Global Millimeter Wave RFIC Market

- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Global Industry Overview Market

- Market Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROTs

- Driver

- Restraint

- Opportunities

- Threat

- Government Regulation

- Competitive Landscape

- Analog Devices, Inc.

- Sivers Semiconductors AB.

- RF Integration Inc.

- RFIC Solutions Inc.

- Anokiwave, Inc.

- MMTRON

- TUSK IC

- Altum RF

- Akronic, P.C.

- Trends & Strategic Analysis of Key RFIC Manufacturers for Satcom Industry

- Ongoing Technological Advancements

- Price Benchmarking

- Annual RFIC Demand (in Thousand Units) by Frequency Band

- (2023-2035)

- Market Value Forecast for RFIC by Frequency Band

- (2023-2035)

- SWOT Analysis

- Component Analysis

- Block Diagram Analysis - Transceiver

- End-User Analysis

- Root Cause Analysis for Millimeter Wave RFIC Market

- Industry Risk Assessment

- Gobal Outlook and Projections

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2023-2035

- Increment $ Opportunity Assessment, 2023-2035

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2023-2035, By

- Frequency Band, Value (USD Million)

- Ka-Band

- V-Band

- W-Band

- Component, Value (USD Million), Volume (Thousand Units)

- Transceivers

- Power Amplifiers

- Mixers

- Oscillators

- Filters

- Switches

- Others

- Satellite Type, Value (USD Million)

- GEO Satellite

- LEO Satellite

- Others

- End User, Value (USD Million)

- Commercial

- Military & Defense

- Aerospace & Aviation

- Telecommunication

- Research & Academic Institutes

- Regional Synopsis (USD Million), 2023-2035

- North America, Value (USD Million)

- Europe, Value (USD Million)

- Asia Pacific, Value (USD Million)

- Latin America, Value (USD Million)

- Middle East and Africa, Value (USD Million)

- Frequency Band, Value (USD Million)

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2023-2035

- Increment $ Opportunity Assessment, 2023-2035

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2023-2035, By

- Frequency Band, Value (USD Million)

- Ka-Band

- V-Band

- W-Band

- Component, Value (USD Million), Volume (Thousand Units)

- Transceivers

- Power Amplifiers

- Mixers

- Oscillators

- Filters

- Switches

- Others

- Satellite Type, Value (USD Million)

- GEO Satellite

- LEO Satellite

- Others

- End User, Value (USD Million)

- Commercial

- Military & Defense

- Aerospace & Aviation

- Telecommunication

- Research & Academic Institutes

- Country Level Analysis, Value (USD Million)

- U.S.

- Canada

- Frequency Band, Value (USD Million)

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2023-2035

- Increment $ Opportunity Assessment, 2023-2035

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2023-2035, By

- Frequency Band, Value (USD Million)

- Ka-Band

- V-Band

- W-Band

- Component, Value (USD Million), Volume (Thousand Units)

- Transceivers

- Power Amplifiers

- Mixers

- Oscillators

- Filters

- Switches

- Others

- Satellite Type, Value (USD Million)

- GEO Satellite

- LEO Satellite

- Others

- End User, Value (USD Million)

- Commercial

- Military & Defense

- Aerospace & Aviation

- Telecommunication

- Research & Academic Institutes

- Country Level Analysis, Value (USD Million)

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Russia

- Rest of Europe

- Frequency Band, Value (USD Million)

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2023-2035

- Increment $ Opportunity Assessment, 2023-2035

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2023-2035, By

- Frequency Band, Value (USD Million)

- Ka-Band

- V-Band

- W-Band

- Component, Value (USD Million), Volume (Thousand Units)

- Transceivers

- Power Amplifiers

- Mixers

- Oscillators

- Filters

- Switches

- Others

- Satellite Type, Value (USD Million)

- GEO Satellite

- LEO Satellite

- Others

- End User, Value (USD Million)

- Commercial

- Military & Defense

- Aerospace & Aviation

- Telecommunication

- Research & Academic Institutes

- Country Level Analysis, Value (USD Million)

- China

- Japan

- India

- Indonesia

- Malaysia

- Australia

- Thailand

- Vietnam

- South Korea

- Rest of Asia Pacific

- Frequency Band, Value (USD Million)

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2023-2035

- Increment $ Opportunity Assessment, 2023-2035

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2023-2035, By

- Frequency Band, Value (USD Million)

- Ka-Band

- V-Band

- W-Band

- Component, Value (USD Million), Volume (Thousand Units)

- Transceivers

- Power Amplifiers

- Mixers

- Oscillators

- Filters

- Switches

- Others

- Satellite Type, Value (USD Million)

- GEO Satellite

- LEO Satellite

- Others

- End User, Value (USD Million)

- Commercial

- Military & Defense

- Aerospace & Aviation

- Telecommunication

- Research & Academic Institutes

- Country Level Analysis, Value (USD Million)

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Frequency Band, Value (USD Million)

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2023-2035

- Increment $ Opportunity Assessment, 2023-2035

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2023-2035, By

- Frequency Band, Value (USD Million)

- Ka-Band

- V-Band

- W-Band

- Component, Value (USD Million), Volume (Thousand Units)

- Transceivers

- Power Amplifiers

- Mixers

- Oscillators

- Filters

- Switches

- Others

- Satellite Type, Value (USD Million)

- GEO Satellite

- LEO Satellite

- Others

- End User, Value (USD Million)

- Commercial

- Military & Defense

- Aerospace & Aviation

- Telecommunication

- Research & Academic Institutes

- Country Level Analysis, Value (USD Million)

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- Frequency Band, Value (USD Million)

- Overview

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

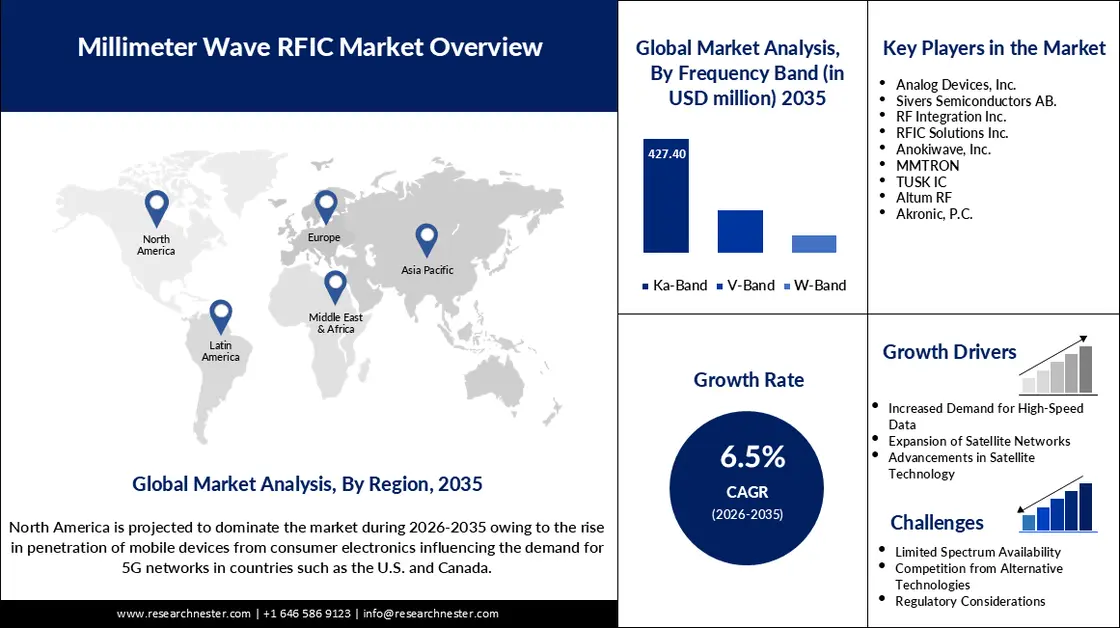

Millimeter Wave RFIC Market Outlook:

Millimeter Wave RFIC Market size was valued at USD 346.63 million in 2025 and is set to exceed USD 650.67 million by 2035, expanding at over 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of millimeter wave RFIC is estimated at USD 366.91 million.

The market is anticipated to rise significantly owing to the rapid adoption of 5G technology worldwide. These components are vital in enhancing high-frequency communication and, as such, important for next-generation network infrastructure. In December 2023, T-Mobile made history by combining eight channels of mmWave spectrum to deliver download speeds of more than 4.3 Gbps. Such advancements proves that RFICs play an important role in the realization of superior network performance. Several governments are investing in the development of 5G infrastructure that will serve to increase connectivity and further drive the growth of the millimeter wave RFIC market.

Integration of emerging fields such as telecommunications, automotive, and healthcare sectors is presenting new opportunities via millimeter wave RFICs. A number of companies are highly interested and investing in research and development that enables them to innovate advanced RFIC solutions for high-speed wireless communication. For example, in August 2024, Intel collaborated with major telecom providers to fine-tune mmWave technology, accelerating the deployment of 5G networks. Government initiatives support digital transformation by improving the overall infrastructure and facilitating seamless adoption. These developments underpin millimeter wave RFICs for the future of communication.

Key Millimeter Wave RFIC Market Insights Summary:

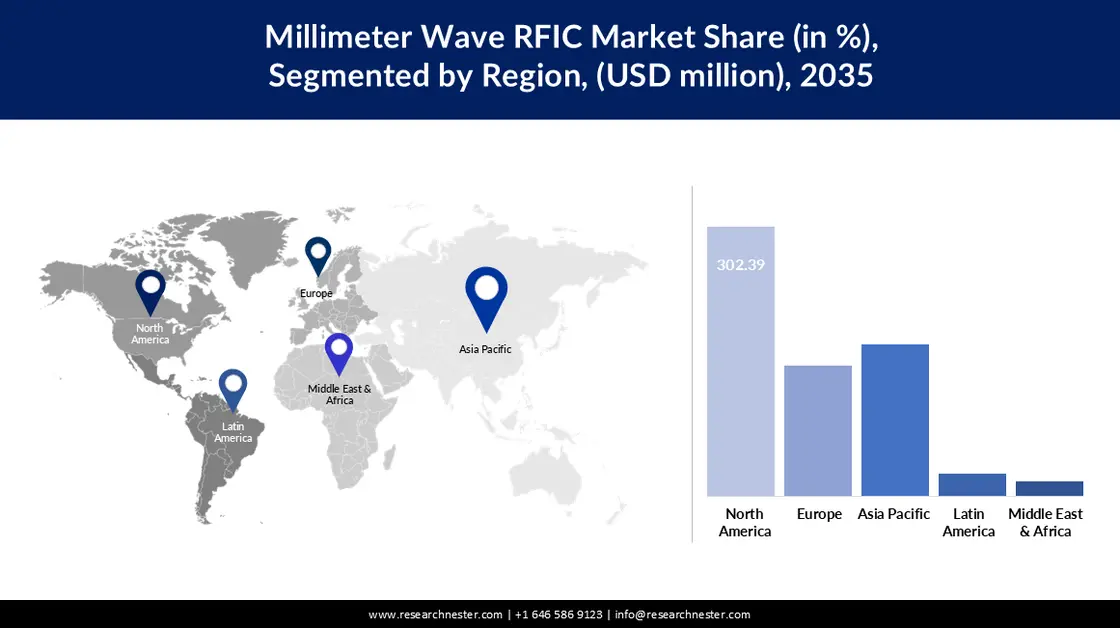

Regional Insights:

- By 2035, North America is projected to hold over 45% share of the millimeter wave rfic market, owing to strong 5G infrastructure investments and rapid mmWave technology adoption.

- Across 2026–2035, Asia Pacific is anticipated to grow around 7.6%, attributed to rising 5G deployment and expanding wireless technology integration.

Segment Insights:

- By 2035, the Ka-Band segment is expected to exceed a 60.5% share in the millimeter wave rfic market, propelled by its expanding application in advanced communication systems.

- By 2035, the transceivers segment is set to capture more than 27.7% share, underpinned by their critical role in ensuring seamless high-frequency data transmission.

Key Growth Trends:

- Increasing 5G networks

- Technological advances in mmWave solutions

Major Challenges:

- Technical challenges in design and fabrication

- Limited penetration in developing markets

Key Players: Analog Devices, Inc., Sivers Semiconductors AB, RF Integration Inc., RFIC Solutions Inc., Anokiwave, Inc., MMTRON, TUSK IC, Altum RF, Akronic, P.C.

Global Millimeter Wave RFIC Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 346.63 million

- 2026 Market Size: USD 366.91 million

- Projected Market Size: USD 650.67 million by 2035

- Growth Forecasts: 6.5%

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: India, Singapore, Taiwan, United Kingdom, Canada

Last updated on : 2 December, 2025

Millimeter Wave RFIC Market - Growth Drivers and Challenges

Growth Drivers

- Increasing 5G networks: The proliferation of 5G networks across different countries drives the demand for RFICs in millimeter waves, which are becoming important in high-frequency band utilization. These materials assist in transmitting data quickly and with better connectivity, which is a feature that is sought in modern communication systems. In February 2023, Cisco teamed up with NEC Corporation for better 5G xHaul and private 5G networking. These partnerships point toward the significant importance of RFICs for new-generation communication infrastructure. This points out the increasing adoption of mmWave technologies in mobile and enterprise networks, indicating their growing relevance in the 5G era.

