Multiplex Biomarker Imaging Market Outlook:

Multiplex Biomarker Imaging Market size was valued at USD 590.2 million in 2025 and is set to exceed USD 1.85 billion by 2035, expanding at over 12.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of multiplex biomarker imaging is estimated at USD 654.47 million.

Improvements in imaging technologies and the growing need for personalized medicine are driving multiplex biomarker imaging market expansion. Recent patterns show a move toward multi-parameter analysis, which combines genetic, molecular, and histological markers to enable more thorough profiling of disease states. For instance, in November 2023, FUJIFILM Healthcare Americas Corporation launched a new medical system at the 2023 Radiological Society of North America (RSNA) annual meeting. The new imaging systems included a 0.4T MRI system, a 128-slice computed tomography (CT) system, two new fluoroscopy systems, and three new digital radiography (DR) suites.

Moreover, the combination of machine learning and artificial intelligence methods, which allow for more complex data analysis and interpretation, further supports this growth. For instance, in October 2024, GE HealthCare incorporated an application orchestration feature powered by third-party artificial intelligence (AI) into True PACS and Centricity PACS. The new AI-enabled products, developed in partnership with Blackford, assist radiologists with their workload, potentially resulting in faster patient diagnosis and treatment. The goal of the partnership is to provide healthcare providers with an AI-enabled platform that includes a library of third-party AI applications covering a range of clinical use cases, from lung scans to mammograms.

The need for early diagnostic tools and the increasing prevalence of chronic diseases are also driving the market's growth. For instance, in February 2024, the Centers for Disease Control and Prevention revealed that in the U.S., an estimated 129 million people suffer from at least one serious chronic illness. The number of Americans living with multiple chronic conditions is rising; 42% have two or more, and 12% have at least five. Approximately 90% of the USD 4.1 trillion spent on health care each year goes toward managing and treating mental health issues and chronic illnesses. Hence, spurs the growth for market.

Key Multiplex Biomarker Imaging Market Insights Summary:

Regional Insights:

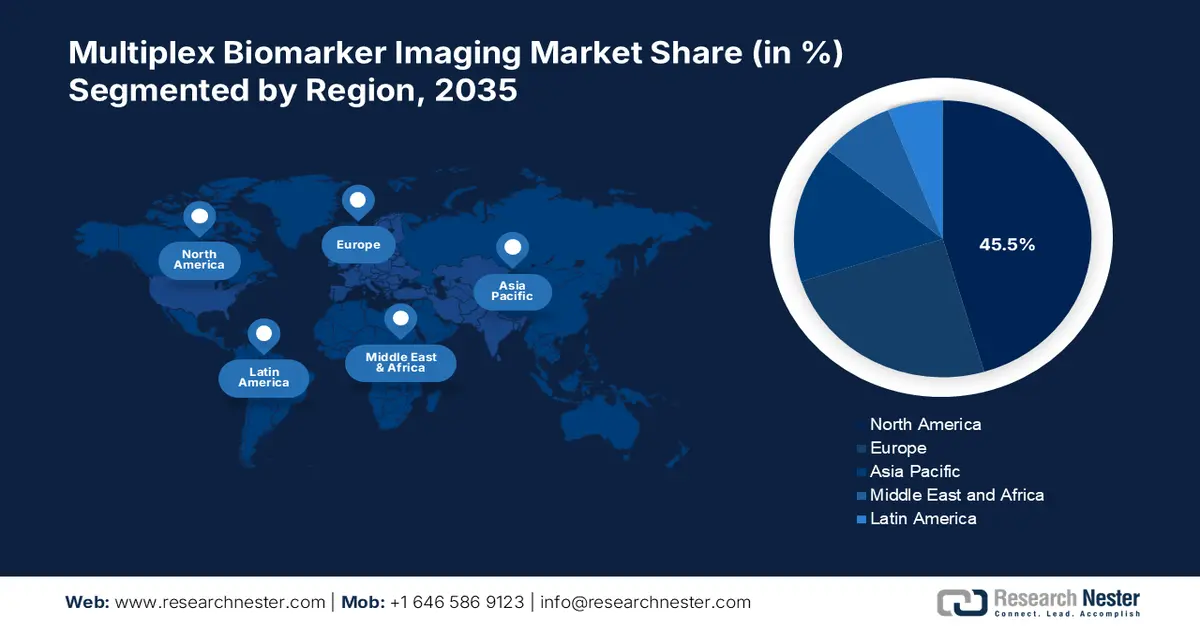

- By 2035, north america is expected to secure nearly 45.5% share in the multiplex biomarker imaging market, attributable to the region’s rapid adoption of innovative diagnostic and genomic profiling solutions.

- Asia Pacific is anticipated to emerge as the fastest-expanding region through 2026–2035, spurred by intensifying biotechnology research and the rising focus on precision medicine.

Segment Insights:

- The immunohistochemistry (IHC) assay segment is projected to command about 49.2% share by 2035 in the multiplex biomarker imaging market, propelled by its capability to deliver high-resolution, spatially precise biomarker visualization.

