Monocrystalline Solar Cell Market Outlook:

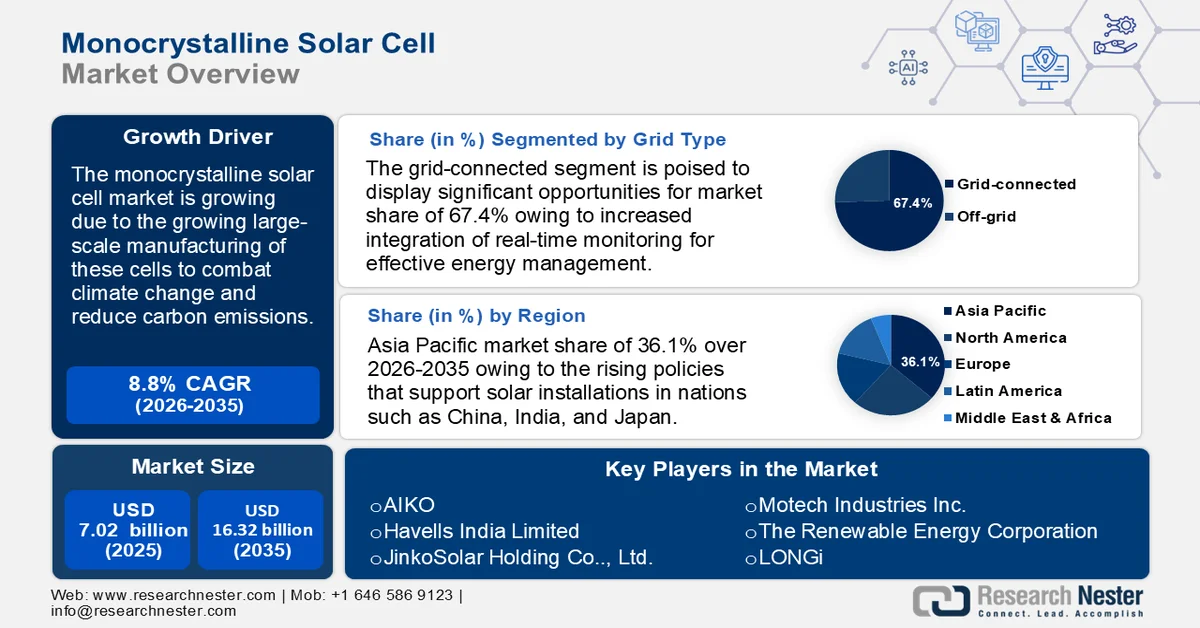

Monocrystalline Solar Cell Market size was valued at USD 7.02 billion in 2025 and is expected to reach USD 16.32 billion by 2035, registering around 8.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of monocrystalline solar cell is evaluated at USD 7.58 billion.

The global monocrystalline solar cell market is flourishing owing to the worldwide transition to renewable energy sources. These solar cells are essential for capturing solar energy and producing sustainable electricity to combat climate change and reduce carbon emissions. The International Energy Agency (IEA) reported that in 2023 solar PV power generation reached a record 320 TWh, a 25% increase over 2022. After wind and hydropower, solar PV is still the third-largest renewable electricity technology, contributing 5.4% of the world's total electricity generation.

Compared to other solar cell types such as polycrystalline or thin-film cells, monocrystalline cells are renowned for their high efficiency, extended lifespan, and superior performance in low light. Solar energy has become a crucial solution to the problem as countries worldwide pledge to use renewable energy. Leading this shift are monocrystalline solar cells, which increase solar energy capacity and have a high energy conversion efficiency. The demand for these cells is further increased by the ambitious promotion of solar power adoption by governments and utility companies through policies and incentives.

Furthermore, as manufacturers scale up production of key components such as polysilicon, wafers, and modules, the availability of high-purity silicon – essential for monocrystalline cells, expands, making them more affordable. Additionally, large-scale manufacturing encourages investments in automation and innovation, leading to higher efficiency and better-performing monocrystalline cells. Therefore, the increasing solar PV manufacturing capacity is significantly driving the monocrystalline solar cell market by improving production efficiency, reducing costs, and improving technological advancements.

