Mixing Console Market Outlook:

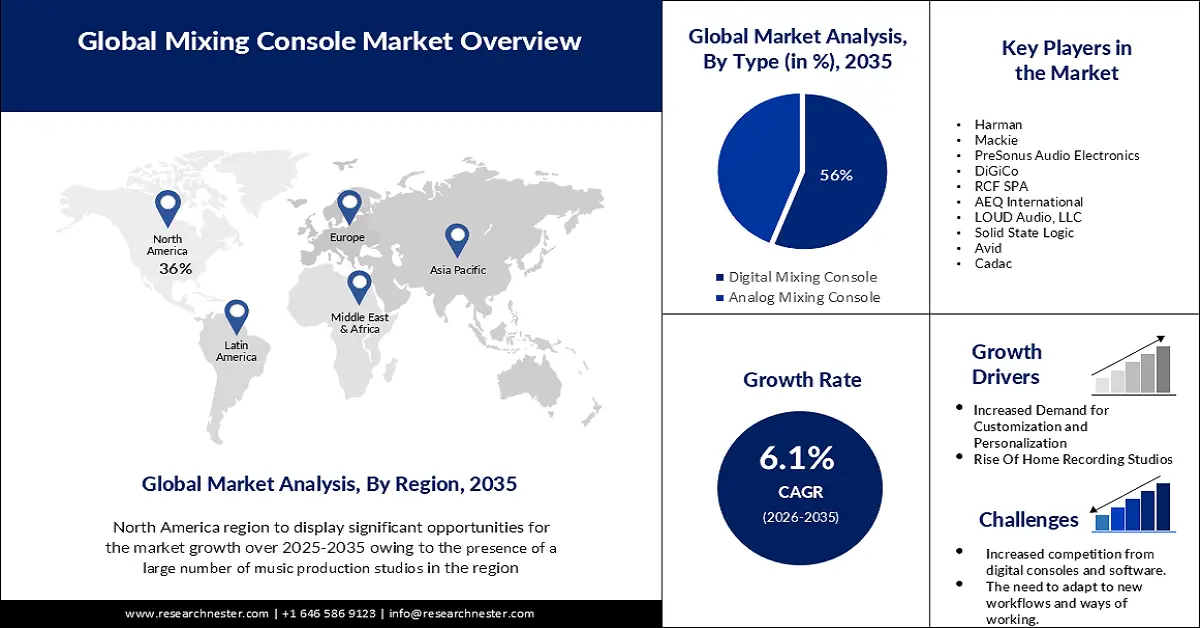

Mixing Console Market size was valued at USD 2.1 billion in 2025 and is set to exceed USD 3.8 billion by 2035, expanding at over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of mixing console is estimated at USD 2.22 billion.

Individuals have become increasingly able to record audio with the advent of personal computers and the internet. This has led to an increase in the demand for mixing consoles, as it allows professionals to edit and polish recordings. New technologies and softwares such as AI-assisted audio mixing, including Cryo Mix, iZotope Neutron, Sonible, LANDR, Maastr, Unchained Music, Waves Nx, are likely to further increase demand for mixing consoles.

As technology continues to evolve, manufacturers are introducing new features into mixing consoles to make them more powerful and efficient. One trend is the integration of digital signal processing (DSP) technology, which allows for more precise control of sound and greater flexibility in mixing. Another trend is the use of touchscreens and mobile apps to control mixing consoles, making them more intuitive and user-friendly.

Key Mixing Console Market Insights Summary:

Regional Highlights:

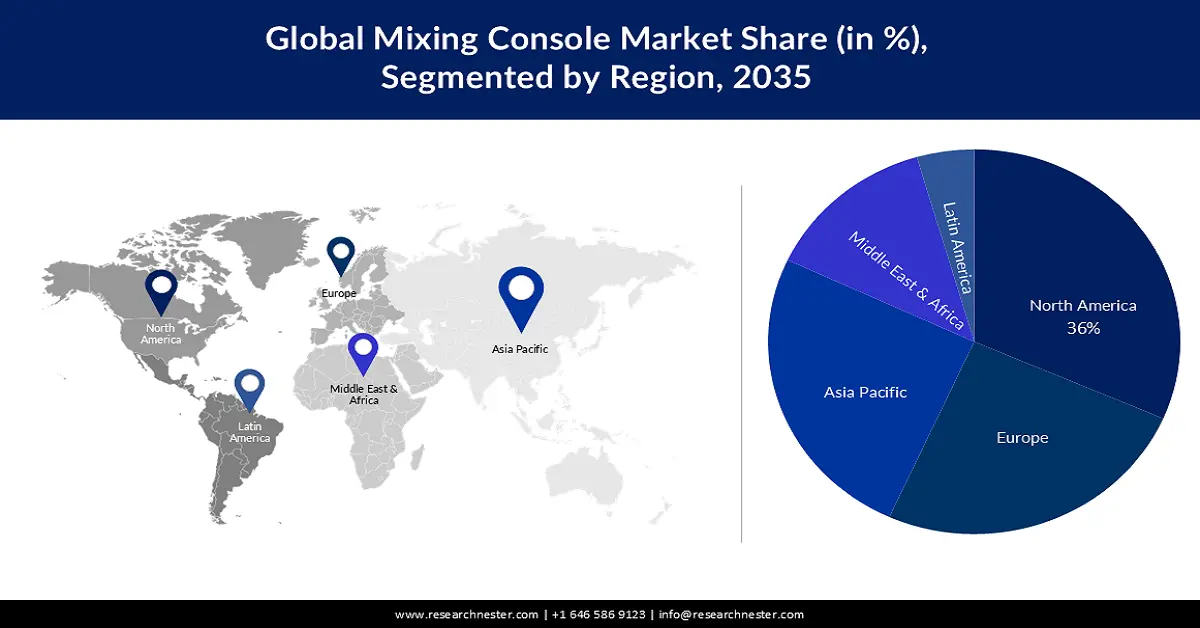

- The North America mixing console market will hold over 36% share by 2035, driven by the presence of many music production studios and rising concerts and live events.

- The Europe market will secure 28% share by 2035, driven by a vibrant music scene, government support, and growing demand for streaming services.

Segment Insights:

- The digital mixing console segment in the mixing console market is projected to hold a 56% share by 2035, driven by growing demand for audio production and advanced DSP capabilities.

- The broadcast tv segment in the mixing console market is anticipated to capture a 38% share by 2035, propelled by the increasing use of streaming services requiring audio mixing.

Key Growth Trends:

- Increased Demand for Customization and Personalization

- Increasing Demand of Live Streaming and Online Content

Major Challenges:

- Rapidly Evolving Technology and The Need to keep up with New Developments

- Increased competition from digital consoles and software.

Key Players: Harman, Mackie, PreSonus Audio Electronics, DiGiCo, RCF SPA, AEQ International, LOUD Audio, LLC, Solid State Logic, Avid, Cadac.

Global Mixing Console Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.1 billion

- 2026 Market Size: USD 2.22 billion

- Projected Market Size: USD 3.8 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 11 September, 2025

Mixing Console Market Growth Drivers and Challenges:

Growth Drivers

-

Increased Demand for Customization and Personalization - As the music industry continues to diversify, there is an increasing demand for mixing consoles that can accommodate a wide range of genres and styles. This has led to a trend towards more customizable and personalized mixing consoles, with features like user-defined presets and flexible routing options. A vast majority, 97% of advertising experts, within the music, movies and media industry incorporate personalization techniques in their marketing strategies. This allows mixers to tailor their console to the specific sound they are looking for, rather than having to choose between only a handfuls of pre-loaded presets. This is why the demand for mixing consoles, which allow users to customize and personalize their music, is on the rise.

-

Rise Of Home Recording Studios - With the rise of home recording studios, there is more demand for mixing consoles that can quickly and easily adapt to different recording setups. This has caused an increase in demand for high-quality mixing consoles with features such as multiple inputs, digital signal processing, and wireless connectivity. This is because the mixing console needs to be able to quickly and easily adjust the EQ, reverb, and other audio settings in order to capture the best sound possible. Additionally, many home recording studios want the ability to record multiple instruments at the same time, which requires a mixing console with more inputs.

- Increasing Demand of Live Streaming and Online Content - The growth of live streaming and online content creation has created a need for compact and portable mixing consoles that can be used in a variety of settings. Approximately a quarter of the time spent viewing content worldwide is dedicated to watching live content while the remaining majority, around 78% is allocated to on-demand content. In the year 2023 43% of individuals residing in the United States have engaged with live streamed content. When comparing data from the quarter of 2021 to that of the previous year there has been a significant increase of approximately 15% in live streaming viewership. Live streaming and content creation requires a lot of equipment, and mixing consoles are essential tools for the broadcaster. Compact and portable consoles allow broadcasters to easily set up their equipment in any location, and they can be powered by batteries, making them even more versatile.

Challenges

-

Rapidly Evolving Technology and The Need to keep up with New Developments - The mixing console market is constantly evolving, with new technologies and features being introduced regularly. This can make it challenging for companies to keep up with the latest trends and stay competitive.

-

Increased competition from digital consoles and software.

- The need to adapt to new workflows and ways of working.

Mixing Console Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 2.1 billion |

|

Forecast Year Market Size (2035) |

USD 3.8 billion |

|

Regional Scope |

|

Mixing Console Market Segmentation:

Type Segment Analysis

The digital mixing console market is estimated to gain the largest revenue share of about 56% in the year 2035. The segment growth can be attributed to the growing demand for audio production and recording studios that require digital mixing consoles to create high-quality sound. The Digital Sound Processing (DSP) devices in the digital mixer allow for more precise control of the audio signal, allowing it to be manipulated in more complex ways. This control can be used to adjust the tone of the signal, add or remove certain frequencies, or even create special effects such as reverb and delay.

Application Segment Analysis

Mixing console market from the broadcast TV segment is estimated to gain the significant share of about 38% in the year 2035 driven by increasing use of streaming services, such as Netflix, Hulu, and Amazon, which are expected to grow at a fast pace in the coming years. As of the quarter of 2023 Netflix boasts a subscriber base of 230 million users. This popular streaming service experienced a rise, in subscribers by 5.6 million compared to the previous quarter. As streaming services become more popular, they are replacing the traditional television method for viewing content. This is driving the demand for mixing consoles, which are used to mix audio and create sound for streaming services.

Our in-depth analysis of the mixing console market includes the following segments:

|

Type |

|

|

Application |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mixing Console Market Regional Analysis:

North America Market Insights

Mixing console market in North America is anticipated to hold the largest with a share of about 36% by the end of 2035. Market growth in the region is also expected on account of the presence of a large number of music production studios and the rising number of concerts and live events in the region. As of 2022 the United States is home to a total of 20,637 businesses in the Audio Production Studios industry. This represents growth of 3.3% compared to the year before. Among these businesses California leads the way with 9,410 establishments, followed by New York with 4,460 and Florida with 2,760. Furthermore, the increasing demand for high-quality audio equipment, the availability of a wide range of products, and the growing preference for digital mixing consoles are expected to drive mixing console market growth in the region.

European Market Insights

The European mixing console market is estimated to be the second largest, registering a share of about 28% by the end of 2035. Europe is home to a vibrant music scene with a strong fan base, as well as a large network of record labels, producers, and promoters. In addition, European governments have been very supportive of the music sector, providing tax incentives and other forms of support. In 2020 the music industry revenue, in Europe reached a total of €4,969.5 million with approximately 95.56 million users. This has resulted in a strong demand for mixing consoles, as musicians and producers need them to create professional recordings. Moreover, the growing demand for streaming services has also increased demand for mixing consoles, as these services require high-quality audio.

Mixing Console Market Players:

- Harman

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mackie

- PreSonus Audio Electronics

- DiGiCo

- RCF SPA

- AEQ International

- LOUD Audio, LLC

- Solid State Logic

- Avid

- Cadac

Recent Developments

- DiGiCo has recently introduced their line of large scale live audio production mixing consoles. While still maintaining a sense of familiarity, the Quantum852 offers improvements in audio quality through enhanced algorithms resulting in a significant advancement, in processing power.

- The PreSonus StudioLive 32 digital mixer is a high quality device designed for audio applications and its now receiving an impressive upgrade. With its ability to control 32 channels individually the StudioLive 32S is a digital mixer that offers the capabilities of a larger mixer in terms of mixing power.

- Report ID: 5398

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mixing Console Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.