MRI Contrast Agents Market Outlook:

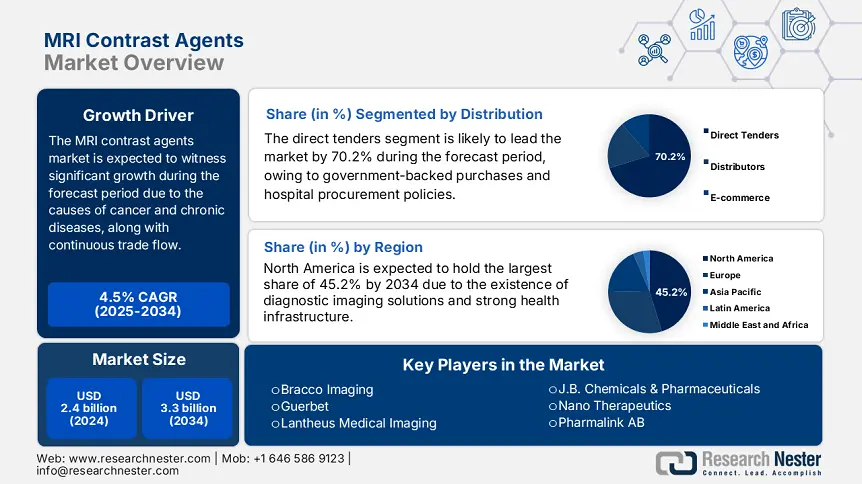

MRI Contrast Agents Market size was USD 2.4 billion in 2024 and is anticipated to reach USD 3.3 billion by the end of 2034, growing at a CAGR of 4.5% during the forecast period, i.e., 2025-2034. In 2025, the industry size of MRI contrast agents is evaluated at USD 2.8 billion.

The international patient pool in the market is gradually increasing, which is highly attributed to a rise in diagnostic imaging volumes for oncological, cardiovascular, and neurological conditions. As per the published 2023 World Health Organization (WHO) report, more than 45 million MRI scans have been conducted every year, with contrast-enhanced procedures catering for an estimated 35% to 40% of overall scans globally. Besides, the U.S. National Institutes of Health (NIH) has reported that gadolinium-based contrast agents (GBCAs) are the ultimate and dominant option, which is administered in more than 25 million doses per year. Meanwhile, the rising aging population is yet another driver for uplifting the market across nations.

Moreover, the supply chain facility in the market includes a complicated network of medical device manufacturers, contrast agent producers, and active pharmaceutical ingredient (API) suppliers. India and China cater to the majority of API manufacturing, with the U.S. International Trade Commission (USITC) indicating USD 325 million in gadolinium compound sourcing as of 2023. Meanwhile, finished contrast agents are effectively produced in Japan, the U.S., and Germany, owing to EMA and FDA reforms. Besides, disruptions in the facility have resulted in price volatility, which has reflected a surge in the producer price index (PPI) by 4.2% year-over-year (YoY) for diagnostic imaging chemicals.