- Introduction

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Global Industry Overview (1/2)

- Market Overview

- Regional Synopsis

- Global Montan Acid Wax Sales Volume Forecast (2020–2036)

- Distribution By Region And Application

- Japan Market

- Key Importing And Exporting Countries

- Competitive Sales Approaches In The Montan Acid Wax Market

- Production Capacity And Market Share Of Leading Manufacturer

- Clariant’s Investment Roadmap And Alternative Development Strategy

- Price Benchmarking

- Application-wise Market Analysis Of Montan Acid Wax

- Comparative Analysis Of Montan Acid Wax Derivatives

- Risk Assessment And Mitigation Strategies

- Buyer Segmentation And Purchase Insights

- Montan Acid Wax Supply Chain

- Competitive Landscape

- DROT

- Government Regulation: How They Would Aid Businesses?

- Ongoing Technological Advancements

- Swot Analysis

- Root Cause Analysis (RCA) for the Market

- Pestle Analysis

- Porter Five Forces

- Industry Risk Assessment

- Global Outlook and Projections (1/2)

- Global Overview

- Market Value (USD Thousand), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Thousand), 2020-2036, By

- Derivatives, Value (USD Thousand), Volume (Thousand Tons)

- Montan Acid Esters Wax

- Montan Acid Calcium Wax

- Others

- Application, Value (USD Thousand), Volume (Thousand Tons)

- Plastics & Rubber Processing

- Coatings & Inks

- Lubricants & Greases

- Paper & Packaging

- Polishes & Emulsions

- Others

- End user, Value (USD Thousand)

- Automotive

- Plastic & Rubber

- Coatings, Paints & Inks

- Paper & Packaging

- Electronics & Electrical

- Others

- Regional Synopsis, Value (USD Thousand), Volume (Thousand Tons) 2020-2036

- North America, Value (USD Thousand), Volume (Thousand Tons)

- Europe, Value (USD Thousand), Volume (Thousand Tons)

- Asia Pacific, Value (USD Thousand), Volume (Thousand Tons)

- Latin America, Value (USD Thousand), Volume (Thousand Tons)

- Middle East and Africa, Value (USD Thousand), Volume (Thousand Tons)

- Derivatives, Value (USD Thousand), Volume (Thousand Tons)

- Global Overview

- North America Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Thousand), 2020-2036, By

- Derivatives, Value (USD Thousand), Volume (Thousand Tons)

- Montan Acid Esters Wax

- Montan Acid Calcium Wax

- Others

- Application, Value (USD Thousand), Volume (Thousand Tons)

- Plastics & Rubber Processing

- Coatings & Inks

- Lubricants & Greases

- Paper & Packaging

- Polishes & Emulsions

- Others

- End user, Value (USD Thousand)

- Automotive

- Plastic & Rubber

- Coatings, Paints & Inks

- Paper & Packaging

- Electronics & Electrical

- Others

- Country Level Analysis, Value (USD Thousand), Volume (Thousand Tons)

- US

- Canada

- Derivatives, Value (USD Thousand), Volume (Thousand Tons)

- Overview

- Europe Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Thousand), 2020-2036, By

- Derivatives, Value (USD Thousand), Volume (Thousand Tons)

- Montan Acid Esters Wax

- Montan Acid Calcium Wax

- Others

- Application, Value (USD Thousand), Volume (Thousand Tons)

- Plastics & Rubber Processing

- Coatings & Inks

- Lubricants & Greases

- Paper & Packaging

- Polishes & Emulsions

- Others

- End user, Value (USD Thousand)

- Automotive

- Plastic & Rubber

- Coatings, Paints & Inks

- Paper & Packaging

- Electronics & Electrical

- Others

- Country Level Analysis, Value (USD Thousand), Volume (Thousand Tons) Electronics & Electrical

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Netherlands

- Switzerland

- Poland

- Belgium

- Rest of Europe

- Derivatives, Value (USD Thousand), Volume (Thousand Tons)

- Overview

- Asia-Pacific Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Thousand), 2020-2036, By

- Derivatives, Value (USD Thousand), Volume (Thousand Tons)

- Montan Acid Esters Wax

- Montan Acid Calcium Wax

- Others

- Application, Value (USD Thousand), Volume (Thousand Tons)

- Plastics & Rubber Processing

- Coatings & Inks

- Lubricants & Greases

- Paper & Packaging

- Polishes & Emulsions

- Others

- End user, Value (USD Thousand)

- Automotive

- Plastic & Rubber

- Coatings, Paints & Inks

- Paper & Packaging

- Electronics & Electrical

- Others

- Country Level Analysis, Value (USD Thousand), Volume (Thousand Tons)

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Taiwan

- Thailand

- Others (Singapore, Philippines, Vietnam, New Zealand, Malaysia and Rest of Asia Pacific)

- Derivatives, Value (USD Thousand), Volume (Thousand Tons)

- Overview

- Latin America Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Thousand), 2020-2036, By

- Derivatives, Value (USD Thousand), Volume (Thousand Tons)

- Montan Acid Esters Wax

- Montan Acid Calcium Wax

- Others

- Application, Value (USD Thousand), Volume (Thousand Tons)

- Plastics & Rubber Processing

- Coatings & Inks

- Lubricants & Greases

- Paper & Packaging

- Polishes & Emulsions

- Others

- End user, Value (USD Thousand)

- Automotive

- Plastic & Rubber

- Coatings, Paints & Inks

- Paper & Packaging

- Electronics & Electrical

- Others

- Country Level Analysis, Value (USD Thousand), Volume (Thousand Tons)

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Derivatives, Value (USD Thousand), Volume (Thousand Tons)

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Thousand), 2020-2036, By

- Derivatives, Value (USD Thousand), Volume (Thousand Tons)

- Montan Acid Esters Wax

- Montan Acid Calcium Wax

- Others

- Application, Value (USD Thousand), Volume (Thousand Tons)

- Plastics & Rubber Processing

- Coatings & Inks

- Lubricants & Greases

- Paper & Packaging

- Polishes & Emulsions

- Others

- End user, Value (USD Thousand)

- Automotive

- Plastic & Rubber

- Coatings, Paints & Inks

- Paper & Packaging

- Electronics & Electrical

- Others

- Country Level Analysis, Value (USD Thousand), Volume (Thousand Tons)

- Saudi Arabia

- UAE

- Israel

- Qatar

- Kuwait

- Oman

- South Africa

- Rest of Middle East & Africa

- Derivatives, Value (USD Thousand), Volume (Thousand Tons)

- Overview

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

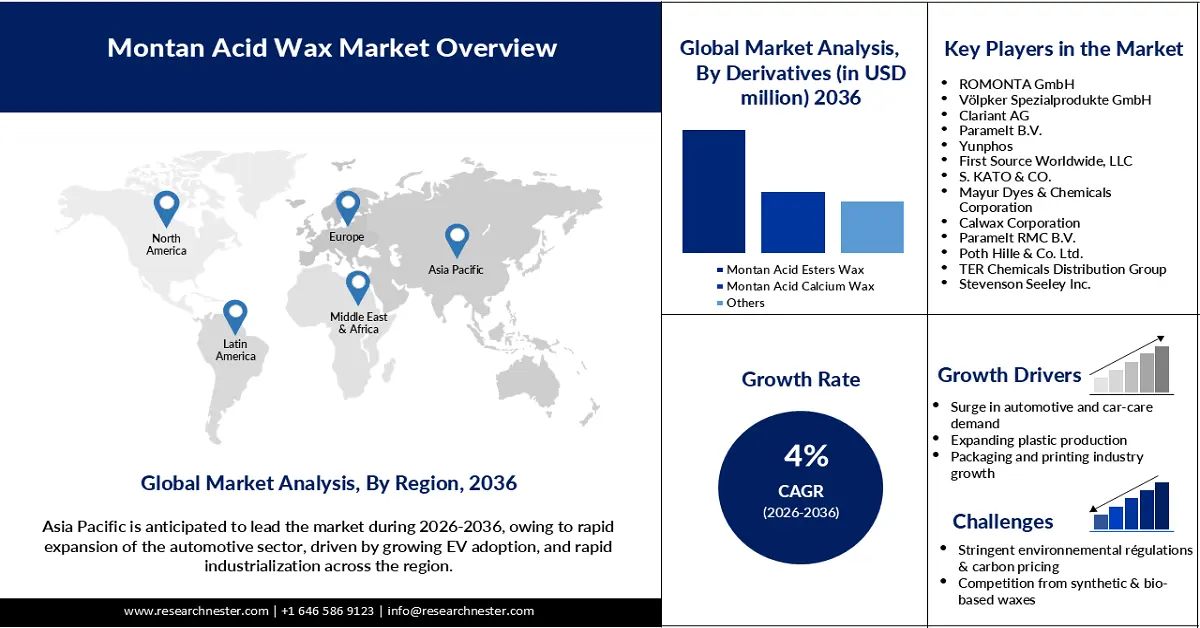

Montan Acid Wax Market Outlook:

Montan Acid Wax Market size was valued at USD 12,834.4 thousand in 2025 and is expected to reach USD 19,816.3 thousand by the end of 2036, registering a CAGR of 4% during the forecast period, i.e., 2026-2036. In 2026, the industry size of montan acid wax is estimated at USD 13,307.5 thousand.

Montan acid wax is the result of the oxidation of montan wax, derived from lignite, a non-renewable fossil fuel. The rising global trade of lignite is expected to fuel the market growth in the coming years. With the rising trade of lignite, its accessibility is also increasing. A trade of USD 11.9 billion took place globally in 2023, evidencing an increase of 1.2% compared to 2022. Indonesia topped the list with a lignite export of USD 10.7 billion. Such an adequate availability of lignite globally indicates the scope of widespread production of montan acid wax, especially when there is a growing demand for the material across different industries.

Top Lignite Exporters and Importers by Country in 2023

|

Countries |

Value |

|

Exporters |

|

|

Indonesia |

USD 10.7 billion |

|

Philippines |

USD 424 million |

|

Germany |

USD 135 million |

|

Importers |

|

|

China |

USD 10.7 billion |

|

Serbia |

USD 381 million |

Source: OEC

Key Montan Acid Wax Market Insights Summary:

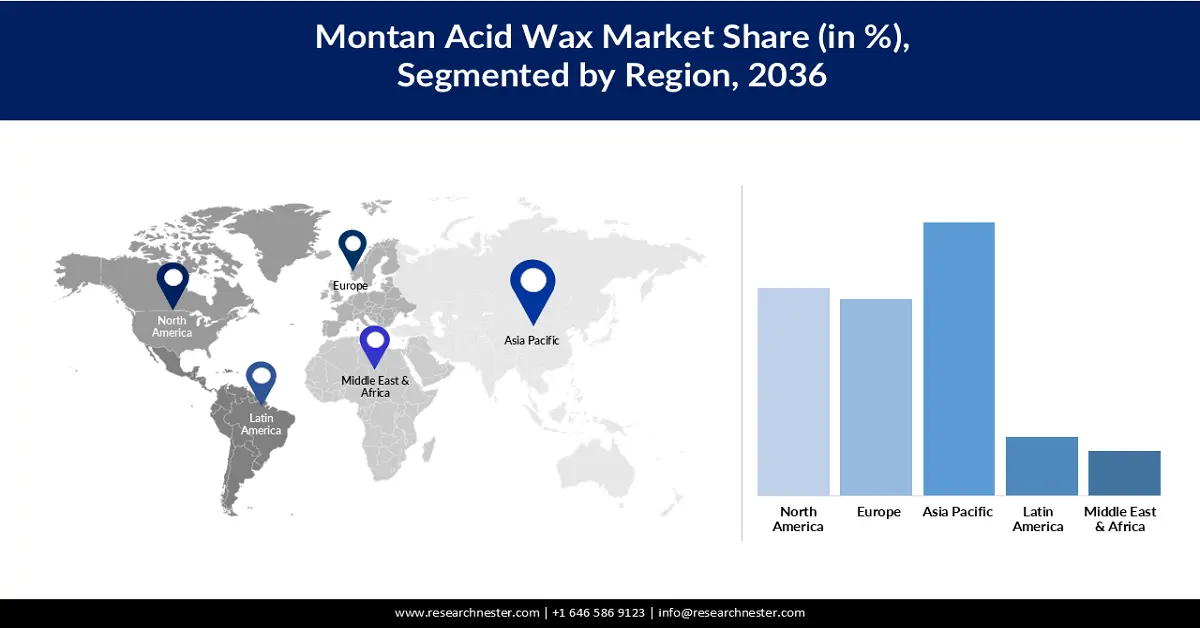

Regional Insights:

- The Asia Pacific Montan Acid Wax Market is expected to dominate with a 36.6% revenue share by 2036, owing to the rapid expansion of the automotive sector and increasing EV adoption.