- The instruments segment is set to maintain a leading position by 2035 as it benefits from escalating demand for high-sensitivity, multi-parameter imaging platforms in advanced clinical and research settings.

Key Growth Trends:

- Increased R&D investments

- Rising adoption in drug development

Major Challenges:

- Lack of standardization

- Skilled workforce shortage

Key Players: Illumina, Inc., Thermo Fisher Scientific Inc., Merck KGaA, PerkinElmer Inc., Illumina, Inc., Abcam plc, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Ayoxxa Biosystems GmbH, Akoya Biosciences, Inc., Bio-Techne Corporation, Fluidigm Corporation, NanoString Technologies, Inc., Roche Diagnostics International Ltd., Olympus Corporation, Leica Biosystems Nussloch GmbH (Danaher Corporation.

Global Multiplex Biomarker Imaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 590.2 million

- 2026 Market Size: USD 654.47 million

- Projected Market Size: USD 1.85 billion by 2035

- Growth Forecasts: 12.1%

Key Regional Dynamics:

- Largest Region: North America (45.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Singapore, Brazil, Australia

Last updated on : 3 December, 2025

Multiplex Biomarker Imaging Market - Growth Drivers and Challenges

Growth Drivers

- Increased R&D investments: The surge in R&D within the multiplex biomarker imaging market is fueling major progress in both diagnostic and therapeutic applications. The market players are pouring significant resources into improving imaging technologies, making it possible to analyze biomarkers with greater precision and thoroughness. For instance, in May 2024, Merck declared to pay USD 600 million to acquire Mirus Bio. Mirus Bio focuses on creating and marketing transfection reagents such as TransIT-VirusGEN from Mirus Bio. It is essential for the development of viral vectors for gene and cell therapies. These efforts enable the identification of new biomarkers, the inclination toward personalized medicine, and enhance patient results.

- Rising adoption in drug development: The market is stimulated by the increasing drug development activities. It provides detailed biomarker profiles, allowing for a better understanding of drug efficacy, patient response, and its potential side effects. For instance, in March 2024, Semarion Ltd. unveiled its SemaCyte Multiplexing Platform, an extension of the SemaCyte Microcarrier platform that uses optical barcoding to speed up screening procedures during in vitro drug discovery. The company combines materials engineering and cell biology to address unmet drug screening needs. Consequently, multiplex biomarker imaging is becoming an essential tool for pharmaceutical companies looking to streamline drug development.

Challenges

- Lack of standardization: The multiplex biomarker imaging industry faces a roadblock due to its widespread use and integration into clinical settings. The variability in methodologies, patterns, and a variety of analytic tools used by medical professionals can lead to inconsistent, unreliable, and inaccurate results. The standards that are not unanimously accepted can hinder reproducibility and fail to make an efficient comparison thus, complicating the regulatory approvals. To enhance and smoothen the regulatory and development procedures, simplified and acceptable standards are to be laid down within the research and clinical settings.

- Skilled workforce shortage: A significant hurdle in the field of market is a dearth of skilled healthcare professionals. The advanced technology demands experts who are well-versed in both imaging methods and interpretation of the data. Analyzing complex, multi-layered datasets requires individuals with specialized training in bioinformatics, imaging systems, and molecular biology. This gap in expertise hinders the broader adoption and effective application of multiplex biomarker imaging, particularly in clinical and research environments where such knowledge is vital for precise diagnosis and treatment development.

Multiplex Biomarker Imaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.1% |

|

Base Year Market Size (2025) |

USD 590.2 million |

|

Forecast Year Market Size (2035) |

USD 1.85 billion |

|

Regional Scope |

|

Multiplex Biomarker Imaging Market Segmentation:

Imaging Technique Segment Analysis

In multiplex biomarker imaging market, immunohistochemistry (IHC) assay segment is poised to capture revenue share of around 49.2% by the end of 2035, due to its ability to generate incredibly detailed, high-resolution images. Biomarkers within tissue samples can be precisely located using such advanced techniques. In January 2023, Akoya Biosciences, Inc. and Agilent Technologies, Inc. announced their collaboration to create multiplex-immunohistochemistry diagnostic solutions for tissue analysis and to market workflow solutions for multiplex assays in the clinical research market. An end-to-end commercial workflow encompassing reagents, staining, imaging, and analysis will be created by combining Agilent's Dako Omnis (autostaining instrument) and Akoya's PhenoImager HT (imaging platform).

Component Type Segment Analysis

In the multiplex biomarker imaging market, the instruments segment has taken a leading edge because of the growing need for sophisticated imaging systems that offer high sensitivity and precision in detecting multiple biomarkers. Imaging instruments are capable for use in immunology, oncology, and personalized medicine. In September 2022, Nucleai and Lunaphore announced a partnership aimed at improving the identification of new biomarkers and therapeutic targets. Through this collaboration, pathology data yielded insightful information by utilizing cutting-edge machine learning and spatial imaging technologies. Furthermore, the demand for cutting-edge imaging equipment is still being driven by the expanding need for high-throughput screening in clinical diagnostics and research.

