Global Monoclonal Antibodies (mAbs) Contract Manufacturing Market

- An Outline of the Global Monoclonal Antibodies (mAbs) Contract Manufacturing Market

- Market Definition

- Market Segmentation

- Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Technological Advancements

- Growth Outlook

- Risk Overview

- SWOT

- Regional Demand

- Mammalian vs Microbial in Monoclonal Antibody Production

- A Comprehensive Analysis of Monoclonal Antibody Manufacturing Technologies

- Growth Potential for End-User of Monoclonal Antibodies (mAbs) Contract Manufacturing Market

- Comparison to Alternative: Monoclonal vs Polyclonal Antibodies

- Epidemiology of Major Disease and Role of Monoclonal Antibodies

- Pipeline Analysis of Monoclonal Antibodies

- Root Cause Analysis (RCA) for discovering problems of the Monoclonal Antibodies

- Porter Five Forces

- PESTLE

- Comparative Positioning

- Competitive Landscape

- Competitive Model

- Market Share of Major Companies Profiled

- Business Profile of Key Enterprise

- AGC Biologics

- Boehringer Ingelheim International GmbH

- Catalent, Inc.

- Charles River Laboratoires International Inc.

- Cytovance Biologics

- Eurofins Scientific SE

- FUJIFILM Diosynth Biotechnologies

- Lonza Ltd.

- Merck KGaA

- Samsung Biologics Co., Ltd.

- Thermo Fisher Scientific Inc.

- WuXi Biologics (Cayman) Inc.

- Global Monoclonal Antibodies (mAbs) Contract Manufacturing Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Global Monoclonal Antibodies (mAbs) Contract Manufacturing Market Segmentation Analysis (2024-2037)

- By Source

- Mammalian, Market Value (USD Million) and CAGR, 2024-2037F

- Microbial, Market Value (USD Million) and CAGR, 2024-2037F

- By Technology

- Recombinant DNA technology, Market Value (USD Million) and CAGR, 2024-2037F

- Hybridoma Technology, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- By End user

- Biopharmaceutical Companies, Market Value (USD Million), and CAGR, 2024-2037F

- Research Laboratories, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

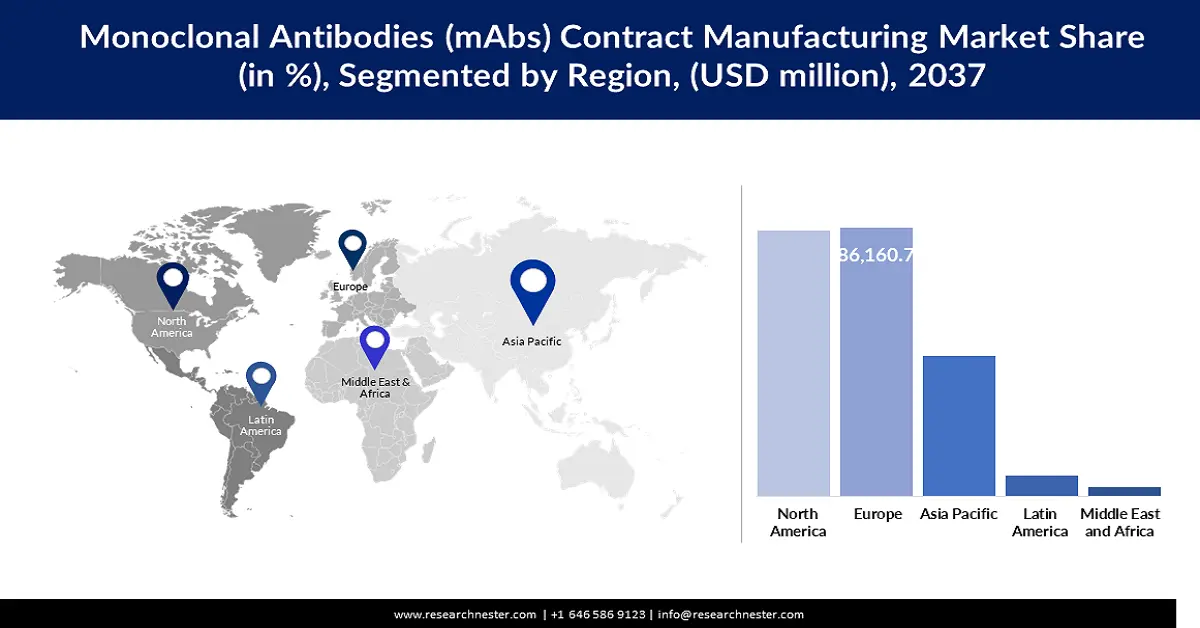

- By Region

- North America, Market Value (USD Million) and CAGR, 2024-2037F

- Europe, Market Value (USD Million) and CAGR, 2024-2037F

- Asia Pacific excluding Japan, Market Value (USD Million) and CAGR, 2024-2037F

- Japan, Market Value (USD Million) and CAGR, 2024-2037F

- Latin America, Market Value (USD Million) and CAGR, 2024-2037F

- Middle East and Africa, Market Value (USD Million) and CAGR, 2024-2037F

- By Source

- Cross Analysis of Source W.R.T. End-User (USD Million), 2024-2037

- North America Monoclonal Antibodies (mAbs) Contract Manufacturing Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- North America Monoclonal Antibodies (mAbs) Contract Manufacturing Market Segmentation Analysis (2024-2037)

- By Source

- Mammalian, Market Value (USD Million) and CAGR, 2024-2037F

- Microbial, Market Value (USD Million) and CAGR, 2024-2037F

- By Technology

- Recombinant DNA technology, Market Value (USD Million) and CAGR, 2024-2037F

- Hybridoma Technology, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- By End user

- Biopharmaceutical Companies, Market Value (USD Million), and CAGR, 2024-2037F

- Research Laboratories, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- U.S., Market Value (USD Million) and CAGR, 2024-2037F

- Canada, Market Value (USD Million) and CAGR, 2024-2037F

- By Source

- Cross Analysis of Source W.R.T. End-User (USD Million), 2024-2037

- Europe Monoclonal Antibodies (mAbs) Contract Manufacturing Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Europe Monoclonal Antibodies (mAbs) Contract Manufacturing Market Segmentation Analysis (2024-2037)

- By Source

- Mammalian, Market Value (USD Million) and CAGR, 2024-2037F

- Microbial, Market Value (USD Million) and CAGR, 2024-2037F

- By Technology

- Recombinant DNA technology, Market Value (USD Million) and CAGR, 2024-2037F

- Hybridoma Technology, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- By End user

- Biopharmaceutical Companies, Market Value (USD Million), and CAGR, 2024-2037F

- Research Laboratories, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- UK,, Market Value (USD Million) and CAGR, 2024-2037F

- Germany, Market Value (USD Million) and CAGR, 2024-2037F

- France, Market Value (USD Million) and CAGR, 2024-2037F

- Italy, Market Value (USD Million) and CAGR, 2024-2037F

- Spain, Market Value (USD Million) and CAGR, 2024-2037F

- BENELUX, Market Value (USD Million) and CAGR, 2024-2037F

- Poland, Market Value (USD Million) and CAGR, 2024-2037F

- Russia, Market Value (USD Million) and CAGR, 2024-2037F

- Rest of Europe, Market Value (USD Million) and CAGR, 2024-2037F

- By Source

- Cross Analysis of Source W.R.T. End-User (USD Million), 2024-2037

- Asia Pacific Excluding Japan Monoclonal Antibodies (mAbs) Contract Manufacturing Market Outlook

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Asia Pacific excluding Japan Monoclonal Antibodies (mAbs) Contract Manufacturing Market Segmentation Analysis (2024-2037)

- Monoclonal Antibodies (mAbs) Contract Manufacturing Market Segmentation Analysis (2024-2037)

- By Source

- Mammalian, Market Value (USD Million) and CAGR, 2024-2037F

- Microbial, Market Value (USD Million) and CAGR, 2024-2037F

- By Technology

- Recombinant DNA technology, Market Value (USD Million) and CAGR, 2024-2037F

- Hybridoma Technology, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- By End user

- Biopharmaceutical Companies, Market Value (USD Million), and CAGR, 2024-2037F

- Research Laboratories, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- China, Market Value (USD Million) and CAGR, 2024-2037F

