Multi-core Processor Market Outlook:

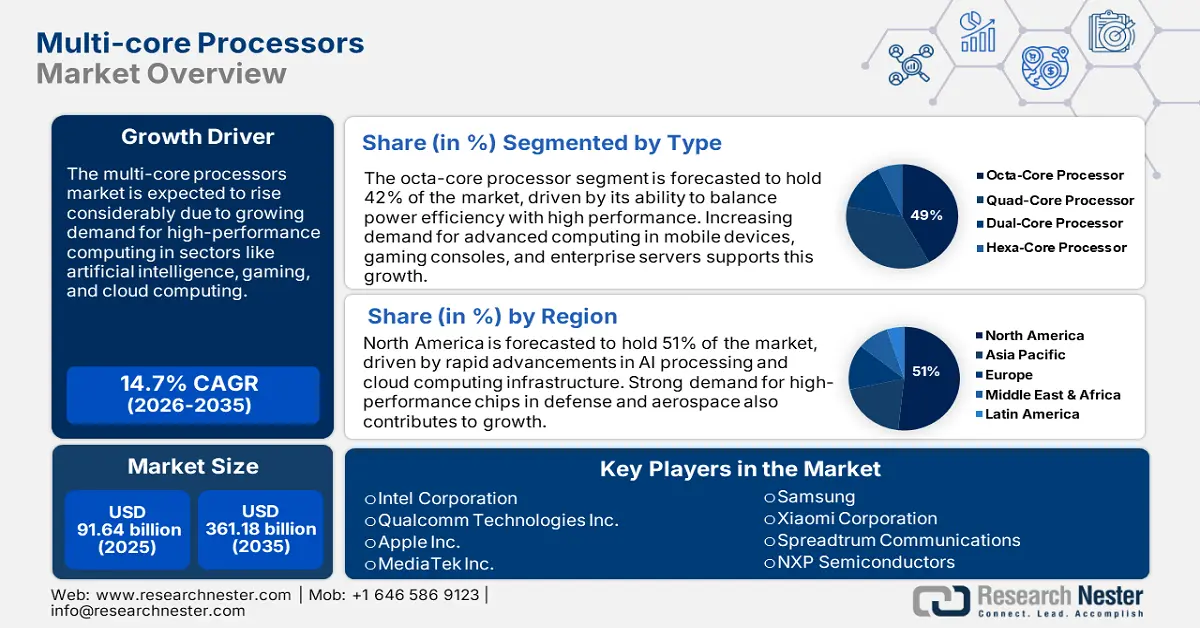

Multi-core Processor Market size was over USD 91.64 billion in 2025 and is projected to reach USD 361.18 billion by 2035, growing at around 14.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of multi-core processor is evaluated at USD 103.76 billion.

The multi-core processor market is expanding at a considerable pace as AI-driven computing, together with cloud-based applications and edge processing demand rises. Advanced neural processing units (NPUs) are becoming standard additions in processors by companies seeking to enhance AI workload processing. During CES 2025, Intel presented their new AI-powered processors, which target power efficiency while optimizing multi-core performance for modern PCs. These processors deliver elevated performance levels for data-heavy applications while solidifying the movement toward AI incorporation in current processor designs.

The partnership between government programs and industry entities creates a roadmap for multi-core computing development which aids semiconductor innovation and supply chain robustness. Globally governments' push for semiconductor independence results in increased investments in chip manufacturing and research and development. The government in Japan allocated USD 7 billion to achieve semiconductor self-reliance while boosting supply chain stability and multi-core processing technology innovation. Furthermore, countries worldwide are working to increase their processor production capacity as part of a larger global push to satisfy the rising demand for advanced computational hardware.

