Mobile Cobots Market Outlook:

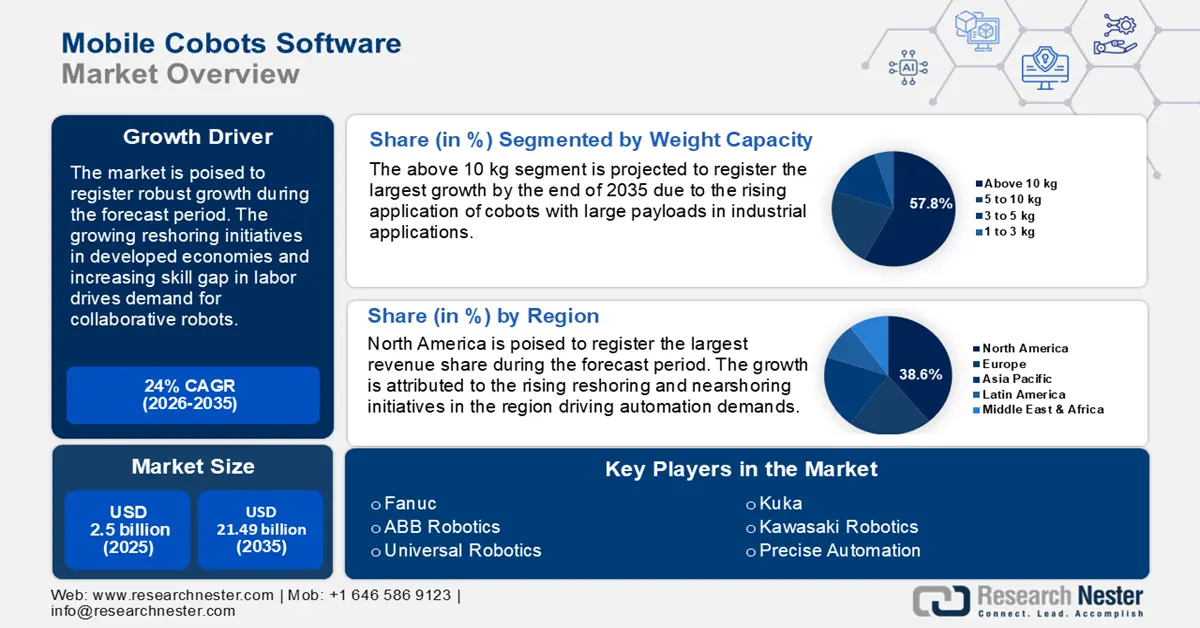

Mobile Cobots Market size was valued at USD 2.5 billion in 2025 and is likely to cross USD 21.49 billion by 2035, expanding at more than 24% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of mobile cobots is assessed at USD 3.04 billion.

A major factor in the mobile cobots market’s expansion is attributed to rapid advancements in collaborative robots. The trends indicate that the market is driven by the shortage of skilled labor coupled with the surging demand for flexible automation. In December 2024, the International Federation of Robotics (IFR) updated its position paper on mobile cobots with key statistics in the table below.

|

Key Statistics of Collaborative Robots |

|

|

Total Industrial Robots installed globally (2023) |

541,302 |

|

Total share of Cobots in global Industrial Robot installations (2023) |

10.5% |

Source: International Federation of Robotics (IFR)

Furthermore, IFR’s statistics indicate that collaborative robots will complement traditional industrial robots in improving productivity to cater to stringent product margins. The growing labor shortage has created the demand for mobile cobots in multiple industries. The automotive industry, a major end user of mobile cobots, is experiencing trends of heavy investment in short supply lines to bring processes closer to customers, where robot automation is applied for cost-effective battery manufacturing and in electric vehicle (EV) projects. For instance, in August 2024, the BMW Group announced the successful trial run of humanoid robots in its Spartanburg production plant. The testing was supported by Figure, a leading robotics company from California.

The table below indicates the unfulfillment of manufacturing jobs as per a report released by the National Association of Manufacturers (NAM) which is expected to drive adoption of mobile cobots.

|

Manufacturing Skills Gap Report (U.S.) |

|

|

Estimated unfulfilled manufacturing jobs by 2030 |

2.1 million |

|

Potential cost of unfulfilled jobs by 2030 |

USD 1 trillion |

Source: National Association of Manufacturers (NAM)

With U.S. set to be a leading market in the global mobile cobots sector. The expansion of the market in the U.S. is poised to have favorable impact on the market worldwide. Additionally, the mobile cobots market is expected to leverage rising demand from multiple industries such as healthcare, logistics & warehousing, aerospace, food packaging, agriculture, etc., to widen the scope of application creating favorable opportunities for mobile cobots manufacturers. The favorable trends for the industry’s growth are projected to remain stable by the end of 2037.

