Microcontroller Market Outlook:

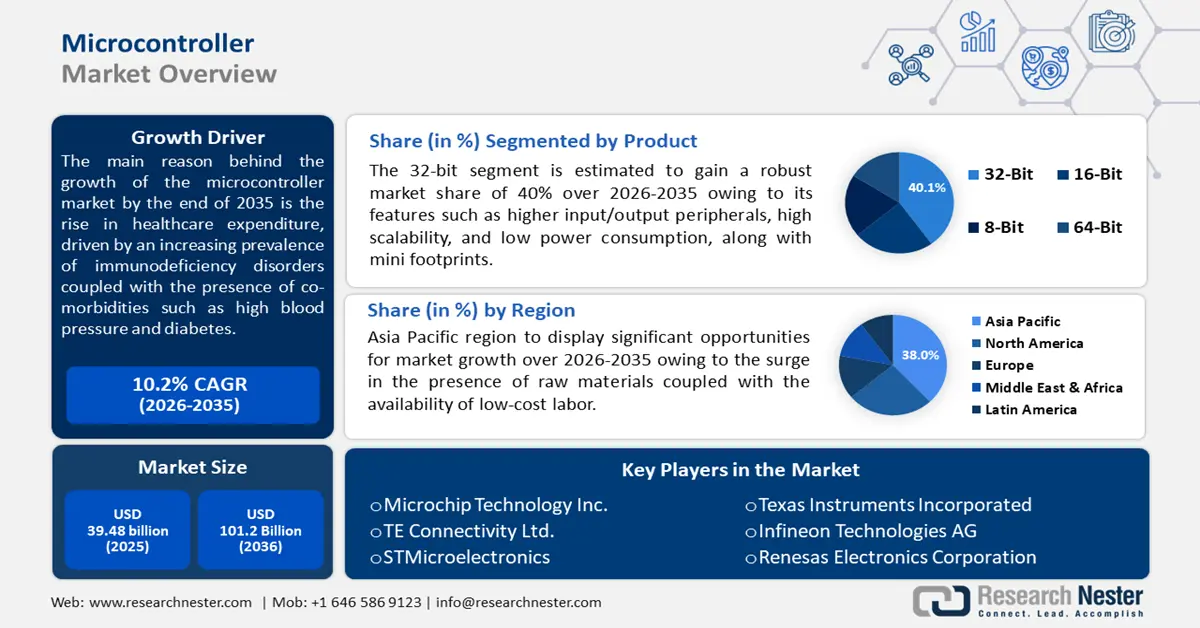

Microcontroller Market size was valued at USD 39.48 billion in 2025 and is likely to cross USD 104.28 billion by 2035, expanding at more than 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of microcontroller is assessed at USD 43.1 billion.

The microcontroller market is growing as a result of the rise in healthcare expenditure, driven by an increasing prevalence of immunodeficiency disorders coupled with the presence of co-morbidities such as high blood pressure and diabetes. In 2020, a National Institutes of Health report stated that globally about 6 million people suffer from primary immunodeficiencies, out of which about 70% remain undiagnosed. Moreover, this will boost the demand for electronic medical devices for measuring sugar levels and blood pressure, thereby driving the growth in dependable and affordable medical equipment worldwide.

Key Microcontroller Market Insights Summary:

Regional Highlights:

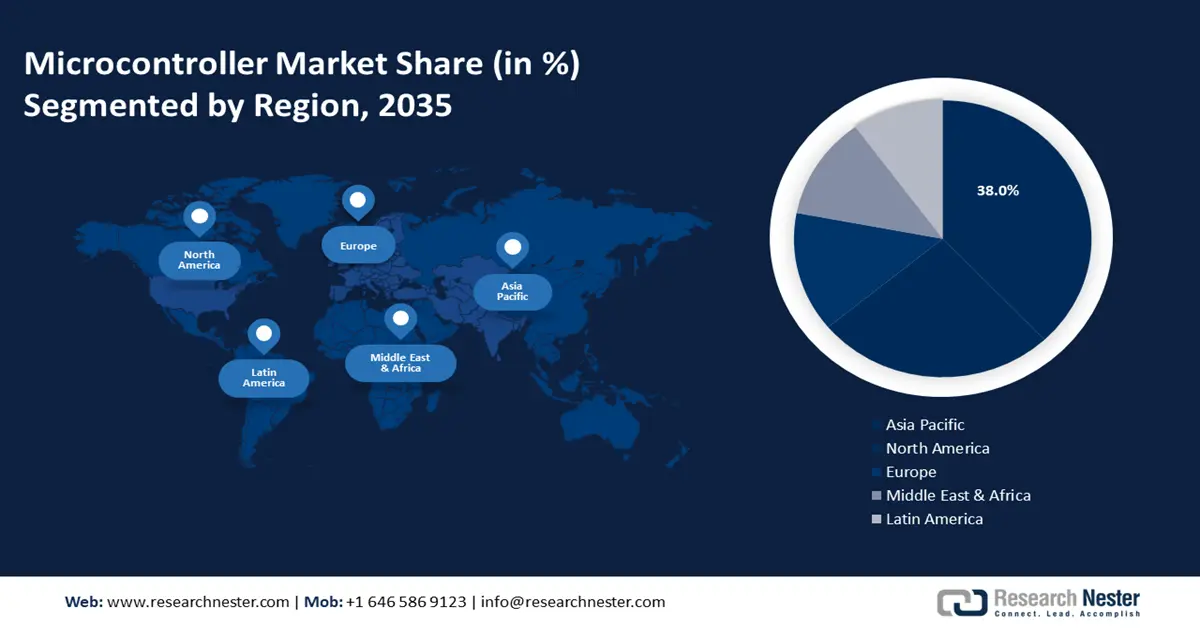

- The Asia Pacific microcontroller market will dominate around 38% share by 2035, driven by the surge in raw material availability and low-cost labor.

Segment Insights:

- The 32-bit segment in the microcontroller market anticipates a 40.10% share by 2035, propelled by increasing adoption of IoT devices, high-performance computing advancements, and growth in automotive and smart home sectors.

- Automotive segment in the microcontroller market is expected to achieve lucrative growth by the forecast year 2035, driven by the booming sales of electric cars, expected to be 3 million higher in 2024 than in 2022.

Key Growth Trends:

- Increasing IoT (Internet of Things) devices

- Demand for technology-based medical devices

Major Challenges:

- Rising security concerns

- Operational failure

Key Players: Intel, Semiconductor Components Industries, LLC, Cypress Semiconductor Corporation, NXP Semiconductors, Microchip Technology Inc., TE Connectivity Ltd., STMicroelectronics, Texas Instruments Incorporated, Infineon Technologies AG, Renesas Electronics Corporation.

Global Microcontroller Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 39.48 billion

- 2026 Market Size: USD 43.1 billion

- Projected Market Size: USD 104.28 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, Japan, South Korea, Taiwan, Singapore

Last updated on : 17 September, 2025

Microcontroller Market Growth Drivers and Challenges:

Growth Drivers

- Increasing IoT (Internet of Things) devices - There is widespread adoption of microcontrollers in IoT systems owing to their affordability, compact size, and energy efficiency. It acts as a communication channel between the external environment and IoT devices. According to Research Nester analysis, in 2022 the global IoT connections showed a significant growth rate of 18.0% and achieved more than 14 billion active IoT endpoints.

Additionally, microcontroller technology has advanced significantly as a result of the rise of an interconnected device network that includes smart meters, household appliances, security systems, tablets, game consoles, televisions, and smartphones. It is anticipated that this will increase demand for IoT microcontrollers.

- Demand for technology-based medical devices - There is a rising advancement of technology in medical devices and equipments that include wearables, diagnostic tools and medical implants. People are becoming aware of their health and are using several wearable medical devices such as blood pressure monitors, heart rate monitors, spirometers, and many more.

Furthermore, the National Library of Medicine in 2020 concluded that about 1/3rd of U.S. adults use wearable healthcare devices, of which about 47% use these devices daily. These technologies assist patient care, increase diagnostic precision and offer a range of treatments. As a result, microcontrollers are in demand to manage and control these devices fostering microcontroller market expansion.

- Rising government initiatives - The automotive industry is shifting toward automation, connectivity, and electrification. Microcontrollers play a crucial role in these innovations, as they are used in essential parts of many automotive control systems, such as airbags, infotainment, advanced driver-assistance systems (ADAS), and anti-lock brakes. Several governments are strategically investing to boost domestic automobile manufacturing. For instance, the Government of India approved the Production Linked Initiative (PLI) in 2021 to provide a budgetary outlay of USD 3.5 billion from 2022 to 2027. This is projected to drive the automobile manufacturing value chain in the country, in turn, aiding the microcontroller market expansion.

