Multirotor Drone Market Outlook:

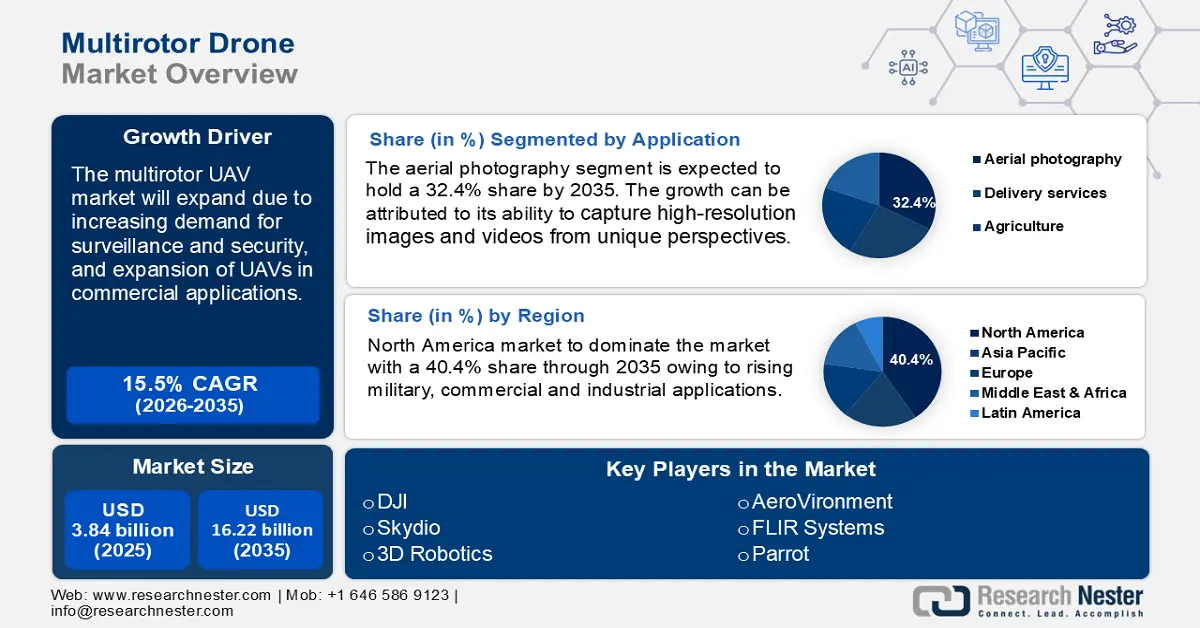

Multirotor Drone Market size was valued at USD 3.84 billion in 2025 and is likely to cross USD 16.22 billion by 2035, registering more than 15.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of multirotor drone is assessed at USD 4.38 billion.

The multirotor drone market is primarily driven by increasing demand for surveillance and security. Multirotor drones are increasingly adopted by military, law enforcement, and border security agencies for intelligence surveillance and reconnaissance (ISR) missions. The rising need for real-time awareness, and cost-effective monitoring is accelerating the adoption of multirotor drones. The U.S. Department of Homeland Security (DHS) expanded its use of multirotor drones for border surveillance and disaster response in August 2024. The DHS deployed drones equipped with thermal imaging and AI-driven analytics to monitor remote border areas, detect unauthorized crossings, and assist in search and rescue operations during natural disasters.

The demand for drones in the entertainment and media sector has led to increased use of recreational drones by hobbyists and photographers. The trend of capturing high-quality visuals in film and tourism has also led to growth. Drone manufacturers are increasingly manufacturing high-quality affordable drones for recreational purposes. For instance, in January 2024, Garuda Aerospace launched a personal drone, Droni for photography enthusiasts. The company decided to launch Droni for an affordable price of USD 981.7 as it combines convenience and quality, catering to growing trends of aerial shots in photography and cinematography.