Our in-depth analysis of the global market includes the following segments:

|

Imaging Technique |

|

|

Component Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Multiplex Biomarker Imaging Market - Regional Analysis

North America Market Insights

North America multiplex biomarker imaging market is expected to dominate revenue share of around 45.5% by the end of 2035, owing to the development of innovative approaches by prominent players present in the region. For instance, in May 2024, Illumina Inc.'s research was presented at the American Society of Clinical Oncology (ASCO) Annual Meeting. Data from multiple studies carried out in collaboration with Labcorp was included in the presentations, demonstrating evidence in favor of using comprehensive genomic profiling (CGP). Illumina also shared the results from its molecular residual disease (MRD) assay.

The U.S. multiplex biomarker imaging market is witnessing profitable growth. The collaborations in the country are fostering expertise and proficiency in delivering effective therapeutic solutions. For instance, in September 2024, Bio-Techne Corporation announced that Lunaphore joined forces with Discovery Life Sciences to extend its global portfolio of biospecimen products and specialty lab services. To advance immuno-oncology, immunology, neuroscience, and infectious disease research across all development stages at a new level of precision and speed, this partnership combines Discovery's scientific expertise with COMET technology with superior tissue profiling capabilities.

The market in Canada is significantly growing due to the government’s support through regulatory framework and investments. For instance, in June 2024, INOVAIT and the Government of Canada announced to provide USD 10.7 million to seven commercialization-focused R&D projects as part of the second iteration of INOVAIT's Focus Fund program. INOVAIT is Canada's network devoted to creating image-guided therapy (IGT) by fusing artificial intelligence (AI), big data, and machine learning supported by the Government of Canada's Strategic Innovation Fund (SIF).

Asia Pacific Market Insights

The market in Asia Pacific is projected to be the fastest-growing market during the stipulated timeframe as a result of growing biotechnology and life sciences research. The need for sophisticated diagnostic instruments is fueled by the region's growing emphasis on precision medicine and the incidence of chronic illnesses. Multiplex biomarker imaging technologies are widely used owing to government initiatives, technological developments, and partnerships between academic institutions and business entities.

The multiplex biomarker imaging market in India is remarkably expanding, driven by government initiatives and funding that assist in driving research activities. For instance, in October 2023, an investment of USD 8.2 billion was committed as an investment in 26 projects that have been approved under the PLI scheme for medical devices. The domestic production of high-end medical devices, such as linear accelerators, MRI scanners, CT scanners, mammograms, C-arms, MRI coils, and high-end X-ray tubes, has begun for 14 of the 26 projects that produced 37 products.

The market in China is gaining noteworthy traction owing to mergers between strong players to explore their commitments and goals towards rendering effective therapeutic solutions and improving healthcare services. For instance, in December 2022, XINGIMAGING, LLC and MITRO Biotech Co., Ltd., merged to form a single business committed to offering a comprehensive range of CRO & CDMO research service offerings. Together, Mitro offered comprehensive CRO services, including clinical and clinical imaging management in China.

Multiplex Biomarker Imaging Market Players:

- Illumina, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thermo Fisher Scientific Inc.

- Merck KGaA

- PerkinElmer Inc.

- Illumina, Inc.

- Abcam plc

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Ayoxxa Biosystems GmbH

- Akoya Biosciences, Inc.

- Bio-Techne Corporation

- Fluidigm Corporation

- NanoString Technologies, Inc.

- Roche Diagnostics International Ltd.

- Olympus Corporation

- Leica Biosystems Nussloch GmbH (Danaher Corporation

The prominent players in the multiplex biomarker imaging market are highly competitive driven by the developmental and research activities carried out by the prominent players. For instance, in June 2023, GT Molecular, Inc. announced its entry into the cancer molecular assay market with two PCR multiplex panels for the EGFR and KRAS Genes. GT-PlexTM PCR assays are highly multiplexed, patented, and pending patents for accurate, low-level mutation detection. Such developments thus raise the bar for competition and create a conducive environment for fostering advancements.

Here's the list of some key players:

Recent Developments

- In April 2024, Bio-Rad introduced the first ultrasensitive multiplexed digital PCR assay, ddPLEX ESR1 Mutation Detection Kit for detecting breast cancer mutations.

- In November 2022, The ZEISS Axioscan partnered with Ultivue Inc. to co-market Ultivue's multiplex biomarker assays for tissue phenotyping. It provided a simplified approach from tissue preparation to image acquisition and analysis for applications in immunology, cancer biology, and drug discovery.

- In August 2021, Fluidigm Corporation with the mission to enhance life via holistic health insight, announced a co-marketing partnership with Ultivue, Inc. The two companies provided a full range of solutions for drug development and biomarker discovery.

- Report ID: 7190

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Multiplex Biomarker Imaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.