Molded Pulp Packaging Market Outlook:

Molded Pulp Packaging Market size was over USD 5.54 billion in 2025 and is anticipated to cross USD 9.55 billion by 2035, growing at more than 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of molded pulp packaging is assessed at USD 5.82 billion.

The growth of the market can be attributed to the proactive effort by the government to reduce plastic in all sort of applications including packaging. This step is likely to open more opportunities for molded pulp packaging. The Indian government proposed the Plastic Waste Management Amendment Regulations in 2021 to forbid some single-use plastic products by 2022.

In addition to these, factors that are believed to fuel the growth of molded pulp packaging market include the rise in harmful packaging waste from the healthcare industry. On the other hand, the harmful material can be replaced by molded pulp as they are toxic-free and becomes convenient for manufacturing safe medical packaging. Around 20% to 25% of the 14 000 tons of garbage produced daily in US healthcare facilities is plastic yet, around 91% of plastics, including those used in healthcare, are not recycled and either end up in landfills or have gotten into the environment. Besides this, the rising use of packaged food, water, and beverages is also expected to boost market growth.

Key Molded Pulp Packaging Market Insights Summary:

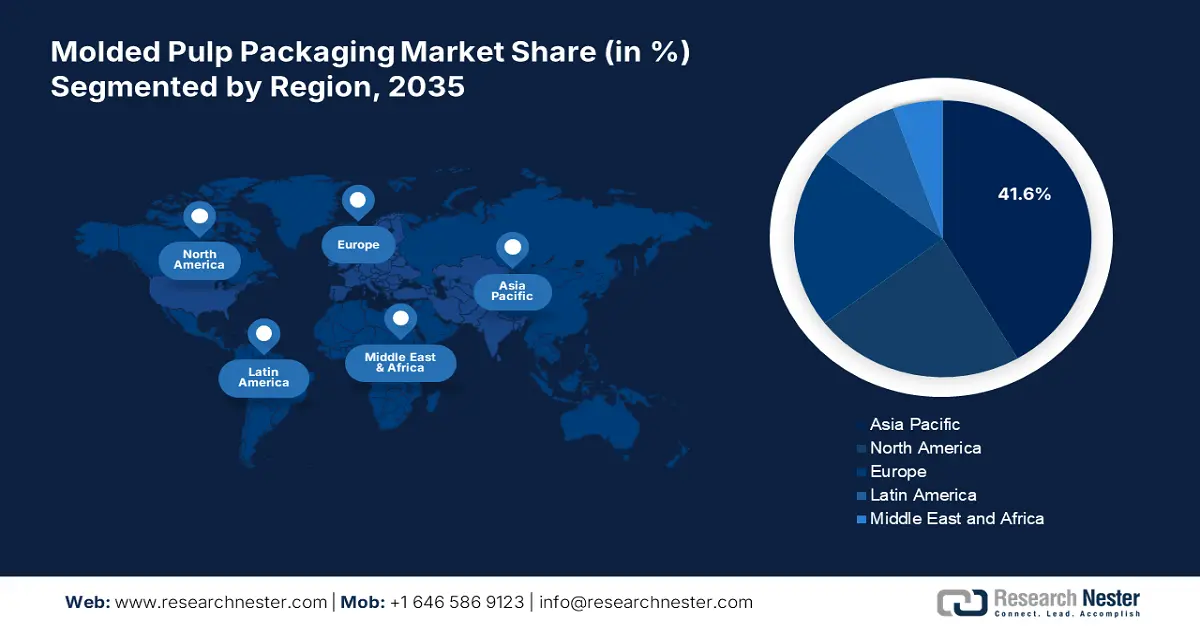

Regional Highlights:

- Asia Pacific molded pulp packaging market will hold over 41.6% share by 2035, driven by rising demand for sustainable packaging and increased egg consumption.

- North America market will secure the second largest share by 2035, fueled by rising packaging industry waste prompting demand for molded pulp packaging.

Segment Insights:

- The food packaging segment in the molded pulp packaging market is expected to secure the largest share by 2035, fueled by a rise in the number of people using online food services.

- The cups segment in the molded pulp packaging market is expected to hold a significant share by 2035, influenced by rising use of coffee cups and government efforts to ban single-use plastics.

Key Growth Trends:

- Growing Packaging Waste

- Rising Need for Sustainable Packaging

Major Challenges:

- Presence of Other Options for Biodegradable Packaging

- High Cost of Pulp Packaging

Key Players: Sabert Corporation, Molpack Corporation Ltd., YFY Jupiter, Inc., Pacific Pulp Molding, Inc., Best Plus Pulp Co., Hartmann, Smurfit Kappa, Western Pulp Products Company, Huhtamaki, SABIC.

Global Molded Pulp Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.54 billion

- 2026 Market Size: USD 5.82 billion

- Projected Market Size: USD 9.55 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, France

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 10 September, 2025

Molded Pulp Packaging Market Growth Drivers and Challenges:

Growth Drivers

- Growing Packaging Waste – After the life of molded pulp packaging expires, it can be recycled again to use in different industries. Moreover, it is lightweight and reduces excess space. Thus, curbing the packaging waste. Nowadays, 91% of packaging trash of the world is dumped in landfills or the environment.

- Rising Need for Sustainable Packaging– the production of molded pulp does not emit as much carbon dioxide as produced in other packaging material. Moreover, they are easily decomposed thus driving the packaging industry towards sustainability. In the United Kingdom, around 77% of consumers demand sustainable packaging from businesses. Moreover, nearly 50% of people agreed to pay more for the product if it is sustainably packed.

- Increasing Trends of Online Shopping –Online shopping or E-commerce is expected to boost the demand for packaging and is likely to create more opportunities for molded pulp packaging. In 2020, more than 1 billion people worldwide shopped online. Furthermore, this number jumped to more than 2 billion in 2021.

- Growing Consumption of Packaged Food – Molded pulp packaging is a safer option than toxic aluminum and petroleum packaging which is highly used in the food industry. The consumption value of packaged organic foods in India totaled USD 15 million in 2021. When compared to the prior year, the consumption value was around USD 14 million.

- Rising Efforts to Reduce Plastic – With the growing concern about the use of single-use plastics, molded pulp packaging is becoming more popular worldwide. According to the World Economic Forum, 170 countries made a commitment in 2019 to reduce their use of plastic by 2030. Furthermore, many have already begun by suggesting or enacting regulations for specific single-use plastics.

Challenges

- Presence of Other Options for Biodegradable Packaging - The other alternatives to molded pulp packaging are corrugated cardboard and mushroom foam. Mushroom foam resembles ordinary paper molded pulp in appearance and operation. On the other hand, corrugated cardboard can offer just as much security as polystyrene as a structural support system. Moreover, it is more affordable, eco-friendly, and highly recyclable.

- High Cost of Pulp Packaging - Molded pulp packaging is a viable solution for eco-friendly packaging, and switching to eco-friendly packaging can be expensive and especially for small enterprises. The cost of production of pulp packaging is expensive, moreover, it is further burdened by fluctuating prices of the raw material. However, the practice of using molded pulp packaging can be cost-effective in long run but it is hard to predict the specific time. Therefore, it becomes expensive to deploy the pulp packaging and is expected to hamper the molded pulp packaging market growth.

- Pulp Packaging Cannot Support Heavy Items.

Molded Pulp Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 5.54 billion |

|

Forecast Year Market Size (2035) |

USD 9.55 billion |

|

Regional Scope |

|

Molded Pulp Packaging Market Segmentation:

End-user Segment Analysis

The food packaging segment is estimated to gain the largest molded pulp packaging market share in the year 2035. The growth of the segment can be attributed to a rise in the number of people using online food services. By 2027, it is anticipated that almost 2,600 million people would order food online around the world. Besides this, the high non-renewable waste generation from the food packaging industry is also anticipated to augment the segment growth. In the United States, food packaging materials account for around 63% of the millions of tons of solid trash that are produced there. Moreover, in 2018 the United States manufactured close to 2 million tons of aluminum packaging which is a non-renewable packaging material. It can be seen all over the grocery stores from chips bags to soda cans.

Product Type Segment Analysis

The cups segment is expected to garner a significant share in the year 2035. The growth of the segment is majorly attributed to the rising use of coffee cups which majorly contributes to pollution. In the UK, almost 3 billion coffee cups are used each year and thrown away, besides this just one in every 400 of these cups is recycled. On the other hand, a rising effort by the government to ban single-use plastic for cups is also expected to boost segment growth. The European Commission decided to ban single-use plastics in 2022, including bags, cotton buds, cutlery, food containers, drinking cups, wet wipes, and others.

Our in-depth analysis of the global market includes the following segments:

|

By Molded Type |

|

|

By Product Type |

|

|

By Source |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Molded Pulp Packaging Market Regional Analysis:

APAC Market Insights

Asia Pacific region is expected to account for more than 41.6% market share by 2035, driven by rising demand for sustainable packaging and increased egg consumption. Young people between the ages of 20 and 29 show the most excitement and awareness for sustainable consumption, and Chinese consumers between the ages of 30 and 49 have the highest sustainable consumption abilities. Moreover, before purchasing a product, about 24% of Gen Z and millennial consumers in China check the packaging for sustainability. Furthermore, the rising consumption of eggs, for which generally molded paper tray packaging is used, is also expected to drive market growth in the region. In India, millions of people depend on eggs, and the annual consumption of eggs per person climbed from around 86 in 2019–20 to nearly 91 in 2020 - 21.

North America Market Insights

The North American molded pulp packaging market is slated to hold the second largest share during the forecast period. The growth of the market can be attributed majorly to the rising waste from the packaging industry. According to the United States Environmental Protection Agency, in 2018, 82.2 million tons of municipal solid waste (MSW) were generated, with a large majority of around 28.1% of the total waste being made up of containers and packaging. Moreover, EPA states that containers and packaging goods are presumptively thrown away the same year as the goods in them are purchased.

European Market Insights

The market in Europe, amongst the market in all the other regions, is projected to hold a significant share by the end of 2035. The growth of the market can be attributed majorly to the rising efforts put in by the government to reduce the waste generated from packaging. According to the European Commission, packaging waste in the EU is expected to rise by 19% by 2030, and by 46% in the case of plastic packaging. Moreover, around 180 kg of packaging waste is produced annually in Europe. While 40% of the plastic and 50% of the paper used in the EU are intended for packaging. European Commission proposed regulations to manage packaging waste, these proposals include that all packaging sold in the EU must be recyclable in a way that is profitable by 2030 in order to promote high-quality recycling.

Molded Pulp Packaging Market Players:

- Sabert Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Molpack Corporation Ltd.

- YFY Jupiter, Inc.

- Pacific Pulp Molding, Inc.

- Best Plus Pulp Co.

- Hartmann

- Smurfit Kappa

- Western Pulp Products Company

- Huhtamaki

- SABIC

Recent Developments

-

SABIC announces the collaboration with Mars Petcare and Huhtamaki for pet food packaging. They aim to advance pet food packaging and to give creative solutions to the leading brand of cat food, SHEBA.

-

Feet area. After this new facility, Sabert will have 4 domestic distribution centers and which is likely to grow the client base of the company in the United States and Western Canada.

- Report ID: 4744

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Molded Pulp Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.