- India, Market Value (USD Million) and CAGR, 2024-2037F

- Indonesia, Market Value (USD Million) and CAGR, 2024-2037F

- South Korea, Market Value (USD Million) and CAGR, 2024-2037F

- Malaysia, Market Value (USD Million) and CAGR, 2024-2037F

- Australia, Market Value (USD Million) and CAGR, 2024-2037F

- Singapore, Market Value (USD Million) and CAGR, 2024-2037F

- Vietnam, Market Value (USD Million) and CAGR, 2024-2037F

- New Zealand, Market Value (USD Million) and CAGR, 2024-2037F

- Rest of APEJ, Market Value (USD Million) and CAGR, 2024-2037F

- By Source

- Cross Analysis of Source W.R.T. End-User (USD Million), 2024-2037

- Japan Monoclonal Antibodies (mAbs) Contract Manufacturing Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Japan Monoclonal Antibodies (mAbs) Contract Manufacturing Market Segmentation Analysis (2024-2037)

- By Source

- Mammalian, Market Value (USD Million) and CAGR, 2024-2037F

- Microbial, Market Value (USD Million) and CAGR, 2024-2037F

- By Technology

- Recombinant DNA technology, Market Value (USD Million) and CAGR, 2024-2037F

- Hybridoma Technology, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- By End user

- Biopharmaceutical Companies, Market Value (USD Million), and CAGR, 2024-2037F

- Research Laboratories, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Source

- Cross Analysis of Source W.R.T. End-User (USD Million), 2024-2037

- Latin America Monoclonal Antibodies (mAbs) Contract Manufacturing Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Latin America Monoclonal Antibodies (mAbs) Contract Manufacturing Market Segmentation Analysis (2024-2037)

- By Source

- Mammalian, Market Value (USD Million) and CAGR, 2024-2037F

- Microbial, Market Value (USD Million) and CAGR, 2024-2037F

- By Technology

- Recombinant DNA technology, Market Value (USD Million) and CAGR, 2024-2037F

- Hybridoma Technology, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- By End user

- Biopharmaceutical Companies, Market Value (USD Million), and CAGR, 2024-2037F

- Research Laboratories, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- Brazil, Market Value (USD Million) and CAGR, 2024-2037F

- Argentina, Market Value (USD Million) and CAGR, 2024-2037F

- Mexico, Market Value (USD Million) and CAGR, 2024-2037F

- Rest of Latin America, Market Value (USD Million) and CAGR, 2024-2037F

- By Source

- Cross Analysis of Source W.R.T. End-User (USD Million), 2024-2037

- Middle East & Africa Monoclonal Antibodies (mAbs) Contract Manufacturing Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Monoclonal Antibodies (mAbs) Contract Manufacturing Market Segmentation Analysis (2024-2037)

- By Source

- Mammalian, Market Value (USD Million) and CAGR, 2024-2037F

- Microbial, Market Value (USD Million) and CAGR, 2024-2037F

- By Technology

- Recombinant DNA technology, Market Value (USD Million) and CAGR, 2024-2037F

- Hybridoma Technology, Market Value (USD Million) and CAGR, 2024-2037F

- Others, Market Value (USD Million) and CAGR, 2024-2037F

- By End user

- Biopharmaceutical Companies, Market Value (USD Million), and CAGR, 2024-2037F

- Research Laboratories, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- GCC, Market Value (USD Million) and CAGR, 2024-2037F

- Israel, Market Value (USD Million) and CAGR, 2024-2037F

- South Africa, Market Value (USD Million) and CAGR, 2024-2037F

- Rest of Middle East & Africa, Market Value (USD Million) and CAGR, 2024-2037F

- By Source

- Cross Analysis of Source W.R.T. End-User (USD Million), 2024-2037

- Global Economic Scenario

- About Research Nester

Monoclonal Antibodies (mAbs) Contract Manufacturing Market - Historic Data (2019-2024), Global Trends 2025, Growth Forecasts 2037

Monoclonal Antibodies Contract Manufacturing Market in 2025 is estimated at USD 89.23 billion. The global market size surpassed USD 83.8 billion in 2024 and is projected to witness a CAGR of over 8.1%, crossing USD 230.66 billion revenue by 2037. Europe is expected to generate USD 85.57 billion by 2037, due to investment in biopharmaceutical manufacturing.

The market for monoclonal antibodies (mAbs) contract manufacturing is growing significantly due to the increasing utilization of biologics in oncology, autoimmune diseases, rare disorders, and other disorders. The industry continues to evolve with a focus on the development of CDMO (Contract Development and Manufacturing Organization) with large bioreactors and single-use technologies to increase production capacity. In April 2024, FUJIFILM Corporation committed USD 1.2 billion to increase the cell culture CDMO facility in North Carolina, which is one of the largest biomanufacturing destinations in North America. This investment is in line with the current trend in the market where there is a need to come up with cost-efficient and large-scale production of mAb to meet the demands of drug manufacturing firms.