Key Multirotor Drone Market Insights Summary:

Regional Highlights:

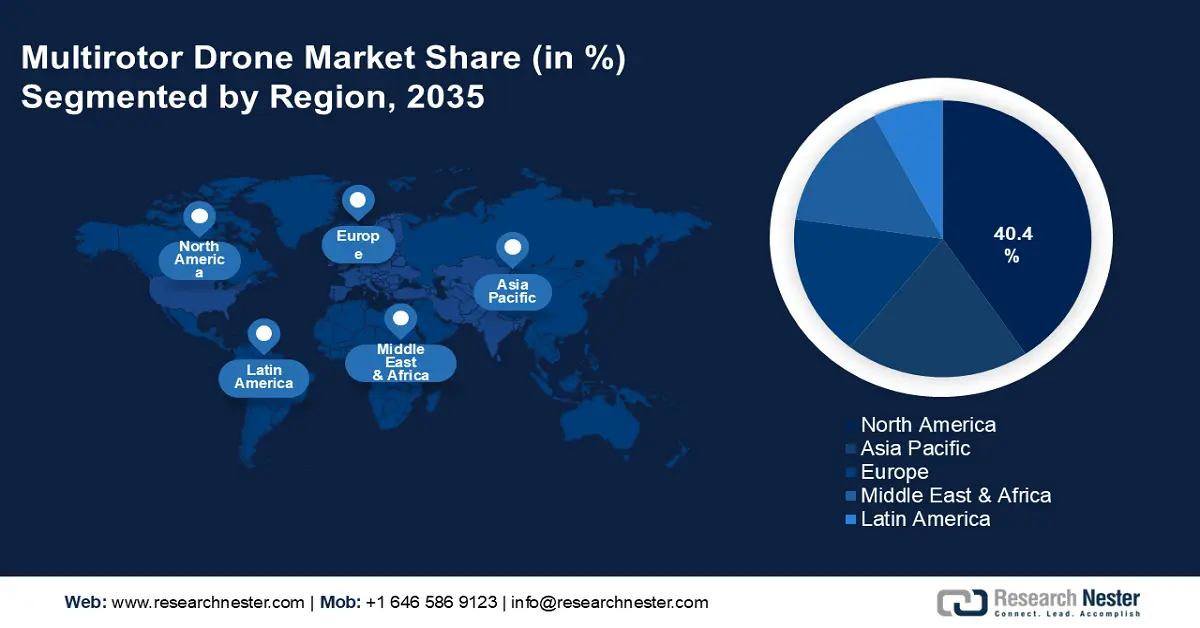

- North America multirotor drone market will account for 40.40% share by 2035, attributed to the growing applications in military, commercial, and industrial use, coupled with advancements in AI, 5G, and battery technology.

- Asia Pacific market will grow rapidly during the forecast period 2026-2035, fueled by defense modernization, smart agriculture, and disaster response initiatives across various countries in the region.

Segment Insights:

- The aerial photography segment in the multirotor drone market is anticipated to achieve significant growth till 2035, driven by advancements in camera technology and drone stability enhancing image quality and usage.

- The heavyweight drones segment in the multirotor drone market is forecasted to experience rapid growth over 2026-2035, driven by increasing applications in military logistics, industrial operations, and large-scale UAV investments.

Key Growth Trends:

- Expansion of UAVs in commercial applications

- Advancements in drone technology

Major Challenges:

- Regulatory and airspace integration issues

- High operational costs and maintenance issues

Key Players: DJI, Parrot S.A., Yuneec International Co., Ltd., Autel Robotics, Skydio, Inc., Freefly Systems, Inc., Hubsan, Walkera Technology Co., Ltd., PowerVision Technology Group, Ehang Holdings Limited.

Global Multirotor Drone Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.84 billion

- 2026 Market Size: USD 4.38 billion

- Projected Market Size: USD 16.22 billion by 2035

- Growth Forecasts: 15.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, France

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 18 September, 2025

Multirotor Drone Market Growth Drivers and Challenges:

Growth Drivers

-

Expansion of UAVs in commercial applications: Multirotor drones are revolutionizing various industries by offering cost-effective, automated solutions. The growing use of commercial applications such as infrastructure inspection, precision agriculture, disaster management, and delivery services lead to the growth of this sector. For instance, National Grid uses a fleet of advanced drones to manage and maintain its huge electricity network over England and Wales. These drones offer a safe, efficient, and cost-effective way to inspect power lines in critical areas in substations. Additionally, multirotor drones provide fast, autonomous, and cheaper delivery services. E-commerce companies such as Amazon, Zipline, and JD. Com uses drones for e-commerce deliveries, medical supplies, and last-mile logistics.

