Global Market Size, Forecast, and Trend Highlights Over 2025-2037

Micro-hospitals Market size was over USD 285.64 billion in 2024 and is anticipated to cross USD 795.74 billion by 2037, witnessing more than 8.2% CAGR during the forecast period i.e., between 2025-2037. In the year 2025, the industry size of micro-hospitals is estimated at USD 304.38 billion.

The reason behind this growth is due to the growing number of patients that are suffering from life-associated chronic diseases, along with the increase in the aging population with high usage of smartphones and internet. According to the World Health Organization, (WHO), the population aged 60 years and more was 1 billion in 2019, and this is expected to cross 2.1 billion by 2050.

Moreover, the increasing prevalence of various chronic and infectious diseases, and the benefits of virtual healthcare, such as saving time and money through offered discounts, prevention from getting infections at hospitals or clinics, and the option for a second opinion simultaneously, are expected to influence the micro-hospitals market growth. According to the World Health Organization (WHO), Healthcare-associated infections (HAIs) affect 5 to 10% of patients in developed countries.

Key Micro-hospitals Market Insights Summary:

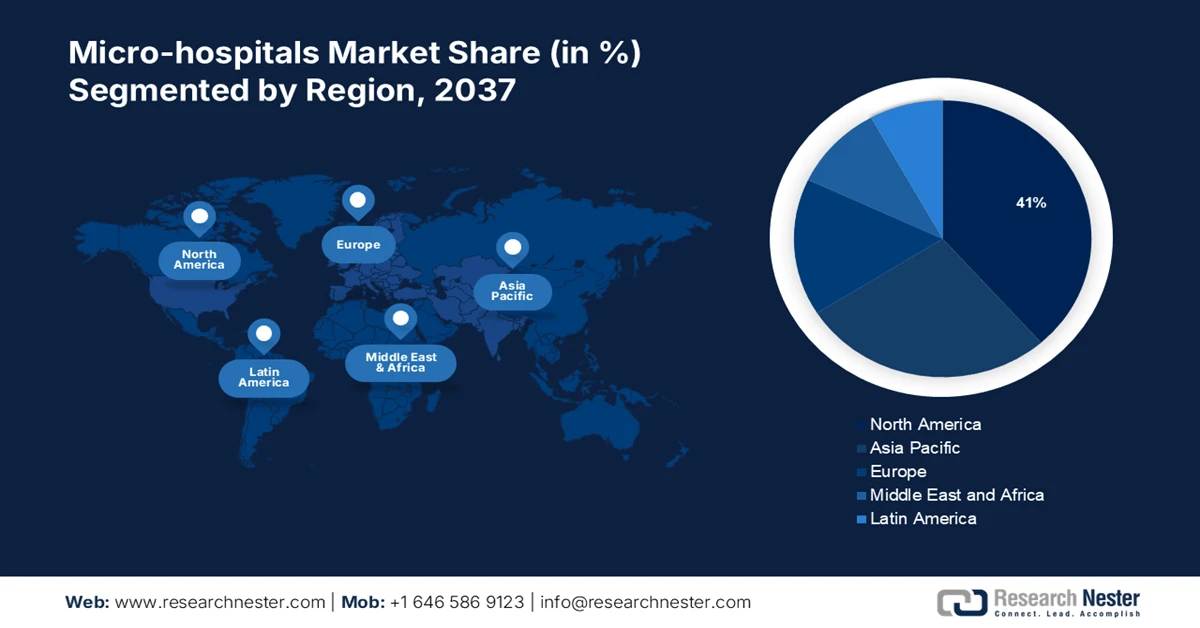

Regional Highlights:

- North America in the micro-hospitals market accounted for approximately 41% share in 2023, supported by rising governmental healthcare investments and intensified R&D efforts strengthening advanced care delivery platforms.

- Asia Pacific is projected to emerge as the second-largest region by 2037, backed by accelerating adoption of technologically advanced healthcare models and expanding industry presence stimulating micro-hospital startups.

Segment Insights:

- The Tier-1 Cities segment in the micro-hospitals market is projected to capture around 42% share by 2037, attributed to dense urban populations and heightened competition pushing demand for specialized and cost-effective healthcare services.

- The International Tourist segment is expected to hold a notable share by 2037, as foreign travelers increasingly prefer targeted and efficient medical services during overseas stays.

Key Growth Trends:

- Increasing healthcare demand and competition

- Growing need for specialized services

Major Challenges:

- Limited availability of skilled professionals

- Limited accessibility for using medical technology and equipment.

Key Players: Dignity Health, Emerus Hospital Partners, LLC, SCL Health, Saint Luke's Health System, Baylor Scott & White Health, CHRISTUS Health, Amerisource Bergen Corp., Cardinal Health Inc., Cigna Corp., Elevance Corp., Pfizer, Walgrees Boots Alliance Inc., Trivitron Healthcare, Seaskymedical.

Global Micro-hospitals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 285.64 billion

- 2025 Market Size: USD 304.38 billion

- Projected Market Size: USD 795.74 billion by 2037

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41% Share)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Japan

- Emerging Countries: India, China, South Korea, Australia, Singapore

Last updated on : 8 November, 2024

Micro-hospitals Market: Growth Drivers and Challenges

Growth Drivers

-

Increasing healthcare demand and competition: As the population is growing and aging, this results in an increasing demand for healthcare services and facilities. Additionally, the healthcare industry is becoming highly competitive along with several larger healthcare groups. This rising demand and competition create a need for effective, efficient, and cost-driven solutions.

-

Growing need for specialized services: The need for specialized services such as senior care, rehabilitation, and several other specialized treatments is in demand. micro-hospitals and clinics can provide localized services and cater to a specific patient group, allowing them to specialize their services and compete against larger hospital systems. This allows a micro-hospital to attract a specific patient group and build a strong local presence.

- Growing preference for personalized care: Patients are becoming more educated and highly aware about the selection of their treatment options. There has been a surge in the process of seeking personalized care services and such patients are willing to pay highly for the same. micro-hospitals can provide highly personalized care along with the services due to their specialized services and localized nature. This is a growth driver for the micro hospital market, as it allows them to establish themselves as a perfect provider of specialized and personalized services in this industry.

Challenges

-

Limited availability of skilled professionals: The availability of skilled professionals such as doctors and nurses is limited, which may limit the ability to provide timely and adequate care.

-

Limited accessibility for using medical technology and equipment.

- Limited space for the infrastructure

Micro-hospitals Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

8.2% |

|

Base Year Market Size (2024) |

USD 285.64 billion |

|

Forecast Year Market Size (2037) |

USD 795.74 billion |

|

Regional Scope |

|

Micro-hospitals Segmentation

Location (Tier 1 cities, tier 2 cities, tier 3 cities)

The tier-1 cities segment is estimated to gain a robust market share of 42% in the coming years owing to the presence of a dense population base, which creates a large customer pool for healthcare services. According to a report, more than 50% of the global population lives in urban areas, and this data might increase 1.5 times and cross the 6 billion population by 2045. This leads to increased competition, as various healthcare players compete for a large and lucrative market. The competition drives the need for specialized and more effective services at a competitive price, which further fuels the growth of micro-hospitals.

End-user (International tourists, corporates, individuals)

The International tourist segment is set to garner a notable share shortly and is likely to remain the second largest segment in the end-user segment of the micro-hospitals market as the tourists from foreign countries, who are unfamiliar with the local language and the country customs, are more likely to seek the need for specialized medical services during their stay in that city. This creates a high demand for micro-hospitals that provide targeted, efficient, and cost-effective services for international tourists.

Additionally, many Tier-1 cities have large numbers of international tourists, which provide a significantly higher customer base and a profitable market for the micro-hospital industry. The presence of international tourists also creates international awareness and appeal, which can also help to expand the micro-hospitals market

Facilities (Physical, therapy, primary care, rotating specialized, surgery centers, ultrasound)

The physical segment in the micro-hospitals market is estimated to hold a noteworthy share as they take up comparatively less space and also require comparatively lower costs than traditional hospitals. This allows for the operation of more micro-hospitals, which expands access to the healthcare industry along with a limited resource. Furthermore, it also reduces the investments that are needed for setting up a hospital, which creates a lower barrier to entry and leads to increased competition, which drives the micro-hospitals market

Our in-depth analysis of the global market includes the following segments:

|

Location |

|

|

End-users |

|

|

Facilities |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Micro-hospitals Industry- Regional Synopsis

North American Market Forecast

The micro-hospitals market in North America is estimated to have the largest share of approximately 41% in 2023, driven by the growing governmental investments in this market. According to a report, the total investment in healthcare was worth 57 billion USD in 2021, indicating a YoY increase of about 137%. Moreover, with the increase in research and development for producing more efficient and reliable healthcare and healthcare delivery platforms, these demands are expected to fuel the demand for the micro-hospitals market in the region.

APAC Market Statistics

The Asia Pacific micro-hospitals market is estimated to be the second largest, during the forecast timeframe led by an increase in the adoption of several technologically advanced healthcare models, along with the ever-expanding geographical reach of the companies in this industry as this causes a surge in the number of micro-hospitals healthcare start-ups along with the growing demand in service launches. For instance, according to the report by the US Department of Health & Human Services (HHS) in February 2022, HHS awarded around USD 55 million to increase virtual healthcare access and quality through community healthcare centers.

Companies Dominating the Micro-hospitals Market

- Dignity Health

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Emerus Hospital Partners, LLC

- SCL Health

- Saint Luke's Health System

- Baylor Scott & White Health

- CHRISTUS Health

- Amerisource Bergen Corp.

- Cardinal Health Inc.

- Cigna Corp.

- Elevance Corp.

- Pfizer

- Walgrees Boots Alliance Inc.

- Trivitron Healthcare

- Seaskymedical

Recent Developments

- SLC Health and international healthcare merger, merged along with Intermountain Healthcare in April 2022, while aiming to integrate their facilities into a single system, as a part of this, Intermountain rebranded itself with a new logo featuring coral and fuchsia logos along with dark blue signs in it.

- Trivitron Healthcare, announced their initiatives to raise awareness for newborn screening in India, “Ek sahi shuruat” on 14 November 2023.

- Report ID: 5952

- Published Date: Nov 08, 2024

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Micro-hospitals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.