Methenamine Market Outlook:

Methenamine Market size was over USD 412.8 million in 2024 and is estimated to reach USD 679.2 million by the end of 2034, exhibiting a CAGR of 6.1% during the forecast period, i.e., 2025-2034. In 2025, the industry size of methenamine is evaluated at USD 436.7 million.

The market is growing steadily on account of the increasing demand for treatment of urinary tract infection (UTI). Particularly, among geriatric individuals, the occurrence of this medical condition is evidently high. Hence, the rapidly aging populations worldwide are expanding the demography. Testifying to the same, the World Health Organization (WHO) revealed that approximately 150.6 million people around the globe are affected by UTIs every year. Another report from the Centers for Disease Control and Prevention (CDC) established that 40.6% of women and 12.7% of men experience at least one UTI in their lifetime.

These epidemiological factors, combined with high rates of recurrent cases, position the market as a critical source of pharmaceutical solutions in urology. However, despite the surge, inflation in the key economic indicators remains persistent in this sector with contrasting cost dynamics. This upstream flow can also be portrayed through the 3.5% rise each year in the producer price index (PPI) from 2020 to 2024, as per a report from the Bureau of Labor Statistics (BLS). Concurrently, between 2023 and 2024, the notable hike in formaldehyde and compliance costs translated to a 4.4% year-over-year (YoY) increase in the consumer price index (CPI) for UTI medications. This underscores the need for cost-optimization in production.

Methenamine Market - Growth Drivers and Challenges

Growth Drivers

-

Willingness-to-pay more among payers: The growing trend of spending out-of-pocket on personal care is influencing both consumers and insurers to allocate greater capital to the market. For instance, in 2023, Medicare expenditure on this category increased to $480.4 million due to increasing UTI cases among elderly individuals. This is further amplifying the cash inflow in this sector. In addition, the out-of-pocket spending on each prescription averaged $45.6 in the U.S., which is also growing at an annual 10.4% on account of formulary restrictions, according to the FDA. Moreover, the dual financial factor is creating sustained adoption of methenamine-based UTI treatments worldwide.

-

Commercial efforts and expansion: Strategic commercialization and innovative consortia are securing progress in the market for the upcoming years. Following the same pathway, in 2024, Bayer AG formed alliances with hospitals to procure contracts for outpatient UTI prevention programs, which helped the company capture an additional 12.4% revenue share. On the other hand, Merck developed an extended-release tablet that improved patient compliance through a 40.5% reduction in dosing frequency. This reflects the sector's potential in expanding clinical applications with enhanced formulation technology, creating strong momentum in this sector.

-

Advancements in products and production: The market is currently benefiting from substantial R&D investments and manufacturing optimization. Government allocations are the biggest supporters of this cohort, where the National Institute of Health (NIH) alone dedicated $13.1 million to extensive UTI antimicrobial research in 2023. On the other hand, production efficiency gains in Germany and Japan through automation in assembly lines reduced production costs by 9.4-12.7%, according to the International Labour Organization (ILO). Moreover, the positive impact of these advancements on amplifying profitability while maintaining quality is attracting larger investors to this sector.

Challenges

-

Antibiotic stewardship policies limiting use: In 2023, the governing body of Germany released the AMR guidelines, downgrading the medicines available in the methenamine market to second-line therapy. This further resulted in a 12.7% prescription decline, as reported by the Robert Koch Institute (RKI). This signifies the risk of financial and brand value losses due to ongoing regulatory reformations. However, Sanofi successfully countered this setback by implementing a comprehensive region-wide clinician education program, demonstrating the therapy's efficiency in specific UTI cases.

-

API supply chain vulnerabilities: Volatilities in the outsourcing process may also limit profitability in the methenamine market. For instance, in 2023, the predominant control of China over worldwide formaldehyde exports resulted in an 18.6% rise in API expenditure, as per a report from the U.S. International Trade Commission (USITC). This threatened and discouraged manufacturers, who were reliant on these raw materials. To mitigate this hurdle, Hikma diversified its API sourcing channel to India, underscoring the power of alternative suppliers and localized production in overcoming economic barriers.

