Minimal Residual Disease Market Outlook:

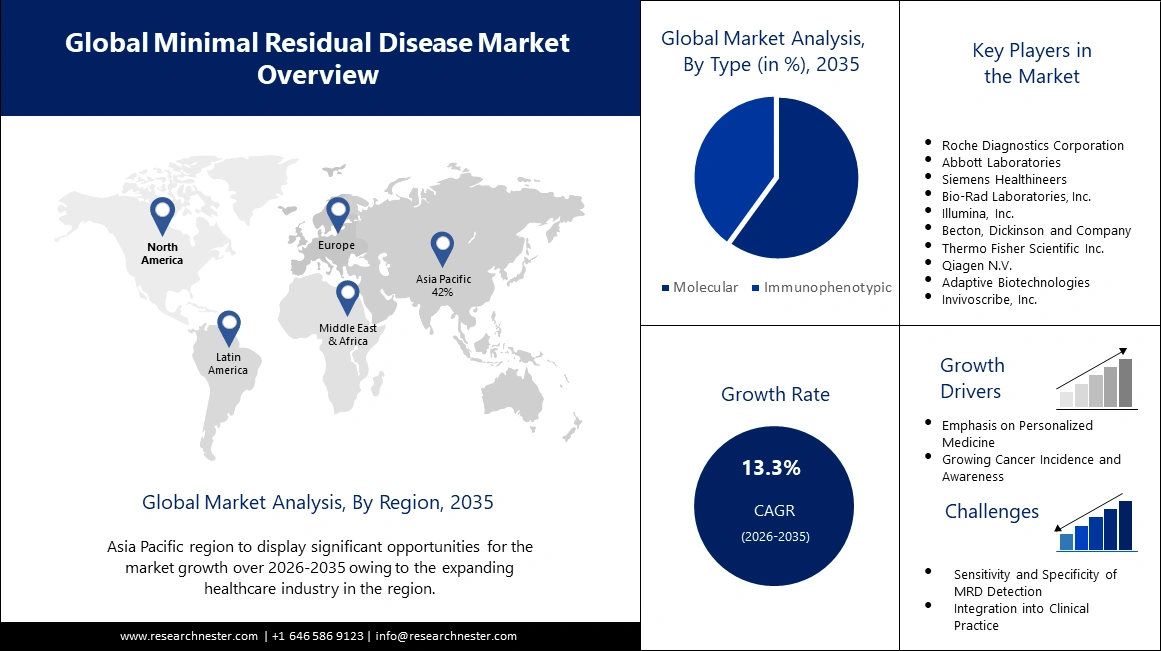

Minimal Residual Disease Market size was valued at USD 2.21 billion in 2025 and is likely to cross USD 7.7 billion by 2035, expanding at more than 13.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of minimal residual disease is assessed at USD 2.47 billion.

One of the predominant factors propelling the minimal residual disease (MRD) revenue share is the relentless advancement in diagnostic technologies specifically designed for precise and sensitive detection of residual cancer cells.

Recent years have seen significant growth in SGD testing use, largely because of the Genomics England 100,000 Genomes Project. As the understanding of cancer biology deepens, there is an increasing demand for sophisticated tools capable of identifying minimal residual disease with heightened accuracy, thereby influencing treatment decisions and patient outcomes. Continuous innovations in diagnostic methodologies, notably the integration of next-generation sequencing (NGS), liquid biopsy techniques, and highly sensitive imaging technologies, have significantly enhanced the capabilities of MRD detection.

In addition, the increasing prevalence of cancer ailment worldwide will also significantly propel the minimal residual disease market growth rate. In fact, globally people 69 years of age and younger, who were in the prime of their lives, accounted for around 57% of new cancer cases and 47% of cancer deaths. By providing more accurate and reliable information about the presence of minimal residual disease, clinicians can tailor treatment plans more precisely, leading to improved patient outcomes and a higher likelihood of successful long-term remission.

Key Minimal Residual Disease Market Insights Summary:

Regional Highlights:

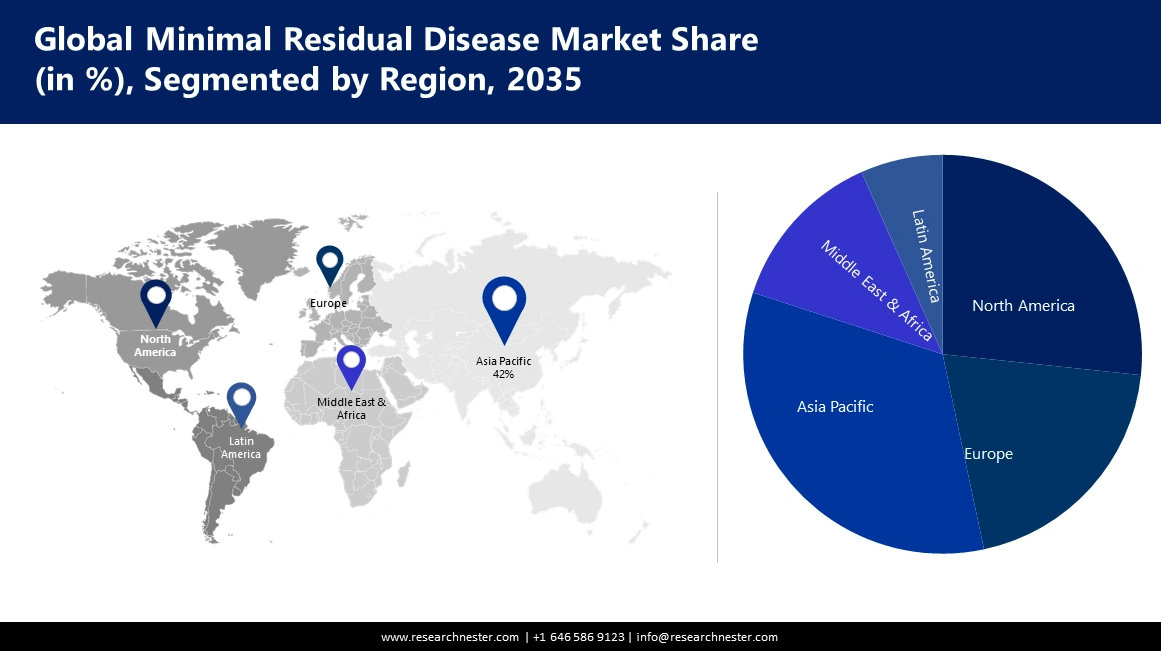

- North America minimal residual disease market will secure over 42% share, driven by rising cancer cases and increasing adoption of minimal residual disease techniques, forecast period 2026–2035.

- Asia Pacific market will hold the second largest share, fueled by rising investments in screening and supportive reimbursement policies, forecast period 2026–2035.

Segment Insights:

- The molecular segment in the minimal residual disease market is projected to command a 60% share by 2035, driven by continuous advancement in sensitivity and specificity of molecular MRD techniques.

- Flow cytometry segment in the minimal residual disease market is expected to achieve 56% growth by the forecast year 2035, driven by the increasing use of flow cytometry as a powerful tool to detect cancer cells worldwide.

Key Growth Trends:

- Rising emphasis on personalized medicine

- Rising cancer awareness globally

Major Challenges:

- Integration into clinical practice

Key Players: Roche Diagnostics Corporation, Abbott Laboratories, Siemens Healthineers, Bio-Rad Laboratories, Inc., Illumina, Inc., Becton, Dickinson and Company, Thermo Fisher Scientific Inc., Qiagen N.V., Adaptive Biotechnologies Corporation, Invivoscribe, Inc.

Global Minimal Residual Disease Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.21 billion

- 2026 Market Size: USD 2.47 billion

- Projected Market Size: USD 7.7 billion by 2035

- Growth Forecasts: 13.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, China

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 16 September, 2025

Minimal Residual Disease Market Growth Drivers and Challenges:

Growth Drivers

-

Advancements in diagnostic technologies - There has been a notable breakthrough in medical technology in recent years. Modern innovations have completely changed how people identify, track, and manage illnesses. The possibilities are virtually limitless, ranging from data integration and artificial intelligence to cutting-edge technology and medicinal breakthroughs like mRNA and CRISPR. Such cutting-edge medical systems technology optimizes patient outcomes and experiences while increasing diagnostic and diagnostic imaging accuracy and efficiency.

These breakthroughs in diagnostic technologies have changed the way people treat minimal residual diseases. These diagnoses help to detect the ailment at an early stage thus, increasing the minimal residual disease market share. - Rising emphasis on personalized medicine - According to medical professionals, pharmacogenomics research, which combines the fields of pharmacology and genomics, offers useful data that helps physicians comprehend the influence of a patient's genetic fingerprint and how that patient reacts to a specific treatment. This helps to get more precise treatment for chronic diseases that increases the market revenue of minimal residual diseases.

Furthermore, by matching the optimal medicine and dosage determined by a patient's genetic composition, this approach seeks to enhance the pharmacological response and reduce side effects associated with treatment. This inclination towards personalized medicines has created wonders for the chronic disease world and made the minimal residual disease market grow even faster. - Rising cancer awareness globally - Cancer is an international illness that is growing quickly. Healthcare systems worldwide are confronted with formidable obstacles in addressing this matter. However, thirty to fifty percent of cancer cases are avoidable. The most economical long-term approach to cancer control is prevention. The secret to early detection and improved health-seeking behavior is cancer awareness.

Cancer is a prevalent disease in both industrialized and developing nations, yet public awareness of the disease is still low.

Challenges

-

Standardization of MRD assessment - In children with B-precursor acute lymphoblastic leukemia (B-ALL), minimal residual disease (MRD) has a very favorable prognostic value. MRD is commonly assessed by flow cytometry, which takes advantage of the phenotypic differences between leukemic and normal cells, or by evaluating clone-specific markers of immunoglobulin and/or T-cell receptor gene rearrangements using polymerase chain reaction (PCR).

From hematological malignancies to solid tumors, the ctDNA assay is used to detect minimal/molecular residual disease (MRD). Tumor-informed and tumor-agnostic tests are the two most often used assay types in MRD testing technologies. MRD is utilized for colorectal cancer (CRC) not only to track recurrence and forecast prognosis, but also to support clinical judgment and evaluate clinical efficacy in the context of chemotherapy, radiation, surveillance, and curative surgery. This can impede the market expansion of minimal residual disease. - The transition from the benchtop to the bedside is slowed by the enormous challenges that next-generation sequencing still presents in quality control management, processing, data storage, and interpretation, even with significant advancements to broaden its applications from research to the clinic.

- Integration into clinical practice

Minimal Residual Disease Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.3% |

|

Base Year Market Size (2025) |

USD 2.21 billion |

|

Forecast Year Market Size (2035) |

USD 7.7 billion |

|

Regional Scope |

|

Minimal Residual Disease Market Segmentation:

Type Segment Analysis

The molecular segment in the minimal residual disease market is estimated to gain the largest revenue share of 60% in the year 2035. One of the primary growth drivers for the molecular segment is the continuous advancement in sensitivity and specificity of molecular MRD techniques. MRD assays must have broad applicability, precision, dependability, and high sensitivity (≥10−4). Additionally, the genetic target for molecular MRD analysis should be sensitive, and stable across time (i.e., present at both diagnosis and relapse) to reflect the dynamics of the malignant clone during therapy, and typical of the disease for all leukemic clones.

Collaborative efforts between research institutions, pharmaceutical companies, and healthcare providers continually validate the efficacy of molecular MRD techniques, fostering confidence in their clinical utility. A multicenter trial involving European institutions, published in Blood, validated the use of ASO-PCR in monitoring MRD in acute promyelocytic leukemia (APL).

Technology Segment Analysis

The flow cytometry segment will hold almost 56% of the revenue share on account of the increasing and pervasive use of flow cytometry to detect cancer cells as it is the most powerful tool available worldwide. Moreover, according to laboratory studies in clinical samples, assays utilizing polymerase chain reaction or flow cytometry can identify a single ALL cell out of 10,000–100,000 normal cells. For MRD monitoring, leukemia immunophenotypes, and antigen-receptor gene rearrangements characterize the great majority of patients; presently, around half of the cases exhibit appropriate gene fusions. Therefore, this technology of MRD will help to boost the market gains.

A useful technique for phenotyping microbial cells is flow cytometry, which makes it possible to quickly analyze and characterize a variety of microbial populations. It can recognize and categorize various bacterial species according to their phenotypic traits. Researchers can assess the number of various microbial species or cell types present in a sample using fluorescent dyes or antibodies that target specific microbial markers. This information can be used to gain insights into population dynamics and the composition of microbial communities.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End User |

|

|

Technology |

|

|

Test Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Minimal Residual Disease Market Regional Analysis:

North American Market Insights

The minimal residual disease market in the North American region is projected to hold the largest revenue share of 42% by the end of 2035. This heightened expansion will be attributed to the rising cases of different kinds of cancers in North America. As cancer cases are on the rise in this region, North America is highly inclining towards minimal residual disease techniques. It is anticipated that there will be 611,720 cancer deaths and 2,001,140 new cancer cases in the US in 2024. Lung cancer continues to be the leading cause of cancer-related mortality in both sexes, with prostate and breast cancers being diagnosed more frequently in men and women, respectively.

The United States and Canada have comparable patterns in the incidence of cancer, which can be attributed to the commonality of risk factors for the disease. Cancers linked to infections have a low incidence, whereas cancers linked to "westernization" of lifestyle have a high incidence. For instance, colorectal cancer incidence is greatest in Northern America among all regions of the world. Therefore, the advancement of the market can be noticed here the most.

APAC Market Insights

The minimal residual disease market in the APAC region is projected to hold the second-largest share during the forecast period. This relentless advancement will be noticed because of rising investment in the field of screening and the existence of supportive compensation policies. For instance, China's outbound stock of foreign direct investment (FDI) rose 93 times between 2000 and 2021, whereas global FDI stocks expanded by 5.6 times during the same period. The stock of inward Chinese FDI increased dramatically in nations including Australia, Canada, and the United States; inflows peaked in 2016–2017.

Again, plans for a ¥ 10 trillion (USD 75 billion) national endowment fund were presented by Japan in 2021. Its designers claim that fostering innovation and enhancing governance are the goals. All these investments and reimbursement policies in the countries of the APAC region on R&D and the field of screening will further enlarge the market revenue.

Minimal Residual Disease Market Players:

- Roche Diagnostics Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott Laboratories

- Siemens Healthineers

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- Becton, Dickinson and Company

- Thermo Fisher Scientific Inc.

- Qiagen N.V.

- Adaptive Biotechnologies Corporation

- Invivoscribe, Inc.

Recent Developments

- Roche Diagnostics Corporation acquired GenMark Diagnostics. This USD 1.8 billion acquisition expanded Roche's portfolio in molecular diagnostics, particularly in syndromic testing and point-of-care solutions.

- Roche Diagnostics Corporation acquired TIB Molbiol. This acquisition strengthened Roche's position in molecular diagnostics in Europe, adding TIB Molbiol's expertise in PCR technologies.

- Report ID: 5723

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Minimal Residual Disease Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.