Motorized Prosthesis Market Outlook:

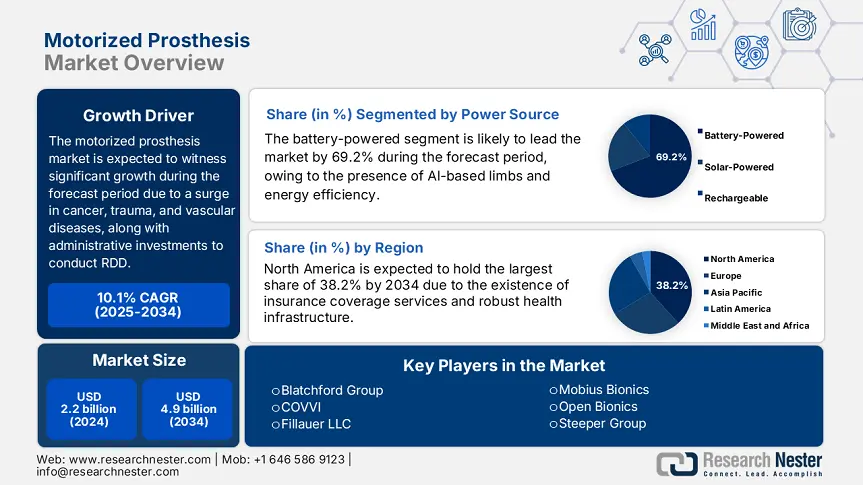

Motorized Prosthesis Market size was USD 2.2 billion in 2024 and is anticipated to reach USD 4.9 billion by the end of 2034, growing at a CAGR of 10.1% during the forecast period, i.e., 2025-2034. In 2025, the industry size of motorized prosthesis is estimated at USD 2.5 billion.

The international market is effectively attributed to an increase in the patient pool, with an estimated 2.3 million limb amputation cases taking place every year, initially owing to the occurrence of vascular disorder (75%), trauma (25%), and cancer (10%). In this regard, more than 185,500 amputations have been conducted annually in the U.S., with diabetes-based complexes catering to 64% of overall cases. This enhanced patient base has necessitated a strong supply chain facility for prosthetics, which includes bio-compatible polymers, electronic components, and raw materials, such as medical-grade silicone, carbon fiber, and titanium. The U.S. sources approximately 40% of these materials, primarily from China, Japan, and Germany, thus enhancing the market exposure.

Furthermore, the worldwide trade dynamics in the market have reached USD 2.7 billion as of 2023, with Germany and the U.S. emerging as notable exporters. According to the 2024 UN Comrade report, the U.S. accounts for a 30% share of exports, while China readily dominates assembly-line manufacturing, generously contributing almost 45% of international prosthetic component production. Besides, government investments to conduct research, development, and deployment (RDD) have exceeded USD 1.3 billion every year, with the NIH providing USD 455 million for neuroprosthetics as of 2024, along with DARPA funding of USD 325 million for advancements in bionic limbs.

Motorized Prosthesis Market - Growth Drivers and Challenges

Growth Drivers

-

Quality enhancement and affordability in healthcare: The market is considered cost-effective for the majority of patients globally. As per a clinical study published by the AHRQ in 2022, it has been found that AI-based limbs diminish rehabilitation timeline by almost 45%, thereby saving USD 2.4 billion in U.S.-based hospital expenses. Besides, the 2023 VA Government report indicated that there are approximately 30% fewer complications with microprocessor knees, and these gains are positively impacting the hospital implementation. Meanwhile, value-specific pricing models are also escalating the market adoption across nations.

-

Veteran and military healthcare funding: The existence of military funding is effectively uplifting the motorized prosthesis market globally. For instance, in 2023, DARPA’s USD 330 million LUKE Arm project enhanced neural implementation for veterans, while the UK successfully pledged £160 million for Heroic Prosthetics. Therefore, both these initiatives have readily prioritized battlefield functionality and durability. Besides, the availability of hybrid prosthetics, which includes the combination of AI and body, is gaining increased traction to help veterans. Based on this, key players need to collaborate with each other to jointly create ruggedized prosthetics.