Challenges

- Rising security concerns - The expansion of IoT connected devices and applications is increasing the risk of security breaches. When designing microcontrollers, security is the priority to prevent data breaches and unauthorized access. Furthermore, the microcontroller industry is subject to several laws and regulations from the automotive and medical device sectors. Manufacturers may find it costly and time-consuming to comply with these regulations, thus, hindering industry growth.

- Operational failure - To function consistently, an MCU requires a stable power network. When external interference continuously interrupts the MCU's power supply, the MCU may enter failure mode. A drop in the operating voltage may result in an MCU freezing or acting strangely.

Microcontroller Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 39.48 billion |

|

Forecast Year Market Size (2035) |

USD 104.28 billion |

|

Regional Scope |

|

Microcontroller Market Segmentation:

Product

32-Bit segment is estimated to dominate over 40.1% microcontroller market share by 2035. The segment's tremendous growth rate can be augmented by its several features, such as higher input and output peripherals, high scalability, low power consumption, and mini footprints compared to several other MCUs in the industry.

A recent report by Research Nester concluded that 32-bit microcontrollers will dominate the landscape, credited to the increase in IoT devices, their high-performance computing technological advancements, and the tremendous growth in the automotive and smart home sectors.

Application

Automotive segment in the microcontroller market is set to showcase lucrative growth rate till 2035, in connection with the microcontroller revenue share attributed to the lucrative influence of smart vehicles and their technological features such as advanced safety systems, telematics, in-vehicle infotainment systems, instrument clusters, and many more. According to a report by the International Energy Agency in 2024, the sales of electric cars were 3 million higher than the sales in 2022, which is about 5 times more than in 2018.

Our in-depth analysis of the global microcontroller market includes the following segments:

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Microcontroller Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is poised to hold largest revenue share of 38% by 2035. The landscape's substantial growth in the region is led by the surge in the presence of raw materials coupled with the availability of low-cost labor in this region. According to a report in 2023, Asia dominated the global goods trade by 53%.

In China, there is an increasing demand for automobiles propelled by several features such as ADAS, safety features, and many more, which fuel the microcontroller landscape. According to the Shanghai Municipal People’s Government in 2023, vehicle sales and production hit more than 480,000 units, with a lucrative growth rate of 46.3% every year.

Japan showed an increase in the wearable technology industry along with the digital health in past years which is expected to act as a growing factor for the microcontroller market in the near future. The International Trade Administration published a report in 2022 stating that about 37% of Japan’s population uses digital technology in health-related concerns and the health-tech market in Japan is predicted to cross 3 billion by 2025.

North American Market Insights

North America in microcontroller market is estimated to capture over 26% revenue share by 2035, and will account for the second position owing to the slated growth in the Internet of Things (IoT) in homes and corporate places. In the United States, there has been an increase in technological advancements in semiconductors coupled with their components. According to the Semiconductor Industry Association in 2024, there has been a year-on-year increase of about 4.3% in the semiconductor employment rate. The semiconductors sector offered approximately 203,000 employment opportunities in 2023.

There is an increasing need for medical devices in Canada which demands a surge in the microcontroller market in the coming years. According to Innovation, Science, and Economic Development Canada in 2024, medical device exports in Canada observed a substantial growth between 2017 and 2022.

Microcontroller Market Players:

- Intel

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Semiconductor Components Industries, LLC

- Cypress Semiconductor Corporation

- NXP Semiconductors

- Microchip Technology Inc.

- TE Connectivity Ltd.

- STMicroelectronics

- Texas Instruments Incorporated

- Infineon Technologies AG

- Renesas Electronics Corporation

Microcontroller market expansion is predicted that the top five companies will occupy about 20%. Most of these companies are continuously expanding, collaborating, and adopting joint venture strategies to strengthen their position in the market. Some of the key players include:

Recent Developments

- Infineon Technologies AG- The AURIX TC4x series, the most recent version of Infineon Technologies AG's AURIXTM microcontroller family, was released. It was designed to meet the needs of the automotive industry's changing trends, such as eMobility, advanced driver assistance systems (ADAS), automotive electric-electronic (E/E) architectures, and affordable artificial intelligence (AI) applications.

- Renesas Electronics Corporation- Renesas declared that the new 22nm node will see the introduction of their first MCU. This MCU, which is intended for use in wireless applications, is an extension of the RA 32-bit Arm Cortex-M family.

- Report ID: 6259

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Microcontroller Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.