Molded Foam Market Outlook:

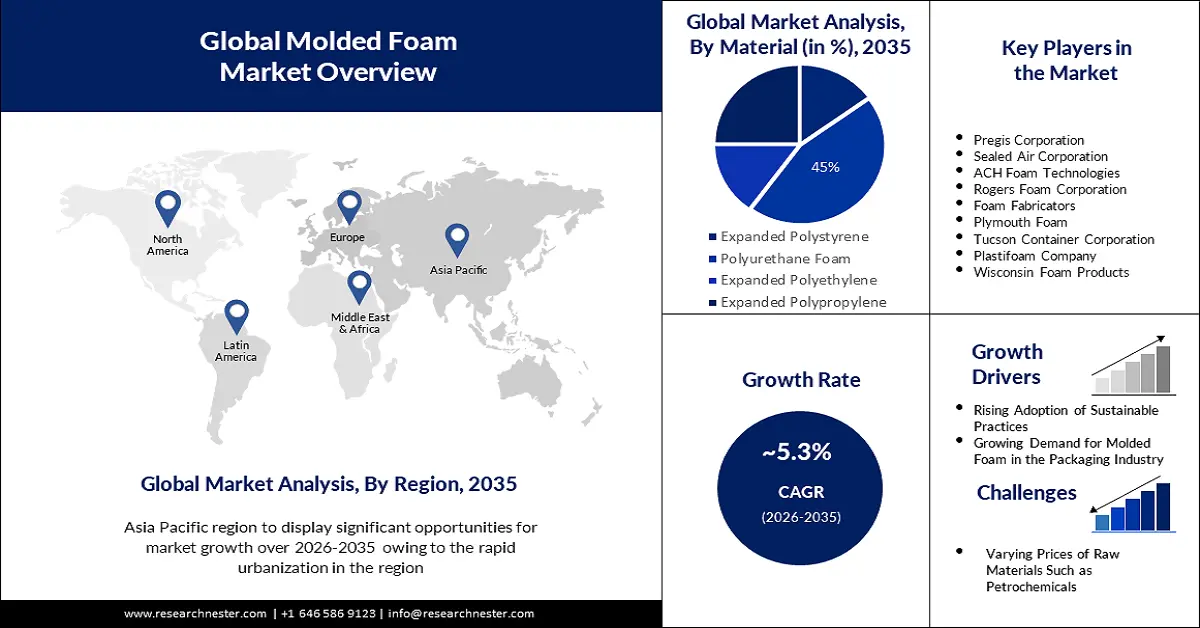

Molded Foam Market size was over USD 17.2 billion in 2025 and is anticipated to cross USD 28.83 billion by 2035, witnessing more than 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of molded foam is assessed at USD 18.02 billion.

The reason behind the growth is due to the growing production of automobiles across the globe owing to the increased consumer interest, and government policies. More than 55 million cars are produced annually, which accounts for about around 2% of global GDP. For instance, more than 85 million motor vehicles were produced globally in 2022, a 5% increase from 2021.

The growing need for aesthetic products is believed to fuel the molded foam market growth. Molded foams are best known to the furniture industry for their ability to produce a wide range of accessories, including mattresses, and are also offered in practical or aesthetically pleasing finishes.

Key Molded Foam Market Insights Summary:

Regional Highlights:

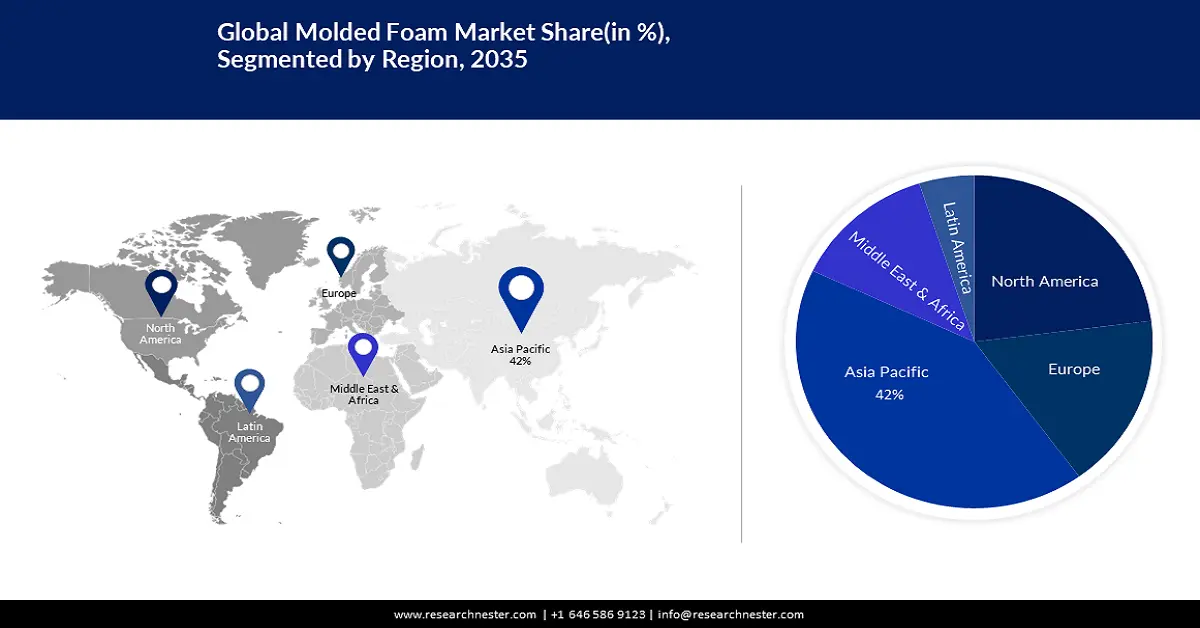

- Asia Pacific molded foam market will hold more than 42% share by 2035, driven by rapid urbanization, rising furniture demand, and expansion of the home furnishings sector.

- North America market will secure the second largest share by 2035, driven by a rapidly growing packaging industry and increased demand for packaged goods.

Segment Insights:

- The polyurethane foam segment in the molded foam market is projected to hold a 45% share by 2035, driven by its use in thermal insulation and protective packaging.

Key Growth Trends:

- Growing Demand for Molded Foam in the Packaging Industry

- Increasing Usage in the Construction Industry

Major Challenges:

- Varying Prices of Raw Materials Such as Petrochemicals

- Environmental concerns may impact the production processes

Key Players: Pregis Corporation, Sealed Air Corporation, ACH Foam Technologies, Rogers Foam Corporation, Foam Fabricators, Plymouth Foam, Tucson Container Corporation, Plastifoam Company, Wisconsin Foam Products.

Global Molded Foam Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.2 billion

- 2026 Market Size: USD 18.02 billion

- Projected Market Size: USD 28.83 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Thailand, Indonesia, Brazil

Last updated on : 16 September, 2025

Molded Foam Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Adoption of Sustainable Practices - Molded foam is completely inert and non-toxic, is remarkably resource-efficient, and is often distinguished by its environmentally favorable qualities.

-

Growing Demand for Molded Foam in the Packaging Industry- Foam packing materials come in a variety of formats that are easily accessible, including sheets, inserts, and custom-molded shapes, and have special qualities, which makes it a great option for packing a variety of goods.

-

Increasing Usage in the Construction Industry- Structural foam molding is a standard practice in the construction industry for producing strong building materials and is also employed in lightweight construction as formwork components. For instance, expandable foams are used to create thermal insulation that can reduce heating energy use by over 65%.

Challenges

-

Varying Prices of Raw Materials Such as Petrochemicals - The majority of non-renewable petrochemical raw materials are utilized in the production of commercial foams, making petrochemicals the most actively consumed raw materials across a wide range of end users. Numerous factors influence the cost of gasoline and diesel including the price of crude oil, followed by federal and state taxes, the global economic outlook, changes in supply and demand, and geopolitical tensions.

-

Environmental concerns may impact the production processes

-

Supply chain disruptions are expected to affect production

Molded Foam Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 17.2 billion |

|

Forecast Year Market Size (2035) |

USD 28.83 billion |

|

Regional Scope |

|

Molded Foam Market Segmentation:

Material Segment Analysis

The polyurethane foam segment is estimated to hold 45% share of the global molded foam market by 2035. The range of polyurethane foams includes flexible porous elastomers and stiff pneumatic resins which are continuously used in flexible foaming as it has several uses, including thermal insulation. The interaction of polyols and diisocyanate produces polyurethane foam, which is nearly ubiquitous owing to its favorable characteristics as compared to similar materials. One typical polymer used to manufacture foam is polyurethane (PU), which is also used in packaging since it is perfect for shielding lightweight and delicate items, and is breathable, flexible, soft, and instantly reverts to its former shape after compression. Molded polyurethane foam packaging is widely used in the shipping protection of automobile parts, and other foreign fragile products to shield the goods from damage while they are being shipped and stored. Polyether-based polyurethane (PU) foams come in a variety of colors, specifications, and densities that offer specialized, form-fitting padding at a reasonable price for distinctive and reliable item protection, and their use is anticipated to expand steadily in the coming years.