Furthermore,drone-friendly laws introduced by governments enable quick commercial UAV operations. The Federal Aviation Administration (FAA) in August 2024 approved Amazon for flying beyond visual line of sight (BVLOS) drone flights. This trial facilitated Amazon’s Prime Air service to deliver small packages within an hour. The new Amazon Prime Air drone can work in light rain and deliver packages up to 5 pounds in an hour. These developments support the wider adoption of drones in delivery networks. -

Advancements in drone technology: The shift towards miniaturization of sensors and improved payload capabilities are key to fuel multirotor drone market growth during the forecast period. UAVs carrying 4K/8K cameras, thermal imaging, and night vision sensors in a compact design enhance the capacity of drones. Thus, it makes UAVs a more versatile, efficient, and reliable option. In February 2025, T-DRONES introduced a versatile unmanned aerial vehicle the VTOL VA32 built for long-duration flights, high payload capacity, and reliability in various industrial applications. The VTOL VA32 can carry up to 5kg of payload from transporting advanced sensors, high-resolution cameras, and heavier cargo. It offers over 4 hours of flight time with a 1kg payload, making it one of the ideal solutions for industries.

Challenges

-

Regulatory and airspace integration issues: Many countries have strict UAV laws restricting altitude limits, flight zones, and BVLOS (Beyond Visual Line of Sight) operations. Additionally, integrating UAVs with existing manned aircraft traffic poses a challenge as it requires the development of Unmanned Traffic Management systems. Moreover, governments and citizens worry about unauthorized surveillance, data privacy, and the potential misuse of drones. This concern from people and local government may limit the use of drones.

-

High operational costs and maintenance issues: Advanced drones with AI-driven autonomy, thermal cameras, and LiDAR sensors are expensive for small businesses and startups to afford. Further, UAVs experience wear and tear due to environmental factors requiring regular maintenance. Also, the charges demanded by trained pilots and drone technicians for operating UAVs lead to high labor costs increasing the total operational value.

Multirotor Drone Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.5% |

|

Base Year Market Size (2025) |

USD 3.84 billion |

|

Forecast Year Market Size (2035) |

USD 16.22 billion |

|

Regional Scope |

|

Multirotor Drone Market Segmentation:

Application Segment Analysis

The aerial photography segment is likely to capture multirotor drone market share of over 32.4% by 2035. Multirotor drones are widely used in aerial photography to capture high-resolution images and videos from unique perspectives. Advancements in camera technology and drone stability enhance image quality and usage. These UAVs are rapidly gaining traction for aerial photography due to its applications in real estate, filmmaking, and surveillance. The wide adoption in consumer and commercial applications fuels market expansion as industries choose drones for cost-effective aerial imaging. For instance, in January 2025, the DJI launched a new affordable 4K drone that can capture 48 mega-pixel high-resolution photos and videos. The drone weighing less than 249 grams offers a flight time of upto 31 minutes and includes features such as palm takeoff without the need for a remote controller. The stability, maneuverability, and advanced camera systems make UAVs ideal for beginners and content creators in aerial photography.

Payload Capacity Segment Analysis

The heavyweight drones segment in multirotor drone market is expected to register rapid growth between 2026 and 2035, owing to increasing applications in military logistics and industrial operations. These drones are designed to carry large payloads ranging from 50kg to over 500 kg for diverse applications. Companies such as Volocopter and Elroy Air are developing UAVs for autonomous heavy-lift missions, expanding their commercial and defense use cases. In addition, governments and industries are investing in large-scale UAVs for supply chain optimization and tactical operations. For instance, in February 2025, the Indian Army disclosed its plan to invest in heavy-duty drones that can operate at a range of over 1000 km, an altitude of over 30,000 feet, and can fly for more than 24 hours.

Our in-depth analysis of the global multirotor drone market includes the following segments:

|

Application |

|

|

Payload capacity |

|

|

End use |

|

|

Number of rotors |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Multirotor Drone Market Regional Analysis:

North America Market Insights

North America multirotor drone market is expected to dominate revenue share of over 40.4% by 2035, driven by growing applications in military, commercial, and industrial use. The U.S Department of Defense is investing heavily in ISR and autonomous combat drones. Top key players such as Amazon, Zipline, and Wing are advancing drone delivery services, supported by evolving FAA regulations. The growth is further fueled by AI, 5G connectivity, and battery advancements that enhance UAV efficiency and market adoption.

The multirotor drone market in the U.S. is rapidly evolving due to defense modernization, commercial drone delivery, and infrastructure monitoring. Companies such as Skydio and Anduril are expanding domestic UAV production to reduce reliance on foreign manufacturers. In 2024, the U.S. Department of Defense awarded a USD 249.9 million contract to Anduril Industries to deliver advanced air defense capabilities such as developing AI-powered drone interceptors. These interceptors are designed to autonomously detect, track, and neutralize aerial threats thereby enhancing battlefield intelligence and defense operations. Further, with the Federation of Aviation Administration’s (FAA) evolving regulations, UAVs are eventually integrating into airspace supporting adoption across industries.

The multirotor drone market in Canada is expanding driven by forestry, mining, and Arctic surveillance applications. The Canada military is investing in UAVs for border security and search and rescue missions. Companies are developing advanced drones for environmental monitoring and emergency response. Further, Canada’s regulatory framework supports commercial UAV growth as Transport Canada approves beyond visual line-of-sight operations for various industries. Due to ongoing geopolitical tension, countries are expanding their drone operations when needed. For instance, in February 2024, Canada donated over 800 Sky Ranger R70 multi-mission unmanned aerial systems to Ukraine to provide military aid to overcome the war. Thus, the Russia-Ukraine conflict has been a demonstration platform for the use of drones to drive trade.

Asia Pacific Market Insights

Asia Pacific multirotor drone market is likely to expand at a rapid rate during the forecast period owing to defense modernization, smart agriculture, and disaster response. Countries such as China, India, and South Korea are heavily investing in UAV technology for border surveillance and industrial applications. Government initiatives such as India’s Drone Shakti and China’s UAV industrial hubs are accelerating innovation and adoption across various sectors. In addition, e-commerce giants are deploying drones for last-mile deliveries in rural and urban areas. This is expected to fuel market growth in the region going ahead.

The multirotor drone market in China is growing fast due to military advancements, industrial automation, and logistics applications. Leading companies such as DJI, EHang, and Ziyan UAV are leading innovations in aerial surveillance, cargo transport, and urban air mobility. As of 2023, DJI, the world's largest consumer drone maker revealed that it has saved more than 1,000 people from danger around the world with its Drone Rescue Map. Additionally, the company supplies 70% of the world's consumer drones and nearly 80% of U.S. consumer drones as reported in 2024. The military forces in China are integrating AI-powered swarm drones for reconnaissance and operations. Further, government-backed UAV industrial zones and export-focused policies are strengthening China’s dominance in the global multirotor drone market.

The multirotor drone market in India is expanding due to the need for defense upgrades, agriculture, and infrastructure monitoring. The government’s Drone Shakti initiative and PLI scheme boost domestic UAV manufacturing in India. Startups like ideaForge and Garuda Aerospace are implementing innovative drones for surveillance, crop spraying, and disaster response. Recently during the Aero India 2025 show in February 2025, Indian start-up company Garuda Aerospace revealed 8 advanced drones designed for defense, safety, and military applications. The Indian Army and DRDO are also deploying AI-powered UAVs for reconnaissance and border security to strengthen defense capabilities.

Multirotor Drone Market Players:

- DJI

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Skydio

- 3D Robotics

- Delair

- Yuneec

- Insitu

- Kespry

- Northrop Grumman

- Parrot

- DroneDeploy

- Matternet

- FLIR Systems

- GoldenEye

- AeroVironment

- SenseFly

The multirotor drone market is dominated by key players such as DJI, Parrot, Skydio, and AeroVironment leading advancements in commercial, defense, and industrial drones. DJI remains the global leader in consumer and enterprise drones, while Skydio and Parrot focus on AI-powered autonomous UAVs. AeroVironment and Teledyne FLIR are driving military drone innovations, supplying ISR and tactical UAVs. Companies are investing in AI, swarm technology, and extended flight endurance to strengthen their market position. Here are some leading players in the multirotor drone market:

Recent Developments

- In February 2025, Volatus Aerospace collaborated with Dufour Aerospace to introduce Dufour Aerospace's Aero2 heavy-lift, hybrid-electric VTOL drone, enhancing UAV capabilities for cargo transport, surveillance, and critical aerial operations in remote regions.

- In February 2025, Drone company Pyka secured FAA authorization for commercial operation of the agricultural crop sprayer Pelican 2 in the USA.

- In January 2025, Alpha Unmanned Systems expanded its trade into India through a partnership with Ukay Metal Industry and introduced its UAV helicopters to meet growing demand in the civil and defense sectors.

- Report ID: 7244

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Multirotor Drone Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.