Below is a graph representing the increasing capacity of solar PV with various components:

Source: IEA

Key Monocrystalline Solar Cell Market Insights Summary:

Regional Highlights:

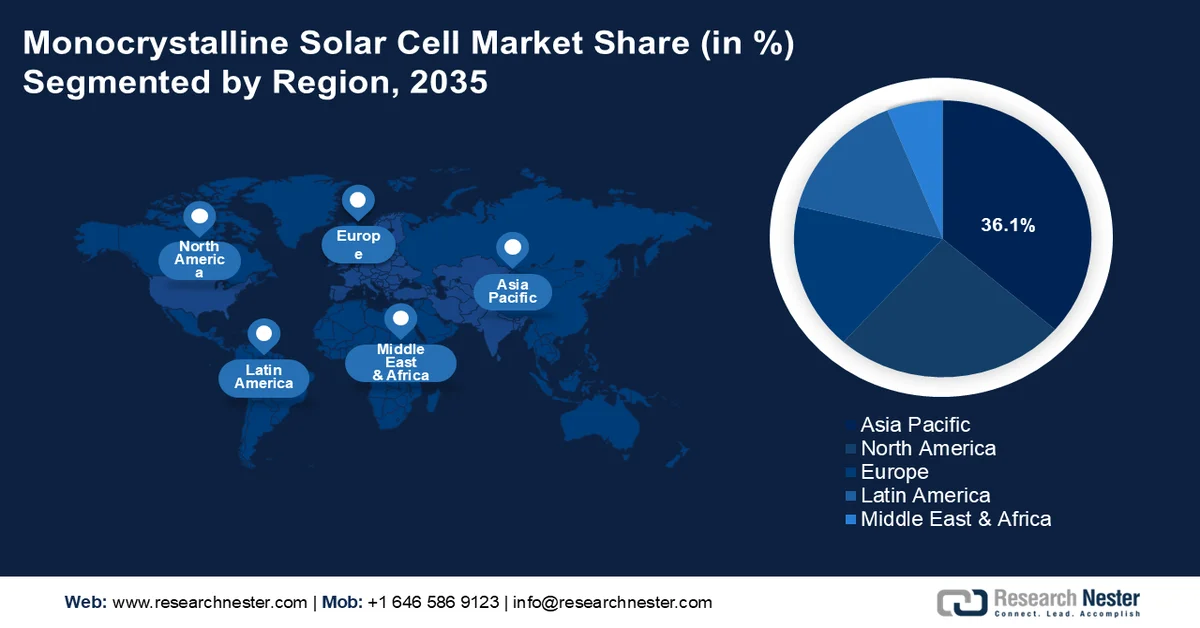

- Asia Pacific in monocrystalline solar cell market is expected to hold 36.1% revenue share by 2035, propelled by rising policies supporting solar installations and large-scale solar farm development.

- North America is anticipated to grow significantly by 2035, driven by increasing residential and utility-scale solar adoption and advancements in energy storage technologies.

Segment Insights:

- The grid-connected segment in monocrystalline solar cell market is projected to account for 67.4% share by 2035, impelled by the integration of smart technology for efficient energy management.

- The industrial segment is expected to gain a significant share by 2035, owing to the adoption of solar energy in manufacturing processes to reduce carbon footprints and energy costs.

Key Growth Trends:

- Surging demand in residential and large-scale projects

- Increased global commerce of silicon

Major Challenges:

- Growing concerns related to environments

- Manufacturing complexities

Key Players: Accenture, LeewayHertz, Oracle Corporation, R3, Ontology, INERY PTE, LTD., Datachain, Quant Network Limited, Band protocol, LiquiDApps.

Global Monocrystalline Solar Cell Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.02 billion

- 2026 Market Size: USD 7.58 billion

- Projected Market Size: USD 16.32 billion by 2035

- Growth Forecasts: 8.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.1% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: United States, Canada, India, Germany, Australia

Last updated on : 25 February, 2026

Monocrystalline Solar Cell Market - Growth Drivers and Challenges

Growth Drivers

- Surging demand in residential and large-scale projects: The monocrystalline solar cell market is experiencing significant growth as an increasing number of individuals opt for solar energy to reduce their carbon footprint and minimize electricity expenses. In residential applications, monocrystalline solar panels are favored due to their high efficiency and compact design. These cells present a cost-effective solution that is attractive to homeowners, as they generate greater electricity output within a limited roof space.

Moreover, substantial investment from governments and utility companies is directed toward large-scale solar farms to mitigate greenhouse gas emissions and address the rising electricity demand. For these extensive projects, monocrystalline solar cells are the preferred choice due to their unparalleled reliability and efficiency. The Press Information Bureau indicated that with USD 223 billion invested in solar in 2023, APAC is leading the way in solar investments regionally. With USD 91 billion in 2023, EMEA (Europe, the Middle East, and Africa) saw a modest increase in solar investment, while the AMER (America) region saw USD 78 billion.

- Increased global commerce of silicon: The increased global commerce of silicon is a key driver of the monocrystalline solar cell market, as it enhances the availability of high-purity silicon – an essential material for these high-efficiency solar cells. As trade barriers decrease and supply chains expand, silicon production costs are optimized, making monocrystalline solar cells more competitive. Additionally, advancements in refining and wafer-cutting technologies, fueled by global investment and knowledge exchange, improve silicon quality and reduce manufacturing waste.

|

Exporters |

Export Value of Silicon (in USD million) |

Importers |

Import Value of Silicon (in USD million) |

|

Germany |

1680 |

China |

791 |

|

U.S. |

1290 |

Germany |

686 |

|

China |

1290 |

Germany |

502 |

|

Japan |

869 |

South Korea |

413 |

|

Belgium |

423 |

Netherlands |

410 |

Source: OEC

The Observatory of Economic Complexity reported that at USD 8.08 billion, silicon was the 413th most traded product in the world in 2023. Silicon shipments dropped from USD 11 billion to USD 8.08 billion between 2022 and 2023, a 26.7% decline. Silicon trade accounts for 0.036% of global trade. According to the Product Complexity Index (PCI), silicon is ranked 32nd.

Challenges

- Growing concerns related to environments: The high energy intensity associated with the production of monocrystalline solar cells has significant implications for both production costs and environmental sustainability. The process of silicon purification and cell fabrication is notably energy-intensive, potentially increasing the carbon footprint associated with solar cell manufacturing. This situation jeopardizes the sustainability objectives of the monocrystalline solar cell market and may deter governments and environmentally conscious consumers from fully adopting monocrystalline solar technology. Additionally, the high energy intensity of these solar cells may adversely affect their cost competitiveness, particularly in regions where energy costs are elevated, thereby reducing their overall attractiveness in such monocrystalline solar cell markets.

- Manufacturing complexities: Monocrystalline N-type cells need more processes and complex techniques than standard P-type cells, which can raise production costs and make it difficult to scale up manufacturing capacity. Additionally, these cells require a more complex production process, which raises the initial expenses. Additionally, the industry may experience supply chain limitations and shortages of essential materials as the demand for monocrystalline N-type cells increases. The overall cost-effectiveness of these technologies may be impacted, for instance, by studies that indicate the increased demand for indium, a critical component in some N-type cell designs, has already resulted in large price hikes.

Monocrystalline Solar Cell Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.8% |

|

Base Year Market Size (2025) |

USD 7.02 billion |

|

Forecast Year Market Size (2035) |

USD 16.32 billion |

|

Regional Scope |

|

Monocrystalline Solar Cell Market Segmentation:

Grid Type Segment Analysis

Grid-connected segment is projected to account for monocrystalline solar cell market share of around 67.4% by 2035. Grid-connected solar power plants utilize monocrystalline solar cell systems to convert sunlight into electricity, which is then distributed to the local electrical grid. These systems facilitate the return of surplus energy to the grid, allowing the system owner to potentially generate savings by selling this excess electricity back to the utility provider. A notable trend within grid-connected systems is the integration of smart technology, which enables effective energy management and real-time monitoring of energy production and consumption.

Application Segment Analysis

The industrial segment in monocrystalline solar cell market is projected to garner a significant share during the assessed period. Large-scale solar projects intended to satisfy the energy requirements of businesses and industries are included in the market for monocrystalline solar cells. Integrating solar energy into manufacturing processes is a noteworthy development in industrial applications that lowers carbon footprints and energy costs.

Monocrystalline cells are among the most efficient solutions in the monocrystalline solar cell market, with efficiency rates ranging from 15% to over 20%. Because they are less impacted by high temperatures than polycrystalline cells, these cells are robust and have a longer lifespan. Furthermore, as countries expand their renewable energy targets and invest in utility-scale solar projects, industries are increasingly adopting monocrystalline technology to maximize energy output per unit of land. Nations such as China, the U.S., and India are leading in solar farm expansion, pushing for high-efficiency solutions that reduce the levelized cost of electricity (LCOE).

The following table shows the operating solar capacity in megawatts as of February 2025:

|

Rank |

Country |

Operating Capacity (in megawatts) |

Percent of Global Total |

|

1 |

China |

447,508 |

48.4% |

|

2 |

U.S. |

121,311 |

13.1% |

|

3 |

India |

72,300 |

7.8% |

|

4 |

Japan |

31,095 |

3.4% |

|

5 |

Spain |

28,014 |

3.0% |

|

6 |

Germany |

26,283 |

2.8% |

|

7 |

Brazil |

20,165 |

2.2% |

|

8 |

Mexico |

12,787 |

1.4% |

|

9 |

France |

11,818 |

1.3% |

|

10 |

UK |

9,031 |

1.0% |

|

11 |

South Korea |

7,450 |

0.8% |

|

12 |

Italy |

4,447 |

0.5% |

Source: Global Energy Monitor

Our in-depth analysis of the global monocrystalline solar cell market includes the following segments:

|

Grid Type |

|

|

Application |

|

|

Technology |

|

|

Installation |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Monocrystalline Solar Cell Market - Regional Analysis

APAC Market Insights

Asia Pacific in monocrystalline solar cell market is expected to dominate around 36.1% revenue share by the end of 2035. Due to its high efficiency and long-term advantages, the monocrystalline solar cell has become a favored option due to rising policies that support solar installations, such as tax incentives, subsidies, and favorable regulatory frameworks. Rapid population expansion, industrialization, and urbanization raise the need for electricity, which pushes the region to use renewable energy sources such as solar power to fulfill the rising energy demand in a sustainable way that affects product growth. The economic environment will also be enhanced by the rise in large-scale solar farms, which are being driven by nations such as China and India, as well as the growing regional commitment to lowering carbon emissions and addressing climate change.

China’s advanced manufacturing capabilities, driven by leading producers such as LONGi and JinkoSolar, have enabled mass production, reducing costs, and improving the efficiency of monocrystalline solar cells. Additionally, the rise of ultra-large utility-scale solar farms, along with urban rooftop solar installations, has increased demand for high-power density solutions. China’s focus on innovations such as bifacial and n-type monocrystalline cells, which offer higher energy yields and lower degradation rates, further fuels monocrystalline solar cell market growth.

The Global Energy Monitor disclosed that although data from the China Electricity Council estimated that the overall capacity, including distributed solar, was 1,120 GW, China's utility-scale solar and wind capacity reached 758 GW by the first quarter of 2024. Additionally, China's Whole Country Solar approach was a major factor in the installation of roughly half of the distributed solar added in 2023 on residential rooftops. Since 2021, distributed solar has grown at a faster rate than centralized solar, making for 41% of the total solar capacity. Moreover, supportive policies such as subsidies, tax credits, and favorable grid integration frameworks continue to accelerate the adoption of monocrystalline solar cells across various sectors.

In India, the Production-Linked Incentive (PLI) scheme and 100% Foreign Direct Investment policy have attracted investments in solar manufacturing, boosting the adoption of high-efficiency monocrystalline panels. With the nation targeting 500 GW of non-fossil fuel capacity by 2030, large-scale solar projects, such as those in Rajasthan and Gujarat, are driving demand for monocrystalline technology, known for its superior efficiency and durability in extreme climates. For instance, the largest Gujarat Solar Park in Asia was launched by Gujarat Power Corporation Limited (GPCL) to lessen the effects of climate change and preserve the environment for future generations.

