Motor Starter Market Outlook:

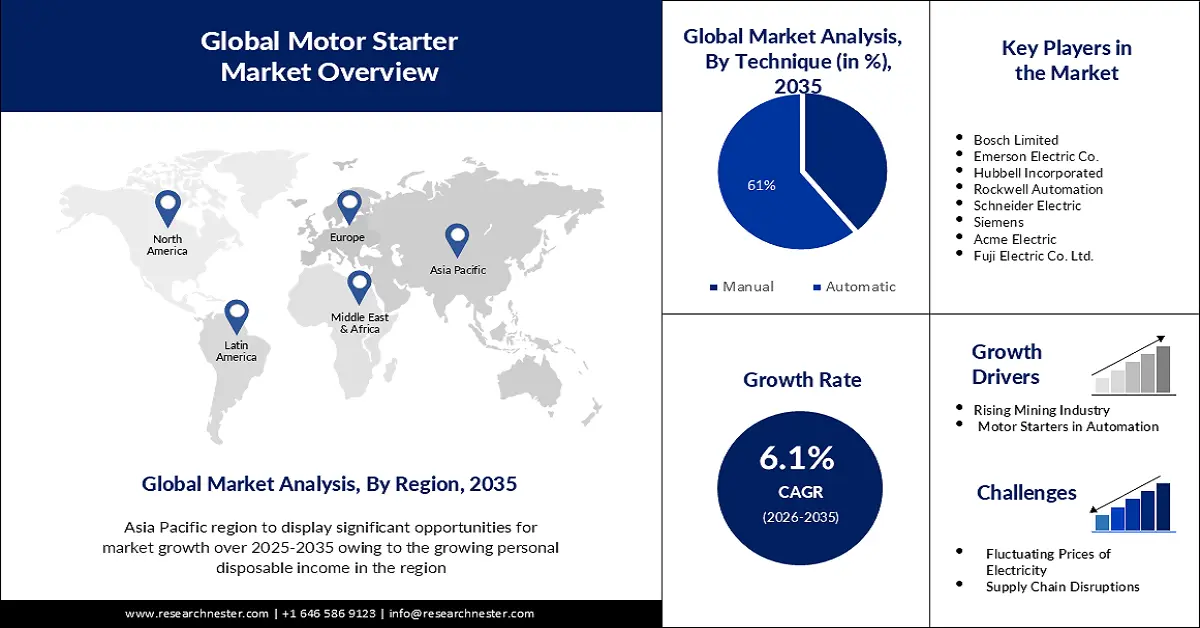

Motor Starter Market size was over USD 7.34 billion in 2025 and is projected to reach USD 13.27 billion by 2035, growing at around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of motor starter is evaluated at USD 7.74 billion.

The reason behind the growth is impelled by the growing need for energy efficiency across the globe. Energy-saving initiatives have a significant chance of preventing greenhouse gas emissions as well as bringing down the cost and demand for this precious resource and are turning into an essential tool for meeting the energy demand's increasing growth. For instance, in 2022, there was over 2% global improvement in energy efficiency, which was twice as much as the preceding five years combined.

The growing demand for vehicles is believed to fuel the motor starter market growth. The part of the car's starting mechanism that converts the electric power flowing into an engine turning moment is called the starter motor which is responsible for starting the engine and also provides the necessary spark for the rest of the operation.

Key Motor Starter Market Insights Summary:

Regional Highlights:

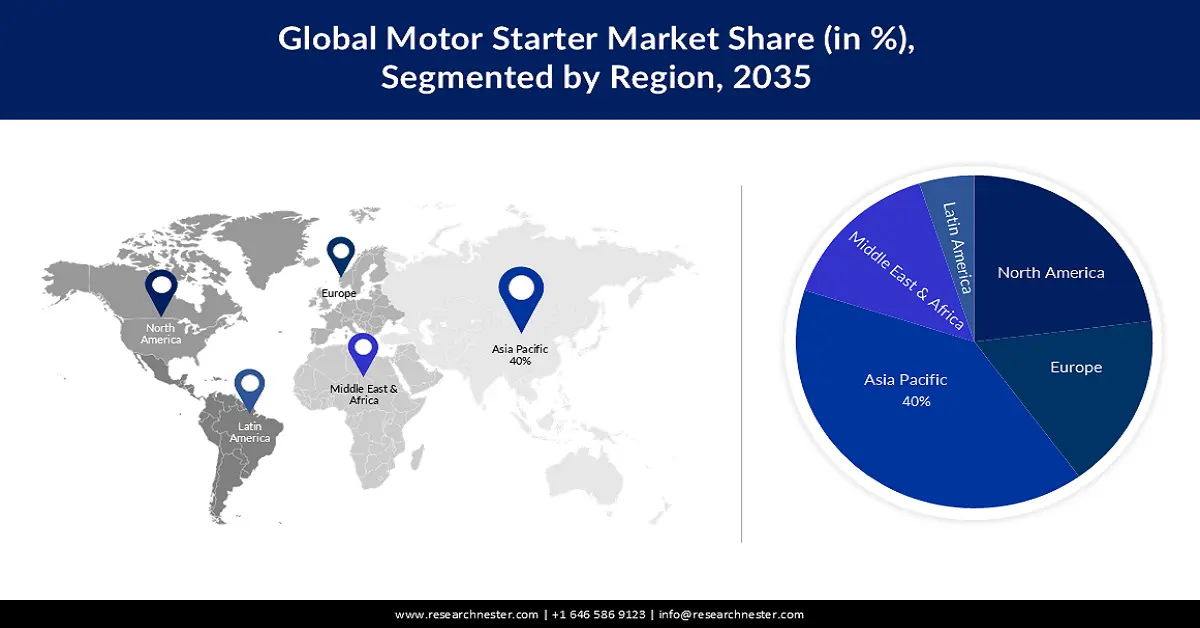

- Asia Pacific motor starter market will hold more than 40% share, propelled by the growing personal disposable income, forecast period 2026–2035.

Segment Insights:

- The automatic segment in the motor starter market is anticipated to achieve a 61% share by 2035, driven by the efficiency and ease of use of automatic motor starters in industrial settings.

Key Growth Trends:

- Motor Starters in Automation

- Growing Adoption in Electronics Industry

Major Challenges:

- Fluctuating Prices of Electricity

- Supply chain disruptions can impact the overall cost of production

Key Players: ABB Inc., Bosch Limited, Emerson Electric Co., Fuji Electric Co. Ltd., Hubbell Incorporated, Rockwell Automation, Schneider Electric, Siemens.

Global Motor Starter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.34 billion

- 2026 Market Size: USD 7.74 billion

- Projected Market Size: USD 13.27 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Motor Starter Market Growth Drivers and Challenges:

Growth Drivers

- Rising Mining Industry - Solid-state motor starters for induction motors have been widely used to bring conveyor systems up to full speed in heavy industries such as coal mining or quarry products owing to their soft-start capability, and the kind of protection they provide are essential in the hazardous environment of an underground mine.

- Motor Starters in Automation- Motor protection is an essential part of machine automation, therefore to ensure that motors may be started safely and avoid serious damage, soft starters are frequently employed.

- Growing Adoption in Electronics Industry- In electrical engineering, motor starters are essentially necessary components that are also used to protect, reverse, and stop electric motors, and also for switching both DC and asynchronous motors.

Challenges

- Fluctuating Prices of Electricity - Electricity and batteries are needed for starter motors, which is determined by the location and style of the home. Monthly, yearly, and seasonal variations are possible in the cost of electricity owing to several conditions, such as the season, the price of running the electrical grid and power plants, fuel prices, demand, Public Service Commission rules, economic situations, geographic location, and weather that results in severe temperatures or damages electricity lines.

- Supply chain disruptions can impact the overall cost of production

- Stringent regulatory requirements may increase the complexity and cost of the production

Motor Starter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 7.34 billion |

|

Forecast Year Market Size (2035) |

USD 13.27 billion |

|

Regional Scope |

|

Motor Starter Market Segmentation:

Technique Segment Analysis

The automatic segment in the motor starter market is estimated to gain a robust revenue share of 61% in the coming years. In essence, an automatic motor starter is a switching device composed of electrical contacts that enter and exit the motor to enable the DC Motor/Generator to start automatically. In an automatic motor starter power is restored in auto mode, and the motor starts on its own as a predetermined proportion of the primary voltage is sent to the secondary by the transformer itself. Automatic motor starters are incredibly effective at providing convenient and trouble-free motor starting, and have superb designs, exceptional functionality, and are simple to install and operate. In reduced-voltage starting applications, auto-transformer motor starters are frequently utilized since they have a few choices for manual speed control, have versatile initial traits, and their output torque is high.

In addition, manual motor starters are electromechanical protection devices for the main circuit, sometimes referred to as manual motor protectors (MMPs) or motor protection circuit breakers (MPCBs) which are mostly used to manually turn motors on and off and to safeguard against overload, phase failures, and short circuits without the need for fuses. With overload protection, a manual starter functions essentially as an "ON-OFF" switch that can be utilized in a variety of construction and industrial applications for local equipment control as they don't take a professional to run these starters; they are quite simple to use and can defend against thermal overload, short circuits, and phase failures.

Voltage Segment Analysis

The low segment in the motor starter market is set to garner a notable share shortly. The low-voltage motor-starting contactor is the most often used motor-starting device that can be used for a variety of sectors and applications since it is capable of interrupting operational overloads offers vital motor control and protection, and is considered excellent for cutting costs by lowering the total power consumption of the system and equipment wear and tear.

In addition, high-voltage solid soft starters, often known as motor soft starters, are modern devices primarily used for protecting and controlling the starting and halting of synchronous and asynchronous motors using a high-voltage soft-start device.

Phase (Single, Three)

The phase three segment in the motor starter market is poised to gain a noteworthy share shortly. An overload relay and a contactor make up a three-phase motor starter which is appropriate for uses where an automatic motor start is required and is frequently employed to control powerful three-phase AC induction motors. Besides this, a starter for a single-phase motor is an electrical device that can be used in place of conventional three-phase motor starters in many industries, including mining, metallurgy, chemical industry, power generation, shipbuilding, construction, marine engineering owing to its benefits, which include simple structure, easy installation, small size, and high efficiency.

Our in-depth analysis of the global motor starter market includes the following segments:

|

Technique |

|

|

Voltage |

|

|

End-User |

|

|

Phase |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Motor Starter Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is estimated to dominate majority revenue share of 40% by 2035, impelled by the growing personal disposable income. In urban India, over 20% of the more than 1,000 respondents reported a net gain in their discretionary income driven by factors such as taxes, and wage growth. As a result, the country will become a consumer powerhouse. For instance, India's per capita household disposable income is expected to reach around USD 26 in 2024.

In addition, several EV promotion initiatives have been put into place in China's largest cities to expedite the adoption of electric vehicles. Particularly, between 2009 and 2022, China spent over USD 25 billion on tax reductions and subsidies for electric vehicles. All these factors are expected to drive the demand for motor starters in the region.

North American Market Insights

The North America motor starter market is estimated to be the second largest, during the forecast timeframe led by the presence of energy efficiency regulations. For instance, the United States Department of Energy has set energy-efficiency requirements for specific equipment and appliances, and it presently covers over 60 different goods. When a product bears the DOE certification mark, it means that it satisfies energy-saving requirements as a result of which the US can cut consumer energy costs and promote employment creation.

Motor Starter Market Players:

- ABB Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bosch Limited

- Emerson Electric Co.

- Hubbell Incorporated

- Rockwell Automation

- Schneider Electric

- Siemens

- Acme Electric

- Fuji Electric Co. Ltd.

Recent Developments

- ABB Inc. announced the launch AMI 5800 NEMA modular induction motor with high-strength welded steel frame construction to provide outstanding dependability and energy efficiency in demanding applications including fans, pumps, compressors, extruders, conveyors, and crushers, maintain or surpass North American energy efficiency standards while providing high performance, and allows for a high degree of modularity and customization to suit both new-build and upgrade projects.

- Acme Electric launched an updated line of industrial control transformers that offers voltage regulation better than that of NEMA standards, gives a range of electromagnetic devices a safe control voltage to operate on, and provides a high level of voltage control in an inrush situation.

- Report ID: 5722

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Motor Starter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.