Micro Motor Market Outlook:

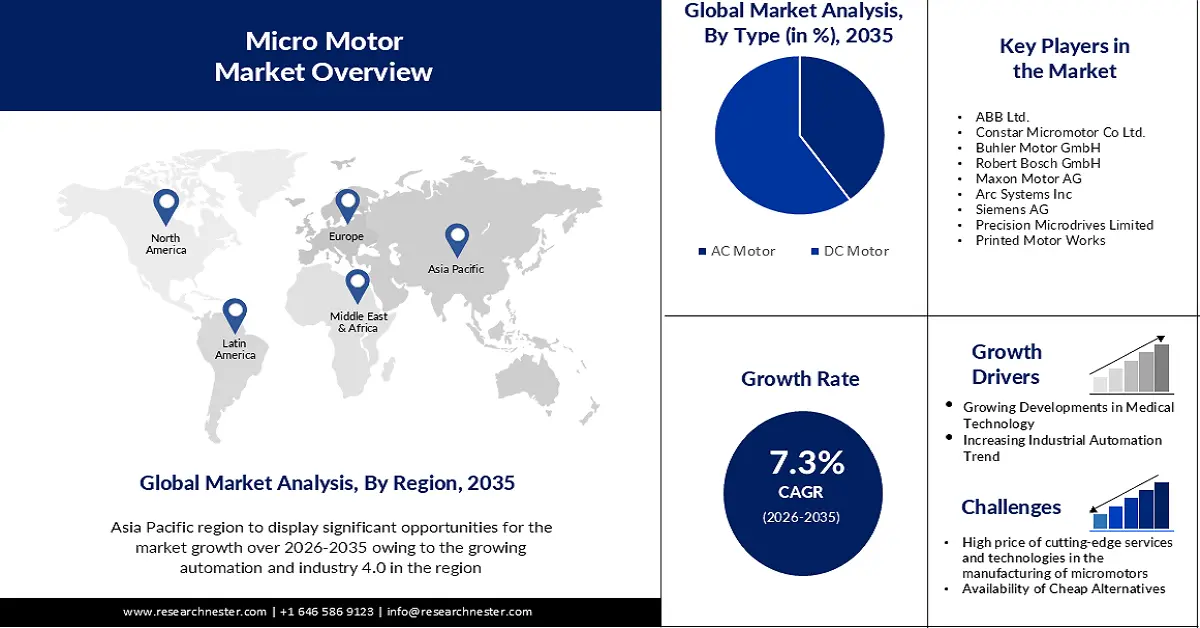

Micro Motor Market size was valued at USD 49.74 billion in 2025 and is set to exceed USD 100.62 billion by 2035, registering over 7.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of micro motor is estimated at USD 53.01 billion.

Micro motors play a major role in the evolution of the robotics industry and the increasing acceptance of consumer electronics like smartphones, tablets, wearables, and smart appliances. These motors are used extensively for tasks like vibration, autofocus in cameras, and precise movement in robotics. In 2022, the consumer electronics industry brought in revenue of a total of USD 987 billion.

In addition to these, the need for micro motors for use in industrial machinery and systems is rising as a result of emerging nations' quick industrialization and infrastructure expansion. China, for instance, saw a 20% growth in industrial robot installations in 2021.

Key Micro Motor Market Insights Summary:

Regional Highlights:

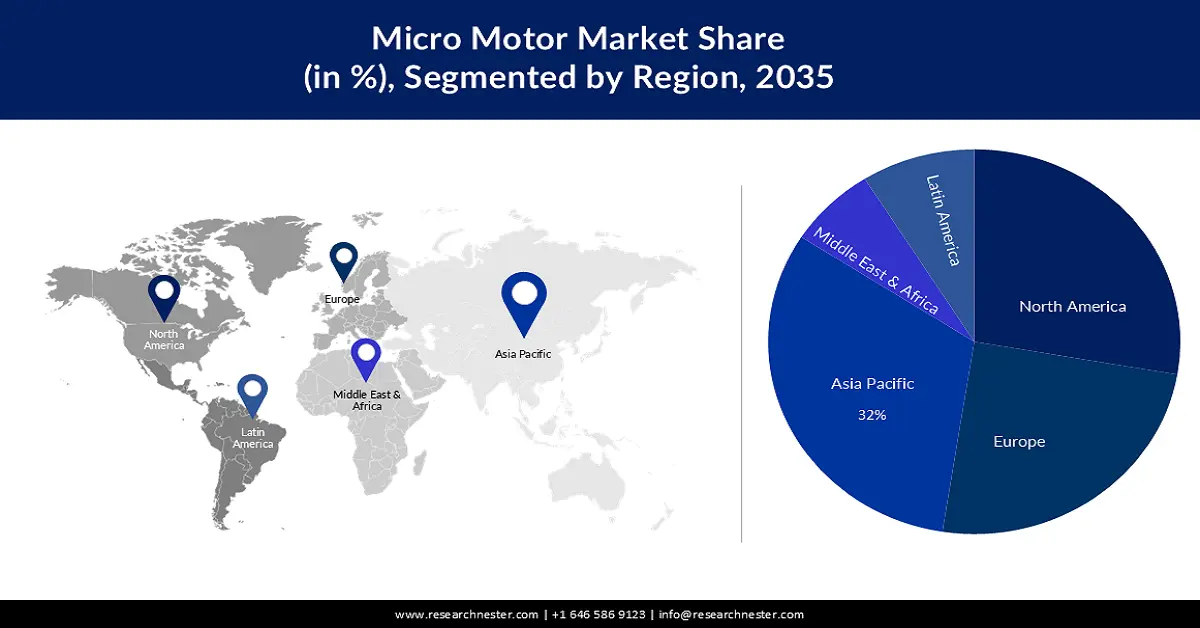

- Asia Pacific micro motor market will secure over 32% share, propelled by the growing reliance on automation and Industry 4.0, forecast period 2026–2035.

Segment Insights:

- The dc motor segment in the micro motor market is anticipated to hold a 60% share by 2035, attributed to its cost-effectiveness and durability compared to AC motors.

Key Growth Trends:

- Growing developments in medical technology

- Increasing industrial automation trend

Major Challenges:

- Micro motors' small size frequently causes overheating and other performance problems. For producers, minimizing these downsides is a major issue.

- The entry of micro motors into low-end and price-sensitive markets is hampered by the availability of small, inexpensive motors.

Key Players: Johnson Electric Holdings Limited, ABB Ltd., Constar Micromotor Co Ltd., Buhler Motor GmbH, Robert Bosch GmbH, Maxon Motor AG, Arc Systems Inc, Siemens AG, Precision Microdrives Limited, Printed Motor Works.

Global Micro Motor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 49.74 billion

- 2026 Market Size: USD 53.01 billion

- Projected Market Size: USD 100.62 billion by 2035

- Growth Forecasts: 7.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Micro Motor Market Growth Drivers and Challenges:

Growth Drivers

-

Growing developments in medical technology - Several factors, including the growing technical improvements in medical equipment, are driving the micro motor market. There is an increasing need for more precise and accurate advanced medical devices led by the rising rates of chronic diseases and healthcare costs.because they are utilized in so many different medical equipment, including dental handpieces, surgical robots, implantable technology, and diagnostic tools, micromotors are essential to addressing this need. Moreover, micro motors' expanding demand in the medical industry has been facilitated by their capacity to be integrated into small, portable medical devices.

-

Increasing industrial automation trend - The growing trend of automation in various industrial processes is driving the micro motor market. Manufacturing industries are concentrating on streamlining processes, cutting waste, and raising productivity to maintain their competitiveness in the industry.Industries with low profitability, such as oil & gas, metal, and packing, now depend heavily on industrial control and factory automation. Precise assembly is also necessary in the car industry to prevent manufacturing errors that cause huge losses.

Many micro motors are needed for various factory automation equipment and devices, including robotic welding, pick-and-place machines, customized conveyor belts, automated testing probes, and 5-axis CNC systems. Factory automation is mostly used in the manufacturing sector to guarantee accurate assembly and fast turnaround times. - Growing popularity of autonomous vehicles - The automobile industry's shift to electric vehicles and autonomous driving technologies will lead to a rise in the need for efficient and small micro motors for a variety of functions within these vehicles, including HVAC systems, power windows, and seat adjustment.More electronic features and systems are being used in the automobile sector. Examples of these include electric power steering, advanced driver assistance systems (ADAS), and electric vehicles (EVs), all of which rely on micromotors for different purposes. Over 10 million EVs are currently on the road. In consideration to this, the micro motor market is estimated to witness growth.

Challenges

-

High price of cutting-edge services and technologies in the manufacturing of micromotors - It can be expensive to create and maintain the specialized production techniques and cutting-edge technology needed to produce micromotors. The business also demands the usage of cutting-edge materials, which impact prices even further.Additionally, compared to other industrial products, the demand for micro motors is frequently lower, which makes it difficult to maintain low costs and realize economies of scale. This is particularly true for specialist micromotors designed for specialized uses, where a great deal of development and customization is required, driving up costs even further.

-

Micro motors' small size frequently causes overheating and other performance problems. For producers, minimizing these downsides is a major issue.

- The entry of micro motors into low-end and price-sensitive markets is hampered by the availability of small, inexpensive motors.

Micro Motor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.3% |

|

Base Year Market Size (2025) |

USD 49.74 billion |

|

Forecast Year Market Size (2035) |

USD 100.62 billion |

|

Regional Scope |

|

Micro Motor Market Segmentation:

Type Segment Analysis

The DC motor segment in the micro motor market is estimated to gain the largest revenue share of about 60% in the year 2035. The segment growth can be credited to the DC motors are less expensive than AC motors and have higher starting torque, and starting and reversing speeds, they are more durable. When compared to brushless motors, brushed motors are less expensive and simpler to install. These motors run between 1,000 and 10,000 revolutions per minute.

A brushed DC micro motor is used in many vehicle systems, including cooling fans, power windows, wipers, and more. Conversely, brushless systems are more prone to breakage and have a longer lifespan. The lifespan of a brushless motor is greater than 10,000 operating hours. Also, to requiring less maintenance, brushless motors produce more output per frame size.

Furthermore, electric hair dryers, electric toothbrushes, and electric razors are just a few examples of personal appliances and power tools that use DC motors because of their high-power density. A Mintel survey from 2022 states that 41% of adults used an electronic toothbrush and 58% used a manual toothbrush during the previous six months.

Application Segment Analysis

Based on application, the medical equipment system segment in the micro motor market is expected to hold the largest revenue share of about 30% by 2035. With the invention of portable medical gadgets, which enable healthcare providers to deliver high-quality care outside of traditional hospital settings, the healthcare sector has experienced a radical change. Thanks to their ability to facilitate early disease identification and lower healthcare expenditures, these technologies have the potential to enhance patient outcomes and lower hospitalization rates.

Surgery has been transformed by micromotors, which provide surgeons with more precise control over surgical instruments and enable less invasive and more efficient procedures. Compact and user-friendly medical equipment and tools that may be carried and utilized in a variety of places, including residences, clinics, ambulances, and isolated areas, are known as portable medical devices. The usage of micromotors in portable medical devices for surgery, medicine delivery, and diagnosis is growing.

Our in-depth analysis of the micro motor market includes the following segments:

|

Type |

|

|

Technology |

|

|

Power Consumption |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Micro Motor Market Regional Analysis:

APAC Market Insights

Micro motor market in the Asia Pacific is estimated to hold the largest with a share of about 32% by the end of 2035. The market in the region is also expected on account of growing reliance on automation and Industry 4.0. The demand for accurate and efficient micromotors is rising as automation and robots become more widely used in sectors including manufacturing, electronics, and the automobile industry.

The need for micro motors is being influenced by the region's increasing need for electric automobiles. With about six million electric vehicles delivered, China led the Asia-Pacific region in sales of electric vehicles in 2022. In contrast, about 28,000 electric vehicles were sold in New Zealand in 2022.

North America Market Insights

The North America region will also encounter huge gain for the micro motor market during the forecast timeframe and will hold the second position on account of the increasing frequency of obesity in this region. This expansion is facilitated by the robust presence of major industrial players as well as the thriving landscape for electrical appliances, automobiles, aircraft, and healthcare.

For instance, the California-based electric vehicle (EV) maker Tesla uses micromotors in a variety of applications, including HVAC systems, electric windows, and power steering. The North American automotive sector is experiencing a surge in demand for superior micro motor solutions impelled by Tesla's inventive approach to electric vehicle technology. The strong market demand for electrical gadgets and personal hygiene products in the area also boosts the need for micro motors.

Micro Motor Market Players:

- Johnson Electric Holdings Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB Ltd.

- Constar Micromotor Co Ltd.

- Buhler Motor GmbH

- Robert Bosch GmbH

- Maxon Motor AG

- Arc Systems Inc

- Siemens AG

- Precision Microdrives Limited

- Printed Motor Works

Recent Developments

- Johnson Electric Holdings Limited introduced the ECI-040 brushless DC motor platform. To make integration easier, the device accepts direct mains AC power through the controller as input. In addition, the electronically commutated motor provides increased efficiency, noise reduction, controllability, and reliability. For a wide range of applications, including coffee makers, smart furniture, and window shutters, the motor provides a robust and steady torque output.

- Maxon Motor run Parvalux, a manufacturer of electric motors, micro-motors, and other components will give on-site technical product and applications expertise for original equipment manufacturers (OEMs) in New York State, Pennsylvania, New Jersey, Maryland, Delaware, Northern Virginia, Washington, DC, and West Virginia owing to a partnership with Keller Industrial Products.

- Report ID: 5651

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Micro Motor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.