Government support is also propelling the market growth, especially in the fields of biopharmaceuticals and advanced manufacturing. According to the International Trade Administration, in 2023, the U.S. biopharmaceutical industry spent USD 96 billion on research and development, thus maintaining its position as the largest producer of biologics in the world. Furthermore, the WHO noted that chronic diseases contribute to more than 70% of the global mortality rate, which will increase the need for mAb therapies. Regulatory agencies are also easing market access to biologics approval processes, meaning that the time to market for monoclonal antibody-based therapies is decreasing. Furthermore, the increasing dependency of biopharma on CDMOs for the transition from clinical to commercial manufacturing is increasing competition and advancement.

Key Monoclonal Antibodies Contract Manufacturing Market Insights Summary:

Regional Highlights:

- Europe is projected to account for around 37.1% revenue share by 2037 in the monoclonal antibodies (mAbs) contract manufacturing market, reflecting its strong CDMO ecosystem and biologics scale-up capabilities, supported by sustained biopharmaceutical investments and supportive regulatory frameworks

- Asia Pacific is anticipated to register a CAGR of approximately 9.2% during 2024–2037, highlighting its accelerating role in global mAbs outsourcing, fueled by rising biosimilar adoption, expanding biologics investments, and manufacturing cost advantages

Segment Insights:

- Mammalian Derived Segment in the monoclonal antibodies (mAbs) contract manufacturing market is projected to capture over 70% share by 2037, reflecting its dominance in biologics production efficiency and quality, supported by the shift toward high-yield expression platforms for complex therapeutics, bolstered by superior protein folding, glycosylation, and bioactivity

- Hybridoma Technology Segment is expected to account for more than 58.3% share by 2037, underscoring its sustained relevance in large-scale antibody generation and clinical development pipelines, reinforced by advancements in high-throughput screening and monoclonal antibody optimization

Key Growth Trends:

- Growing use of biologics and personalized medicine

- Increase in CDMO facilities and bioreactor capacity

Major Challenges:

- High-quality standards and regulatory requirements

- Supply chain concerns regarding raw material and bioreactor components

Key Players: Boehringer Ingelheim International GmbH, Catalent, Inc., Charles River Laboratoires International Inc., Cytovance Biologics, Eurofins Scientific SE, FUJIFILM Diosynth Biotechnologies, Lonza Ltd., Merck KGaA, Samsung Biologics Co., Ltd., Thermo Fisher Scientific Inc., WuXi Biologics (Cayman) Inc.

Global Monoclonal Antibodies Contract Manufacturing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 83.8 billion

- 2025 Market Size: USD 89.23 billion

- Projected Market Size: USD 230.66 billion by 2037

- Growth Forecasts: 8.1% CAGR (2025-2037)

Key Regional Dynamics:

- Largest Region: Europe (around 37.1% revenue share by 2037)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 23 April, 2025

Monoclonal Antibodies (mAbs) Contract Manufacturing Sector: Growth Drivers and Challenges

Growth Drivers

-

Growing use of biologics and personalized medicine: The global trend towards targeted therapies for cancer, autoimmune diseases, and orphan diseases has led to a greater need for mAbs contract manufacturing. There is a growing trend of pharmaceutical firms outsourcing their production processes to CDMOs in order to cut costs and scale up production. In January 2024, UCB Inc. got approval from the FDA for RYSTIGGO (rozanolixizumab-noli), which is a monoclonal antibody treatment for gMG. As precision medicine programs continue to advance, these contract manufacturers are assuming a pivotal position in producing large volumes of mAbs at a high level of quality while being compliant with the increasingly complex set of regulations that govern biologic drugs.

-

Increase in CDMO facilities and bioreactor capacity: The mAbs demand is considerably rising, as a result, leading biomanufacturers are investing in new manufacturing facilities and bioreactor capacities. Most CDMOs are now adopting the latest single-use bioreactor technologies for biologics production that is efficient and cost effective. In June 2024, AGC Biologics expanded the Denmark site to double its capacity, enhancing the company’s position in Europe biologics industry. The growth of mammalian cell culture-based production has resulted in the need for additional infrastructure, improved process effectiveness, and flexibility for contract manufacturers. These innovations are anticipated to decrease the cost of production and enhance the availability of life-saving biological products in the global market.

- Antibody-Drug Conjugate (ADC) manufacturing: The concept of ADCs, which are monoclonal antibodies linked to cytotoxic agents to target cancer cells selectively, is revolutionizing the biologics manufacturing industry. As the ADCs are gaining clinical success, the contract manufacturers are focusing on advanced bioprocessing technologies to manufacture the next-generation biologics. In November 2024, Samsung Biologics signed a USD 668 million deal with a European pharmaceutical firm to further enhance ADC production. This development also emphasizes the role of CDMOs in supporting the production of biologics with high accuracy and delivering oncology monoclonal antibodies and ADC therapies to the global monoclonal antibodies contract manufacturing market.

Challenges

-

High-quality standards and regulatory requirements: The global mAbs contract manufacturing industry has to adhere to various regulatory bodies such as cGMP, FDA, and EMA. CDMOs need to commit a significant amount of resources to quality assurance, process verification, and biosafety to adapt to changing biological drug approval requirements. The rules and regulations keep on changing frequently, making it quite challenging for manufacturers to adapt to the changes and update their production processes and documents. Non-compliance with these requirements may result in a slowdown of products’ approval, recall, and fines that affect the CDMO business and its clients.

-

Supply chain concerns regarding raw material and bioreactor components: The need for high-quality cell culture media, chromatography resins, and purification technologies is a cause for concern in the supply chain. Variations in raw material supply and bioreactor component supply chain can also affect mAbs production time and cost of manufacturing. Furthermore, few suppliers of specialized biologics materials increase the vulnerability of disruptions, especially due to factors such as pandemic or conflict.

Monoclonal Antibodies Contract Manufacturing Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

8.1% |

|

Base Year Market Size (2024) |

USD 83.8 billion |

|

Forecast Year Market Size (2037) |

USD 230.66 billion |

|

Regional Scope |

|

Monoclonal Antibodies (mAbs) Contract Manufacturing Segmentation

Source (Mammalian, Microbial)

Mammalian derived segment is set to capture over 70% monoclonal antibodies contract manufacturing market share by 2037, due to their ability to provide better protein folding, glycosylation, and bioactivity than microbial systems. The transition towards high-yield mammalian expression systems is driving progress in monoclonal antibody manufacturing, especially for oncology, immunology, and rare diseases. In September 2024, MilliporeSigma, the life sciences arm of Merck KGaA, launched the Mobius ADC Reactor, the first single-use reactor for monoclonal antibody-drug conjugates (ADCs). With more emphasis on mammalian-derived biologics, biopharma companies are building up their manufacturing capacities and improving their processes to meet the demand.

Technology (Recombinant DNA technology, Hybridoma Technology)

By 2037, Hybridoma technology segment is expected to capture over 58.3% monoclonal antibodies contract manufacturing market share, owing to its consistent performance in generating mAbs. Monoclonal antibodies are generated from hybridoma technology and have had a tremendous application in diagnostics, therapeutic drugs, and targeted biologics. In February 2024, Charles River Laboratories International Incorporated with Wheeler Bio to combine hybridoma-derived mAb production and clinical development services to enhance drug discovery and INDs. Due to the recent developments in hybridoma technology, high throughput screening, and optimization of monoclonal antibodies, the segment is progressing in both the pharmaceutical and diagnostic industries.

Our in-depth analysis of the global monoclonal antibodies contract manufacturing market includes the following segments:

|

Source |

|

|

Technology |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Monoclonal Antibodies (mAbs) Contract Manufacturing Industry - Regional Synopsis

Europe Market Analysis

Europe monoclonal antibodies contract manufacturing market is expected to account for revenue share of around 37.1% by 2037, attributed to high investment in biopharmaceutical and supportive regulatory frameworks for biologic manufacturing. It has several key CDMOs with sophisticated biomanufacturing capacity to meet the increasing production needs of monoclonal antibodies, biosimilars, and ADCs. This strengthens Europe position in the global mAbs manufacturing industry through the enhancement of public-private partnerships and research and development outlay.

Germany is one of the notable biopharmaceutical markets in Europe owing to high governmental investments, access to advanced R&D facilities, and stable regulation. The German Federal Ministry of Education and Research (BMBF) has earmarked over € 1 billion (USD 1.1 billion) for the development of biotech and to enhance biologics production. Due to the country’s highly skilled labor force and strong technological base, Germany is a dominant player in the mAbs contract manufacturing and biopharmaceutical industries.

France is set to increase its biomanufacturing capabilities through large-scale investments in CDMOs, biosimilars, and ADCs.For example, the government of France has unveiled its “France 2030” plan that will invest €7.5 billion (USD 8.2 billion) in health innovation to strengthen biopharmaceutical production in the country. France is trying to expand as a global hub for biologics manufacturing, precision medicine, and immunotherapy, which makes it a promising mAbs contract manufacturing location in Europe.

Asia Pacific Market Statistics

Asia Pacific monoclonal antibodies (mabs) contract manufacturing market is likely to exhibit CAGR of around 9.2% from 2024 to 2037, due to the increasing adoption of biosimilars, increasing investment in biologics, and cost advantages for manufacturing. China, India, South Korea, and Singapore are the most favored destinations for biomanufacturing owing to their large production capacity and supportive government policies for biologics and mAbs production.

India is building up its biopharmaceutical industry as the growth in biologics, biosimilars, and contract manufacturing partnerships expands. In August 2024, the Indian Central Drugs Standard Control Organisation (CDSCO) granted Boehringer Ingelheim’s SPEVIGO injection the approval for the treatment of generalized pustular psoriasis flares, and it is the first monoclonal antibody treatment in this category. Active governmental policies and policies for more R&D investment have paved the way for India to become a significant player in the monoclonal antibodies contract manufacturing market.

China remains the dominant mAbs contract manufacturing market in the Asia Pacific due to state-backed biotech investments and large-scale CDMO capacity expansions. In December 2024, WuXi Biologics and Sino Biopharm entered into an agreement for monoclonal antibody discovery and development using single B cell technology for the generation of the most efficient preclinical candidate. Currently, China is one of the largest producers of mAbs and has a promising future in the biologics market that is backed by the government.

Companies Dominating the Monoclonal Antibodies (mAbs) Contract Manufacturing Landscape

- AGC Biologics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Boehringer Ingelheim International GmbH

- Catalent, Inc.

- Charles River Laboratoires International Inc.

- Cytovance Biologics

- Eurofins Scientific SE

- FUJIFILM Diosynth Biotechnologies

- Lonza Ltd.

- Merck KGaA

- Samsung Biologics Co., Ltd.

- Thermo Fisher Scientific Inc.

- WuXi Biologics (Cayman) Inc.

The monoclonal antibodies contract manufacturing market is fragmented, where the global CDMOs are increasing their production capacity and adopting newer and better bioprocessing techniques. Some of the market leaders are AGC Biologics, Boehringer Ingelheim, Catalent, Charles River Laboratories, Cytovance Biologics, FUJIFILM Diosynth Biotechnologies, Lonza, Merck KGaA, Samsung Biologics, Thermo Fisher Scientific, and WuXi Biologics. These firms are investing in the growth of mammalian cell culture for biologics production, ADCs, and continuous bioprocessing.

Monoclonal antibodies (mAbs) continue to occupy a prominent role in today’s biologics, and developments in diagnostics continue to expand the range of mAb uses. In April 2024, Thermo Fisher Scientific introduced the EXENT Solution, which is an integrated mass spectrometry solution for monoclonal gammopathy, including multiple myeloma diagnosis. This advanced system enhances the detection and therapeutic measurement of mAb, which is vital in oncology precision medicine. The increasing usage of mAbs in diagnostic and therapeutic applications creates the need for large-scale manufacturing and robust supply chain management among contract manufacturing organizations.

Here are some leading companies in the monoclonal antibodies contract manufacturing market:

Recent Developments

- In October 2024, Lonza extended its long-term partnership with a leading biopharmaceutical company to expand ADC manufacturing at its Ibex Biopark in Visp, Switzerland. The expansion includes commercial-scale mAb production for ADC therapies, strengthening Lonza’s position as a leading CDMO in antibody-drug conjugates.

- In September 2024, Eurofins CDMO Alphora Inc. announced the construction of a GMP Biologics manufacturing facility in Mississauga, Ontario to produce monoclonal antibodies and protein therapies for clinical and commercial applications. The 112,000 sq ft facility is expected to increase global mAb production capacity by 2026.

- In August 2024, Merck Life Science entered into a strategic partnership with Aragen, an R&D and contract manufacturing solutions provider. The collaboration aims to accelerate the development of monoclonal antibodies and novel biologics, reinforcing the trend of big pharma partnering with biotech specialists for streamlined production.

- Report ID: 7165

- Published Date: Apr 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Monoclonal Antibodies Contract Manufacturing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.