Key Multi-Core Processors Market Insights Summary:

Regional Highlights:

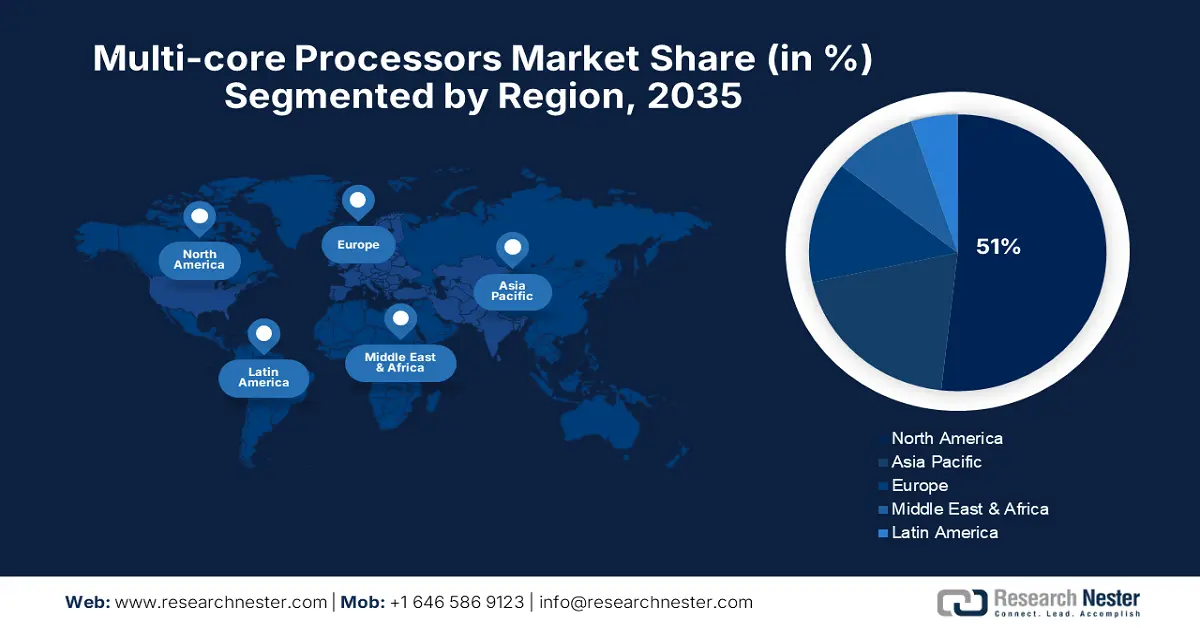

- North America's 51% share in the Multi-core Processor Market is propelled by advancements in AI technologies, cloud computing, semiconductor production, and HPC & 5G infrastructure, driving strong growth through 2026–2035.

- Asia Pacific’s multi-core processor market anticipates lucrative growth through 2026–2035, driven by fast-paced industrialization, 5G expansion, and domestic semiconductor development.

Segment Insights:

- The Healthcare segment is expected to hold a 75% market share by 2035, propelled by increased use of AI diagnostics, medical imaging, and telemedicine.

- The Octa-core Processor segment of the Multi-core Processor Market is expected to capture a 42% share by 2035, fueled by efficiency in managing multi-threaded AI and gaming applications.

Key Growth Trends:

- Increasing AI workloads and edge computing

- Expansion of 5G networks and IoT devices

Major Challenges:

- Chip Shortages and supply chain constraints

- Cybersecurity and power efficiency issues

- Key Players: Intel Corporation, Qualcomm Technologies Inc., Apple Inc., MediaTek Inc., Texas Instruments, Nvidia Corporation, Advanced Micro Devices Inc., ARM Holdings, PLC, Broadcom Corporation, and Marvell.

Global Multi-Core Processors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 91.64 billion

- 2026 Market Size: USD 103.76 billion

- Projected Market Size: USD 361.18 billion by 2035

- Growth Forecasts: 14.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (51% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 13 August, 2025

Multi-core Processor Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing AI workloads and edge computing: AI computing innovations are creating a multi-core processor market that support heavy workloads throughout multiple application domains. Intel presented its Lunar Lake chips in September 2024, which target Qualcomm’s AI processors for enhanced AI performance in laptops, gaming machines, and mobile devices. The fast growth of AI adoption makes companies prioritize multi-threaded architectures that support real-time AI processing together with deep learning functions. Current multi-core chip performance enhancements result from AI-powered edge computing solutions used in robotics and automation systems.

-

Expansion of 5G networks and IoT devices: Advancements in 5G and IoT deployment create an urgent requirement for multi-core processor that feature high-speed connectivity alongside power efficiency capabilities. AMD extended its AI PC offerings with new Ryzen AI processors during July 2024 which target business and IoT markets. Real-time processing capabilities in autonomous systems and smart homes, along with industrial automation, depend on these processors. Multi-core processor become essential tools for delivering uninterrupted wireless connectivity and better data management as industries move towards ultra-fast wireless communication systems.

- Advancements in cloud computing and data centers: The growing scale of cloud computing infrastructure, along with virtualization and hyperscale data centers, creates a stronger demand for advanced multi-core processor. Qualcomm introduced AI-powered PC processors in October 2024 designed to compete with Apple’s M-series and Intel’s AI-focused chips. The processors sustain big workloads, allowing the operation of cloud AI systems alongside virtualized setups and GPU-enhanced computation. AI model training and inference activities need efficient multi-core architectures, which leads to ongoing data center processing advancements. Cloud data centers experience increased processor demand as they move toward software-defined networking (SDN) together with AI-driven automation.

Challenges

-

Chip Shortages and supply chain constraints: Due to the worldwide shortage of semiconductors, production of multi-core processor faces serious delays while costs continue to rise. Modern chip production remains complex, while geopolitical issues and raw material deficits maintain disruptions in supply chain networks. Manufacturers across the globe are turning toward domestic production facilities and forming strategic business partnerships to reduce supply risks while improving production processes. The semiconductor supply chains face new stress from rising AI, 5G, and IoT demands, which demand scalable production solutions. Supply chain constraints continue as an obstacle that threatens market stability throughout future years despite current mitigation efforts.

-

Cybersecurity and power efficiency issues: The expanding workloads from AI applications and cloud services to IoT in multi-core processor create both more security risks and power consumption difficulties. Increased core numbers produce greater system complexity which needs powerful cybersecurity infrastructure to defend against advanced threats that attack hardware and firmware. The substantial energy requirements of high-performance multi-core chips represent a major challenge that affects both operational expenses and environmental sustainability objectives. Resolving these challenges is necessary to sustain industry growth and achieve both security and power efficiency standards.

Multi-core Processor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.7% |

|

Base Year Market Size (2025) |

USD 91.64 billion |

|

Forecast Year Market Size (2035) |

USD 361.18 billion |

|

Regional Scope |

|

Multi-core Processor Market Segmentation:

Type (Dual-Core Processor, Quad-Core Processor, Octa-Core Processor, and Hexa-Core Processor)

The octa-core processor segment is set to capture over 42% multi-core processor market share by 2035, as they excel at managing multi-threaded applications used in AI operations as well as gaming and enterprise systems. Apple released their M4 Pro and M4 Max chips in October 2024 that deliver advanced multi-core CPU and GPU performance specifically designed to handle AI tasks and high-performance computing activities. Using eight processing cores octa-core processor achieve smooth multitasking capabilities while supporting real-time AI inference and deep learning along with delivering high-performance gaming. By distributing processing power efficiently between multiple cores, these processors serve both consumer and professional needs well. Industries will show increased demand for octa-core architectures as AI-powered computing achieves standard status.

End user (Consumer Electronics, Automotive, Telecommunication, Healthcare, Energy, and Others)

By 2035, healthcare segment is estimated to capture over 75% multi-core processor market share due to increased use of AI-assisted diagnostics along with advances in medical imaging and telemedicine. Samsung launched its Galaxy Book 4 series with Intel Core Ultra processors in December 2023 to optimize AI healthcare applications and real-time patient monitoring. Advanced image recognition through medical scans becomes possible with AI-driven multi-core processor, which enhance diagnostic precision and treatment strategies. The rise of smart hospitals and digital healthcare solutions leads to multi-core processor implementation across robotic surgery procedures while they enhance predictive analytics capabilities and support AI-assisted drug discovery work.

Our in-depth analysis of the global multi-core processor market includes the following segments:

|

Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Multi-core Processor Market Regional Analysis:

North America Market Analysis

North America in multi-core processor market is set to capture over 51% revenue share by 2035. The region maintains its leadership position owing to progress made in AI technologies together with cloud computing capabilities and semiconductor production techniques. The demand for multi-core processor market expands as major funding flows into data centers alongside high-performance computing (HPC) and 5G network infrastructures. Organizations are developing AI-powered multi-core chips due to increased attention to cybersecurity and edge computing needs. The global processor industry sees North America as its main competitive force owing to ongoing mobile, gaming, and enterprise computing innovations.

Semiconductor research and manufacturing combined with AI-driven processor development position the U.S. at the forefront of technological advancement. In October 2024, the U.S. Department of Commerce declared that domestic semiconductor fabs would receive USD 4.5 billion more funding through the CHIPS Act to expand processor production capacities. The technological giants Intel, Qualcomm, and AMD are broadening their AI-enhanced multi-core processor offerings to meet increased demand across cloud computing autonomous systems and quantum computing. Through the development of high-performance and energy-efficient chips, the U.S. maintains its leadership position in the multi-core processing field.

Canada multi-core processor sector is expanding, driven by research funding dedicated to artificial intelligence and quantum computing. The government dedicated USD 800 million to semiconductor research and development as well as domestic chip production in May 2024. Global tech companies partner with Canadian universities and research institutions to develop multi-core processor architectures for artificial intelligence and machine learning uses. Canada intends to become a key semiconductor technology hub through its drive toward energy-efficient computing innovation.

Asia Pacific Market Analysis

Asia Pacific multi-core processor market is likely to observe significant growth throughout 2026-2035. The region experiences growth through fast-paced industrialization combined with the development of 5G networks and rising requirements for powerful computing systems. The major semiconductor companies based in China, India, South Korea, and Taiwan direct large investments towards the development of AI-integrated processors that will power consumer electronics as well as cloud computing and IoT applications. Regional governments seek to develop domestic semiconductor manufacturing capabilities to become self-reliant in technology while lessening dependency on overseas chip producers.

The semiconductor industry in India experiences fast expansion due to government-backed programs including “Make in India” and Production-Linked Incentive (PLI) schemes. In September 2024, the Core Ultra 200V series processors from Intel were launched in India, targeting high-performance gaming laptops alongside AI workloads. Next-generation computing becomes more efficient through on-device AI processing which is optimized by Intel’s AI Boost technology integrated into these processors. As India pushes forward with semiconductor independence alongside AI advancements, it anticipates increased adoption of multi-core processor across automotive and enterprise computing fields.

The multi-core processor market remains lucrative in China owing to its large semiconductor production infrastructure. Loongson launched the new 3D5000 processors range aimed at China’s server market and high-performance computing sector in February 2023. The CPUs reach peak processing capabilities for cloud computing and data center operations by achieving four times the speed of regular ARM-based processors. China currently improves its worldwide leadership in semiconductor innovation through its major investments in AI-based chip development and processor manufacturing.

Key Multi-core Processor Market Players:

- Intel Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Qualcomm Technologies Inc.

- Apple Inc.

- MediaTek Inc.

- Samsung

- Xiaomi Corporation

- Spreadtrum Communications

- NXP Semiconductors

Leading technology companies, including Intel, Qualcomm, Apple, MediaTek, AMD, NVIDIA, ARM Holdings, Broadcom, and Marvell, maintain a highly competitive multi-core processor market through their ongoing innovations. Businesses continue to grow their AI-based multi-core solutions, which optimize processing capabilities for cloud computing environments and edge AI systems along with advanced mobile technology. Qualcomm launched an AI-optimized Snapdragon 8s Gen 3 processor for premium smartphones which contributes to mobile computing advancement in September 2024.

The leading companies are boosting their efforts due to their pursuit of energy-efficient hardware designs combined with AI-enhanced processor capabilities. The current industry trend emphasizes AI-integrated multi-core chip development which delivers superior performance together with gaming capabilities and instant AI processing suitable for consumer electronics and enterprise solutions. The semiconductor industry expects its ongoing competitive efforts to produce new advancements in multi-core processing technologies as AI and edge computing keep advancing.

Here are some leading players in the multi-core processor market:

Recent Developments

- In September 2024, NXP announced a new high-performance processing solution tailored for industrial and automotive applications. This latest processor integrates advanced AI capabilities and real-time control functions, enhancing automation, robotics, and next-generation vehicle architectures.

- In January 2024, Intel introduced its 14th Gen desktop processors, emphasizing enhanced multi-core performance for gaming, content creation, and enterprise workloads. The chips come with improved thermal efficiency and integrated AI acceleration to support modern PC applications.

- Report ID: 7081

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Multi-Core Processors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.