Global Multi-Layer Ceramic Capacitor Market

- An Outline of the Global Multi-Layer Ceramic Capacitor Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for Multi-Layer Ceramic Capacitor

- Recent News

- Regional Demand

- Multi-Layer Ceramic Capacitor Market by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: Multi-Layer Ceramic Capacitor Demand Landscape

- Multi-Layer Ceramic Capacitor Demand Trends Driven by Electrification, Downsizing, and Lightweighting (2026-2036)

- Root Cause Analysis (RCA) for discovering problems of the Multi-Layer Ceramic Capacitor Market

- Porter Five Forces

- PESTLE

- Comparative Positioning

- Global Multi-Layer Ceramic Capacitor Market – Key Player Analysis (2036)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2036 (%)

- Business Profile of Key Enterprise

- Murata Manufacturing

- Taiyo Yuden

- TDK Corporation

- Kyocera Corporation

- Nippon Chemi-Con

- MARUWA (Maruwa Co. Ltd.)

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Yageo Corporation

- Walsin Technology Corporation

- Holy Stone Enterprise

- Viking Tech

- Fujian Torch Electron Technology

- Fujian Torch Electron Technology

- Johanson Dielectrics.

- Business Profile of Key Enterprise

- Global Multi-Layer Ceramic Capacitor Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Multi-Layer Ceramic Capacitor Market Segmentation Analysis (2026-2036)

- By Type

- General Capacitor, Market Value (USD Million), and CAGR, 2026-2036F

- Array, Market Value (USD Million), and CAGR, 2026-2036F

- Serial Construction, Market Value (USD Million), and CAGR, 2026-2036F

- Mega Cap, Market Value (USD Million), and CAGR, 2026-2036F

- By Related Voltage Range

- Low Range (Up to 50 V), Market Value (USD Million), and CAGR, 2026-2036F

- Mid-range (100 V - 630 V), Market Value (USD Million), and CAGR, 2026-2036F

- High Range (1000 V & above), Market Value (USD Million), and CAGR, 2026-2036F

- By Case Size

- Less than 0603 Inches, Market Value (USD Million), and CAGR, 2026-2036F

- 0603-1206 Inches, Market Value (USD Million), and CAGR, 2026-2036F

- More than 1206 Inches, Market Value (USD Million), and CAGR, 2026-2036F

- By Dielectric Type

- X7R, Market Value (USD Million), and CAGR, 2026-2036F

- X5R, Market Value (USD Million), and CAGR, 2026-2036F

- C0G, Market Value (USD Million), and CAGR, 2026-2036F

- Y5V, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End use

- Consumer Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial, Market Value (USD Million), and CAGR, 2026-2036F

- Telecommunication, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Regional Synopsis, Value (USD Million), 2026-2036

- North America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Asia Pacific Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Middle East and Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Market Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- By Type

- General Capacitor, Market Value (USD Million), and CAGR, 2026-2036F

- Array, Market Value (USD Million), and CAGR, 2026-2036F

- Serial Construction, Market Value (USD Million), and CAGR, 2026-2036F

- Mega Cap, Market Value (USD Million), and CAGR, 2026-2036F

- By Related Voltage Range

- Low Range (Up to 50 V), Market Value (USD Million), and CAGR, 2026-2036F

- Mid-range (100 V - 630 V), Market Value (USD Million), and CAGR, 2026-2036F

- High Range (1000 V & above), Market Value (USD Million), and CAGR, 2026-2036F

- By Case Size

- Less than 0603 Inches, Market Value (USD Million), and CAGR, 2026-2036F

- 0603-1206 Inches, Market Value (USD Million), and CAGR, 2026-2036F

- More than 1206 Inches, Market Value (USD Million), and CAGR, 2026-2036F

- By Dielectric Type

- X7R, Market Value (USD Million), and CAGR, 2026-2036F

- X5R, Market Value (USD Million), and CAGR, 2026-2036F

- C0G, Market Value (USD Million), and CAGR, 2026-2036F

- Y5V, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End use

- Consumer Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial, Market Value (USD Million), and CAGR, 2026-2036F

- Telecommunication, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- U.S. Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Canada Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- By Type

- General Capacitor, Market Value (USD Million), and CAGR, 2026-2036F

- Array, Market Value (USD Million), and CAGR, 2026-2036F

- Serial Construction, Market Value (USD Million), and CAGR, 2026-2036F

- Mega Cap, Market Value (USD Million), and CAGR, 2026-2036F

- By Related Voltage Range

- Low Range (Up to 50 V), Market Value (USD Million), and CAGR, 2026-2036F

- Mid-range (100 V - 630 V), Market Value (USD Million), and CAGR, 2026-2036F

- High Range (1000 V & above), Market Value (USD Million), and CAGR, 2026-2036F

- By Case Size

- Less than 0603 Inches, Market Value (USD Million), and CAGR, 2026-2036F

- 0603-1206 Inches, Market Value (USD Million), and CAGR, 2026-2036F

- More than 1206 Inches, Market Value (USD Million), and CAGR, 2026-2036F

- By Dielectric Type

- X7R, Market Value (USD Million), and CAGR, 2026-2036F

- X5R, Market Value (USD Million), and CAGR, 2026-2036F

- C0G, Market Value (USD Million), and CAGR, 2026-2036F

- Y5V, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End use

- Consumer Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial, Market Value (USD Million), and CAGR, 2026-2036F

- Telecommunication, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- UK Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Germany Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- France Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Italy Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Spain Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Netherlands Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Russia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Switzerland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Poland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Belgium Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- By Type

- General Capacitor, Market Value (USD Million), and CAGR, 2026-2036F

- Array, Market Value (USD Million), and CAGR, 2026-2036F

- Serial Construction, Market Value (USD Million), and CAGR, 2026-2036F

- Mega Cap, Market Value (USD Million), and CAGR, 2026-2036F

- By Related Voltage Range

- Low Range (Up to 50 V), Market Value (USD Million), and CAGR, 2026-2036F

- Mid-range (100 V - 630 V), Market Value (USD Million), and CAGR, 2026-2036F

- High Range (1000 V & above), Market Value (USD Million), and CAGR, 2026-2036F

- By Case Size

- Less than 0603 Inches, Market Value (USD Million), and CAGR, 2026-2036F

- 0603-1206 Inches, Market Value (USD Million), and CAGR, 2026-2036F

- More than 1206 Inches, Market Value (USD Million), and CAGR, 2026-2036F

- By Dielectric Type

- X7R, Market Value (USD Million), and CAGR, 2026-2036F

- X5R, Market Value (USD Million), and CAGR, 2026-2036F

- C0G, Market Value (USD Million), and CAGR, 2026-2036F

- Y5V, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End use

- Consumer Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial, Market Value (USD Million), and CAGR, 2026-2036F

- Telecommunication, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- China Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- India Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Korea Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Australia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Indonesia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Malaysia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Vietnam Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Thailand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Singapore Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- New Zeeland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2036, By

- By Type

- General Capacitor, Market Value (USD Million), and CAGR, 2026-2036F

- Array, Market Value (USD Million), and CAGR, 2026-2036F

- Serial Construction, Market Value (USD Million), and CAGR, 2026-2036F

- Mega Cap, Market Value (USD Million), and CAGR, 2026-2036F

- By Related Voltage Range

- Low Range (Up to 50 V), Market Value (USD Million), and CAGR, 2026-2036F

- Mid-range (100 V - 630 V), Market Value (USD Million), and CAGR, 2026-2036F

- High Range (1000 V & above), Market Value (USD Million), and CAGR, 2026-2036F

- By Case Size

- Less than 0603 Inches, Market Value (USD Million), and CAGR, 2026-2036F

- 0603-1206 Inches, Market Value (USD Million), and CAGR, 2026-2036F

- More than 1206 Inches, Market Value (USD Million), and CAGR, 2026-2036F

- By Dielectric Type

- X7R, Market Value (USD Million), and CAGR, 2026-2036F

- X5R, Market Value (USD Million), and CAGR, 2026-2036F

- C0G, Market Value (USD Million), and CAGR, 2026-2036F

- Y5V, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End use

- Consumer Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial, Market Value (USD Million), and CAGR, 2026-2036F

- Telecommunication, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Brazil Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Argentina Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Mexico Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2036, By

- By Type

- General Capacitor, Market Value (USD Million), and CAGR, 2026-2036F

- Array, Market Value (USD Million), and CAGR, 2026-2036F

- Serial Construction, Market Value (USD Million), and CAGR, 2026-2036F

- Mega Cap, Market Value (USD Million), and CAGR, 2026-2036F

- By Related Voltage Range

- Low Range (Up to 50 V), Market Value (USD Million), and CAGR, 2026-2036F

- Mid-range (100 V - 630 V), Market Value (USD Million), and CAGR, 2026-2036F

- High Range (1000 V & above), Market Value (USD Million), and CAGR, 2026-2036F

- By Case Size

- Less than 0603 Inches, Market Value (USD Million), and CAGR, 2026-2036F

- 0603-1206 Inches, Market Value (USD Million), and CAGR, 2026-2036F

- More than 1206 Inches, Market Value (USD Million), and CAGR, 2026-2036F

- By Dielectric Type

- X7R, Market Value (USD Million), and CAGR, 2026-2036F

- X5R, Market Value (USD Million), and CAGR, 2026-2036F

- C0G, Market Value (USD Million), and CAGR, 2026-2036F

- Y5V, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End use

- Consumer Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial, Market Value (USD Million), and CAGR, 2026-2036F

- Telecommunication, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Saudi Arabia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- UAE Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Israel Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Qatar Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Kuwait Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Oman Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Middle East & Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Multi-Layer Ceramic Capacitor Market Outlook:

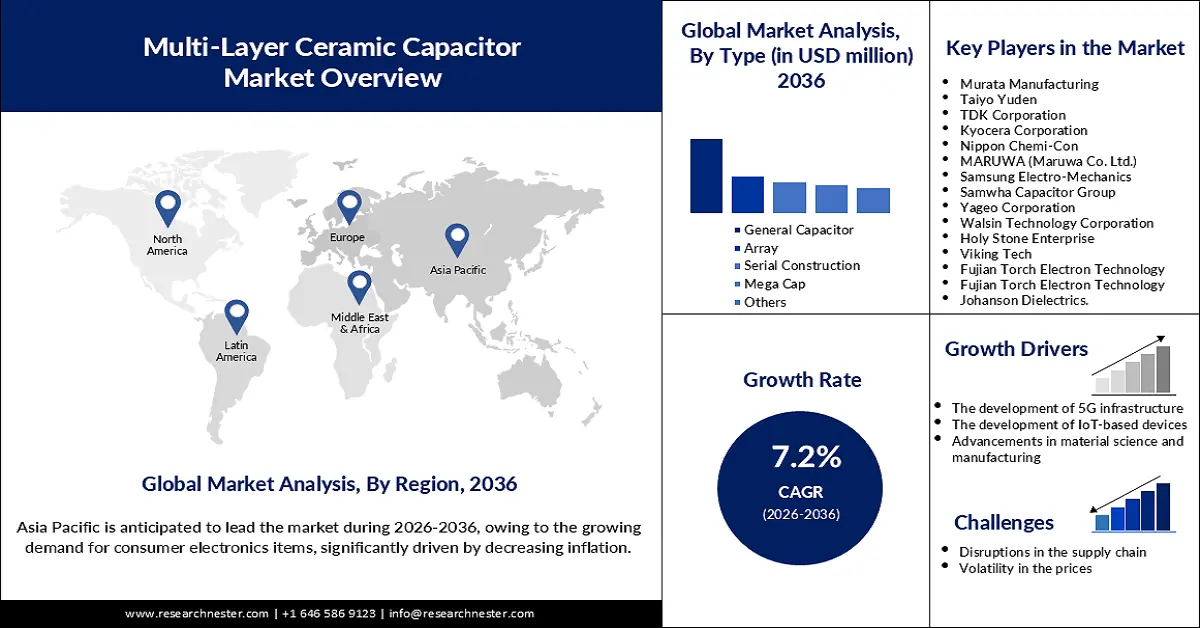

Multi-Layer Ceramic Capacitor Market size is valued at USD 16.39 billion in 2025 and is anticipated to surpass USD 35.31 billion by 2036, expanding at a CAGR of 7.2% during the forecast period, i.e., 2026 to 2036. In 2026, the industry size of multi-layer ceramic capacitor is assessed at USD 17.61 billion.

The multi-layer ceramic capacitor market is expected to grow rapidly with the surging demand for consumer electronics products, such as laptops, smartphones, and other devices. This is leading manufacturers to produce an increasing number of consumer electronics items even in developing economies. As disclosed by the Press Information Bureau in September 2025, smartphone exports from India to the U.S. increased by 55% to 1 trillion, surpassing China as the top smartphone exporter. As a result, the manufacturers of these electronic items are anticipated to witness a growing need for MLCCs. These capacitors play a crucial role in a reservoir for electrical charge to enable control over the flow of electricity in a circuit and reduce interference between different parts.

Rapid adoption of electric and hybrid vehicles is also fueling the multi-layer ceramic market growth. MLCCs play a crucial role in vehicles for voltage management, especially when they offer high capacitance, temperature stability, compact size, and a long battery lifespan. With the growing involvement of manufacturers in the electrification of vehicles, the demand for MLCCs is likely to increase over time. As per the report by the International Energy Agency, the proportion of EVs among newly sold cars in 2024 was 20%, a surge in the rate of sales by 25% to 17 million. In fact, EV sales globally are required to reach around 60% by the year 2030 for the achievement of net-zero targets by 2050.

Key Multi-layer Ceramic Capacitor Market Insights Summary:

Regional Highlights:

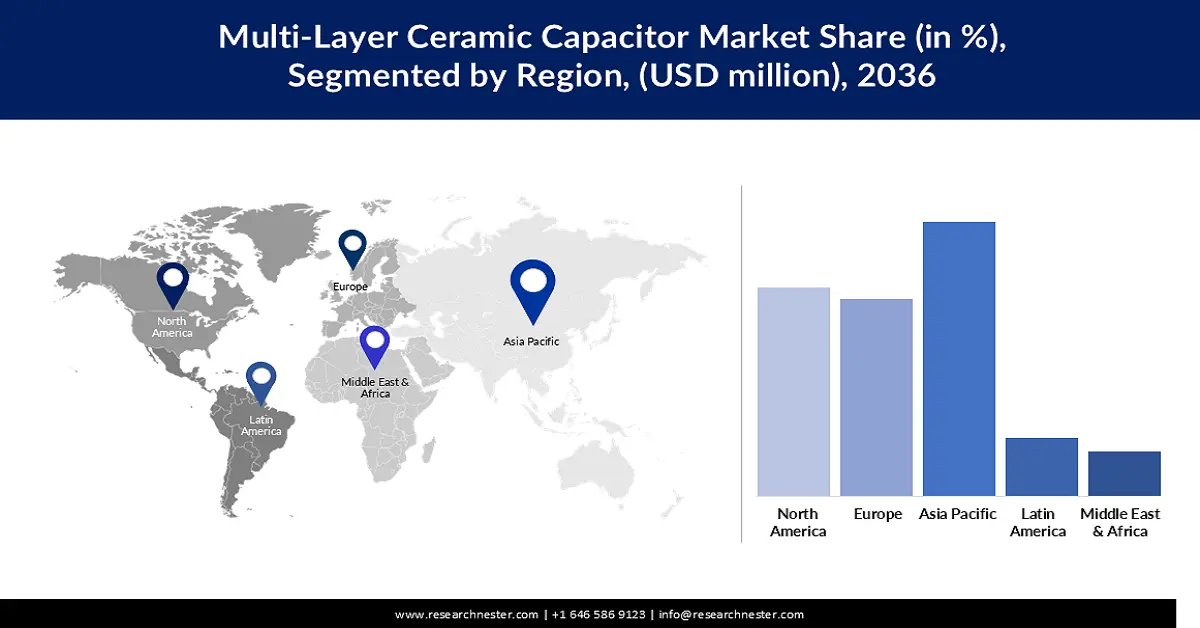

- By 2036, the Asia Pacific multi-layer ceramic capacitor market is anticipated to hold a 43.4% revenue share as expanding EV initiatives and electronics production reinforce regional uptake due to the growing demand for consumer electronics items, significantly driven by decreasing inflation.

- North America is projected to capture a 27.4% revenue share by 2036 as industries increasingly transition toward high-performance, miniaturized electronic components owing to the growing demand for advanced electronics components across multiple industries.

Segment Insights:

- By 2036, the general capacitor segment in the multi-layer ceramic capacitor market is projected to claim a 43.5% share as expanding adoption across gaming devices, mobile phones, TVs, and other electronics strengthens its position owing to the growing demand in gaming machines, cellular telephones, TVs, LCDs, and other electronic products.

- The less than 0603 inches segment is expected to secure a 47.6% share by 2036 as its compact footprint increasingly aligns with next-generation electronics manufacturing requirements propelled by the accelerating demand for miniaturized components.

Key Growth Trends:

- The development of 5G infrastructure

- The development of IoT-based devices

Major Challenges:

- Disruptions in the supply chain

- Volatility in the prices

Key Players: Murata Manufacturing (Japan), Taiyo Yuden (Japan), TDK Corporation (Japan), Kyocera Corporation (Japan), Nippon Chemi-Con (Japan), MARUWA Co. Ltd. (Japan), Samsung Electro-Mechanics (South Korea), Samwha Capacitor Group (South Korea), Yageo Corporation (Taiwan), Walsin Technology Corporation (Taiwan), Holy Stone Enterprise (Taiwan), Viking Tech (Taiwan), Fujian Torch Electron Technology (China), Johanson Dielectrics (U.S.).

Global Multi-layer Ceramic Capacitor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.39 billion

- 2026 Market Size: USD 17.61 billion

- Projected Market Size: USD 35.31 billion by 2036

- Growth Forecasts: 10.2% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.4% Share by 2036)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: India, Vietnam, Mexico, Indonesia, Brazil

Last updated on : 5 November, 2025

Multi-Layer Ceramic Capacitor Market - Growth Drivers and Challenges

Growth drivers

- The development of 5G infrastructure: The initiatives of governments across different countries to develop 5G infrastructure are expected to fuel the demand for multi-layer ceramic capacitors. As per the disclosure by 5G Americas in April 2025, 5G has expanded to 2.2 billion connections, reaching a global inflection point. The integration of MLCCs in 5G networks is crucial for stable electricity for high-frequency signals and the reduction of noise interferences, leading to improved network performance. In addition, MLCCs in smartphones enable storage and release of high-speed data and complex functionalities, which 5G demands.

- The development of IoT-based devices: Continuous development of IoT-based devices, ranging from smart home devices to health monitoring devices to equipment required for industrial automation, is demanding MLCCs for seamless connectivity. MLCCs are engineered for impedance matching in high-frequency circuits that are utilized in compact IoT-based devices. The emergence of certain IoT-based devices in the market is even contributing to increasing the effectiveness of MLCCs. For instance, TDK Corporation announced the launch of the TDK SensEI product line, edgeRX Vision. This is an AI-enabled system for defect detection and is capable of managing even the smallest MLCCs with high precision.

- Advancements in material science and manufacturing: The advancements in material science and manufacturing through innovation led to the miniaturization of the MLCCs, increasing the scope of proliferation of electronic devices and their performance enhancement. Advancements in material science and manufacturing have also led companies to develop miniaturized MLCCs. For example, in September 2024, a leading innovator of electronics items, Murata, unveiled the world’s smallest MLCC sized 006003-inch (0.16 mm x 0.08 mm). A lower volume ratio by 75% is represented by the new MLCCs compared to the components available in the market.

Challenges

- Disruptions in the supply chain: Disruptions in the supply chain of the raw materials, including the primary electrode material Nickel, are a significant matter of concern in the growth of the global multi-layer ceramic capacitor market. Manufacturers in the industry are vulnerable to delays in production, owing to the risk of a lack of accessibility to nickel that can be caused by natural disasters or geopolitical landscape. Global dependency on certain countries for nickel supply increases the likelihood of the discussed risk significantly.

- Volatility in the prices: Fluctuations in the prices of raw materials required to produce MLCC lead to an increase in the prices of end products. Otherwise, operating with adequate profit can be challenging for the manufacturers of the component. As disclosed U.S. Geological Survey, the prices of Nickel increased by 270% in 2022. The market is vulnerable to price challenges due to the need for rare metals, including neodymium and samarium. The prices of the rare materials vary from market to market based on availability, indicating production challenges for the key players in the certain multi-layer ceramic capacitors market.

Multi-Layer Ceramic Capacitor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2036 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 16.39 billion |

|

Forecast Year Market Size (2036) |

USD 35.31 billion |

|

Regional Scope |

|

Multi-Layer Ceramic Capacitor Market Segmentation:

Type Segment Analysis

The general capacitor segment is expected to account for a market share of 43.5% by the end of 2036, owing to the growing demand in gaming machines, cellular telephones, TVs, LCDs, and other electronic products. Therefore, the segment is expected to keep its dominance throughout the forecast period with the expansion of the consumer electronics industry. The global expansion of the automotive sector, with the rapid adoption of EVs, is also accelerating the use of general capacitors. These capacitors are essential to store energy, smooth voltage, and couple signals. As revealed by the India Brand Equity Foundation in April 2024, the government is committed to making the proportion of new vehicle sales 30% among all the new vehicles that will be sold by 2030.

Case Size Segment Analysis

The less than 0603 inches segment is anticipated to acquire a market share of 47.6% by 2036, due to the accelerating demand for miniaturized components. The compatibility of these MLCCs with the process of automotive manufacturing also fuels the dominance of the segment in the global market, especially when there is a growing need to produce EVs and hybrid vehicles. Key players in the market are also investing in the production of the MLCCs with the case size of less than 0603 inches. For instance, in March 2025, KYOCERA AVX introduced a high-capacity MLCC with a case size of 0402-inch and capacitance value of 47µF. The MLCC will be produced in mass from December 2025.

End use Segment Analysis

The consumer electronics segment is projected to hold a revenue share of 32.9% during the study period, as a consequence of the high demand for MLCCs in the production of smartphones, tablets, TVs, laptops, and other items. The use of MLCCs is also growing with the production of IoT-based connected consumer electronics products. For instance, in June 2023, Apple launched Vision Pro. It is an IoT-based connected device that blends digital content with the physical world to enhance user experiences. The need for advanced data processing in these consumer electronic items is fueling the demand for MLCC. MLCCs in electronic devices minimize signal interference and enhance data transfer.

Our in-depth analysis of the multi-layer ceramic capacitor market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Related Voltage Range |

|

|

Case Size |

|

|

Dielectric Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Multi-Layer Ceramic Capacitor Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific multi-layer ceramic capacitors market is estimated to obtain a revenue share of 43.4% by the end of 2036, owing to the growing demand for consumer electronics items, significantly driven by decreasing inflation. The promotion of EV adoption by governments of different countries within the region, driven by a focus on environmental sustainability, is expected to lead to an increase in the production of the vehicles. As a result, the demand for MLCC is likely to surge. As disclosed by the Influencamap, the government of Japan has targeted to achieve 100% EV sales in trade of new light-duty vehicles by 2035, and reduce carbon emissions across the country by 46%.

The multi-layer ceramic capacitor market in China is projected to expand at a CAGR of 7.5% throughout the forecast period, as a consequence of the emergence of the country as the hub of EV production. According to the International Energy Agency, with the manufacturing of 17.3 million cars, China accounted for over 70% of EV production globally in 2024. The market potential is also strengthened by the development of 5G infrastructure. As reported by the State Council in November 2024, all the cities and towns across China will be covered by 5G networks by 2025, with the establishment of 26 base stations per 10,000 people.

Japan multi-layer ceramic capacitor market is projected to witness a CAGR of 6.4% between 2026 and 2036, on account of the growing demand and production of consumer electronics devices, including smartphones, wearables, tablets, and others. The performance of these devices is highly dependent on efficient and compact capacitors. The demand for MLCCs is also fueled by the rapid penetration of ADAS in the automobile sector. MLCCs in ADAS store energy and supply the same stable power to components, such as CPUs, APs, and GPUs. Automotive manufacturers are likely to invest heavily to launch ADAS in Japan since, following China, the U.S, and India, Japan is the fourth largest automotive market, according to the International Energy Agency in January 2024.

North America Market Insights

The North America multi-layer ceramic capacitor (MLCC) market is anticipated to capture a revenue share of 27.4%, as a consequence of the growing demand for advanced electronics components across multiple industries, including automotive, manufacturing, consumer electronics, and others. The shift of these industries towards miniaturization also boosts the demand for high-performance MLCCs. The governments are also supporting the advancements in manufacturing in organizations, increasing the scope of the use of MLCC. As reported by the Government Accountability Office in June 2025, the Manufacturing USA Program is connecting academic institutions, businesses, and others with 17 institutions involved in relevant research and development and training workforce. Companies based in the region are also involved in the development of MLCCs compatible with advanced vehicles.

The multi-layer ceramic capacitor (MLCC) market in the U.S. is set to expand rapidly at a CAGR of 6.9% during the stipulated timeline, on account of the involvement of organizations in on-shore manufacturing of the component increasingly. Such an involvement has become convenient for organizations due to the availability of adequate government support. The growing adoption of EVs and ADAS across the country is indicating the probability of an increasing use of MLCC in the production of vehicles. As disclosed by the Alliance for Automotive Innovation in June 2025, the proportion of EVs among new car sales in the first quarter of 2025 is 9.6%. Between Q1 2024 and Q1 2025, the market share of EVs grew by 0.3% with a 9% increase in the volume of production.

The Canada multi-layer ceramic capacitor (MLCC) market is expected to witness an 8.9% CAGR throughout the forecast period, owing to the steady penetration of automation in the consumer electronics industry. One such example is the inauguration of the Smart Factory Montreal by Deloitte Canada in January 2023, displaying an interrelated ecosystem of over 20 cutting-edge technologies and solutions contributing to transforming manufacturing and warehousing. In enabling industrial automation, MLCCs are widely used for filtering and decoupling purposes. An increased demand is indicated by the rapid expansion of the 5G infrastructure across the country. As the update by the Government of Canada in March 2025 says, measures are being taken to make 5G millimeter wave spectrum accessible for innovative services.

Europe Market Insights

Europe is estimated to be proven as a rapidly expanding multi-layer ceramic capacitor (MLCC) market, acquiring a revenue share of 21.4% between 2026 and 2036. The market is anticipated to grow in terms of sustainability, owing to the production of the component in eco-friendly ways. Precision is also expected to be achieved in the production of the component with the integration of AI. Regulatory push to enhance internet connectivity across the region through the deployment of improved 5G infrastructure is also likely to boost the demand for MLCCs. In January 2025, the European 5G Conference was organized, where polices for the advancement of 5G and the development of 6G infrastructure were discussed, attracting potential investors to obtain effective ROI.

The MLCC market in Germany is projected to experience a CAGR of 7.4%, as a consequence of the steady expansion of the automobile sector. As revealed by the German Trade & Invest, Germany produced 4.0 million passenger cars in 2024. Around 2.8 million new passenger cars were registered in the same business year, resulting in 22% of all car registrations in Europe. The need for the development of complex ADAS technologies also fuels the demand for MLCCs. Industry key players operating in Germany are also supplying MLCCs that can support the electronic circuits in the infotainment systems of the vehicles. Rapid industrial automation significantly accelerates the utilization of MLCCs across various sectors.

The UK MLCC market is likely to expand at a CAGR of 7.4% during the stipulated timeframe, attributed to the proliferation of IoT devices. The development of smart home appliances, especially, is accelerating the utilization of MLCCs. The government is also investing in clean energy and smart grid technologies. A report by the UK Government, published in July 2025, reveals that 84.7 million was raised to supercharge the infrastructure of EVs in Britain. The key players operating in the UK are investing heavily in the development of more advanced MLCCs, best suitable for modern automotive.

Key Multi-Layer Ceramic Capacitor Market Players:

- Murata Manufacturing (Japan)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Taiyo Yuden (Japan)

- TDK Corporation (Japan)

- Kyocera Corporation (Japan)

- Nippon Chemi-Con (Japan)

- MARUWA Co. Ltd. (Japan)

- Samsung Electro-Mechanics (South Korea)

- Samwha Capacitor Group (South Korea)

- Yageo Corporation (Taiwan)

- Walsin Technology Corporation (Taiwan)

- Holy Stone Enterprise (Taiwan)

- Viking Tech (Taiwan)

- Fujian Torch Electron Technology (China)

- Johanson Dielectrics (U.S.)

- Samsung Electro-Mechanics is one of the leading global manufacturers of electronic components, including multi-layer ceramic capacitors (MLCCs). The company serves diverse industries such as automotive, telecommunications, and consumer electronics. Its MLCCs are known for high reliability, miniaturization, and superior performance in high-frequency and high-temperature applications. Samsung continues to expand its production capacity and R&D in advanced materials to meet growing demand from electric vehicles and 5G devices.

- Samwha Capacitor Group specializes in producing passive components, including MLCCs, electrolytic capacitors, and film capacitors. The company caters to applications in power electronics, telecommunications, and industrial automation. It emphasizes innovation in dielectric materials and cost-efficient mass production techniques. Samwha’s global supply network strengthens its position in both consumer and industrial electronics markets.

- Yageo Corporation is a major global supplier of passive components, including resistors, inductors, and MLCCs. The company focuses on high-capacitance and miniaturized MLCCs for automotive, 5G, and IoT applications. Through strategic acquisitions and technological upgrades, Yageo has enhanced its product portfolio and global manufacturing footprint. Its strong presence in Asia, Europe, and the Americas supports its role as a key player in the MLCC industry.

- Walsin Technology Corporation is recognized for its advanced MLCCs used across consumer electronics, industrial equipment, and automotive applications. The company focuses on high-quality, high-reliability products, leveraging automation and material innovation. Walsin continues to invest in R&D to produce MLCCs that meet the needs of miniaturization and high-performance electronic devices. Its global distribution network enhances its competitive edge in the passive component market.

- Holy Stone Enterprise is a specialized manufacturer of MLCCs and other electronic components for a wide range of applications, including automotive, industrial, and telecommunications. The company focuses on developing high-voltage and high-temperature MLCCs suitable for demanding environments. With a strong emphasis on quality control and technological innovation, Holy Stone continues to expand its presence in the global capacitor market. Its strategic partnerships and global supply capabilities reinforce its growth trajectory.

Below is the list of key players operating in the multi-layer ceramic capacitor market:

Key players in the global MLCC market are experiencing a high intensity of competition. The market is characterized by large key players as well as new entrants. The market is moderately concentrated at the same time, since the majority of the revenue share has been captured by the large players. All the key players, regardless of their size, are prioritizing investment in research and development to develop MLCCs with high capacitance and in smaller sizes that can be compatible with miniaturized devices. Consumer electronics, automotive, and manufacturing are the main industries to which key players in the market are supplying MLCCs.

Corporate Landscape of the Multi-Layer Ceramic Capacitor Market:

Recent Developments

- In September 2025, TDK Corporation unveiled the expansion of its CN series. These are MLCCs with low-resistance soft-termination capacity, with a case size of 3225, capacitance of 22 nF, and C0G characteristics at 1000 V.

- In July 2025, Murata Manufacturing started mass production of 0402-inch MLCCs. The miniaturized component has a capacitance of 47µF and is effective in enhancing customer system performance.

- In February 2025, Taiyo Yuden Co., LTD. accomplished the construction of a production premises in its Tamamura Plant, one of the popular MLCC production bases. The premise covers around 9,000 ㎡ of floor area and 3,000 ㎡ f building area.

- Report ID: 5199

- Published Date: Nov 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.