Movies and Entertainment Market Outlook:

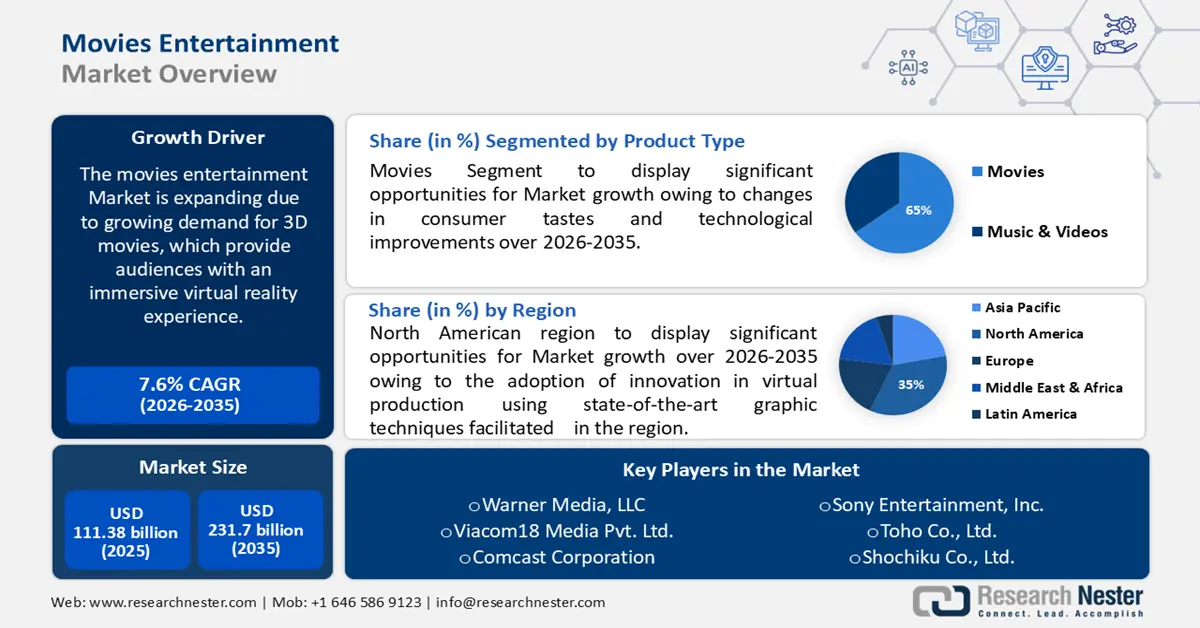

Movies and Entertainment Market size was valued at USD 111.38 billion in 2025 and is likely to cross USD 231.7 billion by 2035, expanding at more than 7.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of movies and entertainment is assessed at USD 119 billion.

The industry is growing favorable demographics, shifting consumption habits, rising disposable incomes, and consumers' inclination to spend money on entertainment and leisure. Growth in the movies and entertainment market is expected to be driven by the growing demand for 3D movies, which provide audiences with an immersive virtual reality experience. Across the globe, there were over 126,35 thousand digital 3D cinema screens in 2021, up from 83,00,000 in 2016. Over half a decade, it has increased by 54 percent.

Furthermore, music is now more widely available to everyone, everywhere, owing to streaming sites that offer both music and video material. The better sound quality of content that is streamed is one of the many additional advantages of streaming platforms that support the industry's expansion. To enter unexplored movies and entertainment market, major players have embraced techniques including distribution alliances and regional expansions.

Key Movies and Entertainment Market Insights Summary:

Regional Highlights:

