Metal Powder Market Outlook:

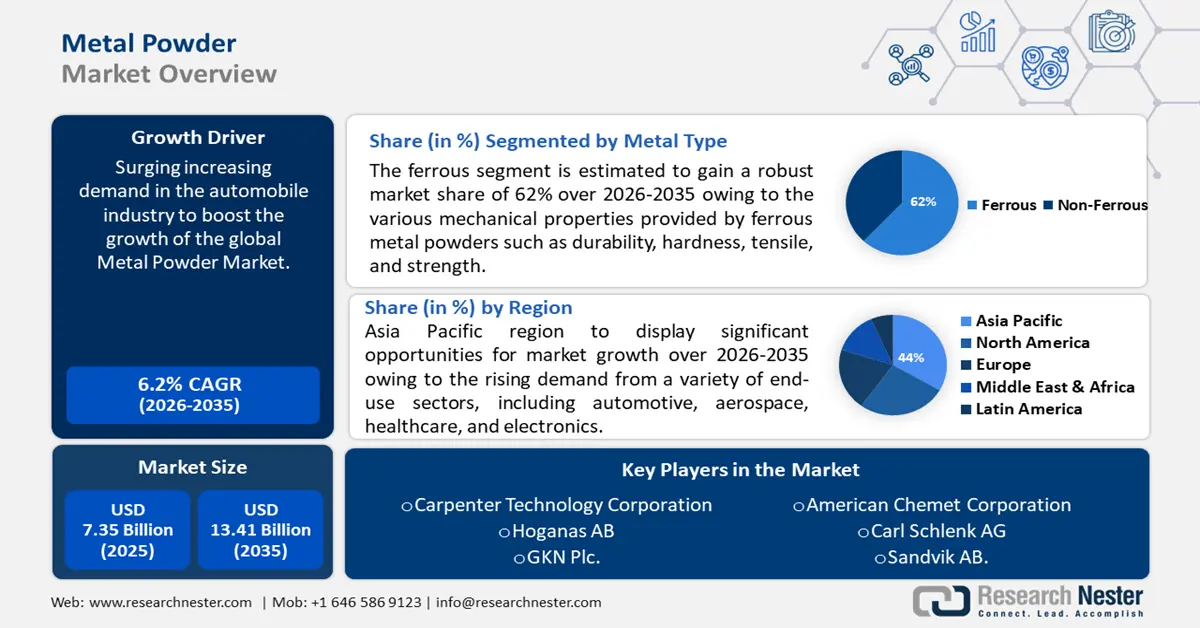

Metal Powder Market size was valued at USD 7.35 billion in 2025 and is expected to reach USD 13.41 billion by 2035, registering around 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of metal powder is evaluated at USD 7.76 billion.

The spur in the market growth can be attributed to the increasing demand in the automobile industry. Metal powders are heavily utilized in the automotive sector in various applications such as the manufacture of engine components such as pistons, connecting rods, and cylinder heads, and the manufacture of transmission gears, brake components, suspension systems, and structural parts. Based on data released by the IEA 50, an estimated 16 million passenger cars were sold in countries with advanced economies alone in 2022.

Moreover, factors like improved c, complex geometries, reduced waste and scrap, superior surface finish, and shortened production cycle times in various manufacturing sectors are set to further propel the market growth in the forecast period.

Key Metal Powder Market Insights Summary:

Regional Highlights:

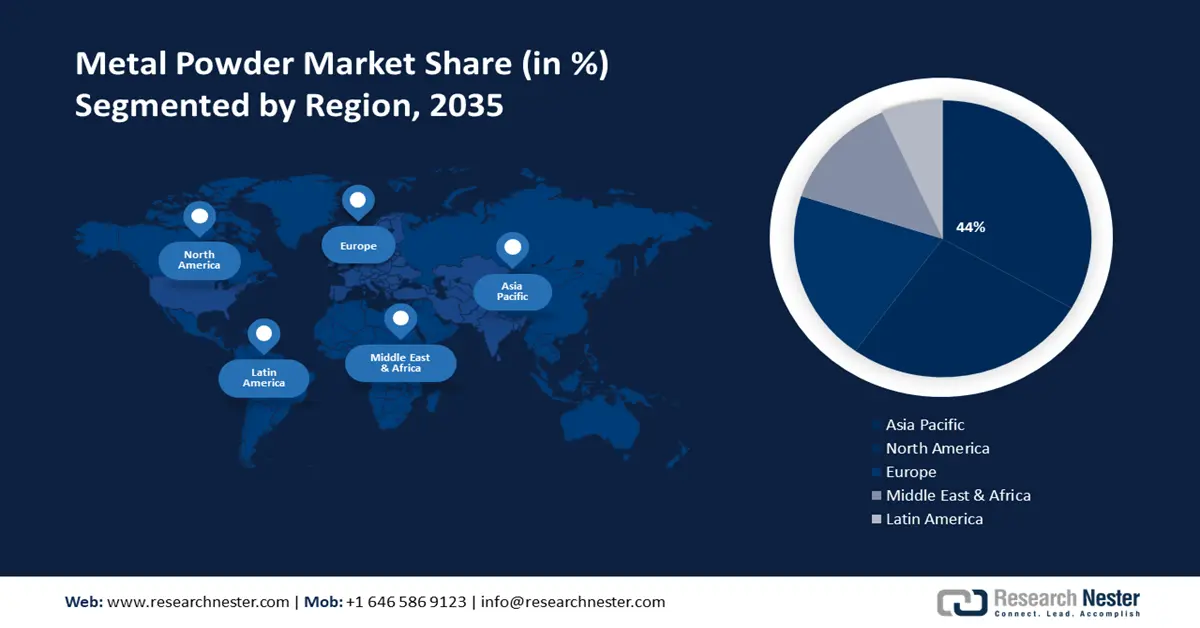

- Asia Pacific metal powder market is anticipated to capture 44% share by 2035, driven by rising demand from automotive, aerospace, healthcare, and electronics sectors.

- North America market will secure the second largest share by 2035, driven by the rising aerospace industry driving demand for metal powders.

Segment Insights:

- The mechanical method segment in the metal powder market is projected to hold a 64% share by 2035, attributed to the process versatility, efficiency, and cost-effectiveness in production.

- The ferrous segment in the metal powder market is projected to hold a 62% share by 2035, driven by mechanical properties like durability and broad flexibility used in autos.

Key Growth Trends:

- Growing demand for metal additives in various industries

- Rapid technological advancements in manufacturing techniques

Major Challenges:

- High cost of metal powder production and raw materials

- It is anticipated that risks related to increased consumption of iron-rich products will impede market expansion.

Key Players: Carpenter Technology Corporation, Hoganas AB, GKN Plc., Rio Tinto, Allegheny Technologies Incorporated, American Chemet Corporation., Carl Schlenk AG, Hitachi Chemical Co., Ltd, Metaldyne Performance Group Inc and Sandvik AB.

Global Metal Powder Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.35 billion

- 2026 Market Size: USD 7.76 billion

- Projected Market Size: USD 13.41 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 17 September, 2025

Metal Powder Market Growth Drivers and Challenges:

Growth Drivers

- Growing demand for metal additives in various industries- The metal powder industry is expanding rapidly, driven in part by rising demand for metal additives. Metal additives are substances made from fine, metal powders to create strong, complex components that are designed either by using a computer-aided design. They play an essential role in improving the mechanical, physical, and chemical characteristics of metal powders, which increases their adaptability and expands their application in several industries including automotive, medical, and aerospace industries. They are used for creating parts with immense geometrical complexity that's impossible via traditional molding, milling, grinding, casting, etc.

- Rapid technological advancements in manufacturing techniques- One of the key drivers behind the growth of the metal powder market is the increasing adoption of additive manufacturing technologies, such as 3D printing. In sectors like aerospace, automotive, and healthcare where complicated parts and components are needed, additive manufacturing is very helpful. Additionally, businesses can now generate spare parts on demand thanks to this technology, which lowers the need for vast inventories boosts supply chain effectiveness, and allows for the production of complex and customized metal parts with high precision and efficiency, opening up new opportunities for manufacturers across industries. For instance, in 2022 the adoption rate has increased to 40% in the last two years.

- Rise in the use of electronic devices is supporting the metal powder market- In the electronics sector, metal powders are frequently utilized to create high-performing parts including heat sinks, connectors, and electrical contacts. The powders are frequently used in a variety of manufacturing processes as additives, fillers, or coatings. For instance, intricate shapes and designs that are challenging or impossible to accomplish using conventional manufacturing techniques can be created using metal powders in injection molding or sintering procedures. Metal powders can also be utilized in printing procedures for the creation of printed circuit boards as conductive pastes or inks.

Challenges

- High cost of metal powder production and raw materials- A sizeable amount of the total production costs may come from the price of the raw materials used to produce metal powder. Commonly utilized in the creation of powder, metals like iron, steel, aluminum, titanium, and copper can have price fluctuations due to availability, market demand, and geopolitical circumstances. Atomization, precipitation, and sintering are examples of energy-intensive processes used in the manufacturing of metal powders. The heat and melting of the raw materials, their atomization or precipitation into tiny powders, and their sintering to produce the necessary characteristics all need a lot of energy. High energy expenditures can significantly impact the whole cost of production further hampering the market growth.

- It is anticipated that risks related to increased consumption of iron-rich products will impede market expansion.

