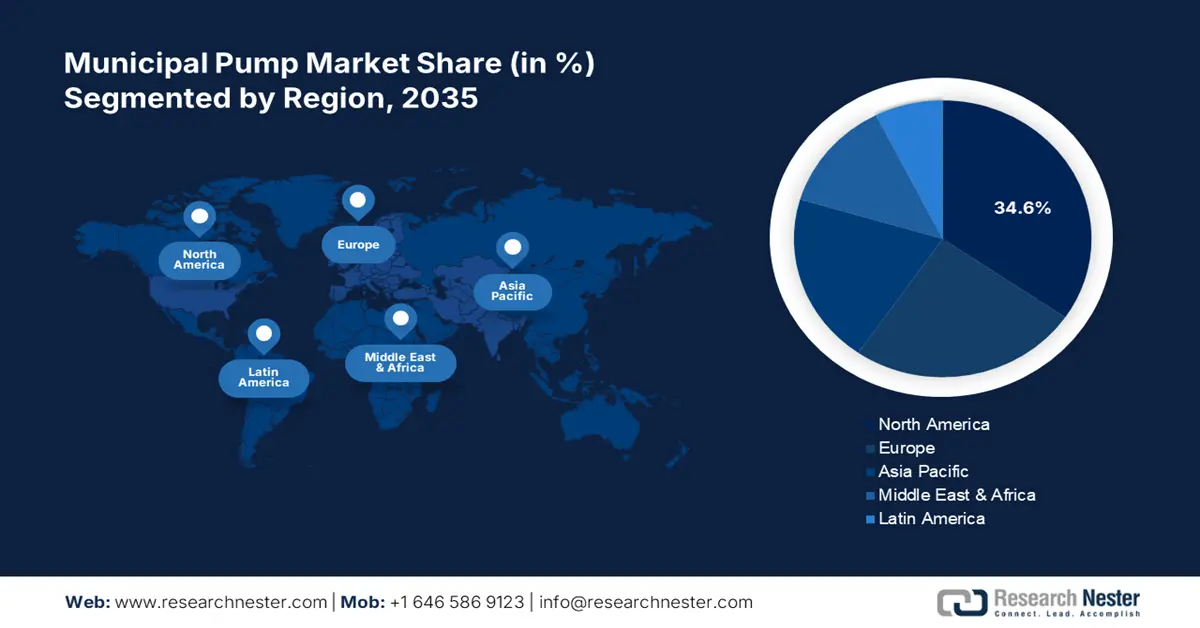

- North America leads the municipal pump market with a 34.6% share, propelled by aging infrastructure through 2026–2035.

- Europe is projected to hold a lucrative share in the Municipal Pump Market from 2026 to 2035, driven by stringent EU water regulations and investments in public water systems.

Segment Insights:

- Centrifugal pumps segment are expected to capture over 41% market share by 2035, driven by their versatility and efficiency in water supply and wastewater management.

- The Clean Water Systems segment of the Municipal Pump Market is anticipated to hold the majority share by 2035, driven by the increasing demand for reliable water supply in urban areas.

Key Growth Trends:

- Water scarcity and recycling initiatives

- Government regulations and investments

Major Challenges:

- Aging infrastructure

- High energy consumption

- Key Players: CORNELL PUMP COMPANY, Crane Pumps & Systems, EXAIR LLC.

Global Municipal Pump Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.48 billion

- 2026 Market Size: USD 4.69 billion

- Projected Market Size: USD 7.51 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, Canada

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Municipal Pump Market Growth Drivers and Challenges:

Growth Drivers

-

Water scarcity and recycling initiatives: About 2.2 billion people do not have access to safe drinking water, and half of the world's population suffers from acute water scarcity for at least part of the year, according to the 2024 UN World Water Development Report. Growing concerns over water scarcity are prompting municipalities to explore alternative water sources, such as greywater recycling and wastewater treatment, to ensure sustainable water management. These initiatives help reduce the demand for freshwater supplies and improve overall water conservation. As a result, municipalities are increasingly investing in specialized pumps designed for greywater and wastewater systems and in turn propagating the municipal pump market.

-

Government regulations and investments: Governments around the world are implementing stricter regulations to improve water management and control pollution, ensuring the protection of public health and the environment. These policies are driving significant investments in municipal pump systems, as municipalities need advanced solutions to meet rising standards for water treatment, wastewater management, and stormwater drainage. For instance, the U.S. announced USD 49 billion in commitments to global water security and sanitation in March 2023. Such investments are crucial to ensure compliance with these regulations, propelling the municipal pump market.

Challenges

-

Aging infrastructure: Many municipal water and sewage systems are aging and no longer able to meet the growing demand for efficient service. These outdated systems require constant maintenance and, in many cases, complete replacement to prevent failures. Upgrading to modern, energy-efficient pumps presents significant challenges, including high upfront costs and the complexity of installation, especially in densely populated urban areas where space is limited and disruptions to daily life need to be minimized. These factors make the transition costly and logistically demanding, thus restricting the municipal pump market.

-

High energy consumption: Pumps, particularly in water and sewage systems, are energy-intensive, contributing significantly to operational costs and environmental impact. With municipalities under increasing pressure to reduce both expenses and their carbon footprint, the adoption of energy-efficient pumps has become essential. However, these advanced pumps often come with high implementation costs, creating a challenge for municipalities to balance budget constraints with sustainability goals. Upfront investments in energy-efficient technologies are necessary, but they can be difficult to justify without long-term financial incentives and diminishing the market as a result.

Municipal Pump Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 4.48 billion |

|

Forecast Year Market Size (2035) |

USD 7.51 billion |

|

Regional Scope |

|

Municipal Pump Market Segmentation:

Pump Type (Centrifugal Pumps, Sewage pump, Gear Pump, Pulp Pumps, Diaphragm Pumps)

The centrifugal pumps segment is likely to hold municipal pump market share of more than 41% by 2035. The segments growth is due to its versatility and efficiency in handling water supply and wastewater management. Its ability to manage large volumes of fluids with minimal maintenance makes it ideal for municipal applications. Centrifugal pumps ranked 220th out of 4,648 products traded globally in 2022.

Furthermore, in 2022, the U.S. held the largest position in importing centrifugal pumps, having a worth of around USD 1.8 billion. Additionally, advancements in energy-efficient models align with sustainability goals, driving adoption. Further, the Urbanization and infrastructure upgrades further boost demand for reliable centrifugal pumps to meet increasing municipal water needs. Thus, propelling the market.

Application (Clean Water Systems, Wastewater and Sewage Handling, Grey Water Recycling)

By application, the clean water system is expected to hold a majority share in the municipal pump market, driven by the increasing demand for reliable water supply in urban areas, coupled with rapid population growth and infrastructure development. As of November 2023, the global water sector requires more than USD 1.3 trillion in investments to meet growing needs. Clean water systems rely on efficient pumps to ensure consistent delivery of portable water. Municipalities prioritize these systems for public health and sanitation, making them a key focus for investments, thereby driving the growth of the municipal pump market.

Our in-depth analysis of the global market includes the following segments:

|

Pump Type |

|

|

Power Source |

|

|

Application |

|

|

Flow Rate |

|

|

Horsepower |

|

|

Technology |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Municipal Pump Market Regional Analysis:

North America Market Statistics

In municipal pump market, North America region is poised to capture over 34.6% share by 2035. North America water and sewage infrastructure is outdated, necessitating upgrades or replacements. Investments in modern, efficient pumps are critical to improve operational efficiency and prevent system failures, driving growth. Urban expansion and population growth drive demand for reliable water systems, requiring advanced municipal pumps for efficient management

Growing awareness of environmental sustainability has spurred a preference for energy-efficient and eco-friendly pumps, aligning with municipalities goals to reduce operational costs and carbon footprints. In the U.S., this shift is driving growth in the municipal pump market. Additionally, the adoption of smart pumps with IoT integration and advanced monitoring capabilities is further enhancing efficiency and reducing downtime. These innovations make smart pumps a preferred choice for municipal applications, helping optimize performance while supporting sustainability objectives and improving overall system reliability.

Sustainability goals and water conservation encourage the adoption of energy-efficient pumps in Canada. Federal and provincial funding for infrastructure projects, including water and sewage systems, is boosting the demand for modern municipal pumps to meet growing public needs. For instance, Water and sewer infrastructure accounted for 28% of all capital expenditures made by municipal, provincial, and regional governments in 2020, according to Canada's Annual Capital and Repair Expenditures Survey in July 2022. Thus, propelling the municipal pump market growth.

Europe Market Analysis

In Europe the market is set to hold lucrative market share over the forecast period. Stringent EU regulations on water management and pollution control push municipalities to adopt energy efficient and environmentally friendly pumping solutions to meet compliance standards. Significant investments are being made and are required in the public water supply and sewerage sector, according to a report released by Water Europe in October 2024. The annual investment in the EU is anticipated to be over USD 46 billion. Expanding urban areas in Europe drive demand for reliable water distribution and wastewater systems, requiring advanced municipal pumps for efficient operations and driving the municipal pump market.

Germany is augmenting the municipal pump market with its significant environmental regulations. Germany has stringent environmental standards that drive the adoption of eco-friendly and energy-efficient municipal pumps. These regulations promote sustainable water management practices and reduce the carbon footprint of water infrastructure. Germany has set a goal to reduce emissions across the board by at least 65% by 2030 and 88% by 2040 as per OED in November 2022. Urbanized regions in Germany require efficient water and wastewater systems, making municipal pumps essential for reliable management in dense areas, propelling the municipal pump market.

The growing population in the UK and expanding urban areas drive demand for efficient water supply and wastewater management systems, necessitating advanced municipal pumps. In the UK, more than 80% of people reside in cities and depend on water management systems to provide basic services as stated by GOV.UK in November 2024. The UK market is witnessing the rapid adoption of smart pumps with IoT integration and energy-efficient designs, with enhanced performance, reduced energy consumption, and support for sustainability goals. Public funding for water and sewage projects drives market growth, ensuring reliable water management in urban and rural areas. Thus, propelling the municipal pump market growth.

Key Municipal Pump Market Players:

- Blackmer

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CORNELL PUMP COMPANY

- Crane Pumps & Systems

- EXAIR LLC

- Grundfos Pumps Corporation

- Liberty Pumps

- KSB SE & Co. KGaA

- MDM Incorporated

- NETZSCH Pumps & Systems

- Pentair plc

- SEEPEX, Inc.

Key companies in the municipal pump market are driving innovation through advanced technologies like IoT-enabled smart pumps and energy-efficient designs. These Pumps optimize performance, reduce energy consumption, and provide real-time monitoring for predictive maintenance. For instance, in October 2024, Verder Liquids announced the Verderflex Dura 60's release. It is the most recent model in its prestigious range of long-lasting peristaltic pumps. Furthermore, sustainable materials and eco-friendly manufacturing processes are being adopted to meet regulatory demands promote environmental responsibility, and propagate the market. Such key players include:

Recent Developments

- In October 2023, a new submersible pump with an open multi-vane impeller was introduced by KSB Group in a discharge tube. Large amounts of industrial or municipal water are transported by it, together with effluent from drainage, and irrigation pumping stations.

- In October 2021, Grundfos introduced a cutting-edge drinking water and dispensing system. Intelligent pumps that manage a membrane treatment system and a dispenser that supplies safe and clean drinking water make up this reasonably priced solution.

- In December 2022, submersible sewage/wastewater pumps (model number 80(100)AFP215) were introduced by HCP Pump Manufacturer Co., Ltd. This pump's impeller is great for handling waste materials since it keeps things from clogging.

- Report ID: 6889

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Municipal Pump Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.