Multiple Sclerosis Therapeutic Market Outlook:

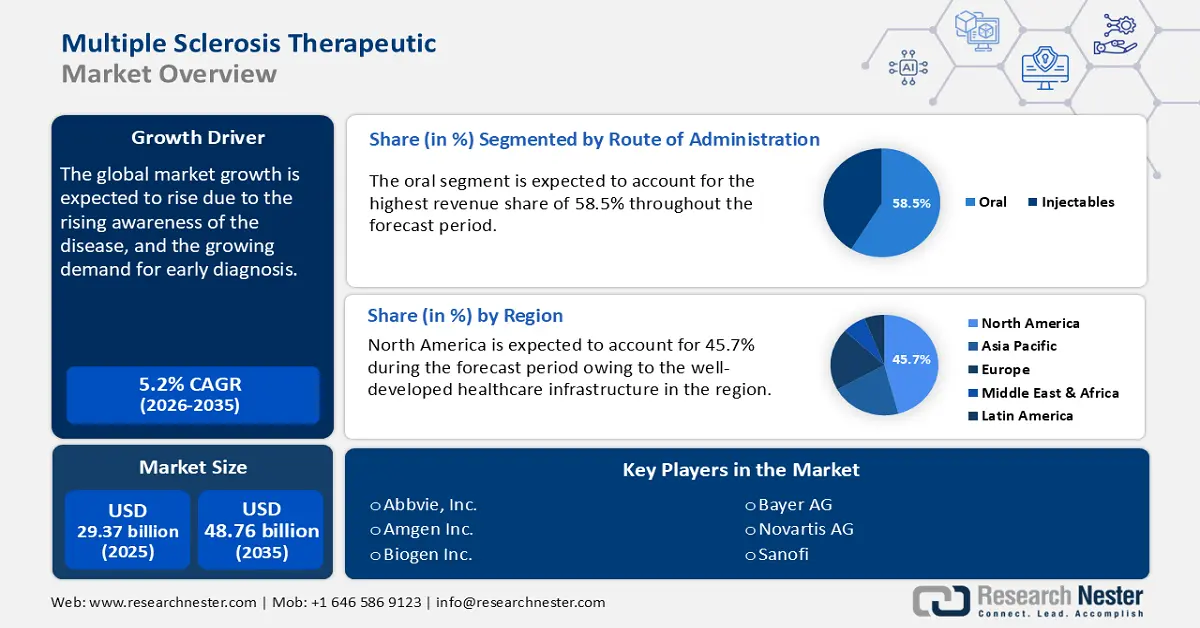

Multiple Sclerosis Therapeutic Market size was over USD 29.37 billion in 2025 and is projected to reach USD 48.76 billion by 2035, growing at around 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of multiple sclerosis therapeutic is evaluated at USD 30.74 billion.

The increasing prevalence of multiple sclerosis globally with its rising awareness is leading to earlier diagnosis and treatment. Advancements in medical research have further resulted in the development of innovative therapies, including biologics, monoclonal antibodies, and oral treatments. These treatments offer improved efficacy and patient convenience.

As per an article posted by WHO in August 2023, over 1.8 million people around the world suffer from multiple sclerosis (MS). The disease is primarily common among young adults and females. Several companies are engaging in R&D to accelerate the development and launch of next-generation treatments to address this rising concern. For instance, in December 2022, the U.S. FDA approved Briumvi to treat adults suffering from relapsing multiple sclerosis (RMS), including clinically isolated syndrome, relapsing-remitting MS, and active secondary-progressive MS. In February 2024, Neuraxpharm Group announced the launch of Briumvi in Europe. Additionally, the trend toward personalized medicines is gaining traction as patients and healthcare providers seek more tailored therapeutic approaches.