- Technological advances in mmWave solutions: Continuous innovation in millimeter wave RFICs is enabling the adoption of next-generation wireless technologies by industries. Advanced design efficiencies and integration capabilities are driving the evolution of 5G and beyond. In July 2024, Qualcomm unveiled advanced mmWave solutions that would further improve 5G network performance, enabling the transfer of more data at faster speeds and boosting overall network capacity. Such improvements are compelling wider adoption in applications like autonomous cars, healthcare systems, and high-speed communication networks.

- Increasing adoption of IoT and smart devices: Growing adoption of IoT and smart devices is increasing the demand for millimeter wave RFICs, which smoothly enable wireless communication. Such components are in high demand to provide reliable and rapid connectivity in dense ecosystems created by IoT. In August 2023, Fujitsu Limited announced a 5G mmWave chip with four-beam multiplexing for efficiency in IoT network improvement. This development is in line with the growing connectivity requirements in smart cities and industrial automation, underlining the rise in RFICs as a part of future technologies.

-

Challenges

- Technical challenges in design and fabrication: The development of mmWave RFICs faces some serious technical challenges, requiring advanced design precision and rich manufacturing experience. These components need to operate efficiently at very high frequencies, which requires sophisticated circuit designs and strict testing processes to ensure reliability and performance. Equally important challenges are thermal management and power efficiency of mmWave RFICs during operation. Besides, specialized materials and the complex fabrication technique that comes along with increased production costs also limit the scalability. These complexities restrict entry to the millimeter wave RFIC market for new players while simultaneously pressuring already existing players to innovate continuously in their lines of production processes.

- Limited penetration in developing markets: The underdeveloped infrastructure and huge costs associated with the deployment of mmWave RFICs in emerging markets could hinder adoption. Most of these countries still need an effective telecommunication network from which they can avail these types of frequencies. Therefore, most of them utilize their previously used frequency bands to connect via mobile, landlines, or both. In addition to this, in emerging millimeter wave RFIC markets, hardly any manufacturing and deployment capabilities for millimeter-wave technology are available. As a result, the limited awareness of mmWave solution advantages further slows down this technology's adoption in these places.

Millimeter Wave RFIC Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 346.63 million |

|

Forecast Year Market Size (2035) |

USD 650.67 million |

|

Regional Scope |

|

Millimeter Wave RFIC Market Segmentation:

Frequency Band Segment Analysis

Ka-Band segment is likely to hold over 60.5% millimeter wave RFIC market share by the end of 2035, due to its usage in advanced communication systems. Furthermore, the growth in dependency of the aerospace and telecommunications industries on the Ka-Band frequency has also garnered significant demand. In March 2024, Pharrowtech secured USD 18.4 million in funding to advance 60 GHz RFICs, emphasizing the rising investment in this frequency band. Moreover, Ka-Band’s ability to deliver enhanced bandwidth efficiency ensures its expanding adoption, propelling the market growth through 2035.

Component Segment Analysis

By 2035, transceivers segment is predicted to hold more than 27.7% millimeter wave RFIC market share, due to their indispensability in connecting communication systems for continuous data flow. These components integrate transmit and receive functions, enabling savings in space and performance for high-frequency applications. The integration into 5G devices, IoT systems, and satellite communication proves the versatility of these components and their importance in such systems. In April 2023, Semtech Corporation released a new IC featuring advanced RF control for 5G devices that demonstrated the evolution in transceiver technology. Transceivers continue to remain central to developing advanced RFIC solutions with the growing demand for high-speed connectivity.

Our in-depth analysis of the global market includes the following segments:

|

Frequency Band |

|

|

Component |

|

|

Satellite Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Millimeter Wave RFIC Market - Regional Analysis

North America Market Insights

North America millimeter wave RFIC market is predicted to account for revenue share of more than 45% by the end of 2035. The region currently leads the market with significant investment in 5G infrastructure and rapid adoption of mmWave technologies for advanced communication. North America is known for innovation in RFIC solutions due to the presence of leading players and extended research initiatives. Additional strong support through regulations and funding for technology innovations further supplements the growth in the market.

The U.S. is anticipated to lead North America market through 2035. Due to strategic investments in 5G infrastructure as well as sophisticated communication technology, the U.S. is spearheading innovations in RFIC design around the globe. The regional expansion business of e-commerce announced by NextPlat Corp in March 2024 has shown the chip integration of mmWave technology into different sectors. It enjoys the advantage of a developed ecosystem comprising technology providers, research institutions, and government initiatives that foster innovation.

The market in Canada is driven by increasing momentum for the adoption of 5G networks and an emphasis on developing better telecommunication infrastructure within the country. A strong focus on closing the gap in connectivity for remote areas is considered a driving factor in the demand for advanced RFIC solutions in Canada. Furthermore, strategic collaborations between companies and global leaders in technology drive market expansion. In addition, tech-driven industries, along with government-backed projects for digital connectivity, have emerged as strong drivers for the growth of mmWave RFIC technologies in Canada.

Asia Pacific Market Insights

Asia Pacific millimeter wave RFIC market is anticipated to observe around 7.6% growth between 2023 and 2035, due to high investments in 5G infrastructure development and rapid dissemination of wireless technologies. The diversified industrial base added to the great consumer markets offers a huge opportunity for applications of RFIC. The regional companies are focused on innovations that can meet local and global demands for high-frequency communication solutions. Further, increasing smartphone and IoT device penetration acts as fuel to growth in the market.

India is swiftly turning into a major player in Asia Pacific market, supported by its rapidly growing telecommunications sector. In August 2022, HFCL Limited partnered with Qualcomm to design mmWave solutions for both India and international markets, demonstrating the country's focus on innovation. Furthermore, the government's push for digital connectivity and the rollout of 5G networks have accelerated the adoption of advanced RFIC technologies. The market in India is anticipated to witness rapid growth due to a healthy electronics manufacturing sector and growth in the country's tech ecosystem.

China has surged forward in the Asia Pacific mmWave RFIC market on strong investments in 5G and other telecommunication infrastructure in recent times. The country has become considerably advanced with millimeter wave technology and is well ahead in wireless innovations. Partnerships between domestic companies and global tech leaders contribute to the rapid adoption of mmWave RFICs in sectors such as telecommunications, defense, and IoT. Also, China has a high-class manufacturing infrastructure and government-supported initiatives, enabling the country to be a major player in the global RFIC market.

Millimeter Wave RFIC Market Players:

- Analog Devices, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sivers Semiconductors AB.

- RF Integration Inc.

- RFIC Solutions Inc.

- Anokiwave, Inc.

- MMTRON

- TUSK IC

- Altum RF

- Akronic, P.C.

The millimeter wave RFIC market is highly fragmented and competitive due to the presence of established players. Some of the leading players include Analog Devices, Inc., Sivers Semiconductors AB, RF Integration Inc., RFIC Solutions Inc., Anokiwave, Inc., MMTRON, TUSK IC, Altum RF, Akronic, P.C. These companies are leading due to technological innovation and huge investments in R&D for the development of advanced RFIC solutions. Therefore, strategic partnerships and collaborations are highly essential for further market penetration in reaching emerging opportunities provided by 5G, IoT, and satellite communication.

In August 2023, Siklu also made an important contribution to the market with a new addition to its portfolio, the MultiHaul TG T261 terminal unit. The addition to Siklu's 60 GHz line indicates the advancement of mmWave frequency application for ensuring high-quality connectivity and superior performance of next-generation communication systems. Efficiency and reliability in design have been paid due attention, keeping in mind growing requirements related to a broad range of wireless communications solutions. Such innovations underline the competitive nature of the market, with companies aiming to stay in the lead.

Here are some leading companies in the millimeter wave RFIC market:

Recent Developments

- In February 2024, Ceragon Networks announced its groundbreaking millimeter wave innovations at Mobile World Congress (MWC) 2024. Among the highlights was a Neptune SoC-based demonstration showcasing a mmW technology capable of delivering 100 Gbps using 4000 MHz channel bandwidth, 16K QAM, XPIC, and MIMO technologies. This industry-first innovation is set to redefine wireless backhaul capabilities by far exceeding current competitor standards. The technology aims to support future-ready networks with ultra-high capacity and reliability.

- In January 2024, Aviat Networks partnered with PT Smartfren Telecom Tbk to deliver high-speed, ultra-reliable wireless connectivity solutions across Indonesia. The collaboration focuses on private wireless networks for indoor and outdoor environments, as well as services enabling digitalization and automation for enterprise customers. This partnership leverages millimeter wave technology to enhance connectivity performance and support Indonesia’s growing digital infrastructure needs.

- In October 2023, NTT Corporation, in collaboration with The University of Tokyo, unveiled the world's first millimeter-wave RFID tag designed to enhance drone navigation accuracy. This innovative tag operates effectively in poor visibility conditions, such as night, fog, and rain, by utilizing millimeter-wave technology that remains unaffected by weather. The battery-less RFID tag can be read over a wide area from the air using a compact millimeter-wave radar mounted on a drone, providing critical environmental information to ensure safe navigation.

- Report ID: 6778

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Millimeter Wave RFIC Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.