Additionally, corporate sustainability commitments, increasing adoption of rooftop solar in commercial and industrial sectors, and advancements in bifacial and n-type monocrystalline cells are further accelerating the monocrystalline solar cell market growth. Also, the declining Levelized Cost of Electricity (LCOE) and improved efficiency-to-cost ratio make monocrystalline panels a preferred choice for industrial and utility-scale solar farms, strengthening India’s position as a global solar energy leader.

North America Market Insights

North America monocrystalline solar cell market is expected to grow at a significant rate during the projected period. The market in the region is distinguished by a significant focus on sustainability and the adoption of renewable energy. Residential solar installations are becoming popular due to government incentives and increased environmental consciousness. Additionally, utility-scale solar projects prosper, particularly in locations with abundant sunshine. The use of monocrystalline solar cells has also been accelerated by net-metering regulations and developments in energy storage technologies. As a result, solar capacity has steadily increased across North America, fueling a thriving monocrystalline solar cell market.

The need for energy independence and falling installation prices is expanding the residential solar in the U.S., which will boost product penetration. Also, the Energy Star reported that an annual residential clean energy tax credit of 30% of the prices for eligible, newly installed property is available to individuals who invest in renewable energy for their homes (such as solar, wind, geothermal, fuel cells, or battery storage technologies) between 2022 and 2032. For properties installed in 2033 and 2035, the credit percentage falls to 26% and 22%, respectively.

Growing awareness of climate change in tandem with the growth of utility-scale solar projects, especially in the sun-rich southwestern and western regions, is increasing demand for the product since these projects can produce more power per unit of area, which maximizes energy production for utilities and optimizes land use.

Furthermore, in Canada, Feed-in tariffs (FITs), tax credits, and net metering programs encourage businesses and homeowners to install solar systems, boosting the demand for monocrystalline solar cells. Also, the industrial sector, particularly in mining, manufacturing, and commercial real estate, is integrating solar power to cut operational costs and meet sustainability goals, further fueling monocrystalline solar cell market growth. According to the Canada Action Coalition, there are currently 196 significant solar energy projects in Canada, with Alberta and Ontario housing the largest of these. Furthermore, the nation's rooftops are home to over 43,000 solar (PV) energy installations that supply electricity directly to homes, businesses, and commercial buildings.

Monocrystalline Solar Cell Market Players:

- AIKO

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Havells India Limited

- JinkoSolar Holding Co., Ltd.

- Motech Industries Inc.

- The Renewable Energy Corporation

- LONGi

- Renesola

- Trina Solar Limited

- JA Solar Holdings Co., Ltd.

- Risen Energy Co., Ltd.

To increase cell efficiency and implement cutting-edge technologies, leading monocrystalline solar cell market companies are making significant investments in research and development (R&D). By increasing energy output, these developments make monocrystalline solar cells more appealing for household and commercial installations. To gain control over the whole value chain, from the procurement of raw materials to the delivery of the finished product, several major firms are using a vertical integration approach. This strategy not only lowers expenses but also guarantees supply chain security and quality control, enabling businesses to react swiftly to changes in the monocrystalline solar cell market and prices.

Recent Developments

- In May 2024, LONGi announced the latest HBC solar cells from LONGi, which were approved by Germany's Solar Energy Research Institute ISFH and achieved an excellent 27.30% efficiency in laboratory tests. This statement intends to highlight LONGi's rapid scientific improvements in solar cell efficiency, cementing its position as a pioneer in solar innovation with a new record-breaking achievement.

- In October 2023, JinkoSolar Holding Co., Ltd., one of the world's largest and most innovative solar module manufacturers, announced a significant technological breakthrough for its 182 mm high-efficiency N-type monocrystalline silicon solar cell. JinkoSolar established a new record with a maximum solar conversion efficiency of 26.89% for its 182 mm and larger monocrystalline silicon TOPCon solar cells.

- Report ID: 7263

- Published Date: Feb 25, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Monocrystalline Solar Cell Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.