-

Trade policies and localization in supply chain: The existence of geopolitical transitions is completely reshaping supply chain dynamics in the motorized prosthesis market. The U.S. is importing 40% of prosthetic components from China, but the CHIPS Act has readily subsidized regional semiconductor manufacturing. In addition, Europe’s Medical Device Regulation (MDR) has enhanced compliance expenses by 20%. Besides, nearshoring microprocessor manufacturing has the ability to combat tariff risks, while developing economies should create localized assembly lines to diminish overall expenses, thus suitable for market upliftment.

Manufacturer Strategies Shaping Market Expansion

Revenue Potential for Motorized Prosthesis Manufacturers (2023-2024)

|

Company |

Strategy |

Revenue Impact (Million) |

Market Share Gain |

|

Össur |

AI-powered POWER KNEE launch (2023) |

USD 155 |

+12% |

|

Ottobock |

IoT partnership with Siemens |

USD 95 |

+8% |

|

Blatchford Group |

EU MDR-compliant LINX® limb |

€85 |

+5% |

|

Fillauer LLC |

DARPA-funded neural integration tech |

USD 55 |

+3% |

Sources: FDA, VA, EMA, DARPA

Feasible Expansion Models Shaping the Motorized Prosthesis Market

Feasibility Models for Market Expansion (2022-2024)

|

Model |

Region |

Impact |

|

Hospital Partnerships |

India |

+12.5% Revenue (WHO) |

|

Government Subsidies |

Brazil |

12,500 Patients Covered (MOH) |

|

Localized Assembly |

Vietnam |

-32% Prosthetic Costs (WB) |

Sources: WHO, MOH, World Bank

Challenges

-

Diversified standards and administrative delays: Various global regulations have developed significant gaps in the motorized prosthesis market entry, which has negatively impacted the overall growth. For instance, Europe’s MDR has surged compliance expenses by 30%, which has been affecting small-scale manufacturers disproportionately. These are considered regulatory obstacles, which tend to cause delays in product introductions, and also need organizations to effectively maintain separate documentation and inventories to address complications. Besides, the absence of harmonized international standards has pressured manufacturers to navigate complicated demands that impact development expenses.

-

Barriers in patient cost-effectiveness: The increased expense of innovative prosthetics has developed huge issues in accessibility, especially in emerging nations, which has caused a hindrance in the overall motorized prosthesis market. For instance, the adoption rate in India is severely low since the expense of myoelectric limbs is USD 15,500, which is higher than the average income of USD 2,500. Besides, few manufacturers, including COVVI, have readily integrated advanced financial models, such as lease-to-own programs, that has enhanced accessibility by 22%, particularly in Mexico. Meanwhile, the critical price difference between next-generation prosthetic technology and patient purchase power still denotes a gap in the global market adoption.

Motorized Prosthesis Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

10.1% |

|

Base Year Market Size (2024) |

USD 2.2 billion |

|

Forecast Year Market Size (2034) |

USD 4.9 billion |

|

Regional Scope |

|

Motorized Prosthesis Market Segmentation:

Power Source Segment Analysis

The battery-powered segment in the motorized prosthesis market is anticipated to hold the largest share of 69.2% by the end of 2034. The segment’s dominance originates from compatibility with AI-powered limbs, along with superior energy efficiency, constituting 32.5% long lifespan in comparison to solar-based alternative options. Besides, recently, there have been advancements in lithium-ion, which have successfully enabled operations continuously for three days. This has effectively addressed 90% of user mobility requirements, which has positively impacted the overall segment in the market globally.

Product Segment Analysis

The lower limb prosthetics segment in the motorized prosthesis market is projected to hold the second-largest share of 48.3% during the forecast timeline. The segment’s growth is highly driven by an increase in the international amputation rates, with diabetes-specific incidents catering to almost 55% of the 185,500 yearly procedures in the U.S. Besides, progressive microprocessor-based knees and ankles currently deliver 95% of natural gait replication, effectively fueling the integration in rehabilitation facilities. Additionally, the segment benefits from Medicare’s expansion as of 2023 to cover approximately 88% of knee systems, thereby denoting a positive impact on the overall market development.

End user Segment Analysis

The hospitals segment is expected to garner the third-largest share of 40.5% in the motorized prosthesis market by the end of the forecast duration. The segment’s upliftment is highly propelled by its vital role for post-amputation rehabilitation at primary care infrastructures. In addition, the 2023 policy of Medicare generously covers nearly 100% of inpatient prosthetic procedures, which is another driver for the segment’s growth. Besides, VA-based hospitals have solely constituted 45% of myoelectric limb adoptions in the U.S. as of 2023, while hospital networks in Germany have successfully gained 95% of patient satisfaction with implemented prosthetic care services.

Our in-depth analysis of the motorized prosthesis market includes the following segments:

|

Segment |

Subsegments |

|

Power Source |

|

|

Product |

|

|

End user |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Motorized Prosthesis Market - Regional Analysis

North America Market Insights

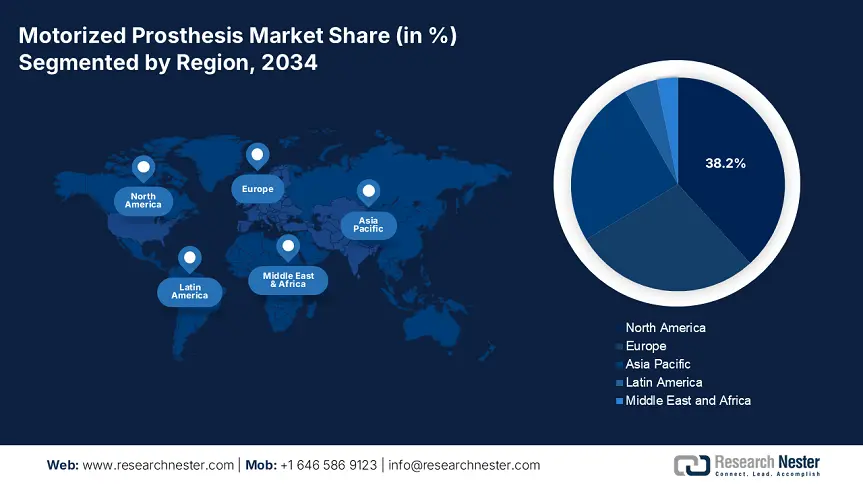

North America motorized prosthesis market is anticipated to be the dominant region, with the highest share of 38.2% by the end of 2034. The market’s growth in the region is highly fueled by an increase in adoption rates, along with an upsurge in robust healthcare and medical facilities. In addition, the region also benefits from the presence of VA and Medicare coverage, accounting for 87.5% of reimbursement for innovative limbs, along with almost 190,000 yearly amputations. The U.S. is dominating the region, with the availability of DARPA’s USD 340 million neural-tech investments as of 2023, as well as the FDA’s role in clearing AI-powered prosthetics, while Canada’s provincial health and medical policies are also uplifting the market.

The motorized prosthesis market in the U.S. is leading the region, with AI-based prosthesis and more than 16 FDA approvals as of 2024. In addition, the 2024 expanded Medicare policy provides coverage for 95% of myoelectric limbs, which has bolstered the implementation rate by almost 13%. Likewise, the VA policy made an allocation of USD 1.2 billion every year for bionic limbs, thereby focusing on neural-integration technology. Besides, the aspect of 3D printing has the capability to diminish manufacturing expenses by approximately 35%. Therefore, all these factors positively impact the market’s growth in the country.

The motorized prosthesis market in Canada is significantly growing at a rate of 7.5%, which is fueled by provincial health and medical reforms. Ontario is also driving the market’s growth, with a 23.5% increase in funds as of 2024, covering almost 200,500 patients, while the country’s national policies generously reimburse 80% of progressive limbs. Besides, the existence of tele-rehabilitation services caters to at least 50% of patients from rural areas, and focusing on developing private-public collaborations, with the intention to ensure 30% in cost reduction by the end of 2030, thus suitable for propelling the overall market in the country.

North America's motorized prosthesis trade and supply chain facilities (2022-2025)

|

Facility Type |

Location |

Key Activity (2022-2025) |

|

Microprocessor Chip Production |

Arizona, U.S. |

65% of U.S. prosthetic chips manufactured (2024 target) |

|

Carbon Fiber Component Plant |

Ontario, Canada |

Supplies 44% of North American prosthetic sockets |

|

VA Prosthetic Distribution Centers |

Texas, U.S. |

Serves 25.7% of U.S. veterans (2023-2025 expansion) |

|

3D Printing Hubs |

California, U.S. |

Produces 20% of modular prosthetic limbs (2022-2025) |

|

Import Warehouses |

British Columbia, Canada |

Handles 38% of Asian-sourced actuators (2022-2024) |

|

Neural Interface R&D Labs |

Massachusetts, U.S. |

DARPA-funded bionic limb testing (2023-2025) |

Sources: Commerce Government, Statistics Canada, VA, NIH, CBSA, DARPA

APAC Market Insights

Asia Pacific motorized prosthesis market is the fastest-growing region, with an expected share of 25.4% during the forecast period. The market’s upliftment in the region is fueled by governmental strategies and a rise in amputations, particularly from diabetic cases, accounting for almost 60.5% of 2.2 million yearly incidences as per a report from WHO. China is leading with the majority of the region’s demand, owing to the 2030 Bionic Limb initiative. Japan follows behind with NHI compensation plans, with India positioned as the third country in line to cater to the market’s growth in the overall region.

The motorized prosthesis market in China is readily dominating the region’s market demand, with a 19.5% revenue share by the end of the forecast duration, which is attributed to state-based strategies, such as the USD 1.5 billion Bionic Limb plan for 2030. Besides, the country has reported approximately 1.6 million amputees every year, while domestic government policies have mandated 75% of localized component manufacturing by the end of 2025, thereby diminishing import reliance. Meanwhile, FDA-based acceptances for 5 neural-controlled limbs have successfully signaled technological upliftment, which has boosted the market in the country.

The motorized prosthesis market in India is projected to hold 10% of the regional share during the forecast period, which is constrained by cost-effectiveness, despite the 500,000 yearly amputations. Besides, the government’s Affordable Prosthetics Mission has targeted 60% of cost reduction through localized manufacturing. Meanwhile, the public expenditure has increased to USD 2.1 billion as of 2023(denoting more than 18.5% surge over the past 10 years, effectively covering 2.6 million patients, of which only 70.5% achieve passive prosthetics. Meanwhile, emerging solutions, such as PPP models and 3D-printed limbs in association with serving rural locations, are also uplifting the market in the country.

Government Policies for Motorized Prosthetics in Australia, Malaysia, and South Korea (2022-2025)

|

Country |

Policy/Initiative |

Funding/Scope |

Launch Year |

|

Australia |

National Disability Insurance Scheme (NDIS) Prosthetics Expansion |

AUD 175 million for advanced limb coverage |

2023 |

|

Malaysia |

Medical Device Tax Exemption Program |

100% import duty waiver for prosthetic components |

2022 |

|

South Korea |

AI Prosthetics Development Initiative |

KRW 305 billion (~USD 230 million) for neural-controlled limbs |

2024 |

Sources: NDIS, MITI, MSIT

Europe Market Insights

Europe motorized prosthesis market is expected to garner a considerable share of 28.2% during the forecast period, attributed to the existence of strong reimbursement policies and an increase in the aging population, with almost 21.5% of the population being more than 65 years old. Germany is leading with an enhancement in yearly expenditure, which is driven by statutory health insurance for almost all advanced limbs. This is followed by the UK’s NHS healthcare budget provision for prosthetics, while France has made a budget allocation of 7.5% for AI-powered devices. Besides, the region’s €2.6 billion Health Fund has escalated R&D, especially for neural-controlled prosthetics, thus suitable for the overall market growth.

The motorized prosthesis market in Germany is dominating the region, with a 13.5% revenue share, which is propelled by its universal health and medical coverage that effectively reimburses all innovative prosthetic expenses. Additionally, the country has made the provision of €4.4 billion yearly to prosthetics, with more than 250 CE-approved AI-based devices as of 2022. Besides, IoT-based limb integration is continuously growing at a 27.5% rate, along with neuroprosthetic research, generously funded by the region’s €2.8 billion Health Fund. Meanwhile, localized manufacturers, such as Ottobock, have successfully leveraged 3D printing to diminish production expenses by almost 23%.

The motorized prosthesis market in the UK is projected to cater to 9.5% of the region’s market share, effectively backed by the NHS’s £1.3 billion yearly expenditure, along with the provision of 85% coverage for myoelectric limbs. Besides, localized policies during the post-Brexit period have bolstered regional manufacturing by approximately 27%, while 3D-printed solutions have reduced expenses by an estimated 40%. Meanwhile, the country reported a total of 120,200 amputees, of which 62.5% cater to diabetes, thereby suitable for uplifting the overall market.

Key Motorized Prosthesis Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global motorized prosthesis market is extremely consolidated, with the presence of key players, including Össur, with 18.5% of the market share, followed by Ottobock with 16%, and Blatchford with 10.8%, collectively dominating through veteran-based solutions and AI implementations. In addition, COVVI and Fillauer have also achieved their respective shares through neural-tech collaborations and partnerships. Besides, emerging market entries, government alliances, and cost reduction are other key strategies that these companies have successfully integrated, thus denoting an optimistic outlook for the overall market across different nations.

Here is a list of key players operating in the global market:

|

Company Name (Country) |

Industry Focus |

Market Share |

|

Össur (Iceland) |

Leader in bionic limbs (POWER KNEE, PROPRIO FOOT) & 3D-printed sockets |

18.5% |

|

Ottobock (Germany) |

Myoelectric arms (Michelangelo Hand) & AI-driven prosthetics for veterans |

16% |

|

Blatchford Group (UK) |

LINX limb system (microprocessor knees) & NHS partnerships |

10.8% |

|

Fillauer LLC (U.S.) |

Modular prosthetic limbs (MPL) & DARPA-funded neural interfaces |

8.2% |

|

COVVI (UK/U.S.) |

Affordable bionic hands (Nexus Hand) for emerging markets |

6.3% |

|

Touch Bionics (UK) |

i-Limb Quantum (multi-grip myoelectric hand) & IoT-enabled prosthetics |

xx% |

|

Steeper Group (UK) |

Bebionic hand & pediatric prosthetics |

xx% |

|

Open Bionics (UK) |

3D-printed Hero Arm (Disney-designed pediatric prosthetics) |

xx% |

|

Mobius Bionics (U.S.) |

LUKE Arm (DARPA-funded advanced neural prosthesis) |

xx% |

|

Protunix (Israel) |

AI-powered prosthetic ankles & military-grade durability |

xx% |

|

Psyonic (U.S.) |

Ability Hand (sensory feedback-enabled) & Medicaid-focused designs |

xx% |

|

Endolite (India) |

Low-cost hydraulic knees & Jaipur Foot collaborations |

xx% |

|

Ortho Europe (UK) |

Modular lower-limb systems & NHS supply contracts |

xx% |

|

Bionic Prosthetics (Australia) |

Solar-powered limbs & telehealth fitting programs |

xx% |

|

UNYQ (U.S./Spain) |

Custom 3D-printed cosmetic covers & scoliosis braces |

xx% |

Sources: Össur, Ottobock, Blatchford, Fillauer, COVVI, TouchBionics, Steeper, OpenBionics, MobiusBionics, Protunix, Psyonic, Endolite, OrthoEurope, BionicProsthetics, UNYQ, Nakashima, Shibaura, OrientalMotor, Rexon, SoftBankRobotics

Below are the areas covered for each company in the motorized prosthesis market:

Recent Developments

- In May 2024, Össur unveiled the POWER KNEE X, which features AI-based predictive movement algorithms, in partnership with the U.S. Department of Veterans Affairs to diminish energy spending by almost 30.5%.

- In March 2024, Ottobock entered into a partnership with Siemens Healthineers to incorporate IoT sensors into its Michelangelo Hand, which has enabled real-time used analytics for clinicians.

- Report ID: 7962

- Published Date: Jul 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Motorized Prosthesis Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert