Multiple Myeloma Therapeutics Market Outlook:

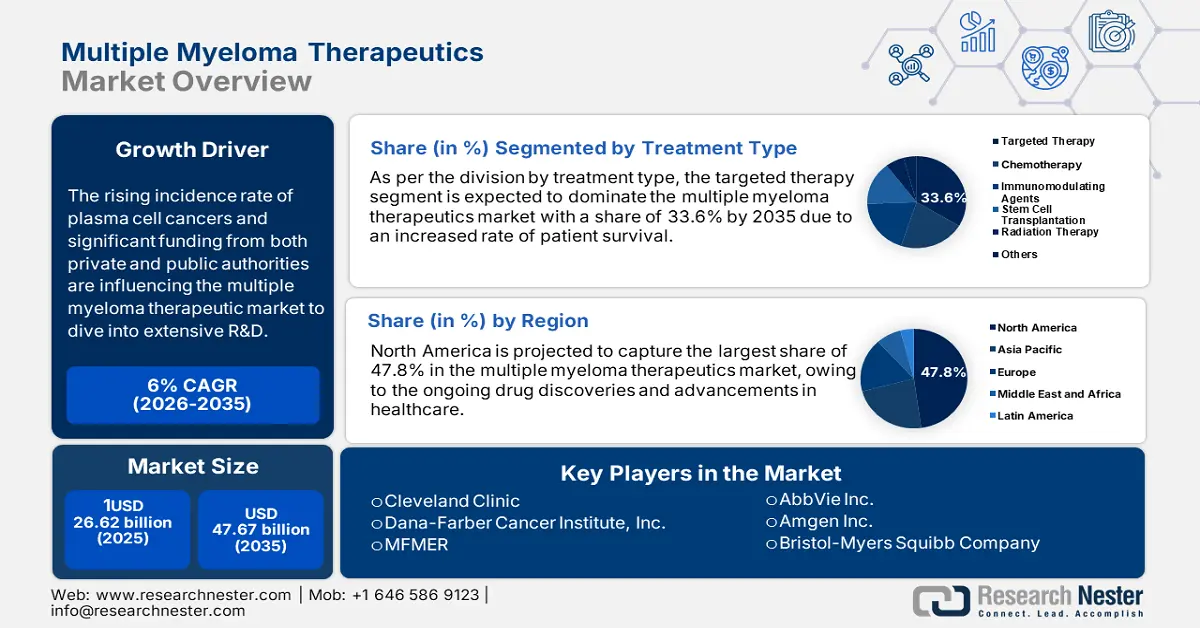

Multiple Myeloma Therapeutics Market size was valued at USD 26.62 billion in 2025 and is set to exceed USD 47.67 billion by 2035, expanding at over 6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of multiple myeloma therapeutics is evaluated at USD 28.06 billion.

The rising incidence rate of plasma cell cancers is driving the need for effective myeloma treatment and therapeutics. The global number of MM accounted to be 160,000 in 2020, according to the NLM article, published in May 2020. The 2022 World Cancer Research Fund International report states, that 187,952 new incidences of multiple myeloma were registered worldwide in the same year. These statistics indicate the need for immediate actions to prevent future increments.

Significant funding from both private and public authorities is influencing the multiple myeloma therapeutic market to dive into extensive R&D. In November 2023, the Multiple Myeloma Research Foundation (MMRF) made a strategic investment of USD 21 million for three research projects. Each MAC program will receive an individual USD 7 million grant to accelerate the testing and clinical trials of advanced therapeutics. Such funding is inspiring pharma companies and service providers to facilitate the highest quality treatment plans for patients. Personalized therapeutic plans are now being tailored to address age-specific properties of cancer cells. Advanced treatment approaches are gaining traction toward generating additional market revenue for investors.