Metal Powder Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 7.35 billion |

|

Forecast Year Market Size (2035) |

USD 13.41 billion |

|

Regional Scope |

|

Metal Powder Market Segmentation:

Metal Type Segment Analysis

Ferrous segment is poised to account for more than 62% metal powder market share by the end of 2035. The segment growth can be attributed to the various mechanical properties provided by ferrous metal powders such as durability, hardness, tensile strength, lower costs, magnetic function, and broad flexibility. Due to these properties, ferrous metal powder is utilized in various industries auto, power tools, construction, piping, shipping containers, and industrial piping. with the automotive sector holding the largest share, using over 70% of the ferrous products produced annually by the market.

Production Method Segment Analysis

By the end of 2035, mechanical method segment is estimated to hold over 64% metal powder market share. The segment growth can be accredited to the versatility and efficiency of the process. The primary mechanical and physical powder production techniques that are employed in the industry for mass production rate include milling, atomization, and physical vapor deposition. In addition, the ability to produce complex shapes and intricate designs with high dimensional accuracy, as well as the fact that near-net shape production eliminates the need for extensive machining and material waste, make it cost-effective for mass production through this process is poised to further propel the mechanical process segment.

End-use Segment Analysis

Throughout the projected period, the automotive industry is predicted to maintain its dominant market share. In the automotive industry, powdered iron is used in operations like injection molding, sintering, hot isostatic pressing, and particle metallurgy. The important factors influencing the market's growth are the increasing production of vehicles, the increasing usage of technology in vehicles, and the shift towards lighter vehicles. Additionally, producers are switching from producing conventional products to customized goods, driving market expansion in the segment. According to studies, in 2021, the industry used more than 200 kilo tons of metal alloy powder, and it is expected to grow in the years to come.

Our in-depth analysis of the market includes the following segments:

|

Metal Type |

|

|

Production Method |

|

|

End-use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Metal Powder Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is estimated to account for largest revenue share of 44% by 2035. One of the key reasons driving the Asia Pacific market is the rising demand from a variety of end-use sectors, including automotive, aerospace, healthcare, and electronics. These sectors require metal powders for applications such as additive manufacturing, surface coating, and sintering. Furthermore, the Asia Pacific region houses some of the car makers globally. Due, to the transition to vehicles and lighter materials there is a need for metal powders like aluminum, titanium, and stainless steel in the car industry. These metal powders play a role in making parts, engine components, and structural elements contributing to market expansion, in the region. For instance, in 2022, it was estimated that about 37.5 million passenger cars were sold within the Asia-Pacific region

Country 1 – China boasts the largest automotive market in the world. In 2022, China manufactured around 23.84 million passenger cars and 3.19 million commercial vehicles. China placed #1 among countries producing the most passenger cars, with approximately 24 million produced. This high frequency of production of vehicles in the country is one of the key reasons for making China one of the top consumers of metal powder in the world. As a result, the metal powder market is expected to gain substantial growth in the coming years.

North America Market Insights

The North America region will also encounter huge growth for the metal powder market during the forecast period and will hold the second position. The rising aerospace industry in the region plays a pivotal role, in driving growth for the market in North America. Metal powders are vital for crafting aircraft components because of their properties and strong strength-to-weight ratio. With advancements in aircraft design and materials the need for metal powders, in aerospace applications is projected to rise. Additionally, several aircraft manufacturers, including Textron in the United States, Bombardier in Canada, and Boeing in the United States, will expand market share in North America. Studies suggest that the USA had an estimated 204,405 aircraft in 2022.

United States of America – The huge aerospace and defense industry in the country has created a high volume of demand for metal powder. The United States market contributed around 89 billion US dollars in aerospace exports in 2021, making it the largest country in terms of sales value. The country is also home to some of the world's largest aircraft manufacturers, including Boeing and Raytheon.

Metal Powder Market Players:

- Sandvik AB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Carpenter Technology Corporation

- Hoganas AB

- GKN Plc.

- Rio Tinto

- Allegheny Technologies Incorporated

- American Chemet Corporation

- Carl Schlenk AG

- Hitachi Chemical Co., Ltd

- Metaldyne Performance Group Inc

The key players that are influencing the metal powder market are:

Recent Developments

- Sandvik AB - The space sector is expanding, and Sandvik has created metal powders that are specifically matched to its needs. One example is the gas-atomized copper-based alloy Osprey® C18150 (CuCrZr). We opted to speak with Dr. Eleonora Bettini, Sandvik's Customer Application Specialist for Metal Powder, about the material's features and possibilities.

- GKN Plc. - On March 27, 2019, the joint project IDAM conducted its kick-off meeting in Munich, which aimed to pave the road for Additive Manufacturing to enter automotive series production. For the first time, the project partners, which include SMEs, large corporations, and research institutions, will industrialize and highly automate metallic 3D printing in the automotive industry.

- Report ID: 6161

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Metal Powder Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.