In addition, expanded Polypropylene (EPP) is a highly versatile closed-cell bead foam known for its flexibility and properties including outstanding energy absorption, multiple impact resistance, thermal insulation, buoyancy, water and chemical resistance, exceptionally high strength-to-weight ratio, and 100% recyclability. For instance, over 95% of air makes up expanded polypropylene, therefore it is incredibly light.

It is an excellent closed-cell foam mold that can be recycled and used in a variety of ways, and is currently widely used for many additional vehicle systems and parts, and is also used to insulate air conditioners, pumps, filters, motors, heaters, ventilation and refrigeration systems, and duct pipes.

Foam Type Segment Analysis

The closed cell segment in the molded foam market is set to garner a notable share shortly. Closed cell foam is a kind of foam in which the individual "cells" are encased and firmly compressed, and is considered a premium material that offers lightweight protection for the body from impacts while offering outstanding absorption. Closed-cell foams are produced by molding, casting, or extrusion into rectangular sheets, continuous rolls, molded strips, or bespoke profiles, which are denser and more widely used varieties of polyether foam in a variety of applications, including soundproofing, padding for weight equipment, seating in recreational vehicles, and waterproof barriers. Closed cell foam has outstanding tensile strength, floats, has a high insulating value works well in both cold and hot conditions, and is also very resistant to dust. Moreover, owing to its superior air barrier qualities over open-cell foam, closed-cell foam is frequently utilized in buildings and can be quite helpful for a range of applications that call for insulation against heat and sound, shock resistance, and moisture.

Our in-depth analysis of the global molded foam market includes the following segments:

|

Foam Type |

|

|

Material |

|

|

Application |

|

|

Form |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Molded Foam Market Regional Analysis:

APAC Market Insights

Molded foam market in Asia Pacific is predicted to account for the largest share of 42% by 2035 impelled by rapid urbanization. China's urbanization rate has increased dramatically in recent years driven by fast suburbanization through the in-situ conversion of towns and villages and migration from rural to urban areas. Over 50% of China's population lives in cities, which has led to a surge in demand for furniture and houses. The growth of the social economy as well as the furniture business is influenced by the Chinese furniture industry which includes a variety of goods such as dining chairs, couches, armchairs, and ottomans. For instance, more than 66% of China's population resided in cities as of 2023.

In addition, India is one of the world's top five makers of furniture and ranks fourth globally in terms of furniture consumption and fifth globally in terms of furniture production. The Indian furniture industry is a subset of the home furnishings sector driven by the growing demand for durable and hybrid seating furniture, rising urbanization, and rising demand for modern, modular furniture among urban people.

North American Market Insights

The North America molded foam market is estimated to be the second largest, during the forecast timeframe led by the growing packaging industry. One of the packaging markets with the quickest rate of growth is the United States, where sales are expected to rise from around USD 713 billion units in 2021 to over USD 764 billion units by 2026 fueled by increased spending power, and a resulting rise in the demand for packaged goods.

Molded Foam Market Players:

- Sonoco Products Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pregis Corporation

- Sealed Air Corporation

- ACH Foam Technologies

- Rogers Foam Corporation

- Foam Fabricators

- Plymouth Foam

- Tucson Container Corporation

- Plastifoam Company

- Wisconsin Foam Products

Recent Developments

- Sonoco Products Company acquired the flexible packaging division of Graphic Packaging Corporation to increase Sonoco's market share by twofold in the packaging industry's fastest-growing sector: flexible packaging, and contribute substantial new and increased capacity in North America for flexible packaging, a packaging industry seeing growth rates higher than the GDP.

- Pregis Corporation revealed investment in the development of multilayer PE film technology to provide the packaging sector with cutting-edge, environmentally friendly solutions constantly, and enable Pregis to design and manufacture high-yield, high-performing "thin" PE film that works very well for use with AirSpeed inflatable systems.

- Report ID: 5695

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Molded Foam Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.