Key Mobile Cobots Market Insights Summary:

Regional Highlights:

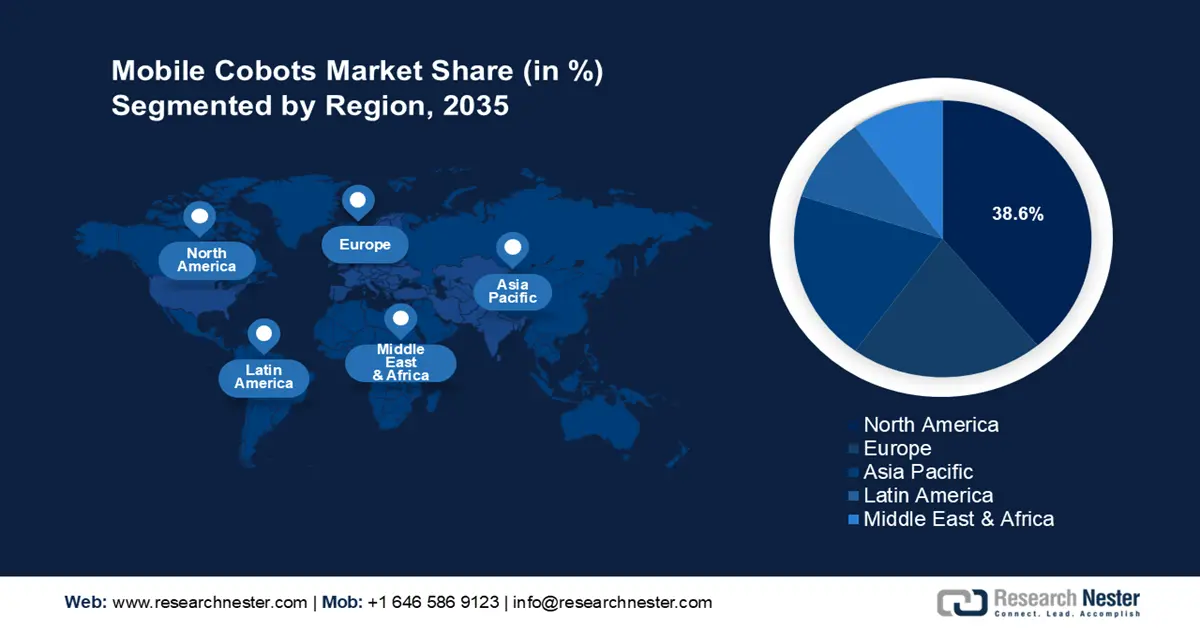

- North America holds a 38.6% share in the Mobile Cobots Market, driven by the reshoring trend and rising automation adoption, positioning it for strong growth through 2026–2035.

- Europe's Mobile Cobots Market is poised for rapid expansion by 2035, attributed to nearshoring trends and rapid deployment of industrial robots.

Segment Insights:

- The Above 10 kg segment is projected to hold a substantial share by 2035, driven by rising demand for high-payload cobots and advancements in robotic technologies.

- The 5 to 10 kg segment of the Mobile Cobots Market is poised to expand significantly from 2026 to 2035, driven by increasing demand from consumer goods, electronics, and automotive industries for mid-range payload cobots.

Key Growth Trends:

- Rising reshoring initiatives

- Integration of artificial intelligence (AI) and digital automation

Major Challenges:

- Charging constraints of mobile cobots

- Handling of fragile and delicate materials

- Key Players: Fanuc, ABB Robotics, Universal Robots, Doosan Robotics, Franka Emika, Kuka, Stäubli, Kawasaki Robotics, Collaborative Robotics, Precise Automation, Yaskawa Electric Corporation, Mobile Industrial Robots.

