Microsurgery Robot Market Outlook:

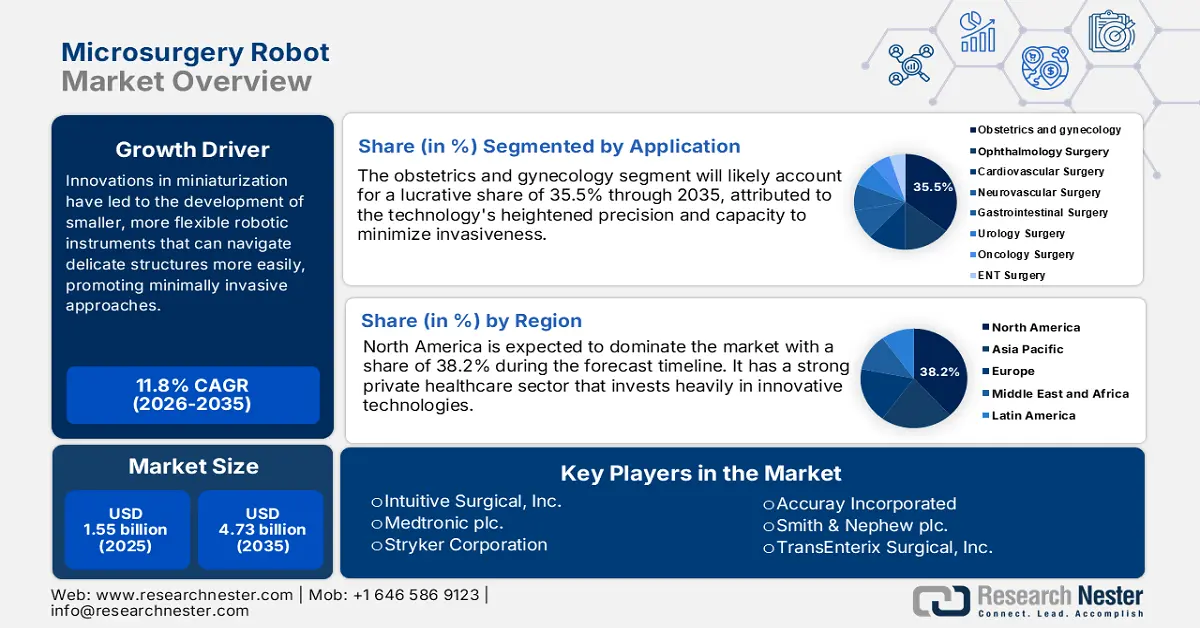

Microsurgery Robot Market size was valued at USD 1.55 billion in 2025 and is expected to reach USD 4.73 billion by 2035, registering around 11.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of microsurgery robot is evaluated at USD 1.71 billion.

The market is growing at a steady pace due to high-definition imaging that helps to perform intricate tasks. For instance, in January 2023, Panasonic Holdings Corporation declared that it developed the hyperspectral imaging technology with the highest sensitivity*1 in the world. By utilizing compressed sensing technology*3 it can be used in medical care and space exploration. Moreover, improvements in robotic innovations that maximize operating skills, growth in minimally invasive procedures, and increased burden of chronic disorders are the central drivers of growth for the microsurgical robot system.

In addition, the need for improved surgical accuracy and faster recovery times in patients is propelling the application of these systems. Trends currently are strongly inclined towards embracing artificial intelligence (AI) and machine learning algorithms that support surgeons in decision-making and precision activities, thereby improving the quality of care. For instance, in October 2024, Microsoft Corp. introduced several innovations in Microsoft Cloud for Healthcare. These developments enhanced collaboration, empowered medical staff, linked care experiences, and provided clinical and operational insights.

Key Microsurgery Robot Market Insights Summary:

Regional Highlights:

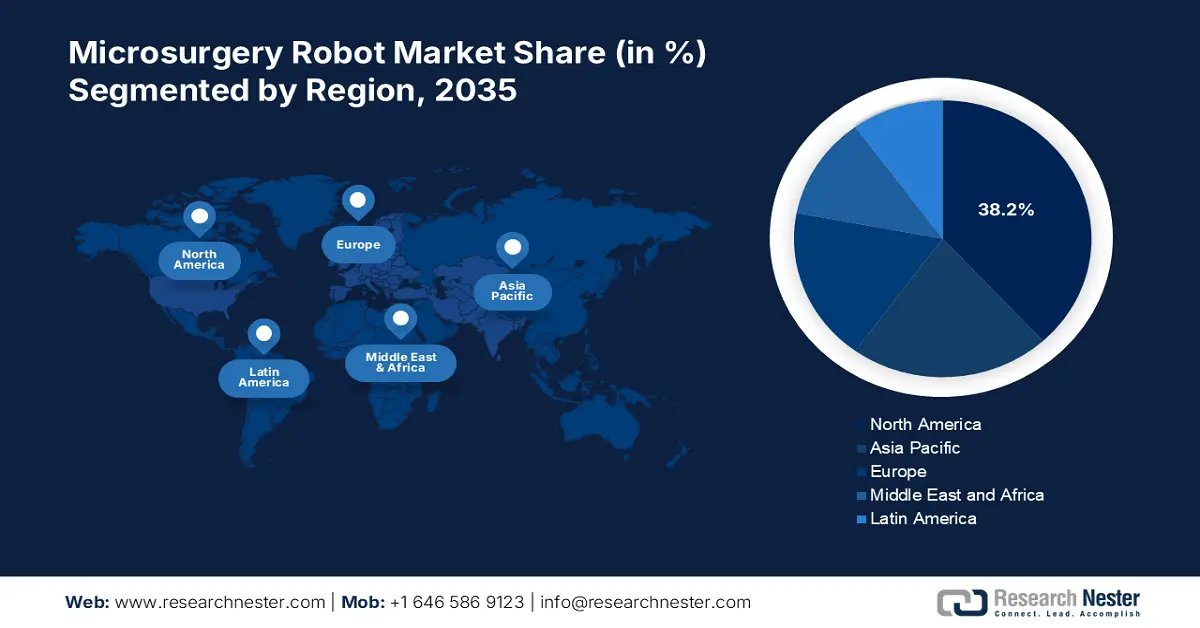

- North America microsurgery robot market will account for 38.20% share by 2035, driven by emphasis on patient safety, healthcare spending, and government initiatives.

Segment Insights:

- The obstetrics and gynecology surgery segment in the microsurgery robot market is expected to hold a 35.50% share by 2035, attributed to rising demand for minimally invasive robotic procedures and a surge in complex surgeries for women.

Key Growth Trends:

- Advancement in robotic technologies

- Training programs for healthcare professionals

Major Challenges:

- Skepticism and resistance to new technologies

Key Players: Intuitive Surgical, Inc., Medtronic plc, Stryker Corporation, Zimmer Biomet Holdings, Inc., Smith & Nephew plc, Mazor Robotics (Medtronic), Microsure B.V., TransEnterix, Inc. (Asensus Surgical), Renishaw plc, Medical Microinstruments S.p.A.

Global Microsurgery Robot Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.55 billion

- 2026 Market Size: USD 1.71 billion

- Projected Market Size: USD 4.73 billion by 2035

- Growth Forecasts: 11.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, China, United Kingdom

- Emerging Countries: China, Japan, India, South Korea, Brazil

Last updated on : 18 September, 2025

Microsurgery Robot Market Growth Drivers and Challenges:

Growth Drivers

-

Advancement in robotic technologies: Improvements in robot technology are the key driving factor in microsurgery robots development only due to greater precision and improved performance of surgery. Advances in high-definition imagery, real-time feed systems, and dexterous robotic instrumentation enable surgeons to conduct complex procedures with unexampled accuracy and precision. For instance, in March 2022, Matrox Imaging was acquired by Zebra Technologies to expand its portfolio in automation and vision technology solutions to provide precision monitoring and control in healthcare settings. Such technologies reduce the risk of complications and shorten the duration of the overall procedure.

-

Training programs for healthcare professionals: Medical education for healthcare professionals is among the key drivers of the microsurgical robot systems market. They facilitate easy skill development, allowing surgeons and surgical teams to operate with these high-technology machines proficiently. For instance, in March 2024, UNICEF India, in collaboration with the International Institute of Health Management Research, New Delhi, and IIT Bombay unveiled a digital course to equip healthcare professionals with the skills to drive the digital transformation of India's healthcare sector. It adds emphasis on training and inspires clinical practice to incorporate microsurgery robots.

Challenges

-

Limited adaptability to all surgical procedures: Limited versatility to any surgical procedure is among the biggest challenges of the microsurgical robot systems market. Robotic systems are superior in certain areas such as neurosurgery and reconstructive surgery, but in other types of surgery, their use may be constrained by anatomical restrictions or by distinctive procedural requirements. This inflexibility will undermine the general usability of robotic systems in operating theaters and even result in under-usage in fields in which traditional strategies are more popular. Hence, the failure to integrate robotic help with more varying surgery approaches is likely to avert the usage and investment of such novel technologies to a broader scope.

-

Skepticism and resistance to new technologies: A strong threat to the microsurgery robots market is apprehensions regarding the efficiency and effect of skepticism on the procedure of surgery. The majority of doctors would disapprove of robotic aid in favor of traditional means, out of fear that undue utilization of technology would render them less effective and less skilled practitioners. Moreover, the potential for complications with robotic procedures and endless long-term outcomes can also be a worry for operators. Not only does this prudence dissuade robotic systems from being introduced, but it also keeps innovation in surgical procedure capability off the table.

Microsurgery Robot Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.8% |

|

Base Year Market Size (2025) |

USD 1.55 billion |

|

Forecast Year Market Size (2035) |

USD 4.73 billion |

|

Regional Scope |

|

Microsurgery Robot Market Segmentation:

Application Segment Analysis

Obstetrics and gynecology segment is projected to capture over 35.5% microsurgery robot market share by 2035, due to the higher number of complex procedures being performed on women. For instance, in July 2023, as per the report by the National Library of Medicine, by 2021, there were 1,235 robotic surgeries performed in obstetrics and gynecology, a sharp increase of 782%. Such increase in cases demand for minimal invasiveness, overall outcomes, and patient satisfaction is improved. Dependence on robotic technology will certainly grow and demand for more advanced surgical procedures in obstetrics and gynecology continues to grow, further solidifying its position.

End use Segment Analysis

The hospitals and clinics segment in the microsurgery robot market will garner a lucrative share due to their primary function of providing high-level services and treatment. Hospitals play a pivotal role in embracing newer technologies in a bid to enhance the outcome of the patient, increase the precision of surgery, and reduce recovery time. For instance, in August 2024, more than 500 in-human surgeries using the Symani Surgical System were completed in the European Union. Furthermore, boosting the central role of hospitals and clinics is growing emphasis on minimally invasive surgery and an expanding number of procedures performed in these institutions.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Microsurgery Robot Market Regional Analysis:

North America Market Insights

North America in microsurgery robot market is projected to dominate around 38.2% revenue share by the end of 2035, owing to the high emphasis in hospitals on promoting patient safety and outcomes. In addition, these crucial areas of care are responsible for the incorporation of such advanced technologies. Furthermore, the region's substantial market share is also a result of encouraging government initiatives, rising healthcare spending, and rising healthcare professional awareness.

The U.S. landscape in the market is characterized by exemplary developments, prompted mainly by an enormous need for accuracy in operations and a growing population in need of sophisticated medical treatments. For instance, in October 2023, Microsure, announced that its Series B2 investment round had closed successfully, raising USD 38 million for development funding to complete the development of its newest microsurgical robot, MUSA-3, for clinical trials. It was approved by the FDA.

The microsurgery robot market in Canada is significantly growing due to smooth regulatory approvals and processes. For instance, in December 2021, the Hugo robotic-assisted surgery (RAS) system was licensed by Health Canada for use in urologic and gynecologic laparoscopic surgical procedures. It accounts for roughly half of all robotic procedures carried out. Hence, accepting such systems and advancements enhances patient outcomes and results in better care.

Asia Pacific Market Insights

The microsurgery robot market in Asia Pacific is projected to be the fastest-growing market during the stipulated timeframe. The strong presence of companies in the region are expanding its footprints to improve healthcare facilities throughout the region. For instance, in October 2023, with two distribution agreements spanning almost a dozen countries in the Asia Pacific (APAC), MMI (Medical Microinstruments, Inc.) announced to maintain its global momentum.

The microsurgery robot market in India is expanding due to the revolutionary steps taken by companies to foster and deliver expertise in the usage of advanced technologies. For instance, in November 2024, a cutting-edge robotic cardiac surgery program was launched in India by SS Innovations International, Inc., leveraging its flagship SSi Mantra surgical robotic system. The company's cardiac program seeks to use the SSi Mantra to train surgeons nationwide in robotic coronary artery bypass and intracardiac surgery, as well as to revitalize and energize the field in India.

The market in China is gaining noteworthy traction owing to the growth of healthcare technology and increasing demand for minimally invasive surgery. For instance, in November 2024, Stereotaxis Inc. declared that the China government had approved its Genesis surgical robot. This advanced system treats arrhythmias by providing safe and accurate cardiac ablation. Thus, patient populations fuel the demand for safe and accurate surgery, propelling China to the lead position in the global microsurgery robot market.

Microsurgery Robot Market Players:

- Intuitive Surgical, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medtronic plc.

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Accuray Incorporated

- Smith & Nephew plc.

- TransEnterix Surgical, Inc.

- Renishaw plc.

- Medrobotics Corporation

- Titan Medical Inc.

- Auris Health, Inc.

- Verb Surgical Inc.

- Microsure

- MST Medical Surgery Technologies Ltd.

- Synaptive Medical Inc.

The microsurgery robots market is highly competitive and intense due to continued investment in research and development by the dominant manufacturers towards introducing more precision and surgical results. For instance, in February 2021, Medical Microinstruments reported that it raised USD 110 million in a Series C funding round led by Fidelity Management & Research Company, with involvement from current investors. Hence, dominant manufacturers of the market concentrate on making new technologies and expanding product lines to address the full range of surgical applications.

Here's the list of some key players:

Recent Developments

- In September 2024, BGS added 1,000 square meters to its production and logistics halls and constructed new laboratory facilities at its Wiehl (NRW) location in response to the increasing need for sterilization services in biotechnology, medicine, and diagnostics.

- In May 2022, Sterigenics expanded its electron beam facility in Columbia City, Indiana. It provided E-beam sterilization services for medical and pharmaceutical devices and demonstrated its commitment to preserving the safety and integrity of these essential healthcare items.

- Report ID: 7212

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Microsurgery Robot Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.