Key Multiple Sclerosis Therapeutic Market Insights Summary:

Regional Highlights:

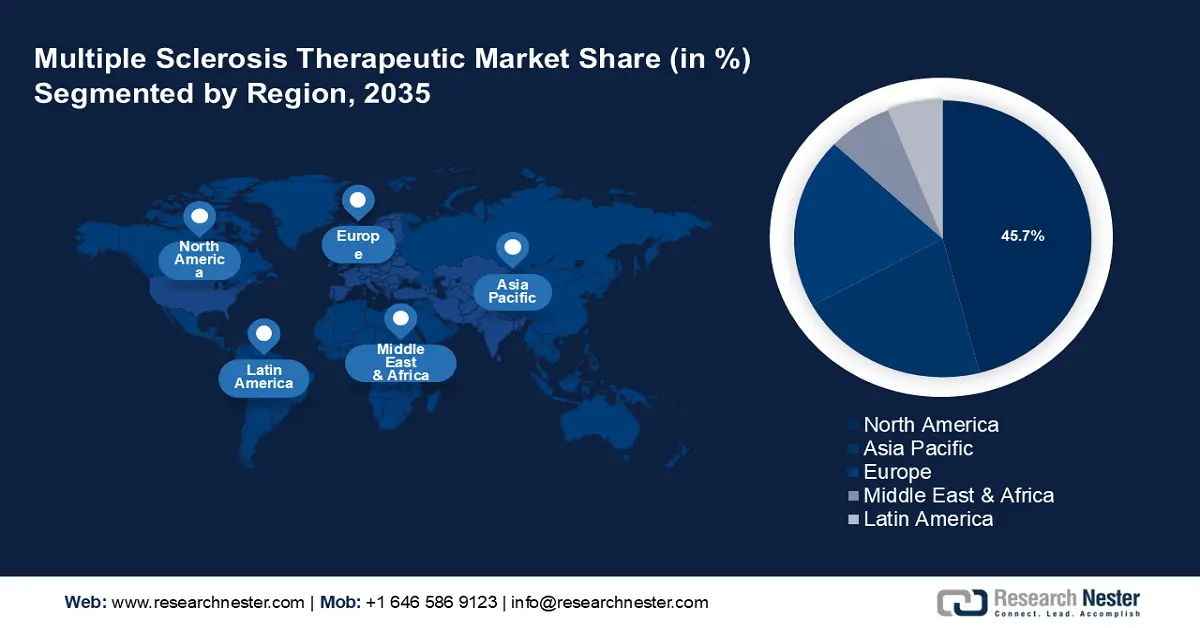

- North America commands a 45.7% share in the Multiple Sclerosis Therapeutic Market, fueled by strong regulatory support for innovative therapies and personalized medicines, driving growth through 2026–2035.

- Europe's Multiple Sclerosis Therapeutic market is set for significant growth by 2035, attributed to growing adoption of advanced therapies and strong regulatory frameworks.

Segment Insights:

- The Oral segment is projected to capture more than 58.5% market share by 2035, driven by higher patient compliance, convenience, and continuous innovation in oral MS treatments.

- The Hospital segment is expected to experience considerable growth from 2026-2035, fueled by hospitals’ role in administering complex therapies and offering comprehensive care.

Key Growth Trends:

- Increasing funding and investments in MS treatments

- Rising R&D activities in the market

Major Challenges:

- High treatment expenses

- Medication-associated side effects

- Key Players: Bayer AG, Bristol-Myers Squibb Company, F. Hoffman-La Roche Ltd., Johnson & Johnson.

Global Multiple Sclerosis Therapeutic Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 29.37 billion

- 2026 Market Size: USD 30.74 billion

- Projected Market Size: USD 48.76 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, France, Japan

- Emerging Countries: Germany, UK, France, Italy, Spain

Last updated on : 14 August, 2025

Multiple Sclerosis Therapeutic Market Growth Drivers and Challenges:

Growth Drivers

- Increasing funding and investments in MS treatments: Both private and public sectors are increasing their financial support for MS research, leading to the development of advanced treatment options. Governments particularly in regions such as North America and Europe are providing grants and subsidies to support the development of novel therapies. Additionally, non-profit organizations and patient advocacy groups are raising significant funds to fuel research and awareness campaigns. Pharmaceutical companies are also increasing investments in the multiple sclerosis therapeutic market. This surge is ultimately driving the competitive dynamics in the MS market, improving access to cutting-edge treatments. For instance, in June 2024, Progentos Therapeutics received USD 65 million in funding to advance the development of myelin regeneration treatments for multiple sclerosis.