Global Mobile Cobots Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.5 billion

- 2026 Market Size: USD 3.04 billion

- Projected Market Size: USD 21.49 billion by 2035

- Growth Forecasts: 24% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 13 August, 2025

Mobile Cobots Market Growth Drivers and Challenges:

Growth Drivers

- Rising reshoring initiatives: To negate the impact of supply chain disruptions, and to ensure greater production agility, manufacturers are relocating operations to home countries which is a major driver of the mobile cobots industry. Mobile cobots play a vital role in reshoring by automating tasks and mitigating labor shortages. Additionally, the majority of industrial products require semiconductor chips which impact the reshoring trend, and specifically designed robots assist in the automation of silicon wafer fabrication.

A few instances of reshoring initiatives are, in January 2022, Intel announced an investment worth USD 20 billion to establish two new advanced chipmaking factories in Ohio, U.S., and automation solution providers are leveraging the trends to supply mobile cobots. For instance, in November 2024, Wes-Tech Automation Solutions announced support for the reshoring movement by helping manufacturers to evaluate the return on investment (ROI) of leveraging automation for reshoring. - Integration of artificial intelligence (AI) and digital automation: The rapid integration of AI and digital automation with mobile cobots has boosted industrial operations. AI-enabled mobile cobots offer enhanced collaboration with human workers. The integration boosts productivity which in turn allows businesses to rapidly cater to mobile cobots market demands. The trends offer lucrative opportunities for manufacturers to integrate AI-enabled mobile cobots for automation in production stages.

The below table highlights trends shaping the connected digital ecosystem which will influence the growth of the mobile cobots industry.

|

Global trends in automation for the Mobile Cobot Industry |

|

Source: IFR

Furthermore, key players in the mobile cobots sector are launching advanced robots that combine advanced AI, modular manipulation systems, and mobility to leverage the favorable trends within the industry. For instance, in November 2024, Collaborative Robotics launched Proxie, an advanced highly-adaptable collaborative robot that is adept at material handling tasks and announced leading companies such as Maersk, Moderna, Mayo Clinic, Tampa General Hospital, and Owens & Minor as customers.

- Advancements in robotics facilitating ease-of-use: The continuous advancements in robotics technology have led to a greater percentage of the successful use case of mobile cobots in various industries. A major advancement that has boosted the adoption of mobile cobots is the expansion of accessibility to non-experts. Key players in software-driven automation companies have enabled users to manage cobots without prior programming experience.

Furthermore, the advent of no-code or low-code technology has allowed users of varied skill levels to program robots. The trends have created profitable revenue segments within the mobile cobots market to offer sensors and new software that facilitate collaborative setup operations. For instance, in November 2023, ABB Robotics announced the offering of intuitive, block-based no-code programming for cobots and industrial robots.

Challenges

-

Charging constraints of mobile cobots: Mobile cobots require batteries and a power source to efficiently function. Disruptions in charging can lead to downtime for manufacturers. Furthermore, manufacturers require fully automatic charging stations for efficient functioning of mobile cobots which can add to implementation and maintenance costs. Additionally, inconsistent charging infrastructure across geographical locations and facilities can complicate cobot deployment especially in regions lacking robust technological infrastructure.

-

Handling of fragile and delicate materials: While AI advancements are underway, cobots face challenges in precision bin picking, which remains one of the most sought-after tasks for cobots. Bottlenecks can exist when the robot arm grabs objects that are mixed and overlap in a container. The advent of machine learning is poised to overcome the bottleneck to ensure extra precision. Additionally, the handling of fragile and delicate materials without causing damage can pose a challenge for cobots. Any damage to delicate materials can heighten costs.

Mobile Cobots Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

24% |

|

Base Year Market Size (2025) |

USD 2.5 billion |

|

Forecast Year Market Size (2035) |

USD 21.49 billion |

|

Regional Scope |

|

Mobile Cobots Market Segmentation:

Weight Capacity (Above 10 kg, 5 to 10 kg, 3 to 5 kg, 1 to 3 kg)

By weight capacity, the above 10 kg segment is expected to account for more than 57.8% mobile cobots market share by the end of 2035. A major driver of the segment is the increasing application of cobots weighing above 10 kg in material handling. The advancements in robotic technologies have enabled cobots to handle larger payloads while maintaining precision. Furthermore, the trends indicate the rising demand for high-payload cobots in automation solutions. In May 2023, Fanuc, a leading player in the mobile cobots sector, introduced two new high-payload capacity collaborative robots with expanded payload capacities of its CRX and CR cobot lines to handle products from 4 to 50 kg.

