Military Image Intensifier Tube Market Outlook:

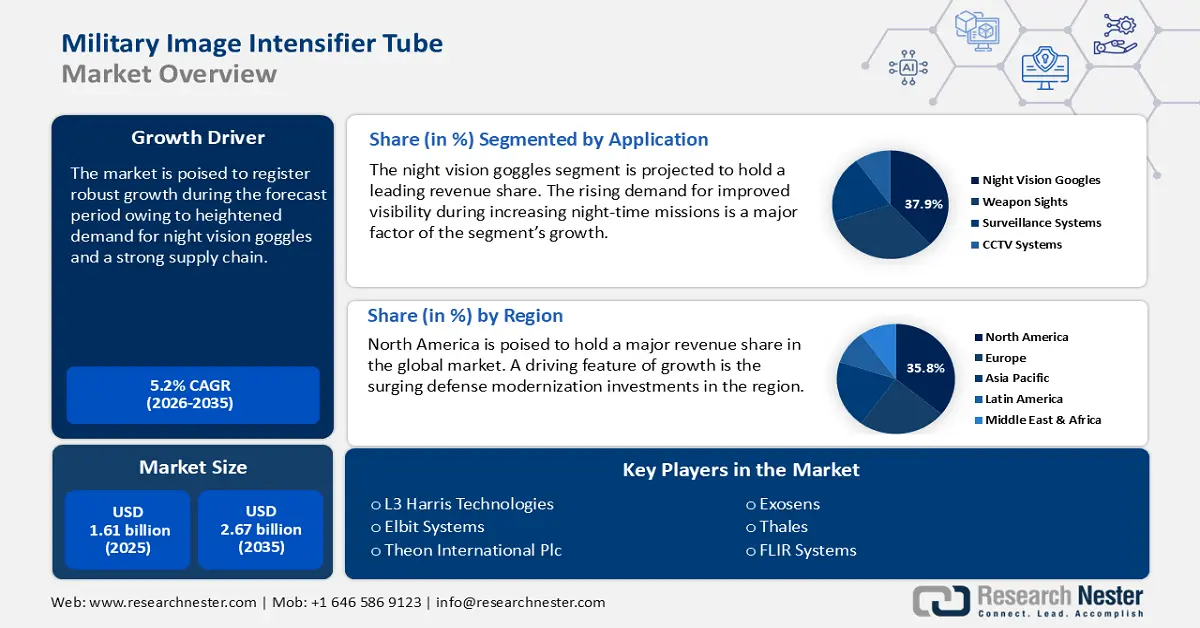

Military Image Intensifier Tube Market size was over USD 1.61 billion in 2025 and is projected to reach USD 2.67 billion by 2035, growing at around 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of military image intensifier tube is evaluated at USD 1.69 billion.

The push for modernization by defense forces worldwide is a major catalyst of the military image intensifier tube market growth. For instance, the U.S. Department of Defense (DoD) provided contracts in 2023 to major companies such as L3Harris Technologies for next-generation image intensifier tubes. The military image intensifier tubes are integral to devices such as night vision goggles which are experiencing heightened demand. These tubes rely on a supply chain beginning with raw material suppliers from APAC to manufacturers assembling photocathodes and microchannel plates. The table below highlights key details on Gallium Arsenide production and trade, which is a key component in the production of Gen-3 photocathodes.

|

Particulars |

Details |

|

2022 |

China exported around 94 metric tons of gallium, which was a 25% increase from exports in 2021. |

|

2022 |

The value of gallium arsenide imports in the U.S. was approximately USD 200 million. |

|

2022 |

The U.S. production of high-purity refined gallium was 290,000 KGs, exhibiting a 16% increase from 250,000 KGs in 2021. |

Source: USGS

Apart from the traditional players in the global defense and arms industries, opportunities in the military image intensifier tube market are rife for non-traditional players to collaborate with defense contractors to refine wafer-scale production techniques. Meanwhile, the Integrated Visual Augmentation System (IVAS) of the U.S. Army underscores a gradual shift toward modular image intensifier tube designs. The market analysis indicates that the global military image intensifier tube market is set to leverage favorable trends and maintain robust growth during the forecast period.

Key Military Image Intensifier Tube Market Insights Summary:

Regional Highlights:

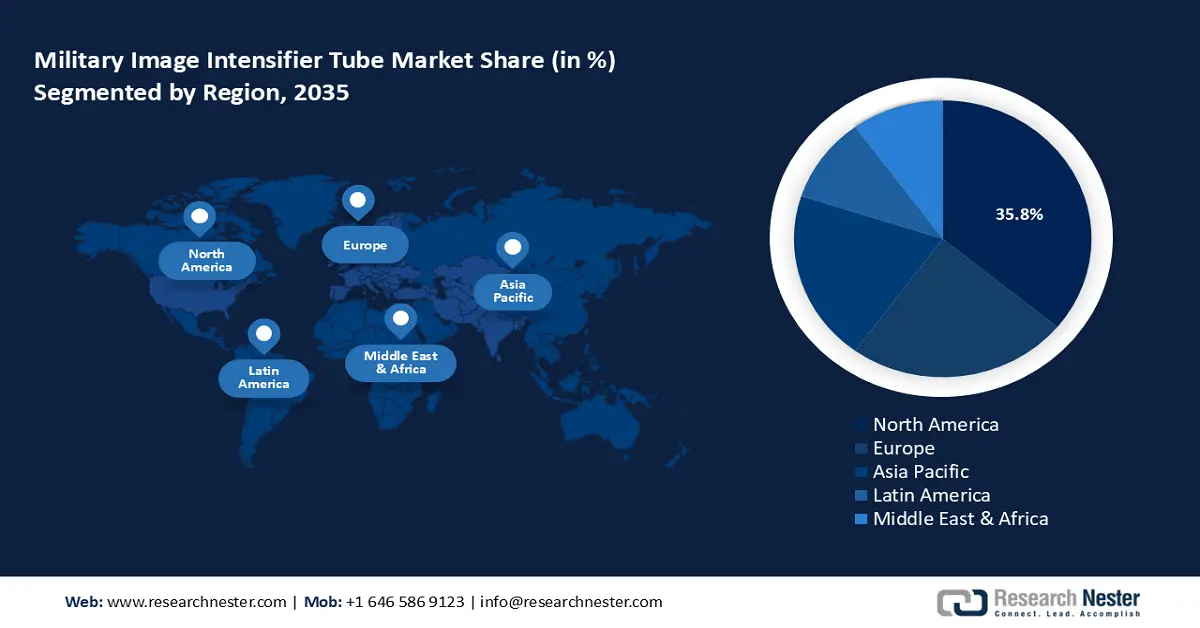

- North America military image intensifier tube market will account for 35.80% share by 2035, attributed to increased defense expenditures and the presence of major defense contractors.

- Europe market will hold the second largest share by 2035, fueled by the modernization of defense forces and increased defense spending by 50% in 2024.

Segment Insights:

- The night vision goggles segment in the military image intensifier tube market is expected to see substantial growth till 2035, driven by the global proliferation of soldier modernization programs.

- The gen 3 segment in the military image intensifier tube market is expected to hold a significant share by 2035, influenced by its superior performance and use in advanced night vision systems.

Key Growth Trends:

- Rising asymmetric warfare and multi-domain operations

- Increase in applications in simulation programs

Major Challenges:

- Competition from digital imaging technologies

- Export licensing complexities in defense trade

Key Players: L3 Harris Technologies, Elbit Systems, Thales Group, Photonis, Hensoldt AG, BAE Systems PLC, Exosens, FLIR Systems, Aselsan, Leonardo, Theon International Plc.

Global Military Image Intensifier Tube Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.61 billion

- 2026 Market Size: USD 1.69 billion

- Projected Market Size: USD 2.67 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Russia, China, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

Military Image Intensifier Tube Market Growth Drivers and Challenges:

Growth Drivers

-

Rising asymmetric warfare and multi-domain operations: The adoption of image intensifier tubes has increased due to the expanding non-state actors and hybrid warfare scenarios. The procurement of Gen III image intensifier tubes is predicted to heighten during the stipulated timeframe in the backdrop of rising investments to improve covert operations. A recent instance of a major defense contract highlights the lucrativeness within the military image intensifier tube market. For instance, in January 2025, L3Harris Technologies announced a USD 263 million order from the U.S. Army to continue production of the enhanced Night Vision Goggle-Binocular (ENVG-B). Moreover, with multiple countries increasing their defense budgets, opportunities arise for defense equipment manufacturers to leverage the demand for night-vision goggles.

- Increase in applications in simulation programs: The military image intensifier tube market benefits from growing demands for advanced combat simulation and training programs. To maintain soft power in the evolving geopolitical ecosystem, defense agencies are scaling up night combat training to improve operational readiness.

Challenges

-

Competition from digital imaging technologies: Advancements in thermal imaging and digital night vision pose a challenge to traditional image intensifier tubes. Dual-mode optics can combine thermal and digital night vision in a single system, which is favored in hybrid warfare. The development can impact the long-term demand for image intensifier tubes.

- Export licensing complexities in defense trade: Stringent export control laws in defense can restrict the ease of international trade, adversely impacting market entry for newcomers. Wassenaar Arrangement, ITAR, etc., limit exports of Gen 4 and Gen 3 intensifiers to non-allied nations, which reduces the scope of market expansion for major defense companies. Additionally, within defense alliances, the approval process for high-end night vision exports can take years or months, affecting supply chain timelines.

Military Image Intensifier Tube Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 1.61 billion |

|

Forecast Year Market Size (2035) |

USD 2.67 billion |

|

Regional Scope |

|

Military Image Intensifier Tube Market Segmentation:

Application Segment Analysis

Night vision goggles segment is set to dominate around 37.9% military image intensifier tube market share by the end of 2035, owing to global proliferation of dismounted soldier modernization programs. The market research indicates that the requirement for improved visibility during night-time missions has heightened. The segment offers abundant investment opportunities, with major players such as L3Harris and Elbit Systems securing substantial contracts. For instance, in December 2023, Elbit Systems was awarded a USD 500 million contract to continue the supply of Squad Binocular Night Vision Goggle (SBNVG) systems to the U.S. Marines. Such major contracts highlight a stable market, making investments in these companies or their suppliers attractive for investors seeking to capitalize on the surging demand for night vision goggles.

The growth in requirement for weapon sights to be attached to next-generation weapons is driving opportunities in the segment within the military image intensifier tube market. In evolving combat scenarios, the requirement for accurate targeting in low-light environments has increased. Applications are set to increase as international conflict zones increase, such as the Ukraine- Russia and Israel-Palestine conflict. Moreover, the integration of night vision weapon sights with other systems, such as the Family of Weapon Sights-Individual (FWS-I) allows wireless links with night vision goggles, signifying advancements within the market. Investment opportunities are rife in leading companies such as Leonardo, DRS, BAE Systems, etc., which are at the forefront of delivering cutting-edge weapon sights solutions.

Technology Segment Analysis

The Gen 3 segment in military image intensifier tube market is set to exhibit the significant share throughout the forecast period as it offers superior performance over earlier generations. Gen 3 tubes are widely used in applications such as the AN/AVS-6 and AN/AVS-9 Aviators Night Vision Imaging Systems. The value chain for Gen 3 involves specialized manufacturing processes, creating opportunities for new entrants to enter the chain by supplying GaAs photocathodes. Moreover, the introduction of white phosphor Gen 3 tubes has changed the trajectory of the segment, by improving image quality substantially. With companies striving to improve the durability and lifespan of Gen 3 tubes, the application scope is predicted to heighten by the end of 2035.

Our in-depth analysis of the global military image intensifier tube market includes the following segments:

|

Application |

|

|

Technology |

|

|

Distribution Channel |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Military Image Intensifier Tube Market Regional Analysis:

North America Market Insights

North America in military image intensifier tube market is set to account for more than 35.8% revenue share by the end of 2035. This growth can be attributed to increased defense expenditures and the presence of major defense contractors. A key trend is the shift towards more durable Gen 3 tubes. Cross-border defense collaborations such as NORAD bolster investments in defense initiatives which has a positive impact on the market’s growth.

The U.S. military image intensifier tube market is set to hold the largest share in North America and remain a leading market globally. For FY2025, the budget allocated is USD 3.0 trillion with 28.6% allocated to national defense. Historically, the U.S. has been the largest spender in defense worldwide, and the spending is poised to increase throughout the forecast period. With escalating geopolitical tensions and the weapons race with China intensifying, the U.S. market is forecasted to provide sustained opportunities for the application of image intensifier tubes in various night-vision-enhancing equipment. Additionally, the profitable opportunities within the U.S. market can be deducted from the surging multi-million-dollar contracts to major companies such as L3 Harris, Leonardo, Elbit Systems, etc., to improve low-light visibility for defense forces.

The Canada military image intensifier tube market is predicted to maintain its growth behind the U.S. market throughout the anticipated timeline. The growing security concerns and Canada’s participation in international peacekeeping have driven the demand for advanced night vision solutions. Moreover, Canada is expected to intensify efforts to maintain pace with advancements in night-vision combat with evolving geopolitical strife, creating opportunities for a greater supply of image intensifier tubes. Prospects within the market include local manufacturing and distribution, with companies such as Alpha Optics Systems playing a role in meeting military needs. Key trends mirror those of the U.S. market, owing to geographical proximity with the focus on Gen 3 intensifying over the years. For investors, the Canada market offers niche opportunities to expand revenue shares.

Europe Market Insights

The Europe military image intensifier tube market is positioned to account for the second-largest revenue share globally, followed by APAC. The market research highlights that the regional market’s growth is fueled by the modernization of defense forces across member states. The European Union’s (EU) Common Security and Defense Policy (CSDP) has been promoting coordinated defense initiatives to support the procurement of advanced military equipment. The IISS reported that Europe increased defense spending by 50% in 2024, which bodes well for major defense firms in Europe, such as Thales and Hensoldt.

The trade dynamics for image intensifier tubes in Europe for military applications are influenced by the European Defense Agency (EDA), which facilitates cooperation and standardization, highlighting the potential of coordinated procurement efforts. In February 2025, Instro Precision Technologies secured a USD 20 million contract to supply XACT nv33 compact night vision goggles (NVGs) to armed forces in the UK.

The Germany military image intensifier tube market is poised to register a significant revenue share in Europe. A key driver of the market is the procurement of new night vision equipment, evidenced by the Ministry of Defense’s order for advanced night vision goggles from Hensoldt in 2022. The procurement highlights Germany’s broader strategy to bolster defense readiness in low-light operations in the backdrop of increased defense spending to meet NATO targets. Recent market movements include the approval of the Third option of the OCCAR night vision contract announced in December 2024. Per the contract, 25 thousand binoculars equipped with photonis image intensifier tubes will be supplied by HENSOLDT Optronics GmBH and THEON SENSORS SA.

The France military image intensifier tube market is set to maintain a growth curve during the forecast period. France’s active role in counter-terrorism and peacekeeping missions, coupled with an increase in investments in advanced defense technologies adds to opportunities within the domestic market. Thales, a major defense company in France, holds a leading share within the domestic market through its portfolio of the LUCIE family of night vision goggles. Furthermore, opportunities center on the Loi de Programmation Militaire 2024-2030, which supports the increase in the defense budget of France. The ecosystem in the France market fosters investment opportunities for firms specializing in high-performance image intensifier technologies.

Military Image Intensifier Tube Market Players:

- L3 Harris Technologies

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Elbit Systems

- Thales Group

- Photonis

- Hensoldt AG

- BAE Systems PLC

- Exosens

- FLIR Systems

- Aselsan

- Leonardo

- Theon International Plc

The military image intensifier tube market is poised to expand during the stipulated timeframe from 2025 to 2037. Companies are advancing revenue shares by investing in R&D for dual-use technologies. Collaboration with defense agencies through contracts and partnerships ensures a steady demand, fostering innovation tailored to specific military needs. For instance, in October 2024, Theon International Plc received approval from the German parliament for FDI in Harder Digital Group, with the acquisition poised to increase the capacity of Gen 3 image intensifier tubes manufacturing lines in Germany.

Here are some key players in the military image intensifier tube market:

Recent Developments

- In February 2025, Microsoft Corporation and Anduril announced a partnership to advance the Integrated Visual Augmentation System (IVAS) program for the U.S. Army. Via this partnership agreement, Anduril will assume the oversight of production and future development related to IVAS.

- In February 2025, Exosens announced the strengthening of its partnership as a key supplier to Senop for night vision image intensifier tubes. The contract is the third for Senop and reflects the rising demand for night vision goggles.

- Report ID: 7307

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.