Key Multiple Myeloma Therapeutics Market Insights Summary:

Regional Highlights:

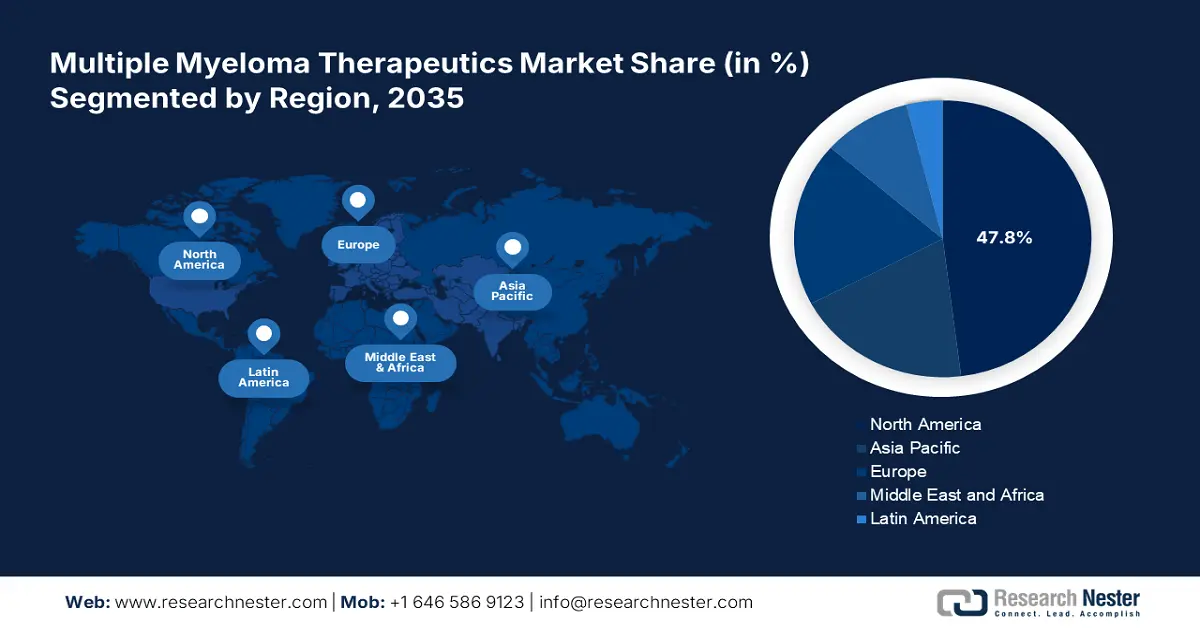

- North America holds a 47.80% share in the Multiple Myeloma Therapeutics Market, with ongoing drug discoveries and advancements in healthcare driving its dominance and strong growth potential through 2035.

Segment Insights:

- The Targeted Therapy segment is projected to exceed 33.6% market share by 2035, driven by improved survival rates and expanded treatment options.

Key Growth Trends:

- Advancement in research and development

- Consistent regulatory approvals

Major Challenges:

- Expensive treatment process

- Concerns about side effects and toxicity

- Key Players: Cleveland Clinic, Dana-Farber Cancer Institute, Inc., Mayo Foundation for Medical Education and Research (MFMER), MD Anderson Cancer Center, Takeda Pharmaceutical Company Limited.

Global Multiple Myeloma Therapeutics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 26.62 billion

- 2026 Market Size: USD 28.06 billion

- Projected Market Size: USD 47.67 billion by 2035

- Growth Forecasts: 6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 14 August, 2025

Multiple Myeloma Therapeutics Market Growth Drivers and Challenges:

Growth Drivers

- Advancement in research and development: New therapies are fueling innovation in the multiple myeloma therapeutics market. Methods including monoclonal antibodies, CAR T-cell therapies, and immune checkpoint inhibitors are gaining traction. The introduction of novel combinations is proving to be effective for treating cancer even in stage-variation. For instance, in September 2024, Johnson & Johnson launched FDA-approved combined bispecific therapy of TALVEY and TECVAYLI. Investigational phases have received high and durable responses in triple-class refractory patients with relapsed multiple myeloma. Additionally, the investigation revealed its efficacy in treating patients with extramedullary diseases.

- Consistent regulatory approvals: Accelerated government approvals are contributing to the boom in the market. New drugs and therapies are being launched with such regulatory support. This further facilitates innovative treatment methods for the patients. In August 2023, the FDA granted the accelerated approval of elranatamab-bcmm for adult patients. Acceptance for distributing such antigens was further continued for other competitors as well. Additionally, this encouraged manufacturers to produce more efficient drugs for improved patient outcomes. Early diagnosis of cancer has helped governments to engage in effective treatments to reduce mortality rates, further fueling the market.

Challenges

- Expensive treatment process: The economic barriers often halt the treatments to reach patients in need. The cost of new therapies and medication may limit patient access and affordability. Inadequate health insurance coverage can deter patients from investing in necessary supplements. The whole process of treatment may create an economic burden for the patient’s family to convey. Moreover, the drainage of savings due to the prolonged and expensive treatments may result in the discontinuation of medication and therapies. Further, hinders the growth of the multiple myeloma therapeutics market.

- Concerns about side effects and toxicity: After-effects of associative therapies and medicines may build insecurities in consumers. Impact on the quality of life can eventually result in stoppage of treatment. Many patients develop resistive antibodies, opposing treatments from effecting. This may require new options to be introduced in between the processes, leading to extensive expenses. The complexity of the disease often makes it difficult to comply with new formulations. Further, disrupts the acquired progress through aligned therapies in the multiple myeloma therapeutics market.

Multiple Myeloma Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 26.62 billion |

|

Forecast Year Market Size (2035) |

USD 47.67 billion |

|

Regional Scope |

|

Multiple Myeloma Therapeutics Market Segmentation:

Treatment Type (Chemotherapy, Targeted Therapy, Immunomodulating Agents, Stem Cell Transplantation, Radiation Therapy)

Targeted therapy segment is projected to account for multiple myeloma therapeutics market share of more than 33.6% by the end of 2035. The disease-specific pathways of these drugs are designed to increase the rate of survival for cancer patients. This further implies in broadened usage of targeted therapies in various treatment processes. The improved outcomes for multiple myeloma are inspiring manufacturers to invest in R&D to expand available options. In June 2024, Mission Bio launched a multi-omics solution, Tapestri to provide precise insights for R&D in multiple myeloma therapeutics. This product suite will help to classify cell types in the process of identifying immunotherapeutic targets including BCMA.

Route of Administration (Oral, Parenteral)

Based on the route of administration, the oral segment is estimated to capture a significant share of the multiple myeloma therapeutics market. The growth is propelled by patient adherence and convenient usage of oral supplements. These therapies are being increased in efficacy by combining them with other treatments. For instance, in October 2024, Jhonson & Jhonson received extensive approval for DARZALEX SC formulation for 1st stage myeloma patients. The quadruplet therapy can be used with a combination of bortezomib, lenalidomide, and dexamethasone. The new oral therapy is examined by the PERSEUS study, ensuring a 58% reduction in disease progression or mortality. Such innovative ways of taking supplements are creating the scope to develop more personalized regiments.

Our in-depth analysis of the global market includes the following segments:

|

Treatment Type |

|

|

Route of Administration |

|

|

Disease Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Multiple Myeloma Therapeutics Market Regional Analysis:

North America Market Analysis

North America industry is set to dominate majority revenue share of 47.8% by 2035. Ongoing drug discoveries and advancements in healthcare are driving significant growth in this region. The rising incidences of multiple myeloma are increasing awareness about early detection and treatment of these cancers. This further inflates the demand for effective treatments and a robust pipeline of new therapies. In May 2024, Kite and Arcellx collaboratively announced the phase 3 clinical trial of anitocabtagene autoleucel, iMMagine-3. This program will help test the efficacy of anti-cel in generalized use in patients opposing the standard of care (SOC). Innovative strategies including the application of immunotherapy and high-dose therapy are consolidating the position of this region.

The U.S. is solidifying its position as one of the biggest consumers of the market. The rising incidences are increasing the demand for therapeutics and revolutionary treatment plans. According to a report published by the American Cancer Society, in August 2024, around 35,780 people are estimated to be diagnosed with MM. The report further states, that 12, 540 deaths are to be occurred due to multiple myeloma. These numbers showcase the need for advanced and efficient therapeutic solutions to prevent and reduce the incidence rate.

Canada is also fostering the potential to present lucrative growth in the market in upcoming years. The supportive regulatory frameworks in this country facilitate quicker approvals for new drug discoveries. In February 2024, Health Canada approved ELREXFIO to engage in treating adult patients. Pfizer states that the drug will evolve the treatment process for multiple myeloma patients with at least three prior lines of therapy. This further influences service providers to develop new strategies and action plans to control the increasing number of MM cases.

APAC Market Statistics

The Asia Pacific multiple myeloma therapeutics market is also presenting greater investment opportunities. The aging population garners the possibility of holding the biggest number of future MM patients. According to the MJA report published in August 2024, Australia has the highest rate of incidence and mortality rates of MM in the world. The report further states, that 2625 people were diagnosed and 1100 people died due to multiple myeloma in 2022. Thus, the requirement for early detection and prevention is also increasing to support the process of reducing the risk. The introduction of novel therapies and combined treatment plans is accelerating the adoption of new methods. The partnership between local and international companies is fostering the scope of R&D in this sector.

India is growing to lead the market with its emphasized pharmaceutical industry. The frequent occurrence of investment and development of drugs are propelling opportunities to capture the international landscape. The concerning numbers of MM incidences are dragging the focus to developing cost-effective treatments. For instance, in April 2024, the president of India launched the world’s most affordable CAR-T Cell therapy, NexCAR19. This innovative solution is the country’s first homegrown anti-cancer therapy to be approved by the U.S. to treat multiple myeloma.

China market has strong potential for the development of new therapies. The government is supporting the market growth through continuous approvals for cancer medicines. For instance, in March 2024, China approved the NDA of BCMA CAR-T Therapy Zevorcabtagene Autoleucel. This drug is to be used for multiple myeloma patients with progress in 3 prior lines of therapy. The country is focusing on reducing the heightening cost of healthcare, particularly cancer treatments. Local manufacturers are addressing the aim of developing biosimilar antigens to make treatments and therapies affordable.

Key Multiple Myeloma Therapeutics Market Players:

- Service Providers

- Cleveland Clinic

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dana-Farber Cancer Institute, Inc.

- Mayo Foundation for Medical Education and Research (MFMER)

- MD Anderson Cancer Center

- Memorial Sloan Kettering Cancer Center

- Medication Manufacturers

- AbbVie Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amgen Inc.

- Bristol-Myers Squibb Company.

- Glenmark Pharmaceuticals Ltd.

- Johnson & Johnson Services, Inc

- Merck & Co, Inc.

- Novartis AG

- Sanofi S.A.

The multiple myeloma therapeutics market is majorly driven by new developments and advanced applications. The industry leaders are now focusing on integrating technologies to expand their portfolio, making MM treatment accessible for patients. This is further creating an opportunity for drug manufacturers to streamline their products. Public and governing authorities are collaborating to realize the concept. For instance, in October 2024, the International Myeloma Foundation collaborated with SparkCures to build a platform to match clinical trials. The platform, myeloma.org. will connect myeloma patients with care partners to discover clinical trials, based on the patient’s health-related information. Such key players in the market include:

Recent Developments

- In September 2024, the FDA approved Sarclisa, the first anti-CD38 therapy, launched by Sanfoi for newly diagnosed adult myeloma patients. The therapy is combined with standard-of-care treatment and is dedicated to helping patients, who are not eligible for transplant.

- In April 2024, Johnson & Johnson got approval from the FDA to release CARVYKTI for treating adult patients. The BCMA-targeted treatment is highly effective for patients with relapsed or refractory multiple myeloma.

- Report ID: 6606

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.