In November 2024, the IFR published a successful use case in the use of cobots to increase ROI with the use case boding well for increasing investments in the manufacturing of cobots above 10 kg. The use case indicated that Raymat collaborated successfully with Universal Robots to automate complex TIG welding, MIG welding, and CNC machine tending applications.

|

Cobots Production Output at Raymath |

|

|

Increase in production capacity with cobots |

200% |

|

Improvement in machine tending performance with cobots |

600% |

Source: IFR

The 5 to 10 kg segment of the mobile cobots sector is poised to expand during the forecast period. The growing demand from the consumer goods, electronics, and automotive industries for 5 to 10-kg payload mobile cobots to improve operations and maintain safety standards is a key factor in the segment’s growth. In the rapid adoption of automation in industrial spaces, the moderate payloads provide the ability to execute repetitive operations at a fast pace.

Additionally, the demand from small and medium-sized manufacturers for cobots between 5 to 10 kg is poised to expand with key industry players investing to increase production to cater to demand. For instance, in September 2024, Vention Ltd., and ABB Robotics announced collaboration to expand mobile cobots market reach to small and medium-sized manufacturers. In the collaboration, the ABB GoFa robots will be available on the Vention marketplace to provide manufacturers with payloads ranging from 5 to 10 kg.

Application (Robotic Arms, Automatic Pallet Forks, Conveyor Brands/Belts, Safety Units, Shelf Units)

The robotic arms segment of the mobile cobots market is projected to grow during the forecast period. A key driver of the segment’s expansion is the rising application of robotic arms in welding and assembly across multiple sectors. Furthermore, improved precision offered for repetitive tasks such as palletizing, picking, and sorting is poised to benefit the segment’s growth by driving demand. Additionally, the advent of AI and IoT integration in robotic arms ensures downtime reduction positioning them as indispensable tools in industrial automation. The table below indicates the operational stock of industrial robots globally from 2020 to 2023, with the increasing figures auguring well for the demand for robotic arms.

|

Global Operational Stock of Industrial Robots |

|

|

2023 |

4.28 million |

|

2022 |

3.90 million |

|

2021 |

3.47 million |

|

2020 |

3.02 million |

Source: The World Robotics Report

Our in-depth analysis of the mobile cobots market includes the following segments:

|

Segment |

Subsegment |

|

Weight Capacity |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mobile Cobots Market Regional Analysis:

North America Market Forecast

North America in mobile cobots market is expected to hold over 38.6% revenue share by the end of 2035. The increasing reshoring initiatives in the region are a major driver of the market with mobile cobots positioning themselves as a vital component to ensure ease of reshoring. Furthermore, advancements in automation have positioned North America as a competitive mobile cobots market. The table below indicates key reshoring trends in North America that are poised to drive demand for mobile cobots in automation.

|

Reshoring Trends in North America |

|

|

Total Cost of Ownership (TCO) estimation |

U.S.-based manufacturing locales registered an advantage against offshoring to China in 32% of cases bolstered by the 15% Section 301 tariffs raise. |

|

Favorable U.S. Government Economic Policies |

The three bills, i.e., Bipartisan Infrastructure Law, Chips and Science Act, Inflation Reduction Act have assisted in leveling the playing field in certain industries. |

Source: A3 Association for Advancing Automation

Furthermore, advancements in automation, including mobile cobots are poised to drive nearshoring and reshoring initiatives in North America.

The U.S. mobile cobots market is projected to account for a dominant share in North America. Reshoring initiatives in the U.S. fueled by advancements in automation and increasing integration of mobile cobots in production facilities create a burgeoning industry in the country. Additionally, growing investments to advance robotics and its application benefit manufacturers of mobile cobots. In April 2024, the Mass Leads Act proposed USD 25 million for a new program to expand investments and research in robotics.

Furthermore, the recent collaboration between robotics and automotive companies to integrate robots in automobile production is poised to create revenue streams in the mobile cobots sector. For instance, in January 2024, Figure, a California-based company developing autonomous humanoid robots, announced a commercial agreement with BMW Manufacturing Co., Ltd., to deploy robots for the automation of difficult tasks.

The Canada mobile cobots market is poised for expansion by the end of 2035. Canada benefits from the reshoring initiatives in North America which are driving the demand for automation solutions. A key driver in the market is the expansion of smart manufacturing initiatives in the country. The table below refers to robotics technology adoption statistics in Canada which assist the growth of the mobile cobot sector in the country.

|

Robotics Adoption in Canada |

|

Canada was ranked in fifteenth among the top 20 countries for industrial robotics adoption by the International Federation of Robotics in 2023. |

|

From 2016 to 2019, the robot density in Canada has increased per 10 thousand employees. The automotive sector of Canada is poised to lead the demand for cobots. |

|

Firms in Canada that have embraced robotics have reported increase in productivity in 2020 and grew their workforce by nearly 20% suggesting robotics adoption to address the skilled labor shortage in Canada. |

Source: Statistique Canada

Europe Market Forecast

The Europe mobile cobots market is poised to register the fastest expansion during the forecast period. The rapid integration of industrial robots in Europe bodes well for the mobile cobots market in the region. For instance, in September 2024, IFR reported Europe to account for 17% of robotics deployment in 2023. Additionally, the rising nearshoring demand in Europe is poised to benefit the expansion of the mobile cobots sector. The table below refers to automotive investments and industrial robot installations in countries in the European Union, and the increasing rate of installation highlights the growth of the mobile cobots market.

Industrial Robots Installation by Country in EU (2023)

|

Name of the Country |

Units Installed |

Increase in % |

|

Germany |

28.3 thousand |

+7% |

|

Spain |

5.05 thousand |

+31% |

|

Slovakia |

2.17 thousand |

+48% |

|

Hungary |

1.65 thousand |

+31% |

Source: IFR

The Germany mobile cobots market is expected to register the largest revenue share in Europe and maintain its growth by the end of 2035. German accounted for the largest installment of industrial robots in 2023 as per the IFR, registering a 7% increase in comparison to the preceding year. The rising demand for robotics in the industrial sector is positioned to create profitable revenue streams in the domestic sector with Germany having a robust automotive industry with a stronghold in global automobile production expected to lead demand for mobile cobots.

Furthermore, the advent of nearshoring and offshoring trends in the country is poised to heighten the installation of mobile cobots in the country. For instance, in February 2023, Wolfspeed announced plans to build the world’s largest silicon carbide device manufacturing facility in Germany. The advent of such mega projects is an emerging trend supporting the adoption of mobile cobots.

The France mobile cobots market is poised to expand during the forecast period. France remains the third largest market in EU. Despite a 13% reduction in industrial robotics installation in 2023, the market in France is expected to leverage advancements in robotics supported by government and EU initiatives. Additionally, a sustained push to bolster domestic production by integrating automation is poised to create lucrative opportunities in the sector. The trend is supported by the expansion of automation solutions companies to France. For instance, in February 2024, the logistics automation specialist Swisslog announced the expansion of its presence in France.

Key Mobile Cobots Market Players:

- Fanuc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB Robotics

- Universal Robots

- Doosan Robotics

- Franka Emika

- Kuka

- Stäubli

- Kawasaki Robotics

- Collaborative Robotics

- Precise Automation

- Yaskawa Electric Corporation

- Mobile Industrial Robots

- Comau SpA

The global mobile cobots market is poised for expansion during the forecast period. Key players in the market are investing to launch advanced collaborative robots capable of various payloads to increase revenue share. Additionally, key players are investing in offering low-code and no-code collaborative robots to expand the scope of usage in the mobile cobots markets while keeping up with the demand for automation solutions. A recent advent of a major player in the mobile cobots sector upgrading payloads was by Universal Robots. In September 2024, Universal Robots announced an increase in the payload capacity of its new-generation high payload cobots, i.e., UR20 and UR30, facilitating customers to lift more at no additional cost.

Here are some key players in the mobile cobots market:

Recent Developments

- In November 2024, Mobile Industrial Robots announced the MC600 mobile collaborative robot. The new cobot has been approved by MiR Go and is capable of handling payloads of up to 1322 lbs. (600 kg) to assist in automating complex workflows in industrial environments.

- In October 2024, Universal Robots launched its AI accelerator to enable a new wave of AI-powered cobot innovations. Universal Robots’ next-generation software platform PolyScope X powered by NVIDIA Isaac accelerated libraries and AI models, and is designed for commercial and research applications.

- Report ID: 6967

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mobile Cobots Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.