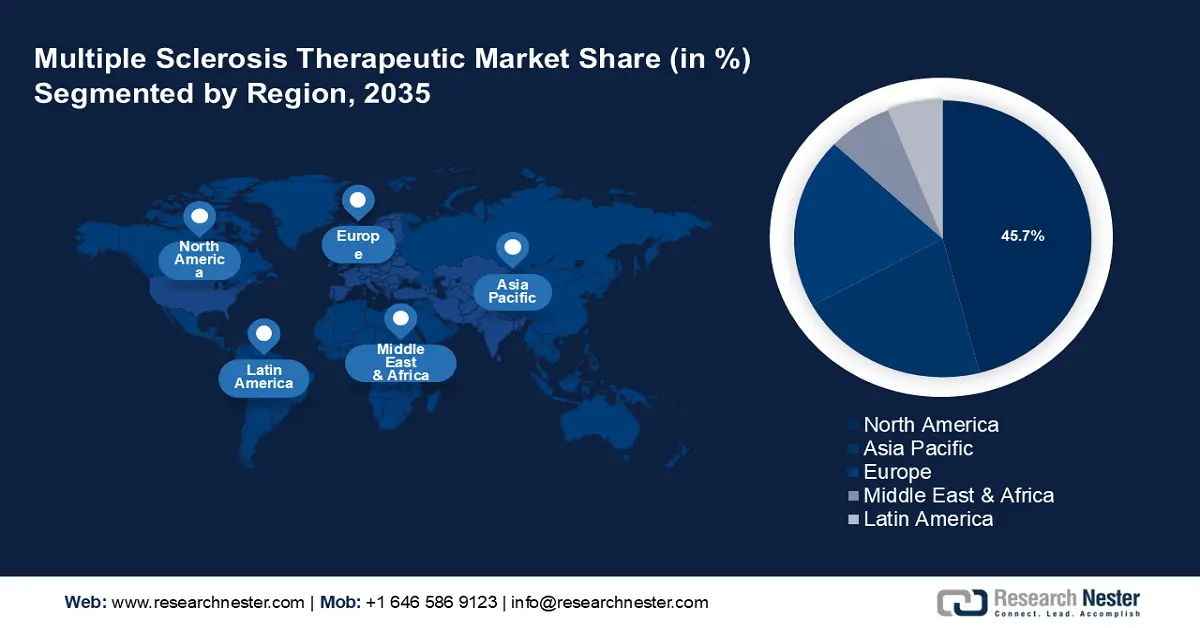

Multiple Sclerosis Therapeutic Market Regional Analysis:

North America Market Analysis

North America industry is poised to account for largest revenue share of 45.7% by 2035. The region also benefits from strong regulatory support for innovative therapies and a growing focus on personalized medicines. Advanced treatments such as biologics, oral drugs, and monoclonal antibodies are widely available, making the market highly competitive. In November 2023, the National Multiple Sclerosis Society invested USD 4.4 million in multi-year funding to launch new MS research projects. Such funds and grants are also boosting the multiple sclerosis therapeutic market in the region.

U.S. holds the largest share in North America market and is primarily driven by a strong pipeline of innovative treatments, including next-generation biologics, supported by FDA approvals and expedited regulatory pathways for breakthroughs. Additionally, the high prevalance of MS in the U.S. is also driving the multiple sclerosis therapeutic market growth in the country. As per the National Multiple Sclerosis Society, almost 1 million people in the United States were diagnosed with MS in 2019. The rising number of cases in the country, in addition to growing trend for personalized medicines, is boosting the market growth significantly.

Canada multiple sclerosis therapeutic market is driven by the country’s relatively high prevalance of the disease, particularly in provinces such as Alberta and Saskatchewan. As per an article by the Government of Canada, nearly 290 out of every 100,000 Canadians aged 20 years and above was living with MS from 2021 to 2022, and 7 out of 10 are women. The government funded healthcare system plays a central role in treatment access, with reimbursement policies significantly influencing the availability of therapies. Public awareness and early diagnosis initiatives, supported by organizations such as Multiple Sclerosis Society of Canada is also driving the country’s market growth significantly.

Europe Market Statistics

The region is witnessing growing adoption of advanced therapies, and strong regulatory frameworks. While biologics and oral therapies are widely available, the region faces challenges related to pricing and varying reimbursement policies across the countries. The entry of biosimilars and generics is also shaping the multiple sclerosis therapeutic market dynamics, offering cost-effective alternatives to expensive branded drugs. In June 2024, the European Commission approved the anti-CD20 therapy, the first twice-yearly injection for relapsing and primary progressive multiple sclerosis (RMS and PPMS). These factors are further boosting the region’s market growth.

UK is largely driven by the National Health Service which provides wide access to MS treatments. The multiple sclerosis therapeutic market is also supported by a well-established network of MS clinics, and specialists, making it a leading player in early diagnosis and long-term management. In July 2024, the UK Government released a report stating that the Medicines and Healthcare Products Regulatory Agency (MHRA) approved a new formulation of the medicine ocrelizumab (Ocrevus 920mg solution for injection). It is aimed to treat relapsing forms of multiple sclerosis (RMS) and primary progressive multiple sclerosis (PPMS) in adults.

France witnesses a strong demand for both oral and injectable therapies, owing to the rising prevalence of MS. French regulatory bodies, such as the Haute Autorite de Sante (HAS) plays a key role in assessing the cost-effectiveness of MS therapies, influencing the availability of advanced treatments. As per a report by the National Institutes of Health, in France, the highest prevalence rates were observed in the northeastern regions and the lowest rates in the southwestern regions. Nearly, 51.8% of the population received at least one MS-specific drug in 2021. These rising cases are projected to further accelerate the multiple sclerosis therapeutic market growth by 2035.