Methenamine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

6.1% |

|

Base Year Market Size (2024) |

USD 412.8 million |

|

Forecast Year Market Size (2034) |

USD 679.2 million |

|

Regional Scope |

|

Methenamine Market Segmentation:

Form Segment Analysis

Tablets are anticipated to dominate the methenamine market by holding the largest share of 58.4% by the end of 2034. The leadership is primarily backed by ongoing insurance coverage expansion and strong worldwide preference for oral formulations. According to the Centers for Medicare & Medicaid Services (CMS), UTI drug spending under Medicare Part D is growing at an annual 8.4%. Moreover, the convenience in administration, coupled with established reimbursement pathways for oral formulations, positions tablets as the preferred delivery method for methenamine therapies, ensuring their continued utilization in infection management.

Application Segment Analysis

UTI treatment is predicted to command dominance over the methenamine market with a 65.6% share over the discussed timeframe. Critical healthcare trends, including the rising occurrence rate and antibiotic resistance, are the major drivers behind the proprietorship. In this regard, the CDC reported 3.1 million antibiotic-resistant UTI cases in the U.S. every year till 2024. Thus, being a non-antibiotic alternative, methenamine is becoming the gold standard for first-line treatment of this ailment. Simultaneously, WHO projected the global population of residents aged over 60 to reach 1.7 billion by 2030, which indicates sustainable enlargement of the patient pool of UTI.

End user Segment Analysis

The hospitals & clinics segment is poised to constitute the largest end-user revenue portion in the methenamine market during the analyzed tenure, with a 42.8% share. Strong demand for alternatives to combat antimicrobial resistance is becoming a primary procurement goal for these institutions, contributing to the forefront position. On the other hand, in 2022, a study from the Agency for Healthcare Research and Quality (AHRQ) also demonstrated the ability of these medicines in saving $1.6 billion for the U.S. healthcare system over two years. Thus, hospitals are increasingly adopting methenamine as first-line prophylaxis to achieve 15.3% lower readmission rates, reinforcing its cost-effectiveness compared to traditional antibiotics.

Our in-depth analysis of the methenamine market includes the following segments:

|

Segment |

Subsegments |

|

Form |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

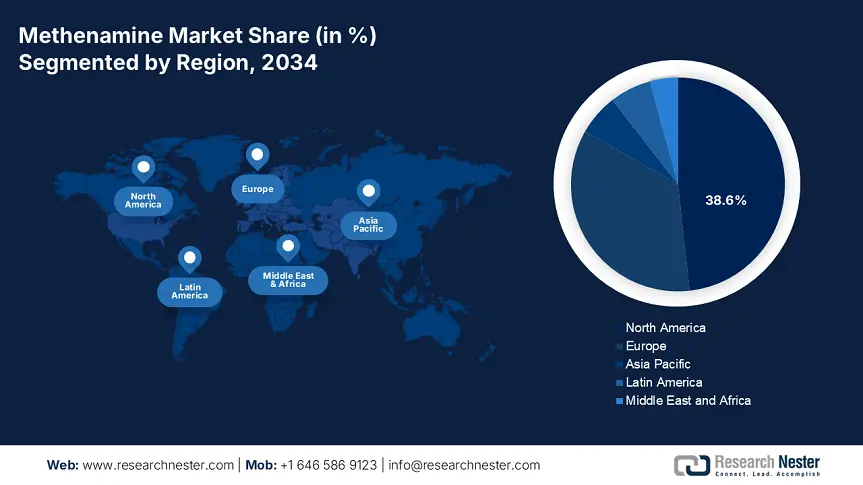

Methenamine Market - Regional Analysis

North America Market Insights

North America is expected to gain the highest share of 38.6% in the global methenamine market over the assessed timeline. The region is augmenting remarkably with its high UTI burden of 25.5 million annual cases, as recorded by the CDC. The advanced healthcare infrastructure and widespread awareness about UTI prevention also enlarges the consumer base for this sector. Moreover, the region's well-established pharmaceutical distribution channels ensure broad access to associated therapies, while the combination of sophisticated medical systems and federal funding creates sustained demand across the region.

The U.S. leads the North America methenamine market on account of its 8.4 million annual UTI incidences and substantial healthcare investments, as per the CDC. Besides, in 2024, Medicare Part D allocated $1.4 billion to UTI treatments (CMS.gov), while Medicaid expanded its coverage to 55.3% of UTI patients. Moreover, with the rising population of patients with antibiotic-resistant infections, the country is becoming the epicenter of demand for this medicine as a first-line treatment. Further, the $650.4 million R&D investment by the NIH in 2023 strengthens the development of specialized formulations for vulnerable populations, making the U.S. a regional leader in both consumption and innovation.

Canada is also poised to show strong growth in the regional methenamine market, which is mostly backed by provincial and federal healthcare allocations. As evidence, in 2024, the governing body of Ontario alone invested $180.4 million in UTI treatments. Besides, the AMR Action Plan of Health Canada committed $320.5 million to promote and accelerate methenamine adoption between 2023 and 2030. On the other hand, the Canadian Institute for Health Information (CIHI) reported a 12.4% annual increase in UTI-related hospitalizations, reflecting continued rise in demand in this sector.

APAC Market Insights

Asia Pacific is poised to emerge as the fastest-growing region in the global methenamine market by the end of 2034. Demand in the region for these medicines is also projected to increase at a 7.4% CAGR, fueled by demographic and healthcare trends. Japan leads the landscape with comprehensive NHI coverage of 85.4% of methenamine costs and $3.6 billion allocation in 2024, according to a report from the MHLW. On the other hand, South Korea and Malaysia are leveraging their generic adoption through 20.3% funding increases from 2020 to 2024. This is further supported by the region's aging populations and its dominant position in API production.

China dominates the APAC Methenamine market with a commanding 40.4% share, backed by its dual role as both major producer and consumer. As evidence, the country supplies 60.4% of global methenamine APIs and accounts for 45.7% of worldwide exports, while simultaneously addressing 1.8 million annual domestic UTI cases, according to the National Medical Products Administration (NMPA). In addition, in 2024, the government of China dedicated $4.5 billion to support this leadership, with NMPA antibiotic stewardship policies further driving adoption.

India represents 25.4% of the regional revenue generation from the methenamine market. The rural healthcare expansion, reaching 2.7 million patients, and $2.1 billion government healthcare investment are the major growth engines behind the country's augmentation in this sector. This is further attracting global pioneers to invest more in this category. As evidence, Cipla captured 22.5% share in this sector through the commercialization of its affordable $0.50 generic dose, while Sanofi boosted its emerging market revenue by 11.3% through rural healthcare partnerships, as per the National Health Policy (NHP).

Government Investments & Policies

|

Country |

Government Investment/Policy |

Budget/Funding (Million) |

|

Australia |

National UTI Management Initiative (incl. Methenamine) |

$8.5 (2025) |

|

South Korea |

Digital Health Integration for UTI Monitoring |

$5.8 (2024) |

|

Malaysia |

National AMR Action Plan Phase II |

$4.4 (2025) |

Source: DoH Australia, South Korea MOHW, and Malaysia MOH

Europe Market Insights

The Europe methenamine market is poised to sustain steady growth during the tenure from 2025 to 2034. The region's consistent performance in this sector originates from the rising UTI prevalence among aging populations and favorable policy reforms. For instance, the Pharmaceutical Strategy promotes adoption in this category by prioritizing antimicrobial resistance solutions. Besides, the national healthcare systems are increasingly procuring Methenamine as a cost-effective UTI prophylactic. This combination of demographic trends and proactive regulatory frameworks positions Europe as a stable, innovation-driven market.

Germany leads the Europe methenamine market due to being the region's largest source of revenue generation and pharmaceutical innovation. Additionally, the 12.3% increase in government spending from 2021 to 2024 testifies to the presence of a strong financial backing through antibiotic stewardship programs, where BÄK's UTI protocols alone drove 7.3% annual demand increase in 2023. Moreover, with 24.6% of the population projected to be aged over 65 by 2030, Germany continues to fuel the category with consumer base enlargement. Further, the German Pharmaceutical Industry Association projected the country to exhibit a 6.4% CAGR by 2034 on account of R&D tax incentives.

The UK holds a 22.3% revenue share in the Europe methenamine market, backed by National Health Service (NHS) policy reforms and £500.6 million antimicrobial funding, according to the Association of the British Pharmaceutical Industry (ABPI). With UTI cases rising at a 15.6% rate, demand for these medicines continues to grow across the country, evidenced by a 2023 study from the UK Health Security Agency (UKHSA). This is further supported by the 2024 UK Generics Strategy, which enhances affordability in this sector.

Country-wise Government Provinces

|

Country |

Government Policy / Initiative |

Budget / Funding (Million) |

Key Focus |

|

Spain |

Digital Prescription Integration |

€2.4 (2025) |

E-prescribing for UTIs |

|

Italy |

Regional UTI Screening Programs |

€4.7 (2024) |

Early detection in elderly populations |

|

Russia |

AMR Task Force Expansion |

₽800.6 (2025) |

Surveillance & treatment protocols |

Source: MoH Spain, AIFA, and MOH Russia

Top 20 Global Drugs in Clinical Trials (2024)

|

Drug/Combination Drug Name (Sponsor) |

Clinical Trial Phases |

Approval Status |

Key Statistics |

|

Donanemab (Eli Lilly) |

Phase 3 completed |

Expected FDA approval Q4 2024 |

35.8% slowing of cognitive decline in Alzheimer's patients |

|

Tirzepatide (Eli Lilly) |

Phase 3 for obesity |

Approved for diabetes (2022) |

22.8% average weight loss in trials |

|

BNT162b2 (Pfizer/BioNTech) |

Phase 3 for updated boosters |

FDA-authorized |

90.3% efficacy against Omicron subvariants |

|

Lecanemab (Eisai/Biogen) |

Phase 4 monitoring |

FDA-approved (2023) |

27.4% slower cognitive decline |

|

Zolbetuximab (Astellas Pharma) |

Phase 3 for gastric cancer |

Expected 2025 |

31.6% survival improvement in Phase 2 |

|

Resmetirom (Madrigal Pharmaceuticals) |

Phase 3 for NASH |

FDA submission Q1 2024 |

26.3% fibrosis improvement |

|

Bempedoic Acid (Esperion Therapeutics) |

Phase 3 CV outcomes |

Approved (2020) |

21.8% LDL reduction in statin-intolerant patients |

|

VX-548 (Vertex Pharmaceuticals) |

Phase 3 for non-opioid pain |

Expected 2025 |

50.7% pain reduction in Phase 2 |

|

mRNA-1345 (Moderna) |

Phase 3 for RSV |

FDA-approved (2024) |

84.5% efficacy in seniors |

Source: NEJM, JAMA, CDC, Alzheimer’s Association, ASCO, and AHA

Key Methenamine Market Players:

- Merck & Co., Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sanofi (France)

- Bayer AG (Germany)

- Novartis AG (Switzerland)

- GlaxoSmithKline (UK)

- Pfizer Inc. (U.S.)

- Teva Pharmaceutical (Israel)

- Sun Pharma (India)

- Cipla Ltd. (India)

- Aspen Pharmacare (South Africa)

- Hikma Pharmaceuticals (UK)

- Lupin Ltd. (India)

- Mylan N.V. (U.S.)

- Fresenius Kabi (Germany)

- Aurobindo Pharma (India)

- Sandoz (Switzerland)

- STADA Arzneimittel (Germany)

- Mayne Pharma (Australia)

- Samsung Bioepis (South Korea)

Current dynamics in the methenamine market feature intense competition among Western pharmaceutical innovators and APAC-based large-scale generics producers. These players are implementing distinctive strategies to sustain their leadership in economically mature and price-sensitive regions, respectively. Their commercial operations primarily consist of R&D in extended-release formulations, expansion in underserved countries, and integration of cost-optimization in manufacturing. This is further accompanied by strategic mergers and acquisitions.

The top contenders of this cohort include:

Recent Developments

- In May 2024, Sun Pharmaceutical launched an affordable generic Methenamine tablet, priced 40.7% lower than branded alternatives to improve accessibility in India and emerging markets. This cost-effective formulation is projected to double the company's Methenamine revenue in Asia by 2025.

- In March 2024, GSK introduced its next-generation Hiprex formulation, featuring enhanced bioavailability for improved efficacy. The new formulation drove 15.6% sales growth in Europe during Q2 2024 and gained 8.3% additional U.S. market share through expanded insurance coverage.

- Report ID: 7953

- Published Date: Jul 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Methenamine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert