Global Methotrexate Drug Market TOC

- Market Definition

- Definition

- Market Segmentation

- Product Overview

- Assumptions and Acronyms

- Research Methodology

- Research Process

- Primary Research

- Manufacturers

- Suppliers/Distributors

- End-Users

- Secondary Research

- Market Size Estimation

- Analyst Review

- Executive Summary – Global Methotrexate Drug Market

- Market Dynamics

- Growth Drivers

- Restraints

- Market Trends

- Opportunities

- Regulatory and Standards Landscape

- FDA

- WHO

- Others

- Industry Risk Analysis

- World Economic Outlook: Challenges for Global Recovery and its Impact on Global Methotrexate Drug Market

- Impact of COVID-19 on the Global Methotrexate Drug Market

- Epidemiology Analysis of Cancer and Rheumatoid Arthritis

- End-user analysis

- Industry Supply Chain Analysis

- Competitive Landscape

- Company Market Share Analysis

- Company Profiles

- Pfizer Inc.

- Azurity Pharmaceuticals, Inc.

- Cumberland Pharmaceuticals Inc.

- Teva Pharmaceuticals USA, Inc.

- Amneal Pharmaceuticals LLC

- Sun Pharmaceutical Industries Ltd.

- Aurobindo Pharma Limited,

- Sandoz Inc

- Hikma Pharmaceuticals PLC

- Eisai Co., Ltd.

- Other prominent players

- Global Methotrexate Drug Market 2023-2036

- Market Overview

- By Value (USD Million)

- By Type

- >10 mg, 2023-2036F (USD Million)

- >15 mg/ml, 2023-2036F (USD Million)

- 17.5 mg/ml – 25 mg/ml, 2023-2036F (USD Million)

- Others, 2023-2036F (USD Million)

- By Disease Type

- Cancer, 2023-2036F (USD Million)

- Breast Cancer, 2023-2036F (USD Million)

- Leukemia, 2023-2036F (USD Million)

- Lung Cancer, 2023-2036F (USD Million)

- Lymphoma, 2023-2036F (USD Million)

- Gestational Trophoblastic Disease, 2023-2036F (USD Million)

- Osteosarcoma, 2023-2036F (USD Million)

- Autoimmune Diseases, 2023-2036F (USD Million)

- Psoriasis, 2023-2036F (USD Million)

- Rheumatoid Arthritis, 2023-2036F (USD Million)

- Crohn's Disease, 2023-2036F (USD Million)

- Others, 2023-2036F (USD Million)

- Ectopic Pregnancy, 2023-2036F (USD Million)

- Others, 2023-2036F (USD Million)

- Cancer, 2023-2036F (USD Million)

- By Drug Type

- Branded, 2023-2036F (USD Million)

- Generics, 2023-2036F (USD Million)

- By Route Of Administration

- Injectable, 2023-2036F (USD Million)

- Oral, 2023-2036F (USD Million)

- By End User

- Hospitals, 2023-2036F (USD Million)

- Specialty Clinics, 2023-2036F (USD Million)

- Home Healthcare, 2023-2036F (USD Million)

- Others, 2023-2036F (USD Million)

- By Region

- North America, 2023-2036F (USD Million)

- Europe, 2023-2036F (USD Million)

- Asia Pacific, 2023-2036F (USD Million))

- Latin America, 2023-2036F (USD Million)

- Middle East & Africa, 2023-2036F (USD Million)

- By Type

- North America Methotrexate Drug Market 2023-2036

- Market Overview

- By Value (USD Million)

- By Type

- >10 mg, 2023-2036F (USD Million)

- >15 mg/ml, 2023-2036F (USD Million)

- 17.5 mg/ml – 25 mg/ml, 2023-2036F (USD Million)

- Others, 2023-2036F (USD Million)

- By Disease Type

- Cancer, 2023-2036F (USD Million)

- Breast Cancer, 2023-2036F (USD Million)

- Leukemia, 2023-2036F (USD Million)

- Lung Cancer, 2023-2036F (USD Million)

- Lymphoma, 2023-2036F (USD Million)

- Gestational Trophoblastic Disease, 2023-2036F (USD Million)

- Osteosarcoma, 2023-2036F (USD Million)

- Autoimmune Diseases, 2023-2036F (USD Million)

- Psoriasis, 2023-2036F (USD Million)

- Rheumatoid Arthritis, 2023-2036F (USD Million)

- Crohn's Disease, 2023-2036F (USD Million)

- Others, 2023-2036F (USD Million)

- Ectopic Pregnancy, 2023-2036F (USD Million)

- Others, 2023-2036F (USD Million)

- Cancer, 2023-2036F (USD Million)

- By Drug Type

- Branded, 2023-2036F (USD Million)

- Generics, 2023-2036F (USD Million)

- By Route Of Administration

- Injectable, 2023-2036F (USD Million)

- Oral, 2023-2036F (USD Million)

- By End User

- Hospitals, 2023-2036F (USD Million)

- Specialty Clinics, 2023-2036F (USD Million)

- Home Healthcare, 2023-2036F (USD Million)

- Others, 2023-2036F (USD Million)

- By Country

- United States, 2023-2036F (USD Million)

- Canada, 2023-2036F (USD Million)

- By Type

- Europe Methotrexate Drug Market 2023-2036

- Market Overview

- By Value (USD Million)

- By Type

- By Disease Type

- By Drug Type

- By Route Of Administration

- By End User

- By Country

- United Kingdom, 2023-2036F (USD Million)

- Germany, 2023-2036F (USD Million)

- France, 2023-2036F (USD Million)

- Italy, 2023-2036F (USD Million)

- Spain, 2023-2036F (USD Million)

- Russia, 2023-2036F (USD Million)

- Netherlands, 2023-2036F (USD Million)

- Rest of Europe, 2023-2036F (USD Million)

- Asia Pacific Methotrexate Drug Market 2023-2036

- Market Overview

- By Value (USD Million)

- By Type

- By Disease Type

- By Drug Type

- By Route Of Administration

- By End User

- By Country

- China, 2023-2036F (USD Million)

- India, 2023-2036F (USD Million)

- Japan, 2023-2036F (USD Million)

- South Korea, 2023-2036F (USD Million)

- Singapore, 2023-2036F (USD Million)

- Australia, 2023-2036F (USD Million)

- Rest of Asia Pacific, 2023-2036F (USD Million)

- Latin America Methotrexate Drug Market 2023-2036

- Market Overview

- By Value (USD Million)

- By Type

- By Disease Type

- By Drug Type

- By Route Of Administration

- By End User

- By Country

- Brazil, 2023-2036F (USD Million)

- Mexico, 2023-2036F (USD Million)

- Argentina, 2023-2036F (USD Million)

- Rest of Latin America, 2023-2036F (USD Million)

- Middle East & Africa Methotrexate Drug Market 2023-2036

- Market Overview

- By Value (USD Million)

- By Type

- By Disease Type

- By Drug Type

- By Route Of Administration

- By End User

- By Country

- Israel, 2023-2036F (USD Million)

- GCC, 2023-2036F (USD Million)

- South Africa, 2023-2036F (USD Million)

- Rest of Middle East & Africa, 2023-2036F (USD Million)

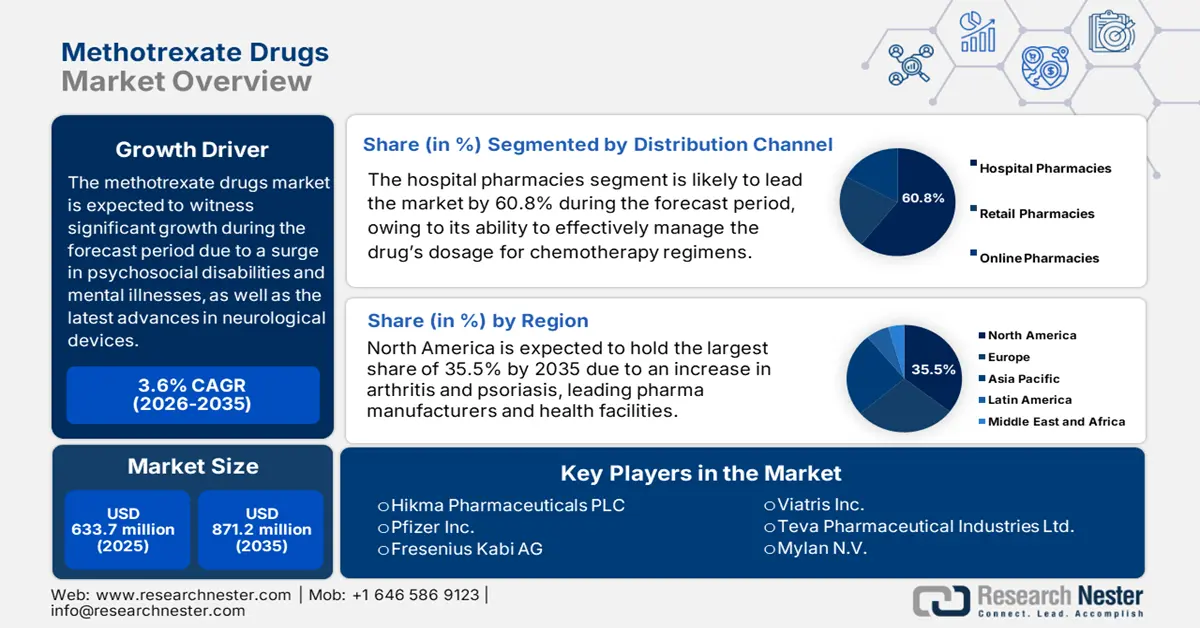

Methotrexate Drugs Market Outlook:

Methotrexate Drugs Market size was USD 633.7 million in 2025 and is anticipated to reach USD 871.2 million by the end of 2035, increasing at a CAGR of 3.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of methotrexate drugs is estimated at USD 680.1 million.

The market, despite being mature, effectively exhibits stabilized growth by evolving healthcare landscapes, economic necessity, and clinical utility. Its international position is deliberately resilient from a foundational role rather than innovation in worldwide treatment protocols. Factors, such as a rise in different cancers and rheumatoid arthritis (RA), increased cost of targeted and biologic synthetic DMARDs, and growth in healthcare facilities across emerging economies, are readily driving the market’s upliftment. According to an article published by NLM in March 2025, the RA prevalence accounts for 0.5% to 1.0%, and predominantly affects females, with a male-to-female ratio ranging from 1:2 to 1:3.

Moreover, as per an article published by the World Health Organization (WHO) in March 2025, the universal health coverage (UHC) index has readily increased from 45 to 68 over the past four years, which is also driving the market globally. Besides, the aspect of the primary healthcare (PHC) approach resulted in 75% of medical benefits, which includes saving more than 60 million lives and boosting the international life expectancy by 3.7 years by the end of 2030. Meanwhile, evolution in clinical practices, the launch of innovative delivery systems, and the National Essential Medicines Lists (NEMLs) inclusion are also uplifting the market.

Key Methotrexate Drugs Market Insights Summary:

Regional Insights:

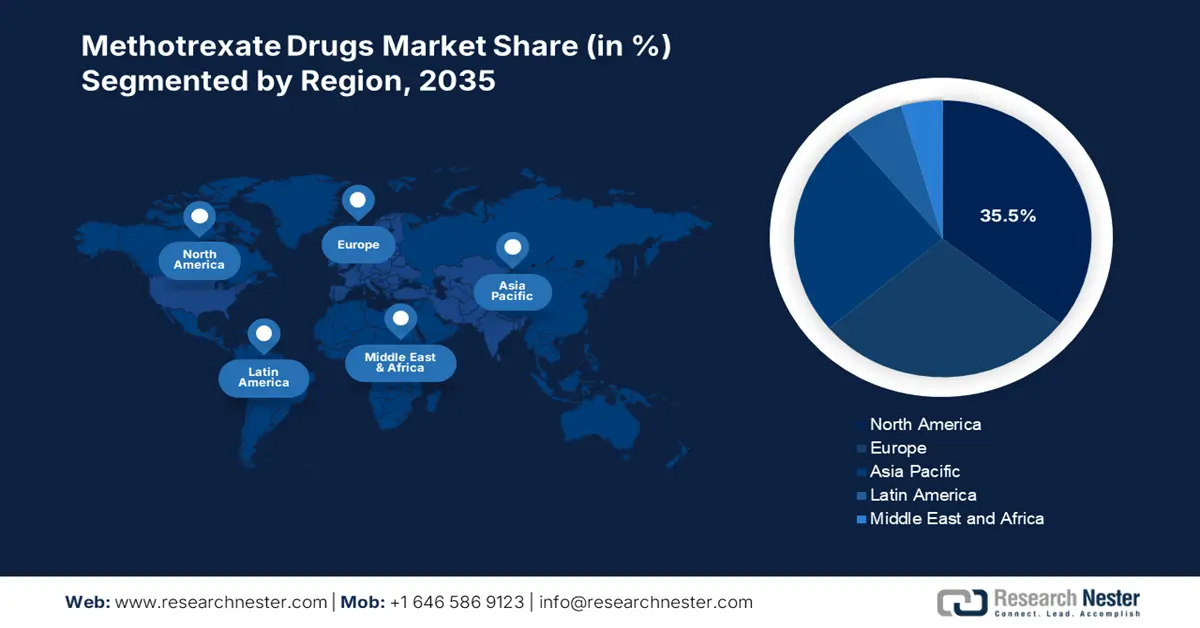

- North America in the Methotrexate Drugs Market is projected to secure a 35.5% share by 2035 due to a surge in autoimmune diseases.

- Asia Pacific is anticipated to expand rapidly during 2026–2035 owing to rapid improvement in healthcare infrastructure and medical expenditure.

Segment Insights:

- The hospital pharmacies segment in the Methotrexate Drugs Market is set to command 60.8% share by 2035 propelled by clinical demands for managing high-dose methotrexate.

- The oral segment is expected to capture the second-highest share through 2026–2035 supported by cost-effective and convenient medication.

Key Growth Trends:

- Advancements in biologics

- An increase in drug approvals

Major Challenges:

- Limitation in market incentive for advancement

- Minimal product differentiation and intense competition

Key Players: Hikma Pharmaceuticals PLC (UK),Pfizer Inc. (U.S.),Fresenius Kabi AG (Germany),Viatris Inc. (U.S.),Teva Pharmaceutical Industries Ltd. (Israel),Mylan N.V. (Now part of Viatris) (U.S.),Dr. Reddy's Laboratories Ltd. (India),Sun Pharmaceutical Industries Ltd. (India),Novartis AG (Sandoz) (Switzerland),Accord Healthcare Ltd. (UK),Sintetica SA (Switzerland),Medac GmbH (Germany),Shanghai Pharmaceuticals Holding Co., Ltd. (China),Kwizda Pharma GmbH (Austria),RPG Life Sciences Ltd. (India).

Global Methotrexate Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 633.7 million

- 2026 Market Size: USD 680.1 million

- Projected Market Size: USD 871.2 million by 2035

- Growth Forecasts: 3.6%CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Australia

Last updated on : 25 September, 2025

Methotrexate Drugs Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in biologics: These have dramatically optimized patient outcomes with chronic conditions, including arthritis, psoriasis, and Crohn’s disease. These assist in managing symptoms, improve quality of life, and diminish disease progression, thereby suitable for driving the market globally. According to an article published by NLM in May 2023, a total of 37 biologics-based drugs have been approved by the U.S. FDA. Additionally, 46% of these drugs successfully received the Orphan Drug Status from the FDA, thus denoting an optimistic outlook for the overall market.

- An increase in drug approvals: This driver caters to years of research, extended clinical studies, and meticulous preparation, which positively impacts the methotrexate drugs sector internationally. In this regard, an article has been published by Drug Discovery Today in February 2025, wherein a clinical study was conducted on 2,092 active ingredients across 18 notable pharmaceutical organizations, along with 274 latest drug approvals. Based on this, the first approval rate was 14.3% across leading research-specific pharmaceutical organizations, widely ranging between 8% to 23%, thus bolstering the market’s exposure globally.

- Rising investments in digital health technologies: The particular technologies have emerged as an integral part of the modernized healthcare sector since they provide a comprehensive range of applications. Additionally, these tend to empower patients, as well as enhance healthcare delivery, hence proliferating the market. As stated in the September 2023 NLM article, a physician-based computer order entry system has the ability to diminish at least 55% of non-intercepted critical medication errors within a hospital facility. Therefore, with such a capability, digitalized technologies can be easily implemented in healthcare to make advancements in receiving results.

2022 National List of Essential Medicines Driving the Market

|

Medicine Type |

Dosage Form |

|

Ketamine |

Injection 10 mg/mL Injection 50 mg/mL |

|

Propofol |

Injection 10 mg/mL |

|

Thiopentone |

Powder for injection 0.5 g Powder for injection 1 g |

|

Bupivacaine |

Injection 0.2 % Injection 0.5 % Injection 0.5 % with 7.5 % glucose |

|

Lignocaine |

Topical forms 2% to 5 % Injection 1 % Injection 2 % Injection 5 % with 7.5 % glucose |

|

Lignocaine (A) + Adrenaline (B) |

Injection 1% (A) + 1:200000 (5 mcg/mL) (B) Injection 2% (A) + 1:200000 (5 mcg/mL) (B) |

|

Atropine |

Injection 0.6 mg/mL |

|

Glycopyrrolate |

Injection 0.2 mg/mL |

Source: CDSCO

2022 Cancer Prevalence Boosting the Market

|

Cancer Type |

Incidence |

|

Overall cases |

20 million |

|

Deaths |

9.7 million |

|

Death among women |

1 in 12 |

|

Lung |

12.4% |

|

Female Breast |

11.6% |

|

Colorectum |

9.6% |

|

Prostate |

7.3% |

|

Stomach |

4.9% |

Source: NIH, May 2024

Challenges

- Limitation in market incentive for advancement: The crucial commercial challenge in the market caters to the lack of a suitable return-on-investment model for ensuring advancements. Globally, payers are unwilling to pay any kind of suitable premium for drugs with a cents-per-dose generic alternative. Therefore, generously making investments in creating a patient-friendly and new formulation is considered a financially untenable approach. Besides, market dynamics exclusively reward the low-cost producer, which in turn is negatively impacting the market’s growth.

- Minimal product differentiation and intense competition: The market is extremely saturated with different generic manufacturers, developing a hyper-competitive environment, wherein product differentiation is nearly impossible. Besides, competing on price solely results in profit margins, which are frequently estimated to be on the lower side. This commoditization has left no room for suppliers to make investments in patient safety programs, medical education, and sales forces that can effectively differentiate their respective brands from a generic drug, thus causing a hindrance in the market’s development.

Methotrexate Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.6% |

|

Base Year Market Size (2025) |

USD 633.7 million |

|

Forecast Year Market Size (2035) |

USD 871.2 million |

|

Regional Scope |

|

Methotrexate Drugs Market Segmentation:

Distribution Channel Segment Analysis

Based on the distribution channel, the hospital pharmacies segment in the methotrexate drugs market is anticipated to account for 60.8% of the market share by the end of 2035. The segment’s growth is highly attributed to clinical demands for managing high-dose methotrexate, which is suitable for catering to chemotherapy regimens for specific cancers, such as lymphoma and lymphoblastic leukemia. This particular treatment has been mandated for rigid inpatient monitoring for critical toxicity, including nephrotoxicity and myelosuppression. Besides, the increased administration for complicated biologic therapies, especially for autoimmune disorders, frequently monitored and initiated in hospitals and clinical centers, is also contributing towards the overall segment.

Route of Administration Segment Analysis

Based on the route of administration, the oral segment in the methotrexate drugs market is projected to account for the second-highest market share during the forecast period. The segment’s development is highly driven by the aspect of medication in a cost-effective and convenient way, along with the most commonly utilized administration form. In this regard, the September 2023 NLM article indicated that methotrexate drugs are administered either subcutaneously or orally in dosages of almost 30 mg per week, which is considered the most primary site of drug absorption, thus suitable for driving the segment’s exposure internationally.

Formulation Segment Analysis

Based on the formulation, the tablets segment in the methotrexate drugs market is expected to cater for the third-largest share by the end of the projected period. The segment’s growth is subject to optimizing patient care through digitalized record accessibility, ensuring communication support, and providing real-time monitoring. According to the January 2025 EMC Organization article, the suitable dosage for methotrexate is a 2.5 mg tablet, which results in increased growth of cancer cells. Additionally, with this dosage in the form of a tablet assists in treating different psoriasis cases and RA, thereby denoting an optimistic approach for the segment’s exposure in the market globally.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Distribution Channel |

|

|

Route of Administration |

|

|

Formulation |

|

|

Application |

|

|

Drug Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Methotrexate Drugs Market - Regional Analysis

North America Market Insights

North America in the methotrexate drugs market is projected to garner the largest share of 35.5% by the end of 2035. The market’s growth in the region is highly attributed to a surge in autoimmune diseases, including psoriasis and arthritis, progressive healthcare facilities across different countries, the presence of notable pharma manufacturers, tactical collaborations, an increase in patient awareness, and administrative support. As per the 2025 National Psoriasis Foundation article, the disease affects approximately 3.0% of the adult population, particularly in the U.S., which accounts for over 7.5 million adults. Additionally, an estimated 600,000 adults in the country reside with undiagnosed psoriasis, thereby bolstering the market’s growth in the region.

The market in the U.S. is growing effectively, owing to the aspect of the highest population with autoimmune incidences, suitable reimbursement policies, aging demographics driving the drug demand, focus on research and developmental activities, robust industrial presence, and comprehensive insurance coverage. As per an article published by NLM in December 2024, more than 15 million, which is 4.6% of the country’s population are diagnosed with at least 1 autoimmune disorder as of June 2022. In addition, almost 34% are diagnosed with more than 1 autoimmune disease, with 63% of females being readily affected, thus suitable for the market’s development.

The methotrexate drugs market in Canada is uplifting due to generous grant provision by the government, stabilized growth, owing to suitable federal health and medical budgets, advanced health infrastructure, early diagnosis service, provincial-level investment, effective deals with industrial associations, and competitive market presence. According to a report published by the Government of Canada in 2023, the Musculoskeletal Health and Arthritis Institute provided USD 100,000 to ensure relevant research and mandate priorities between 2022 and 2023, thereby symbolizing a huge growth opportunity for the market in the country.

Arthritis Incidence in North America (2022-2023)

|

U.S. |

Canada |

||

|

Components |

Prevalence |

Components |

Prevalence |

|

Total incidences |

18.9% |

Overall arthritis affecting the population |

6 million |

|

Men |

16.1% |

Common |

1 in 5 people |

|

Women |

21.5% |

Rise in incidence |

9 million by 2045 |

|

18 to 34 years |

3.6% |

Health impact |

More than 3 times |

|

35 to 49 years |

11.5% |

Mental health effect |

Over 2 times |

|

50 to 64 years |

29.0% |

Pain associated |

40% |

|

65 to 74 years |

44.0% |

Mobility issue |

Almost 5 times |

|

Over 75 years |

53.9% |

- |

- |

Sources: CDC, February 2024; Arthritis Society Canada, 2025

APAC Market Insights

Asia Pacific in the methotrexate drugs market is expected to emerge as the fastest-growing region during the predicted timeline. The market’s exposure in the region is highly fueled by rapid improvement in healthcare infrastructure and medical expenditure, an upsurge in chronic autoimmune diseases, extension of medical protocols in the West, the presence of policy reforms, and an increase in pharmaceutical market penetration. As per a data report published by ADB in June 2025, over 20 countries in the region constitute 20% higher risk of people facing death, owing to chronic conditions. However, to keep a check on this, an early screening program reached almost 40% of the population in Mongolia, thereby creating an optimistic approach for the market.

The market in China is gaining increased traction, owing to government-based healthcare strategies targeting rare diseases, the NMPA’s support for regional and fast-track manufacturing approvals, an increase in diagnosed patients, and a surge in insurance coverage. As per the February 2023 Journal of the American Medical Directors Association article, the domestic prevalence of any chronic disorder has been 81.1%, which accounts for 179.9 million adult patients. However, there has been an increase in the prevalence between 80 to 84 years of age, thus denoting a positive outlook for the market’s demand in the country.

The methotrexate drugs market in India is developing due to the presence of an underserved patient population, priority for national insurance, along with cost-effective therapies for chronic diseases, generous investment in pharmaceutical manufacturing, and extension of government subsidies for crucial drugs. According to the May 2023 NLM article, the healthcare system in the country is extremely diversified and comprises a network of private and public sectors, while providing suitable medical services to 1.4 billion inhabitants. Besides, the Ayushman Bharat scheme provides almost INR 5 Lakhs coverage per family every year, thus bolstering the market’s exposure.

2022 Healthcare Expenditure in the Asia Pacific

|

Countries |

% of GDP |

|

Korea Republic |

9.4 |

|

Japan |

11.4 |

|

Malaysia |

3.9 |

|

Indonesia |

2.6 |

|

Philippines |

5.1 |

|

Cambodia |

4.7 |

|

China |

5.3 |

|

Australia |

9.9 |

Source: World Bank Data, 2025

Europe Market Insights

Europe in the methotrexate drugs market is considered to account for a considerable market share by the end of the forecast timeline. The market’s exposure in the region is highly driven by suitable advancements in technology, ongoing innovation in optimizing drug formulations, diversified healthcare sectors, robust government support, and acceleration in research and development. According to the September 2024 ECIPE article, technology diffusion in healthcare caters to 2.5% of innovators, 13.5% early adopters, and 34% early majority. Besides, the 2025 Europe Commission data report stated that 100% of the region’s citizens will gain access to online medical records through e-health, as well as a digitalized ID card.

The methotrexate drugs industry in Germany is gaining increased exposure, owing to the aspect of government spending, wide-range patient accessibility, increased biosimilars penetration, integrated real-world evidence, and active participation in the regional pharmaceutical policy and advanced programs. According to a data report published by ITA in August 2025, the Horizon Europe program, since its initiation, readily supports R&D activities, particularly for cancer treatments by utilizing digital, aging, smart health, and generative AI models, along with USD 8.9 million EU4MEDTECH to streamline administrative pathways. Besides, the aging population suffering from chronic diseases, and all these factors denote an optimistic outlook for the overall market in the country.

The methotrexate drugs market in the UK is also growing due to the provision of wide accessibility and reimbursement rates by the NHS-based universal healthcare policy, government reforms focusing affordable prescribing aspect, robust digital health facility, and continuous private and public investments in patient education and pharmaceutical R&D. According to an article published by the Department of Health and Social Care in November 2022, an estimated 53% of NHS consultants in the country undertook private practice, with approximately 3,000 overall operating in the private sector, thus denoting a positive outlook for the market’s growth.

Key Methotrexate Drugs Market Players:

- Hikma Pharmaceuticals PLC (UK)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer Inc. (U.S.)

- Fresenius Kabi AG (Germany)

- Viatris Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Mylan N.V. (Now part of Viatris) (U.S.)

- Dr. Reddy's Laboratories Ltd. (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Novartis AG (Sandoz) (Switzerland)

- Accord Healthcare Ltd. (UK)

- Sintetica SA (Switzerland)

- Medac GmbH (Germany)

- Shanghai Pharmaceuticals Holding Co., Ltd. (China)

- Kwizda Pharma GmbH (Austria)

- RPG Life Sciences Ltd. (India)

The international methotrexate drugs market is effectively dominated and fragmented by already established generic pharmaceutical manufacturers. Competition in the market is initially based on affordability, regulatory compliance, and supply chain dependency, in comparison to product advancements. Besides, suitable and tactical strategies, such as vertical integration to successfully control API supply and combat shortage risks, have been clearly seen in Fresenius Kabi and Hikma Pharmaceuticals. Meanwhile, organizations, such as Viatris and Pfizer, have leveraged their massive international distribution networks to achieve tenders in public health systems, thereby suitable for boosting the market globally.

Here is a list of key players operating in the global market:

Recent Developments

- In August 2025, Aldeyra Therapeutics, Inc. declared that the EMA has successfully granted the Orphan Designation for ADX-2191, which is a methotrexate intravitreal injection, for aiding primary B-Cell lymphomas of immune-privileged sites.

- In August 2024, Linepharma International Inc. notified that NORDIMET, which is the first-ever methotrexate pen for self-injection, is readily available in Canada for the purpose of providing treatment to adult patients with RA and disabling psoriasis.

- Report ID: 2738

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Methotrexate Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.