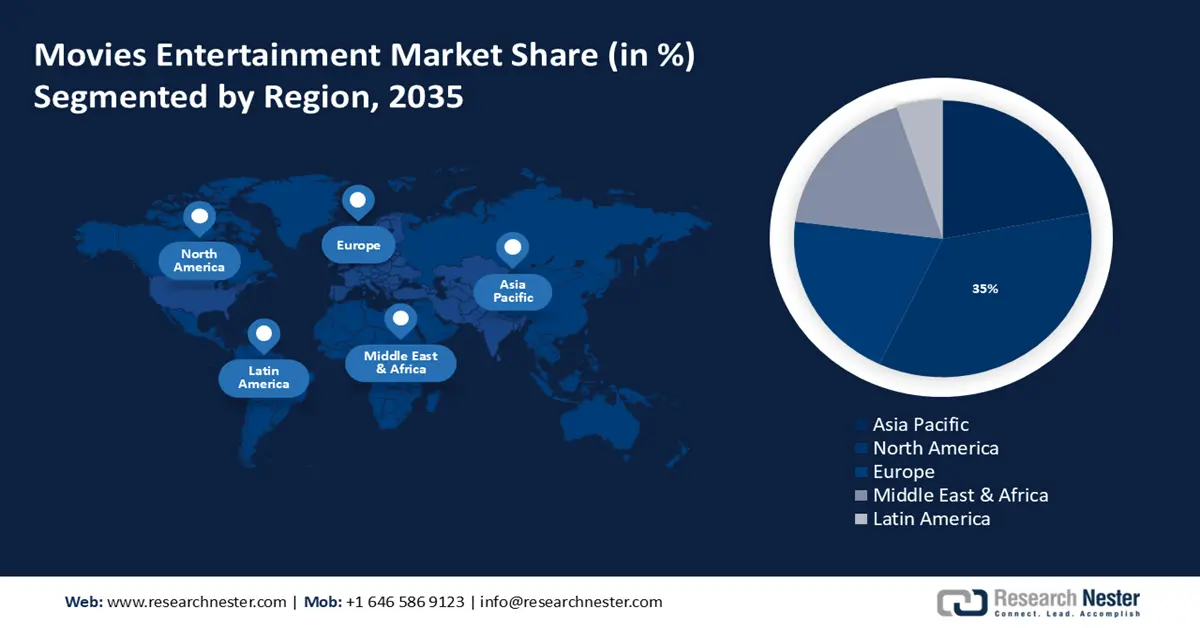

- The North America movies and entertainment market is anticipated to capture 35% share by 2035, driven by innovation in virtual production and 3D content.

- The Asia Pacific market will register significant growth during the forecast timeline, driven by rising internet access and demand for offline & online media.

Segment Insights:

- Movies segment in the movies and entertainment market is projected to achieve 65% growth by the forecast year 2035, driven by the use of visual effects and changing consumer entertainment preferences.

- The streaming media segment in the movies and entertainment market is expected to see significant growth till 2035, fueled by rising demand for subscription-based content and live sports popularity.

Key Growth Trends:

- Growing demand for original content to provide growth opportunities

- Arrival of 5G technologies to fuel market growth

Major Challenges:

- Changing consumer preference to hinder market growth

- The issue of content piracy will limit market growth

Key Players: Warner Media, LLC, Viacom18 Media Pvt. Ltd., Comcast Corporation, Netflix, Vivendi SE, Universal City Studios LLC, Paramount Global, Amazon.com, Inc., The Marcs Studios, Sony Entertainment, Inc.

Global Movies and Entertainment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 111.38 billion

- 2026 Market Size: USD 119 billion

- Projected Market Size: USD 231.7 billion by 2035

- Growth Forecasts: 7.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, United Kingdom, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

Movies and Entertainment Market Growth Drivers and Challenges:

Growth Drivers

-

Growing demand for original content to provide growth opportunities – Original content creation and release can be advantageous for stakeholders in the global film and entertainment industries. In recent times, the movies and entertainment market has experienced extreme saturation.

Customers are tired of watching the same old shows and programs because they can now simply obtain movies and television shows. If current trends are to be believed, viewers have demonstrated a preference for more genuine content. For instance, Squid Games, a well–liked Netflix series, is stated to have earned more than USD 900 million within its first year of availability on the streaming service. - Arrival of 5G technologies to fuel market growth – Media entertainment are expected to undergo a significant transformation as a result of the arrival of 5G technology. Video, music, and gaming material downloads from the internet will be completed very instantly since it will be 10 times faster than 4G technology. All platforms, including game consoles, smartphones, PCs, and smart TVs, are anticipated to benefit from the technology's improvements in user experience.

With the advent of 5G, applications for augmented and virtual reality are anticipated, as well as a completely new channel for connecting with customers. The 5G–driven innovation that will lead the way is probably gaming. Rapid response times and high–definition, real–time streaming are likely to be further advantages for mobile cloud gaming.

In addition, forecasts predict that mobile data traffic will reach almost 330 exabytes per month by 2028 and more than triple the volume consumed in 2022, which are expected to be accompanied by 5G deployment around the world. - Rise in disposable income – The development in the economy has a big role in the movies and entertainment market growth. The expansion of the market is expected to be fueled by increased spending on online entertainment as a result of higher per capita disposable income and increased consumer buying power.

It is anticipated that having more disposable income will improve living conditions and make it possible for consumers to purchase high–tech devices like smartphones and smart TVs, which will fuel the growth of the online entertainment industry. Furthermore, in recent years, growing Asian nations like China and India have seen notable increases in disposable income. This has led to a rise in the cost of online entertainment, which propels the expansion of the worldwide movies and entertainment market.

Challenges

-

Changing consumer preference to hinder market growth – One of the hardest obstacles for any supplier of goods or services is the worldwide movies and entertainment market. Consumer preferences in this market are always shifting, particularly in the current day as people are increasingly certain of their tastes and the kinds of content they want to consume.

By flatly rejecting content that falls short of their expectations, consumers are regaining power over the entertainment sector. With a very diverse audience to serve, film production companies are finding it difficult to figure out the secret to success. - The issue of content piracy will limit market growth – The internet's commercialization has led to widespread content piracy, affecting stock photography, music, movies, and video games. Easy access allows anonymous piracy, driven by factors like release dates, regional barriers, and scarcity. Torrent websites further exacerbate losses for entertainment companies, while ISPs' lack of action worsens the issue.

Movies and Entertainment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.6% |

|

Base Year Market Size (2025) |

USD 111.38 billion |

|

Forecast Year Market Size (2035) |

USD 231.7 billion |

|

Regional Scope |

|

Movies and Entertainment Market Segmentation:

Product Type Segment Analysis

Movies segment is expected to dominate movies and entertainment market share of over 65% by 2035. The movie business has changed dramatically over the last thirty years, mostly due to changes in consumer tastes and technological improvements. The way tales are portrayed on screen has changed dramatically as a result of the growth of visual effects, from the ground–breaking usage of computer–generated imagery (CGI) in movies like "Jurassic Park" and "Terminator 2: Judgment Day" to the smooth integration of digital effects in contemporary blockbusters. This has raised the bar for cinematic spectacle and immersion by enabling filmmakers to construct aesthetically spectacular worlds and animals.

A sizable portion of the populace still considers movies to be among their favorite forms of entertainment. It has taken time and great strategic planning to integrate cutting-edge technology with the movie-watching experience, which has led to more people spending more to enjoy high-quality films. According to Box Office Mojo, Avengers: Endgame has reached more than USD 2.798 billion at the box office since its theatrical release in 2019.

Mode of Watching Segment Analysis

Over-the-top platforms segment in the movies and entertainment market is set to grow exponentially till 2035. The tendency began with COVID–19, which resulted in theater closures for several months all around the world. Several over–the–top (OTT) services had a sharp increase in popularity and subscriber base this year.

As existing company organizations engaged in further expansion, new domestic firms entered the industry in response to the unexpected demand. One of the most well-known OTT platforms, Netflix, for instance, claimed to have more than 209 million paying customers as of 2021, and that figure has continued to rise. Theaters are still, nonetheless, a substantial industry stockholder.

Type (Print Media, Digital Media, Streaming Media)

In movies and entertainment market, streaming media segment is expected to account for revenue share of around 38% by 2035. The growth of the market is fuelled by the growing demand for subscription-based services, increasing availability of region-specific and original content, and the popularity of live sports.

It was observed by Research Nester Analyts that Video streaming services are estimated to have around 1.8 billion subscribers. These drivers are changing the strategies adopted by the vendors in the movies and entertainment market as the emphasis on enhanced customer experience by providing personalization and low-cost services is increasing daily.

Our in–depth analysis of the global movies and entertainment market includes the following segments:

|

Product Type |

|

|

Mode Of Watching |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Movies and Entertainment Market Regional Analysis:

North America Market Insights

North America industry is likely to dominate majority revenue share of 35% by 2035. The market growth in the region is also expected on account of innovation in the virtual production using state-of-the-art graphic techniques facilitates the profitable expansion of the entertainment and movie industries in this region.

Furthermore, it is anticipated that the amount of 3D movies with sound and visual effects that provide audiences with a virtual reality experience will increase, which will help North America's revenue growth. For instance, As of July 2019, "Star Wars: The Force Awakens" was the 3D film with the biggest lifetime box office gross in North America, earning USD 936.66 million.

Over the forecast period, the United States movies and entertainment market is anticipated to increase at a compound annual growth rate (CAGR) of 7.2%. In the US, the attraction of high-profile films and events in theaters keeps patrons coming back to see them. Major studios extensively invest in big-budget blockbusters with exceptional production standards, cutting-edge visual effects, and compelling stories to entice audiences.

For example, Paramount Pictures debuted "Top Gun: Maverick" in theaters nationwide on May 27, 2022. The film achieved extraordinary heights, shattering the Memorial Day opening record with a staggering 160.5 million USD in box office sales over the course of period.

Over 244,000 employment were supported by Canada's film industry, which brought in a record-breaking $11.3 billion in operating revenue in 2021—the second year of the pandemic. Surprisingly, the pandemic caused the industry to accelerate as Canada shot an unparalleled amount of projects in 2021 as a consequence of a backlog of unfinished projects, the launch of new projects, and a rise in streaming demand.

APAC Market Insights

APAC movies and entertainment market is expected to witness significant growth by 2035, owing to growing leisure and entertainment spending being solely responsible for the market’s growth.

One of the main reasons for this expansion is the expanding internet access in the region's emerging economies, such as Vietnam and India, which has fueled the growth of the online media and entertainment sectors in these nations.

In 2022, the number of online users in the Asia Pacific region increased to more than 2.6 billion. Furthermore, as indicated by the development of amusement parks, festivals, and trade exhibits, the growing trend for offline media and entertainment is supporting the expanding movies and entertainment market growth in Asia Pacific.

Over the past few decades, the Chinese film and entertainment industry has grown significantly, reflecting the nation's overall economic progress. The demand for movie theaters has also surged as a result of this booming industry. China built almost 2,000 new screens in the first two months of 2021, the National Film Administration of China reports, despite the uncertainties surrounding the exhibition business brought on by COVID–19.

With the rise in popularity of "K–Wave" dramas, movies, and music over the last 10 years, South Korea has transformed from a consumer nation to a content powerhouse. Owing to the construction of multiplexes and the widespread culture of going to the movies, the Korean film industry has expanded to become one of the busiest in the world. The Korean cinema market was projected to be worth $2.2 billion in 2019 before the pandemic, with over 226 million attendees, exceeding the 200 million threshold for the ninth consecutive year, according to the Korea Cinema Council.

Furthermore, Japanese films, especially anime, have a strong international following. Collaborations with foreign studios and participation ininternational film festivals help promote Japanese movies globally. In 2022, the overseas revenue of the animation sector in Japan reached a value of approximately 1.46 trillion Japanese yen, following strong growth in recent years. In 2022, the combined value of the domestic and international anime markets amounted to approximately 2.93 trillion yen, which was a new record for the industry.

Movies and Entertainment Market Players:

- The Walt Disney Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Warner Media, LLC

- Viacom18 Media Pvt. Ltd.

- Comcast Corporation

- Netflix

- Vivendi SE

- Universal City Studios LLC

- Paramount Global

- Amazon.com, Inc.,

There are several global giants in the film and entertainment sector, making it very competitive, prioritizing storytelling and creativity over commercial success, often collaborating with emerging talent.

Recent Developments

- Warner Media, LLC subsidiary Warner Music since 2020, has been the only distributor of Tips Music's 13,000+ song Hindi repertoire, which has greatly aided in the expansion of the business's Bollywood soundtracks globally. With its international teams, Warner Music has provided specialized commercial support to a range of Digital Service Providers (DSPs), proposing and securing prominent playlist positions for both frontline and back catalog releases.

- The Walt Disney Company, Hulu, and Max are all included in the new streaming bundle that Warner Bros. Discovery and Disney Entertainment announced. The streaming services will be available together starting this summer in the United States, giving customers the best entertainment value and an unheard-of assortment of content from the biggest and most adored entertainment brands, such as ABC, CNN, DC, Discovery, Disney, Food Network, FX, HBO, HGTV, Hulu, Marvel, Pixar, Searchlight, Warner Bros., and many more.

- Report ID: 6241

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Movies and Entertainment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.