- Rising R&D activities in the market: The pipeline for MS drugs is robust, with numerous candidates in various stages of clinical trials. As many as 24 MS clinical trials are in progress at the University of California San Francisco, in September 2024. R&D is significantly driving the exploration of combination therapies, new formulations, and biomarkers to personalize treatment. This is aimed at ensuring that patients receive therapies best suited to specific genetic and disease profiles. The surge in R&D activities is enhancing competition, fostering dynamic multiple sclerosis therapeutic market growth, in addition to expanding treatment options. In August 2020, Sanofi announced the acquisition of Principia Biopharma which owns a portfolio of experimental multiple sclerosis treatment. The acquisition aims to enhance research activities in MS and other immune-mediated diseases.

Challenges

- High treatment expenses: MS treatment cost remains an endless challenge to the multiple sclerosis therapeutic market growth despite the high occurrence of the disease. It makes access to innovative treatments difficult for several patients, particularly in regions with limited health coverage or lower income levels. Even in developed economies, the financial burden can strain the insurance systems, leading to restricted reimbursement policies and limiting patient access. All these factors therefore pose a threat to the market, globally, limiting multiple sclerosis therapeutic market expansion and adoption.

- Medication-associated side effects: Several available multiple sclerosis therapies can cause a range of advanced reactions. Common effects of DMTs include flu-like symptoms, injection site reactions, fatigue, and gastrointestinal issues. Monoclonal antibodies like ocrelizumab and ofatumumab increase the infection risk due to their immunosuppressive effects, leading to respiratory infections. This emphasizes the importance of thorough patient education, regular monitoring, and supportive care to manage the side effects. Lack of these leads to lesser adoption of the treatments.

Multiple Sclerosis Therapeutic Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 29.37 billion |

|

Forecast Year Market Size (2035) |

USD 48.76 billion |

|

Regional Scope |

|

Multiple Sclerosis Therapeutic Market Segmentation:

Route of Administration (Oral, Injectables)

In route of administration, oral segment is set to hold multiple sclerosis therapeutic market share of more than 58.5% by 2035. It is easier to monitor oral medications than injectable therapies, making a patient more compliant and convenient. The patients are allowed to take medication at home, in the absence of any medical supervision, thus enhancing their treatment process.

This convenience leads to adherence to the treatment routine, which is critical in chronic conditions including multiple sclerosis, as it demands a thorough treatment to manage symptoms, thereby, slowing disease progression. Moreover, continuous innovation in oral formulations, with improved safety profiles and efficacy in treating both relapsing and progressive MS, has further solidified their dominance in the market. For instance, in March 2019, the U.S. FDA approved Novartis’ Mayzent tablets to treat adults with relapsing forms of multiple sclerosis.

Distribution Channel (Hospital pharmacy, Retail pharmacy, Online Pharmacy)

In distribution channel, the hospital segment in multiple sclerosis therapeutic market is projected to witness a considerable growth during the forecast period, owing to their central role in diagnosing, managing, and treating the disease. Hospitals serve as key points for the administration of high-cost and complex therapies, including biologics, and monoclonal antibodies. These often need specialist supervision, and intravenous delivery in some cases. In addition, hospitals have necessary infrastructure for administering treatments that require refrigeration and specialized handling, making them a preferred channel for distributing these advanced therapies. Furthermore, hospitals tend to offer comprehensive care, including physical therapy, counseling, and access to multidisciplinary teams, positioning them as dominant players in the multiple sclerosis therapeutic market.

Our in-depth analysis of the global market includes the following segments:

|

Drug Class |

|

|

Route of Administration |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Multiple Sclerosis Therapeutic Market Regional Analysis:

North America Market Analysis

North America industry is poised to account for largest revenue share of 45.7% by 2035. The region also benefits from strong regulatory support for innovative therapies and a growing focus on personalized medicines. Advanced treatments such as biologics, oral drugs, and monoclonal antibodies are widely available, making the market highly competitive. In November 2023, the National Multiple Sclerosis Society invested USD 4.4 million in multi-year funding to launch new MS research projects. Such funds and grants are also boosting the multiple sclerosis therapeutic market in the region.

U.S. holds the largest share in North America market and is primarily driven by a strong pipeline of innovative treatments, including next-generation biologics, supported by FDA approvals and expedited regulatory pathways for breakthroughs. Additionally, the high prevalance of MS in the U.S. is also driving the multiple sclerosis therapeutic market growth in the country. As per the National Multiple Sclerosis Society, almost 1 million people in the United States were diagnosed with MS in 2019. The rising number of cases in the country, in addition to growing trend for personalized medicines, is boosting the market growth significantly.

Canada multiple sclerosis therapeutic market is driven by the country’s relatively high prevalance of the disease, particularly in provinces such as Alberta and Saskatchewan. As per an article by the Government of Canada, nearly 290 out of every 100,000 Canadians aged 20 years and above was living with MS from 2021 to 2022, and 7 out of 10 are women. The government funded healthcare system plays a central role in treatment access, with reimbursement policies significantly influencing the availability of therapies. Public awareness and early diagnosis initiatives, supported by organizations such as Multiple Sclerosis Society of Canada is also driving the country’s market growth significantly.

Europe Market Statistics

The region is witnessing growing adoption of advanced therapies, and strong regulatory frameworks. While biologics and oral therapies are widely available, the region faces challenges related to pricing and varying reimbursement policies across the countries. The entry of biosimilars and generics is also shaping the multiple sclerosis therapeutic market dynamics, offering cost-effective alternatives to expensive branded drugs. In June 2024, the European Commission approved the anti-CD20 therapy, the first twice-yearly injection for relapsing and primary progressive multiple sclerosis (RMS and PPMS). These factors are further boosting the region’s market growth.

UK is largely driven by the National Health Service which provides wide access to MS treatments. The multiple sclerosis therapeutic market is also supported by a well-established network of MS clinics, and specialists, making it a leading player in early diagnosis and long-term management. In July 2024, the UK Government released a report stating that the Medicines and Healthcare Products Regulatory Agency (MHRA) approved a new formulation of the medicine ocrelizumab (Ocrevus 920mg solution for injection). It is aimed to treat relapsing forms of multiple sclerosis (RMS) and primary progressive multiple sclerosis (PPMS) in adults.

France witnesses a strong demand for both oral and injectable therapies, owing to the rising prevalence of MS. French regulatory bodies, such as the Haute Autorite de Sante (HAS) plays a key role in assessing the cost-effectiveness of MS therapies, influencing the availability of advanced treatments. As per a report by the National Institutes of Health, in France, the highest prevalence rates were observed in the northeastern regions and the lowest rates in the southwestern regions. Nearly, 51.8% of the population received at least one MS-specific drug in 2021. These rising cases are projected to further accelerate the multiple sclerosis therapeutic market growth by 2035.

Key Multiple Sclerosis Therapeutic Market Players:

- Abbvie Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amgen Inc.

- Acorda Therapeutics, Inc.

- Biogen Inc.

- Bayer AG

- Bristol-Myers Squibb Company.

- F. Hoffman-La Roche Ltd

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis AG

- Teva Pharmaceutical Industries Ltd.

- Pfizer Inc.

- Sanofi

- Viatris Inc.

Companies in the multiple sclerosis therapeutics adopting several strategies to strengthen their position and enhance their product portfolios. Extensive investment in R&D activities, and launching innovative new treatments, particularly in biologics and oral therapies are two of the highly adopted strategies. Companies are also focusing on securing regulatory approvals for new drugs. Collaboration and acquisition activities are maintaining the competition in the global multiple sclerosis therapeutic market. For instance, in October 2020, Eli Lilly and Company announced the acquisition of Disarm Therapeutics for an upfront payment of $135.0 million. Some of the prominent players include:

Recent Developments

- In February 2024, Roche Pharma India launched its breakthrough drug, Ocrevus, aimed at treating multiple sclerosis (MS). It claims to be the first and only approved therapy for both PPMS & RMS with more than 300000+ patients treated globally.

- In December 2023, Vanda Pharmaceuticals announced the acquisition of Johnson & Johnson company Actelion Pharmaceuticals’ Ponvory, which is aimed to treat adults with relapsing forms of multiple sclerosis (RMS).

- In August 2024, Otsuka Pharmaceutical Co., Ltd. announced the acquisition of Jnana Therapeutics Inc., aiming to use Jnana's novel approach to drug discovery, enabled by RAPID.

- Report ID: 6549

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.