Mitral Valve Disease Market Outlook:

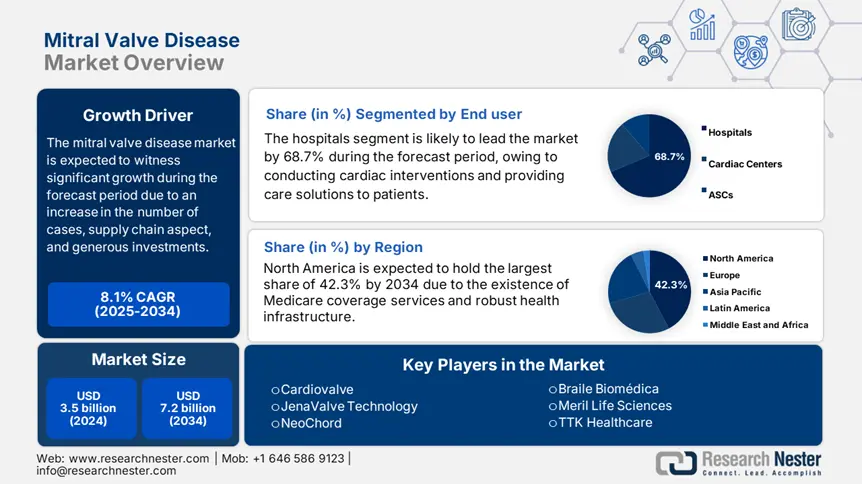

Mitral Valve Disease Market size was USD 3.5 billion in 2024 and is anticipated to reach USD 7.2 billion by the end of 2034, growing at a CAGR of 8.1% during the forecast period, i.e., 2025-2034. In 2025, the industry size of mitral valve disease is estimated at USD 3.8 billion.

The international patient pool in the mitral valve disease (MVD) market is projected to constitute more than 25 million cases every year, of which 4.7 million critical cases need intervention. The rising aging population is one of the key drivers, with an estimated 12.5% of adults aged over 75 years readily suffering from moderate to severe valvular disorder. Besides, the supply chain aspect for MVD treatments includes complicated logistics, such as medical device manufacturing, bioprosthetic valve materials, and API production for anticoagulants. The U.S. effectively imports approximately 40% of its valve-based raw materials, initially from Switzerland, Germany, and Ireland, while India and China source 45% of generic MVD drugs, thus suitable for the market expansion globally.

Moreover, the worldwide trade in the market has increased to USD 9.5 billion as of 2023, of which transcatheter devices effectively account for 65% of exports from the U.S. and Europe. Besides, assembly lines are concentrated in West Europe and North America for mechanical valves, while Asia Pacific is dominating the production of disposable catheters. Meanwhile, private and public investments for conducting research, development, and deployment (RDD) have surged to USD 2.2 billion as of 2023, of which 70% has been provided to transcatheter advancements. The U.S. FDA has accepted more than 7 latest MVD devices as of 2023, thereby escalating the overall market.

Mitral Valve Disease Market - Growth Drivers and Challenges

Growth Drivers

- Increase in aging population and disease occurrence: The international aging demographic is one of the biggest growth drivers for the market demand. According to the 2024 CDC report, an estimated 15% of adults suffer from the disease, of which 2.3 million patients need suitable treatment options, particularly in the U.S. Besides, MVD incidences in Germany have surged to 17.5% over the past 7 years, and readily affected almost 480,500 patients as of 2024. Additionally, Asia Pacific has witnessed a rapid rise, owing to lifestyle disorders, such as diabetes and hypertension, with the prevalence in China projected to be twice by the end of 2030.

- Extension in transcatheter and minimally invasive therapies: There has been a sudden transition from open-heart surgery to transcatheter mitral valve repair (TMVR), which is effectively revolutionizing the global market. In this regard, the TMVR integration in Europe has increased to 42.5% between 2020 and 2024, which is led by the UK and France. Besides, MitraClip procedures in the U.S. currently account for approximately 65.5% of mitral valve interventions, which has surged from 30% over the past seven years. Therefore, this trend is highly fueled by short hospital accommodations, which is 4 days in comparison to a week for surgery.

- Supply chain and trade optimization for valve manufacturing: The global supply chain for the market is undergoing changes. For instance, the U.S. readily imports 50% of transcatheter components, such as nitinol frames, from Ireland and Germany. Besides, China is dominating the API manufacturing for anticoagulants, such as warfarin, with 21.5% growth in export as of 2023. However, geopolitical challenges have augmented expenses, with valve production costs rising to 8.5% as of 2023. Organizations are positively responding, with Abbott opening a USD 220 million TMVR facility in Texas to reduce import dependency, thus suitable for market upliftment.

Manufacturer Strategies Shaping the Market

Revenue Potential for Major MVD Manufacturers (2023-2024)

|

Company |

Key Product |

Revenue Impact (2023-2024) |

Market Share Change |

|

Abbott Laboratories |

MitraClip G4 |

+USD 1.3 billion (Global sales) |

+5.1% (U.S. dominance) |

|

Edwards Lifesciences |

Pascal Precision |

€425 million (EU sales) |

+7.2% (EU adoption) |

|

Medtronic |

TMVR Training in Asia |

18.5% APAC revenue growth |

+3.5% (India/China) |

|

Boston Scientific |

AI-Guided Repairs |

USD 305 million (U.S. hospitals) |

+4.1% (Tech-driven) |

Sources: FDA, EMA, WHO, NIH

Feasible Expansion Models Shaping the Market

Revenue Feasibility Models (2022-2024)

|

Model |

Region |

Revenue Impact |

Key Outcome |

|

Hospital Partnerships |

India |

+12.7% Revenue |

40.5% cost reduction |

|

Govt. Reimbursement |

U.S. |

USD 1.9 billion Medicare |

25.3% TMVR adoption growth |

|

Localized Manufacturing |

Brazil |

15,500 procedures |

30.3% faster treatment access |

Sources: ICMR, CMS, Ministério da Saúde

Challenges

- Inadequate physical training for TMVR: The aspect of limitation in trained specialists has deliberately throttled the integration of innovative MVD therapies, which has caused a hindrance in the overall market. For instance, approximately 30.5% of cardiologists in India are skilled in TMVR techniques, which has pressured patients to gain care at urban facilities. Likewise, rural hospitals in the U.S. deliberately lack TMVR programs, which tends to delay care for almost 35% of eligible patients. However, manufacturers are making investments in education to overcome this barrier and enhance the market exposure globally.

- Barriers in patient cost-effectiveness: The aspect of high expenses effectively prevents accessibility even in the presence of treatment availability, which negatively impacts the market. For instance, almost 70% of MVD patients in Brazil depend on underfunded public hospitals, where the waiting duration tends to exceed over two years. Similarly, underinsured patients from the U.S. experience more than USD 10,500 in copayments for TMVR, despite the availability of Medicare coverage, thus limiting the market expansion.

Mitral Valve Disease Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

8.1% |

|

Base Year Market Size (2024) |

USD 3.5 billion |

|

Forecast Year Market Size (2034) |

USD 7.2 billion |

|

Regional Scope |

|

Mitral Valve Disease Market Segmentation:

End user Segment Analysis

The hospitals segment in the market is anticipated to hold the largest share of 68.7% by the end of 2034. The segment’s growth is effectively fueled by its role as the primary center for complicated cardiac interventions. Hospitals generously provide suitable care pathways by combining post-operation rehabilitation, surgery, and diagnostics, essential for MVD’s multidisciplinary treatment demands. Besides, the TMVR implementation in hospitals has increased by 35% between 2022 and 2034, owing to hybrid operating room investments, along with Medicare reimbursements, thus suitable for uplifting the segment’s growth.

Product Segment Analysis

The transcatheter devices segment in the market is expected to hold the second-largest market share of 60.5% during the forecast duration. The segment’s upliftment is effectively attributed to superior clinical results as well as minimally invasive nature. The incorporation of Edwards’ Pascal systems and Abbott’s MitraClip has surged to 41.5% between 2022 and 2024, which is driven by CE and FDA acceptances for extended indications. Besides, TMVR devices can diminish hospital accommodations to almost 3 to 5 days and reduce a month’s mortality rates to 2%. Therefore, all these factors are readily responsible for bolstering the segment in the market within the forecast timeline.

Material Segment Analysis

The bioprosthetic valves segment in the market is expected to garner the third-largest market share of 55.8% during the forecast timeline. The segment’s exposure is fueled by its wide-range utilization in both transcatheter and surgical mitral valve interventions. This particular segment has originated from porcine tissue and bovine pericardium and tends to reduce the demand for long-lasting anticoagulation therapy, thereby making it the most suitable choice for elderly patients, comprising more than 72% of MVD cases. Besides, the segment’s development is also propelled by cutting-edge anti-calcification technologies, including Edwards' Inspiris Resilia tissue treatment.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Product |

|

|

Material |

|

|

Treatment |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mitral Valve Disease Market - Regional Analysis

North America Market Insights

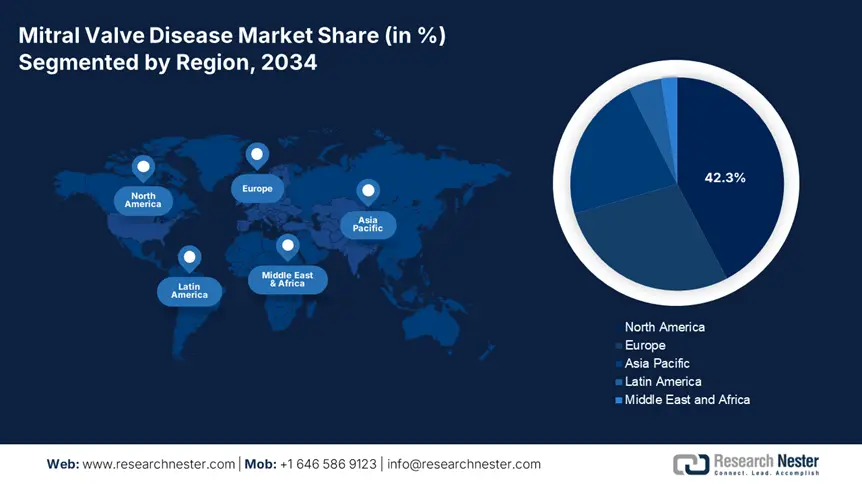

North America in the mitral valve disease market is considered to be the dominant region, with a projected market share of 42.3%, along with an 8.2% growth rate by the end of 2034. The market’s growth in the region is effectively fueled by an increase in the implementation of transcatheter therapies, along with the presence of innovative healthcare facilities. The U.S. is dominating the region, owing to Medicare coverage facilities for the majority of TMVR procedures, along with the provision of federal funding for healthcare. Besides, Canada is also contributing with funds allocated for cardiac care, along with a surge in outpatient TVMR and AI-based valve repairs.

The mitral valve disease market in the U.S. is effectively dominating the region, owing to rapid TVMR implementation, catering to 40.5% growth as of 2022, along with an upsurge in Medicaid and Medicare expenditure, accounting for USD 5.5 billion as of 2023. Besides, Medicaid generously covers more than 75% of TMVR procedures, of which USD 850 million has been provided in 2024. Meanwhile, AI-powered valve repairs, advancements in devices, and outpatient TMVR are other key trends that are uplifting the market in the overall country. For instance, NIH-funded clinical studies have demonstrated 28.5% rapid procedures, while CMS reimbursements for similar day discharges diminish expenses by 19.5%.

The mitral valve disease market in Canada is also significantly growing at a rate of 6.7%, which is highly driven by the provision of public healthcare investments, accounting for USD 3.4 billion as of 2023. Besides, Ontario is majorly leading the country’s exposure, with 20% increased spending on valve treatments over the past 4 years. Meanwhile, gaps in rural care, bioprosthetic valve preference, and provincial TMVR expansion are other key trends that are positively impacting the market in the country. For instance, the USD 55 million program of Alberta enhanced accessibility by almost 38%, while almost 72% of surgeries utilize tissue valves to combat anticoagulants.

North America Mitral Valve Disease Supply Chain & Trade Facilities (2022-2025)

|

Facility Name |

Location |

Function |

Year Operational |

|

Abbott Vascular Manufacturing |

Santa Clara, U.S. |

Produces MitraClip components & final assembly |

2022 (Expansion) |

|

Edwards Lifesciences Innovation Hub |

Irvine, U.S. |

R&D and production of Pascal TMVR systems |

2023 |

|

Medtronic TMVR Training Center |

Minneapolis, U.S. |

Surgeon training & device prototyping |

2022 |

|

Boston Scientific AI Integration Lab |

Marlborough, U.S. |

AI-driven valve repair system development |

2024 |

|

Health Canada-Approved Sterilization Facility |

Toronto, Canada |

Ethylene oxide sterilization for imported valves |

2023 |

|

CryoLife Tissue Processing Plant |

Kennesaw, U.S. |

Bovine pericardial tissue treatment for valves |

2022 |

|

Canada Medical Device Free Trade Zone |

Vancouver, Canada |

Tariff-free import/export hub for cardiac devices |

2024 |

Sources: FDA, NIH, CMS, AHRQ, Health Canada, CDC, Trade Commissioner

APAC Market Insights

Asia Pacific in the mitral valve disease market is the fastest-growing region, with an expected 22.1% by the end of the forecast timeline, owing to a rise in cardiovascular disease occurrence and an increase in the aging population. China is readily dominating the region with the largest revenue share, and is driven by administrative healthcare and medical expenditure since 2024. This is followed by India, with yearly growth through public funding to cater to untreated and undiagnosed patients. Malaysia and South Korea are following closely, and are rapidly incorporating affordable TMVR devices, with 22% and 32% increases in procedural volumes.

The mitral valve disease market in China is expected to hold 50% of the region’s share, which is fueled by the USD 4.4 billion administrative healthcare expenditure as of 2024. In addition, the country comprises 1.7 million patients diagnosed with MVD, with the TMVR integration increasing to 31.5% yearly, owing to acceptances for 5 regional devices as of 2023. Besides, the country’s National Reimbursement Drug List (NRDL) presently covers 3 cutting-edge bioprosthetic valves, diminishing out-of-pocket expenses by 34%. Therefore, all these factors are effectively responsible for bolstering the overall market in the country.

The mitral valve disease market in India is projected to account for 23% of the region’s market, with the provision of USD 2.1 billion in public funding as of 2023. In addition, the country caters to almost 2.5 million patients demanding treatment for the disease. Besides, localized players, such as TTK Healthcare, are effectively addressing poor accessibility with USD 2,500 mechanical valves by capturing 15.7% market share. Meanwhile, the Ayushman Bharat scheme generously covers valve surgeries for 520 million citizens, but only 8.5% are able to receive care, owing to shortages in hospitals. The aspect of low-cost bioprosthetics and private-public collaborations are other growth opportunity for the market growth in the country.

APAC Government Initiatives in Mitral Valve Disease (2022-2025)

|

Country |

Initiative/Policy |

Funding/Scope |

Launch Year |

|

Australia |

Medicare Benefits Schedule (MBS) expansion for TMVR |

USD 128 million allocated for TMVR reimbursement (covers 1,250 procedures/year) |

2023 |

|

Malaysia |

National Cardiovascular Disease (CVD) Program |

USD 60 million for cardiac care, including MVD treatments (focus on rural areas) |

2022 |

|

South Korea |

AI-Based Cardiac Care Initiative |

USD 525 million for AI-driven diagnostics (includes MVD screening) |

2024 |

Sources: Australian Government Health, MOH Malaysia, KFDA

Europe Market Insights

Europe in the mitral valve disease market is expected to hold a considerable share of 28.2% during the projected timeline. The market’s upliftment in the region is effectively propelled by the presence of progressive health and medical systems, along with a rise in the aging population. Germany is deliberately leading the region’s revenue, owing to yearly spending and reimbursement coverage solutions. This is followed by France, with increased provision of funds as a part of its health budget. The UK is also contributing to the NHS adoption of TMVR to combat waiting timelines. Besides all these factors, regional strategies, such as the €2.7 billion Health Data Space, have escalated AI-powered diagnostics, thereby suitable for market development.

The mitral valve disease market in Germany is dominating the overall region with 32.7% revenue share, which is driven by nearly 100% reimbursement coverage for TMVR, as well as the €4.1 billion in yearly healthcare expenditure. The country is also leading in outpatient TMVR integration, diminishing hospital accommodations by at least 50% and also saving €10,500 per procedure. Besides, more than 550 hybrid operating rooms, the country generously performs over 25,500 TMVR procedures every year, which is backed by AI-based diagnostics, further funded with €520 million, thus denoting a positive impact on the overall market.

The mitral valve disease market in France is projected to hold 22.7% of the region’s market by generously allocating 7.5% of its health budget, accounting for €1.3 billion for progressive treatment, such as bioprosthetic and TMVR valves. The French National Authority for Health has successfully fast-tracked 7 TMVR devices as of 2023, thereby bolstering the market incorporation by almost 19.5%. Besides, biosimilar anticoagulants have lowered expenses by 27.5%, while telecardiology programs have effectively aimed to cater to barriers in rural accessibility, thereby creating an optimistic outlook for the market in the country.

Key Mitral Valve Disease Market Players:

- Abbott Laboratories (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Edwards Lifesciences (U.S.)

- Medtronic (Ireland)

- Boston Scientific (U.S.)

- LivaNova (UK)

- CryoLife (U.S.)

- MicroPort Scientific (China)

- Braile Biomédica (Brazil)

- Meril Life Sciences (India)

- TTK Healthcare (India)

- JenaValve Technology (Germany)

- Cardiovalve (Israel)

- NeoChord (U.S.)

- Corcym (Italy)

- Xeltis (Netherlands)

The international mitral valve disease market is extremely consolidated, with the existence of organizations, including Medtronic, Edwards, and Abbott, collectively dominating the market with 60% of share through TMVR integration. Besides, training programs, product expansion, and investments are other tactical initiatives that these companies have deliberately implemented to uplift the market globally. For instance, according to the 2024 FDA report, Abbott initiated the expansion of its MitraClip G4 in Asia, while Edward made an investment of USD 560 million in Pascal Precision for outpatient TMVR, thereby suitable for skyrocketing the market’s exposure across different nations.

Here is a list of key players operating in the global market:

Recent Developments

- In May 2024, Abbott Laboratories declared that it received the FDA acceptance for its cutting-edge MitraClip G5 system, which features AI-powered leaflet grasping to diminish procedure duration by almost 25%.

- In April 2024, Edwards Lifesciences unveiled Pascal Precision+ in Europe, which is a TMVR system with actual echocardiography integration, which has been possible through an investment of €320 million in Irish manufacturing.

- Report ID: 7964

- Published Date: Jul 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mitral Valve Disease Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert