Milk Protein Market Outlook:

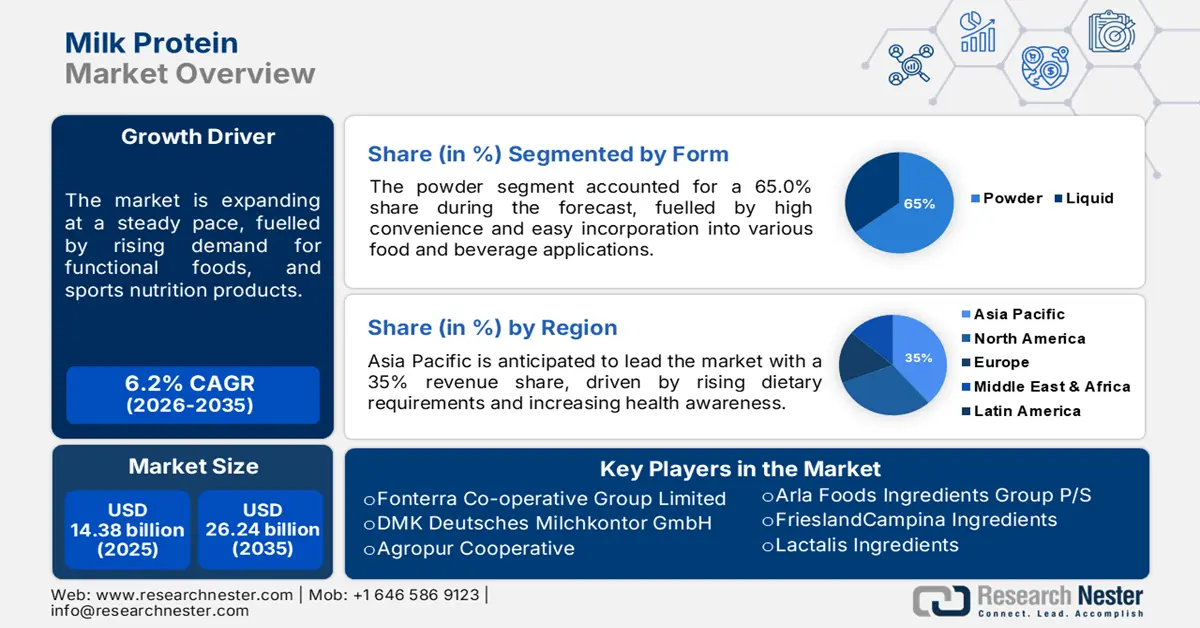

Milk Protein Market size was over USD 14.38 billion in 2025 and is projected to reach USD 26.24 billion by 2035, growing at around 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of milk protein is evaluated at USD 15.18 billion.

The global milk protein market is expected to thrive, supported by an array of favorable factors boosting consumer awareness of health and wellness, demand for functional foods, and sports nutrition products. Due to this increasing demand, milk protein companies are busy innovating products and expanding their portfolios. Several milk protein manufacturers invest in research and development to introduce new milk protein formulations answering to the detailed needs of consumers, be it regarding plant-based or clean-label products. For instance, in August 2024, Fonterra partnered with Superbrewed to introduce a new line of milk protein concentrates made for ready-to-drink products.

Government and regulatory bodies also play an important role in shaping the milk protein market. There are policies now in place in most countries to support home dairy industries and promote the production of value-added dairy products such as milk proteins. According to the U.S. Department of Agriculture, exports of milk protein concentrate from the United States increased by 15% in 2023 over the previous year, documenting the growing demand worldwide. Companies are also shifting toward food safety and quality standards; investments in advanced processing technologies and traceability systems.

Key Milk Protein Market Insights Summary:

Regional Highlights:

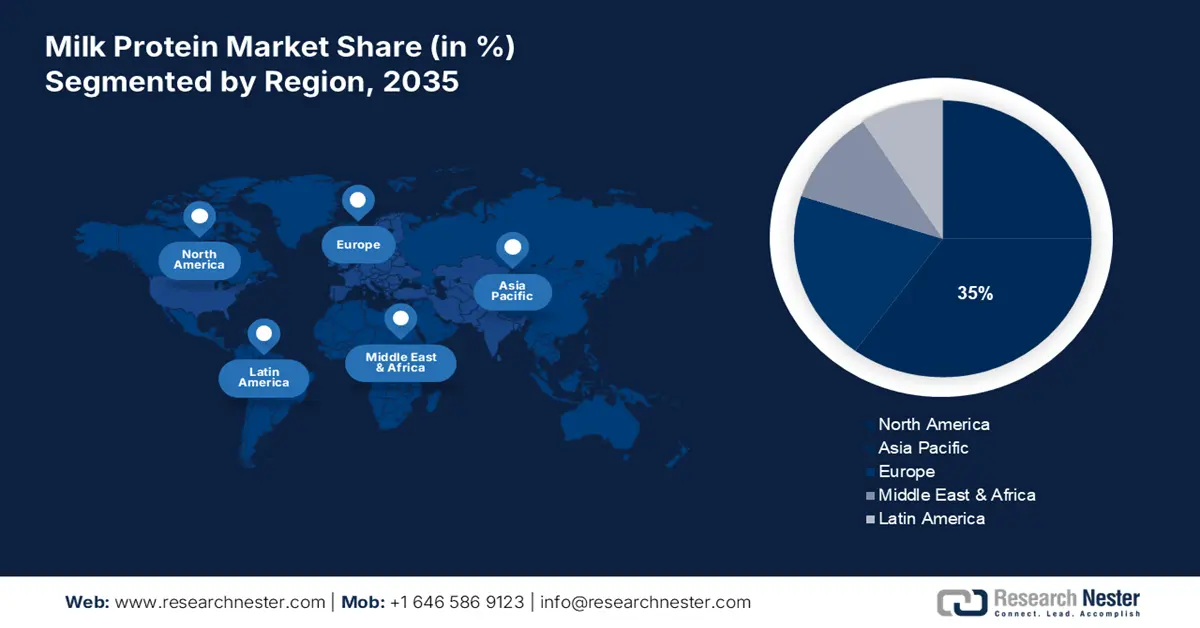

- The Asia Pacific milk protein market will account for 35% share by 2035, driven by rising disposable income, dietary modification, and health awareness.

Segment Insights:

- The powder segment in the milk protein market is anticipated to experience robust growth till 2035, propelled by the long shelf life, transportability, and formulation convenience of powdered milk proteins.

- The hydrolyzed segment in the milk protein market is expected to maintain a 42% share by 2035, driven by rising demand for easily digestible and hypoallergenic proteins, particularly in baby food and sports nutrition.

Key Growth Trends:

- New baby formulas and clinical nutrition applications

- Greater emphasis on health

Major Challenges:

- Environmental sustainability concerns

- Quality standards and regulatory hurdles

Key Players: Fonterra Co-operative Group Limited, Arla Foods Ingredients Group P/S, FrieslandCampina Ingredients, Lactalis Ingredients, Glanbia plc, and Kerry Group plc are some prominent companies.

Global Milk Protein Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.38 billion

- 2026 Market Size: USD 15.18 billion

- Projected Market Size: USD 26.24 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, France, Netherlands

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Milk Protein Market Growth Drivers and Challenges:

Growth Drivers

- New baby formulas and clinical nutrition applications: The milk protein market is growing rapidly owing to its wide application in infant formulae and clinical nutrition products. In July 2024, Arla Foods Ingredients announced the entry of a novel fraction of milk protein developed for infant formula should lead further toward achieving the overall status of infant milk to mimic human milk and support the overall development and growth of infants. With the increasing birth rate in developing countries and acceleration in early child nutrition awareness, the demand for high-quality milk protein in infant formula is likely to surge.

- Greater emphasis on health: The health benefits that protein consumption provides have become apparent. Also, consumers are increasingly looking for protein-rich food and beverages to help enrich their daily diet in pursuit of multiple health needs, starting with weight management to muscle building, amongst others. The same is true for the sports nutrition segment, where milk proteins find ready appreciation thanks to their complete amino acid profile, coupled with excellent digestibility. In October 2023, Glanbia Nutritionals added a new clear protein beverage, whey protein isolate, to the marketplace as demand for sports nutrition's functional drinks continues to rise.

- Technological advancements in protein processing: The advancements in protein extraction and processing technologies have opened further possibilities for the dairy ingredients-producing sector to prepare a milk protein ingredient characterized by far higher functionality but even greater purity and sensory characteristics. Advanced membrane filtration makes it possible to produce milk protein concentrates with tailor-made protein profiles that fit different end-use applications. For example, in June 2023, GEA Group announced the launch modules of a new ultra-filtration system to produce milk protein to obtain an increase in yield of up to 10%, with a reduced energy consumption that benefits the economic and environmental sustainability of milk protein manufacturing.

Challenges

- Environmental sustainability concerns: The milk protein sector has seen an immense demand from environmental concerns, with dairy farming attributed to greenhouse gas emissions and water use in processing. This has impelled the industry players to make an investment in production methods that are environmentally friendly and a step towards carbon emissions reductions. However, implementation of the practices might be costly, complex, and elevate the cost of the output with rippling implications on the competitive price of products in the market.

- Quality standards and regulatory hurdles: Navigating the complex landscape of food safety regulations and quality standards across different markets is quite a challenge for milk protein manufacturers. Strict food regulations, stringent control of labeling, food additive use, and production-related processes by governments worldwide have seen manufacturers invest heavily in such compliance measures, quality assurance systems, etc. This may be a difficult task for smaller producers or those looking to expand to new international markets.

Milk Protein Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 14.38 billion |

|

Forecast Year Market Size (2035) |

USD 26.24 billion |

|

Regional Scope |

|

Milk Protein Market Segmentation:

Product Type Segment Analysis

Among the product types, the hydrolyzed segment will account for 42% share by 2035. Hydrolyzed milk proteins are well consumed due to their relative digestibility and less allergenicity compared to other types of milk protein, and therefore, find a deep application in baby food and sports materials. Companies are investing in the research and development of hydrolyzed milk proteins. For example, in July 2024, Arla Foods Ingredients obtained FDA approval of high-nutrition hydrolyzed whey protein. These proteins are hydrolyzed into smaller peptides for enhanced absorption, easier digestion, and rapid nutrient uptake, especially in people with digestive sensitivities. Increasing demand for clean-label, easily digestible protein sources further drive the segment's growth.

Form Segment Analysis

By form, the powder segment dominates the milk protein market and is estimated to hold a 65% share by 2035. Powdered milk proteins, on the other hand, not only extend shelf life but are also easily transportable and storable until the need arises for such products in food formulation. Powdered milk proteins can be easily included in many types of food and beverage products, thereby being an ideal choice for manufacturers across industries. This convenience factor for the consumers is an additional contributing factor in segments like sports nutrition and dietary supplements. The ability to exactly set protein content and the easy, convenient reconstitution of the powder, with active interest, pointed more toward industrial use than consumer applications.

Application Segment Analysis

By application, the food & beverage segment leads the milk protein market and is likely to contribute over 25% of the share by 2035. All these dairy-based foods can, therefore, use any form of milk protein to develop wide product lines, from bakery to confectionery and beverages. This increasingly furthers the use of milk proteins for food and beverage formulation due to the push for clean labels and natural ingredients.

The increased popularity of high-protein diets alongside the never-ending awareness of health-related properties linked to milk proteins has fueled this segment. In January 2024, Nestle developed a technique to reduce the fat present in milk sugar to capture the opportunity around increased consumer interest in meals and snacks in the dairy and beverages category.

Our in-depth analysis of the milk protein market includes the following segments:

|

Product Type |

|

|

Form |

|

|

Form |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Milk Protein Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is anticipated to hold largest revenue share of 35% by 2035. This is attributed to numerous factors, such as rising disposable income, dietary modification, and increasing awareness of health benefits accompanied by protein consumption. In India, the milk protein market is growing at a rapid rate, with an increasing product base as a result of the increasing population and urbanization, as well as an increase in the sale of protein-based processed food and drinks.

India’s milk protein market is growing due to an increase in government efforts to ensure the nutrition and safety of food, as well as the growth in intake of Western-style dairy comprising a great volume of milk protein. In Japan, the market is growing due to an increasing geriatric population as well as functional and nutritional food consumers.

Companies in Asia Pacific are quite aggressive in their innovation pursuits to cater to the varied needs of consumers from different countries. Many players are now developing products that although locally favored, get the nutritional mandates from milk proteins. For instance, in March 2024, Yili Group launches into the Chinese milk protein market with a new line of high-protein milk products with some milk protein fractions available to help maintain immune health. Together with the national nutrition guidelines, the Chinese government is also improving stimulation for the consumption of milk and milk products, which stimulates the demand for milk proteins.

North America Market Insights

The milk protein market in North America is poised for steady growth from 2024 to 2035 due to increasing consumer sophistication in health and wellness and increased demand for functional food and sports nutrition products. This is based on the region's strong food and beverage market, coupled with a growing trend toward protein-enriched products that can create huge opportunities for milk protein manufacturers. Additionally, the rapidly increasing market for clean-label and natural ingredients serves to boost the demand for milk proteins in various applications.

Companies in North America's milk protein market invest continuously in the development of innovative products that cater to changing consumer preferences. Meantime, the government has been proactive in supporting the dairy industry in Canada in various means. In recent data by Agriculture and Agri-Food Canada, the eagerness of other countries for Canadian dairy ingredients made the country escalate its exportation of milk protein products to 12% more in 2023 than in past years. As a result, several manufacturers are focusing on launching functional and nutritionally specialized innovative milk protein ingredients.

Milk Protein Market Players:

- Fonterra Co-operative Group Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DMK Deutsches Milchkontor GmbH

- Agropur Cooperative

- Saputo Inc.

- Arla Foods Ingredients Group P/S

- FrieslandCampina Ingredients

- Lactalis Ingredients

- Glanbia plc

- Kerry Group plc

- Dairy Farmers of America, Inc.

- Nestlé S.A.

- Chr. Hansen Holding A/S

- Groupe Lactalis SA

- Danone S.A.

- Land O'Lakes, Inc.

The global milk protein market is significantly competitive, with players such as Nestlé SA, Danone, and Arla Foods at the leading position. These companies maintain an edge in the competition due to their extensive availability of resources and innovation capabilities. Other players like Fonterra Co-operative Group and Lactalis Group are also key participants contributing through continuous product launches and geographical expansions. Industry leaders are refreshing their product lines due to the increasing consumer demand for more high-protein, health-oriented, and sustainable food options.

In March 2024, Haven, New Zealand's premium infant nutrition company, launched the world's first 100% oat-based toddler drink: Heaven Oat. This new product is specially designed for dairy-intolerant children and plant-based parenting. It is an indication of the trend in the industry toward alternative and plant-based feeding solutions. This development mirrors a growing trend among firms to broaden their product offerings in line with the changing dietary preferences of the world consumer base.

Here are some leading companies in the milk protein market:

Recent Developments

- In July 2024, U.S.-based Ripple Foods launched Ripple Shake Ups Protein Shakes; these have been the first and only kids' protein shake designed to take on the challenges of "tweenage hanger" with a satisfying combination of 13g of plant-based protein and 3g of filling fiber.

- In February 2024, Vivici—a start-up created by both Fonterra and DSM-Firmenich, which is based in New Zealand and the Netherlands, respectively—announced that it is ready to supply volumes at a commercial level of whey protein. At just over a year since its inception, this has become a huge step in shaking up the US 'animal-free dairy' category.

- In February 2024, Swiss multinational Nestlé SA launched Better Whey, its first precision fermentation dairy protein powder. This lactose-free, animal-free whey isolate product was launched under the brand Orgain, in which Nestle acquired a majority stake in 2022 to strengthen its leading position in functional nutrition.

- In November 2023, Valio launched Valio Eila MPC 65—a new milk protein concentrate to help manufacturers make products with better taste and healthiness in high-protein products by capitalizing on Valio's expertise in lactose-free milk proteins to meet growing global market demand.

- Report ID: 6340

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Milk Protein Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.