Metal Foam Market Outlook:

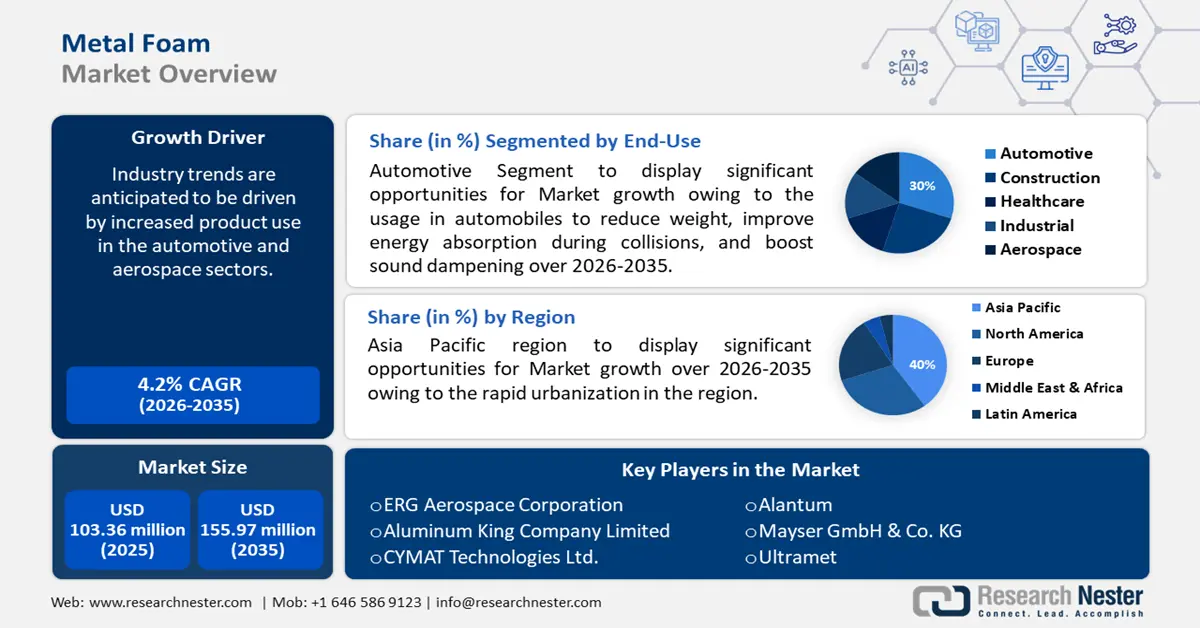

Metal Foam Market size was over USD 103.36 million in 2025 and is anticipated to cross USD 155.97 million by 2035, growing at more than 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of metal foam is assessed at USD 107.27 million.

Industry trends are anticipated to be driven by increased product use in the automotive and aerospace sectors. 85.4 million motor vehicles were produced globally in 2022, a 5.7% increase from 2021.

Key Metal Foam Market Insights Summary:

Regional Highlights:

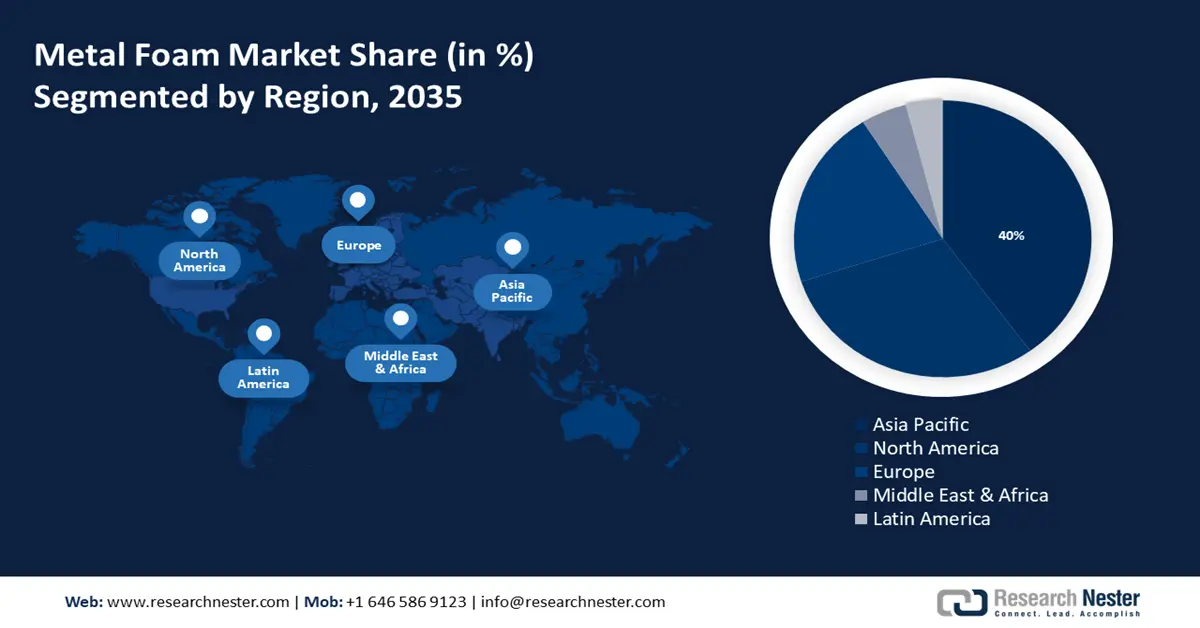

- Asia Pacific metal foam market is anticipated to capture 40% share by 2035, driven by rising automobile production and urbanization trends.

- North America market will achieve huge CAGR during 2026-2035, driven by stricter emissions regulations and increased demand in the automotive and green building sectors.

Segment Insights:

- The automotive segment in the metal foam market is anticipated to grow significantly by 2035, driven by the use of metal foam in vehicles to reduce weight, improve safety, and enhance sound dampening.

- The copper segment in the metal foam market is expected to experience substantial growth till 2035, driven by its anti-corrosion, energy absorption, and noise reduction properties.

Key Growth Trends:

- Extensive use of metal foam

- Releases of new products to expand the market

Major Challenges:

- High cost

- Lack of understanding

Key Players: ERG Aerospace Corporation, Aluminum King Company Limited, CYMAT Technologies Ltd., Alantum, Ultramet, Mott, Mayser GmbH & Co. KG, Liaoning Rontec Advanced Material Technology Co. Ltd., Shanxi Putai Aluminum Foam Manufacturing Co. Ltd..

Global Metal Foam Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 103.36 million

- 2026 Market Size: USD 107.27 million

- Projected Market Size: USD 155.97 million by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Metal Foam Market Growth Drivers and Challenges:

Growth Drivers

- Extensive use of metal foam - The global metal foam market is driven by the expansion of end-use sectors' desire for lightweight materials. The spending on building in developing nations is enhanced by rising per capita income, better living standards, and an increase in construction activity. The aforementioned phenomena is anticipated to have a favorable impact on the metal foam market during the forecast period.

Due to India, China, Vietnam, and Indonesia, the building industry in South Asia is also rapidly growing, the GDP projections for these countries range from 5% to 7% as per the statistics of World Bank. The rapid expansion of developing nations and the building industry are driving up demand for metal foam market in the next years. - Releases of new products to expand the market - Because aluminum metal foam contains air bubbles that are produced during the manufacturing process, it has a higher energy absorption capacity than steel. To support the Made in India campaign, NALCO added Aluminum Alloy 1200 as a new product to its lineup. Grade 1200 commercial aluminum alloy has special qualities like high thermal conductivity, high reflectivity, and strong resistance to corrosion.

- Increased use of metal foams in industrial settings - The rise of automobile firms has been fueled by urbanization and globalization, which have led to the development of aircraft and emerging technologies. Roughly one-third of India's population resided in cities in 2022. Metals and alloys are utilized to make components in each of these sectors.

Tantalum, titanium, and aluminum are the metals that are utilized to make metal foams. Because of their many special qualities, metal foams are widely used as parts of machinery, tanks, and other vehicles. They are also mass-produced items that are mostly found in cars, where they are used to improve ride comfort by lowering noise and vibration, increasing toughness, and absorbing impact energy.

Challenges

- High cost - The metal foam market's expansion is being somewhat impeded by concerns about the high cost of metal foams. Metal foam is expensive due to its complex and energy-intensive manufacturing methods. Additionally, decreased mechanical characteristics, microstructural heterogeneity, and lower fatigue strength are predicted to hinder metal foam market growth throughout the projection period, making it more difficult to weld, solder, and join metal foam. Maintaining the shape and size of the gas-filled holes found in metal foams during manufacture is a challenging task.

- Lack of understanding - Metal foams are irreparable, and once damaged, the entire metal foam has to be replaced by fresh material. Lack of understanding of primary mechanism for manufacturing superior quality metal foams is a major concern. Additionally, metal foams are produced in small quantities, and the manufacturing process is labor-intensive and takes a substantial amount of time.

Metal Foam Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 103.36 million |

|

Forecast Year Market Size (2035) |

USD 155.97 million |

|

Regional Scope |

|

Metal Foam Market Segmentation:

End-Use

Automotive segment is set to capture metal foam market share of over 35% by 2035. A foam metal is a type of cell structure made of a robust metal, such aluminum, with a large volume of gas-filled pores.

Metallic foams are mostly used in automobiles to reduce weight, improve energy absorption during collisions, boost sound dampening, and, in military applications, lessen the impact of IEDs. In April 2022 to March 2023, the industry produced 2,59,31,867 vehicles, including passenger cars, commercial vehicles, three-wheelers, two-wheelers, and quadricycles, compared to 2,30,40,066 units in April 2021 to March 2022.

Because it usually retains some of the physical characteristics of its base material, foam formed from non-flammable metal stays non-flammable and can be recycled as the basis material.

In Asia-Pacific automobile sector will increase dramatically due to the region's massive population growth, rising per capita income, and economic progress in nations like China, India, and other ASEAN countries.

Material

Copper segment in the metal foam market is estimated to witness substantial CAGR till 2035. Copper foam has great anti-corrosion properties, high energy resistance, and good conductivity. This material's electromagnetic shielding and noise absorption properties make it useful in a variety of applications.

With a porosity of 85%, the produced open-cell copper foam has over 90% energy absorption efficiency. It is mostly used as a buffering material in pressure-reducing systems that use pressure gauges. It also aids in the absorption of vibrations, thermal insulation, and other beneficial components. The need for copper foam material ought to rise as a result of these qualities.

Our in-depth analysis of the global market includes the following segments:

|

Material |

|

|

Product |

|

|

Application |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Metal Foam Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to dominate majority revenue share of 40% by 2035. Automobile sales will be impacted by variables such increased urbanization, shifting customer preferences, and population growth in emerging economies. Over 2.2 billion people, or 54% of the world's metropolitan population, reside in Asia.

The need for metal foam in this region is anticipated to rise in tandem with China's expanding automobile industry. Production and sales volumes year-to-date were 9.012 million and 9.079 million, respectively, up 7.9% and 10.2% year over year.

Because of the dense population and consequently heavy traffic in Japan, automakers are always searching for methods to reduce the weight of their vehicles in order to increase fuel economy. At midyear, Japan's population is projected to be 123,294,513.

Throughout the projected period, the metal foam market in Korea is expected to be driven by the rising usage of metals in automobile parts. Korean iron ore mines produced more than 434,000 metric tons of iron ore in 2022.

North America Market Insights

The North America region will also encounter huge growth for the metal foam market during the forecast period. Government regulations to reduce carbon emissions and promote fuel efficiency have led to a rise in the use of these materials in cars to either replace or reduce the use of heavier materials. In 2022, North America accounted for 16.9 million car sales worldwide, or 20.7% of total sales.

Certifications for Green Buildings in Building projects in United States aim for green building certifications like ENERGY STAR and LEED. Metal foams are becoming more and more popular in the building industry since they meet certification requirements and have energy-saving qualities and are recyclable. In 2021, the US spent more than $86 billion on green construction projects.

Metal Foam Market Players:

- AlFoam Technologies Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ERG Aerospace Corporation

- Aluminum King Company Limited

- CYMAT Technologies Ltd.

- Alantum

- Ultramet

- Mott

- Mayser GmbH & Co. KG

- Liaoning Rontec Advanced Material Technology Co. Ltd.

- Shanxi Putai Aluminum Foam Manufacturing Co. Ltd.

While differentiating commodities is typically laborious, the two main competing considerations are price and raw material quality. Suppliers of raw materials have benefited from increased demand for aluminum in a variety of applications, which has helped them guard against the extreme metal foam market volatility that is still present.

Recent Developments

- Cymat Technologies Ltd. is dedicated to offering partners and clients worldwide distinctive stabilized aluminum foam solutions. Cymat has the sole authority to manufacture unique Stabilized Aluminum Foam globally through patents and licenses. This ultra-light metallic foam is made using a proprietary process that includes pumping gas into molten alloyed aluminum that contains a dispersion of tiny ceramic particles.

- Mott Corporation is among the leading companies in the world at setting new standards for "normal" in the areas of computer power, space exploration, renewable energy, and medical. Mott Corporation produces goods composed of porous metal. The company offers precision filters and fluid control devices for processes like wicking, sampling, particle flotation, carbonation, diffusion, and aeration.

- Report ID: 6220

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Metal Foam Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.