- Europe is projected to register a CAGR of 2.8% during 2026–2035, attributed to the growing preference for natural and non-toxic ingredients in cosmetics supported by abundant local availability of raw materials.

Segment Insights:

- The montan acid esters wax segment is projected to hold a 64.6% share by 2036 in the Montan Acid Wax Market, propelled by the growing need for customization through esterification enhancing sustainability and performance in additive applications.

- The plastics and rubber processing segment is anticipated to capture a 45.6% share by 2036, supported by the expanding use of montan acid esters wax as a sustainable and high-performance lubricant in compliance with stringent environmental regulations.

Key Growth Trends:

- Surge in automotive and car-care demand

- Rapid expansion of the packaging industry

Major Challenges:

- Stringent environmental regulations & carbon pricing

- Competition from synthetic & bio-based waxes

Key Players: ROMONTA GmbH, Völpker Spezialprodukte GmbH, Clariant AG, Paramelt B.V., Yunphos, First Source Worldwide, LLC, S. KATO & CO., Mayur Dyes & Chemicals Corporation, Calwax Corporation, Paramelt RMC B.V., Poth Hille & Co. Ltd., TER Chemicals Distribution Group, Frank B. Ross Co., Inc., Dhariwal Corp Limited, Stevenson Seeley Inc.

Global Montan Acid Wax Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12,834.42 thousand

- 2026 Market Size: USD 13,307.5 thousand

- Projected Market Size: USD 19,816.30 thousand by 2035

- Growth Forecasts: 4% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.6% Share by 2036)

- Fastest Growing Region: Europe

- Dominating Countries: Germany, China, United States, Japan, India

- Emerging Countries: South Korea, Brazil, Indonesia, Mexico, Thailand

Last updated on : 29 September, 2025

Montan Acid Wax Market - Growth Drivers and Challenges

Growth Drivers

- Surge in automotive and car-care demand: The rapid expansion of the global automotive industry and increasing craze for car care fuels the market growth, since montan wax is a crucial component for car polishing. As reported by the European Automobile Manufacturers’ Association in March 2025, the global automotive industry sold 76.6million units of cars in 2024, an increase in yearly car sales by 2.5% compared to the previous business year. In addition, car sales in the EU reached 10.6 million units in total in 2024, with an increase of 0.8%. This is likely to lead to an increased production of montan wax. With the increased availability of the montan wax, its production is expected to become more convenient.

- Rapid expansion of the packaging industry: Montan acid wax is widely used in the packaging sector as an anti-blocking agent and external lubricant owing to its unique properties, including water repellent, abrasion resistance, along with gloss-enhancing and protective properties. As the demand for packaged goods and products for applications and industrial use is rising across the globe, the need for different types of montan acid wax is expected to increase. For instance, according to the report published by the India Brand Equity Foundation (IBEF), the packaging industry in India reached USD 204.81 in 2025 at a CAGR of 26.7%. This is expected to support the market growth in the coming years.

Challenges

- Stringent environmental regulations & carbon pricing: The production of montan acid wax is likely to be hampered due to certain stringent environmental regulations and carbon pricing. Especially when the European Union has announced restrictions on the production and use of materials, responsible for high carbon emissions. On the other hand, as reported by the World Bank Group in May 2024, revenues from carbon pricing reached USD 104 billion. Around 75 carbon pricing mechanisms are operational globally. Thus, the production of montan acid wax may become increasingly complex and expensive.

- Competition from synthetic & bio-based waxes: Synthetic and biobased waxes are rapidly gaining popularity across several sectors due to their renewability, high performance, and eco-friendliness. Though montan wax is considered environmentally acceptable than paraffin wax, it is derived from a fossil source, limiting its sustainability credentials.

Montan Acid Wax Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2026 |

|

Forecast Year |

2026-2036 |

|

CAGR |

4% |

|

Base Year Market Size (2025) |

USD 12,834.42 thousand |

|

Forecast Year Market Size (2036) |

USD 19,816.30 thousand |

|

Regional Scope |

|

Montan Acid Wax Market Segmentation:

Derivatives Segment Analysis

The montan acid esters wax segment is expected to account for a market share of 64.6% by the end of 2036, due to the need for customization of montan wax through esterification. The esterification of montan wax makes it sustainable and capable of delivering higher performance, especially as an additive in plastics. Companies are also investing in the production of such esterified montan wax. These waxes are likely to be adopted in various industries increasingly, since there is a rising demand for sustainable materials.

Below is the list of several esterified montan waxes that are used for a variety of purposes related to car care and use in automotive:

|

Supplier / Distributor |

Product Name |

How It’s Used in Car Care |

|

Clariant |

Licowax E (flakes/powder) |

Ester of montanic acids used as a hard, emulsifiable wax in polishes for gloss, durability, and low migration; also, in polymer processing |

|

Völpker / WARADUR |

WARADUR KME / ESL / LGE (montanic-based ester waxes & blends) |

Explicitly promoted for car polish / polish base formulations. Good source for polish-grade montan esters |

|

IruChem |

Montan Wax E, Montan Wax OP (partly saponified montanic ester wax) |

Used as ester/partially saponified montan wax in formulations for polish emulsions, and widely used as a lubricant/release agent for polymer parts |

|

Poth Hille |

Bleached Montan Wax OP (ester wax, flaked) |

Specifically, compatible with water-based and solvent-based polishes - easy emulsification; used in car/shoe/floor polishes |

|

Distributors (Palmer Holland, specialty chemical distributors) |

Clariant Licowax E (distributed) |

Distributors often provide TDS/SDS and supply small-to-bulk orders to formulators |

Source: Clariant, Völpker, IruChem, Poth Hille

Application Segment Analysis

The plastics and rubber processing segment is anticipated to acquire a revenue share of 45.6% by the end of 2036, owing to the scope of using montan acid esters wax as a highly performing lubricant. Companies are likely to increasingly adopt the montan wax for plastics and rubber processing, increasing the need for producing montan acid wax. Such a probability is driven by the stringent regulations encouraging sustainable rubber and plastics processing. One such example is the arrival of Commission Regulation (EU) 2023/2055 into force under the REACH regulation in October 2023. The regulation prohibits the use of synthetic polymer microplastics. Thus, the regulation hinders the demand for synthetic wax in plastics processing, where the use of montan acid wax as a material is comparatively sustainable.

End use Segment Analysis

By 2036, the plastic and rubber segment is expected to hold a revenue share of 38%, as a consequence of the rapid expansion of the plastics and rubber industry and the rising need for different types of plastics and rubber across consumer electronics, automotive, construction, and packaging sectors. As per the Economic Co-operation and Development (OECD), plastic production in 2040 is expected to increase by 70% compared to 2020. The production of plastics and rubber is likely to increase with the growth of the mentioned user sectors, who have been actively using the materials. This is expected to increase the use of montan wax as a lubricant for processing purposes. With rising montan wax production, the convenience of producing montan acid wax is expected to increase.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Derivatives |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Montan Acid Wax Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is expected to emerge as the dominating market by acquiring a revenue share of 36.6% by the end of 2036, owing to the rapid expansion of the automotive sector. The expansion is likely to be driven by the increasing adoption of EVs. As reported by the International Energy Agency, emerging and developing economies witnessed a massive surge in sales of EVs. With the expansion of the automotive sector, the demand for montan acid wax is expected to increase for car polishing purposes. Rapid industrialization across the region is also increasing the demand for montan acid wax to be used as a lubricant, additive, and coating agent in various processes.

China is expected to emerge as an expanding montan acid wax market at a CAGR of 5.8% during the forecast period, due to growing demand for the material and rapid expansion of the automotive sector. Not only the EV sector, but also the entire automotive sector is expanding in China, fueling the demand for montan acid wax. As revealed by the State Council of China in October 2023, with an increase of 1.9% compared to the previous business year, automobile production in China reached 21.47 million in 2023. In the same business year, China’s automobile sales increased by 2.4%, and stood at 21.57 million units. The presence of facilities for montan wax resourcing and production, and growing demand for the same in China, is another factor expected to fuel market growth in the coming years.

Montan acid wax market in Japan is anticipated to expand rapidly at a CAGR of 5.2%, owing to growing preference for natural and less harmful products. Japan is a country with an adequate availability of lignite. As per the report by the World Bank Group, Japan spent USD 3,715.95 thousand to import 15,107,000 kg of lignite in 2023. With adequate availability of lignite, the scope for effective production of the montan acid wax is expected to increase. The demand for such produced component to be supplied in the market is also likely to increase over time.

Europe Market Insights

Europe market is expected to expand at a CAGR of 2.8% during the forecast period, on account of the rising demand for natural and non-toxic ingredients in cosmetics products across the region. In addition, there is a sufficient availability of natural ingredients within the region, increasing the scope of producing sustainable cosmetic products. As reported by the Centre for the Promotion of Imports (CBI) from developing countries in February 2025, over the past five years, the imports of natural ingredients to be used in cosmetics increased by 5.5% every year. The scope of producing sustainable cosmetics items is likely to lead to an increased use of montan acid wax for the formulation of structure and texture, emulsion stabilization, and others.

The montan wax market in Germany is poised to witness an expansion at a CAGR of 3.7% throughout the forecast period, owing to growing demand for high-performance coatings across the country. To meet such demand, companies based in Germany are actively investing in the production of montan wax, increasing the scope of producing montan acid wax. Moreover, Germany has a robust chemical and specialty wax industry, including manufacturers involved in lignite mining, refining, and downstream processing.

Montan acid wax market in France is expected to experience a rapid expansion between 2026 and 2036, as a consequence of the strong emphasis on green chemistry and decarbonization policies. According to the United Nations Conference on Trade and Development (UNCTAD) in May 2024, financial aid of USD 4.6 billion was approved by the European Commission as a state aid scheme with the motive of supporting the manufacturing industry to fulfill its decarbonization goals. Thus, availing financial support for the production of montan acid wax can be easier for companies in the coming years. Moreover, rising adoption of montan acid wax in the plastic and rubber processing is expected to fuel market growth by the end of 2036.

North America Market Insights

Montan acid wax market in North America is anticipated to witness a steady expansion throughout the forecast period, due to rising preference among the consumers of pharmaceuticals, cosmetics, and food industries for natural and mineral/fossil-derived waxes within the region. The involvement of a wide range of companies in the production of wax is likely to keep the market stable and even growing, displaying a widespread scope of producing montan acid wax through oxidation. This indicates the potential of the market layers to be involved in producing montan acid wax.

The montan acid wax market in the U.S. is expected to register rapid growth during the forecast period, owing to a high focus on enhancing industrial processing efficiency and growing inclination towards less harmful waxes compared to paraffin. Montan acid wax is rapidly gaining traction in the paper and packaging industry for enhancing printability, surface smoothness, and moisture resistance in paper coatings. Moreover, automotive manufacturers based in the U.S. are constantly launching new automotive models, providing evidence of rising use of montan acid wax for polishing purposes.

Montan acid wax market in Canada is expected to witness a rapid expansion at a CAGR of 2.8% throughout the forecast period, owing to the consistent growth of the consumer electronics sector. In 2025, the sales of consumer electronics products, including gaming devices, smartphones, TV Peripherals, and others in Canada, are expected to reach USD 977 billion. This indicates an extensive use of montan acid wax as a high-performance additive in the manufacturing of consumer electronics products. The cost-effectiveness and potential to alter other high-performance waxes are likely to attract manufacturers towards montan acid wax.

Key Montan Acid Wax Market Players:

- ROMONTA GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Völpker Spezialprodukte GmbH

- Clariant AG

- Paramelt B.V.

- Yunphos

- First Source Worldwide, LLC

- S. KATO & CO.

- Mayur Dyes & Chemicals Corporation

- Calwax Corporation

- Paramelt RMC B.V.

- Poth Hille & Co. Ltd.

- TER Chemicals Distribution Group

- Frank B. Ross Co., Inc.

- Dhariwal Corp Limited

- Stevenson Seeley Inc

The global market is highly competitive and ever-evolving, due to the rapid expansion of the end use industries of the material, such as automotive, cosmetics, and others. The production and supply of montan acid wax globally are controlled by a few numbers of key players, making the market highly concentrated. The majority of the key players are based in Europe. All the key players associated with the industry are consistently innovating and focusing on a variety of product forms. They are even putting efforts to manufacture montan acid wax as modified as possible.

Below is the list of key players associated with the global montan acid wax market:

Recent Developments

- In August 2024, ROMONTA Group inaugurated its new substitute fuel power plant at Amsdorf site. It is a drastic step taken by the business towards sustainable and carbon-neutral production of montan wax, increasing the scope of montan acid wax production sustainably.

- In December 2023, IruChem launched Montan Wax OP, a montanic ester wax that is partially saponified. The component is used as a lubricant in injection and extrusion blow molding. The material can also be used for rigid PVC in calendaring.

- Report ID: 8135

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Montan Acid Wax Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.