Metal Cutting Tools Market Outlook:

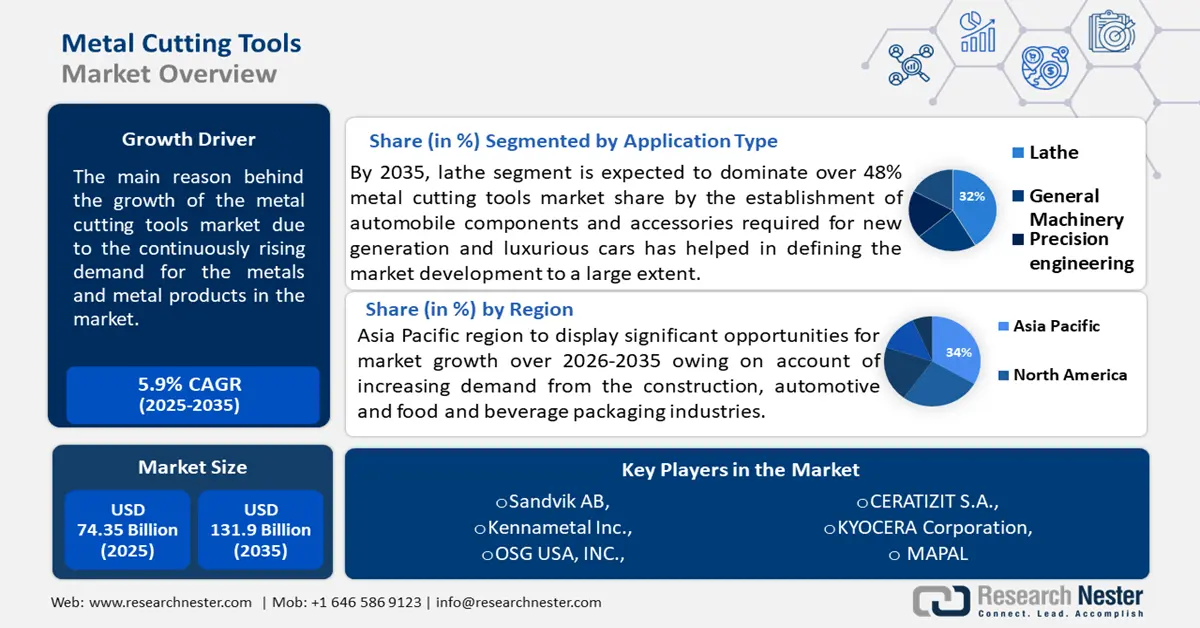

Metal Cutting Tools Market size was over USD 74.35 billion in 2025 and is anticipated to cross USD 131.9 billion by 2035, growing at more than 5.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of metal cutting tools is assessed at USD 78.3 billion.

The metal cutting tools market has been growing progressively due to the continuously rising demand for metals and metal products in the market. According to our reports, finished steel products’ global requirement hiked up to 250 million tons in around 2019. Technological enhancements have also come into play regarding the designing and manufacturing of even finer cutting tools so as to enable enhanced productivity, enhanced results, and cut on waste of time and material when dealing with metal products. The increasing usage of equipment for cutting metals across different industries is also playing a good role in the growth of the market.

Key Metal Cutting Tools Market Insights Summary:

Regional Highlights:

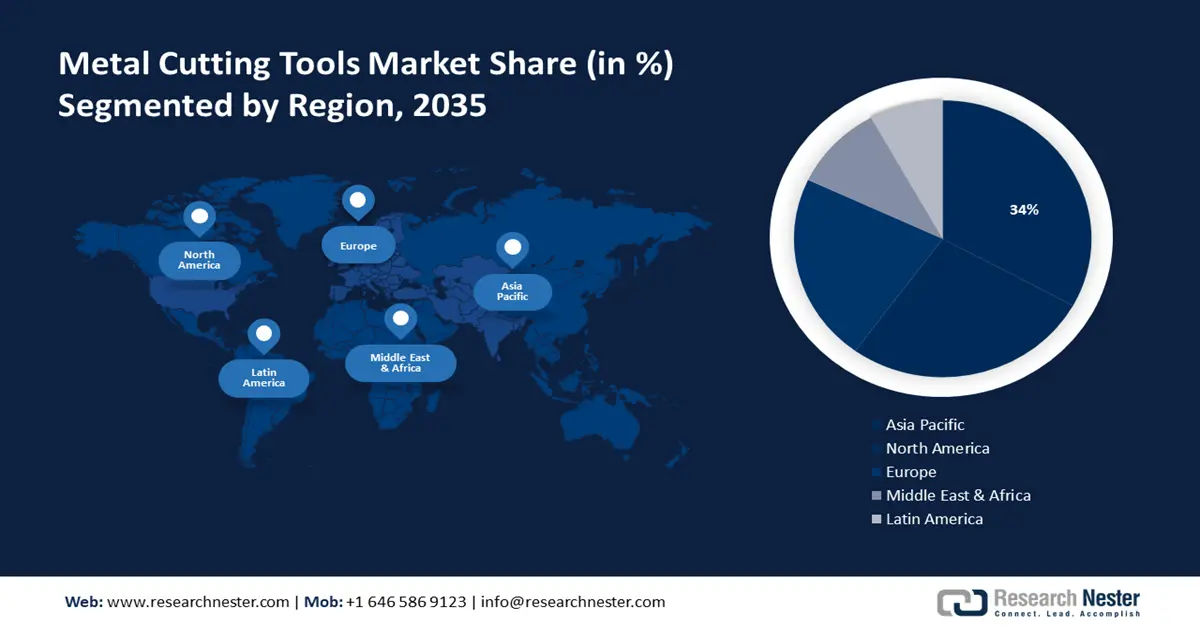

- Asia Pacific metal cutting tools market will dominate around 50% share by 2035, driven by Asian countries dominating CNC machinery globally.

- North America market will secure the second largest share by 2035, driven by its dynamic and indispensable role in machine manufacturing.

Segment Insights:

- The indexable segment in the metal cutting tools market is forecasted to achieve significant growth till 2035, driven by cost-effectiveness and replaceable inserts that reduce tooling costs.

- The lathe segment in the metal cutting tools market is anticipated to capture a 48% share, fueled by growing needs in automobile manufacturing and CNC machine use by the forecast year 2035.

Key Growth Trends:

- Advanced Technology

- Industry 4.0 adaptation

Major Challenges:

- Fierce rivalry and saturation of the market

- Price fluctuations for raw materials

Key Players: OSG USA, INC., CERATIZIT S.A., KYOCERA Corporation, MAPAL, Mitsubishi Motors North America, Inc., BIG KAISER Precision Tooling Inc.

Global Metal Cutting Tools Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 74.35 billion

- 2026 Market Size: USD 78.3 billion

- Projected Market Size: USD 131.9 billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (50% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Metal Cutting Tools Market Growth Drivers and Challenges:

Growth Drivers

- Advanced Technology - The requirement for factory automation is getting high and thus, the implementation of smart manufacturing practices into manufacturing processes and products. This is due to advantages that come with the use of the system such as productivity, quality of the goods produced, and any issue with a labor shortage. The manufacturing and machinery industry will transform from the daily starch known method to smart, connected, and integrated machines.

Open technologies can be of benefit to manufacturers in streamlining operations and improving the utilization of energy resources, gaining automatic virtual metrology systems, and attaining better human system interface. The stats reveal how the discrete industries which consist of automotive, manufacturing, and electronics would be expecting for 50% market share for Human Machine Interface globally in the years to come. - Industry 4.0 adaptation - The analyses of the advanced level of Industry 4.0 also affected the metal cutting industry in a major way. Thus, for the metal cutting tools, industry 4.0 has brought smart cutting tools which are able to share information with machines, gather information and correct operations accordingly. These tools can look at the cutting process as it occurs and change speed, feed, and other things for the cutting process. The investments in upcoming firms making technology associated with the industry 4.0 were observed to the tune of USD 2 billion in the year 2021. Collectively, the range of activities referred to as cross-border M&As involved 2.513 deals made during the 11-year period.

- Metal evolution - Essential needs manufacturing processes are key driver for the development of new and improved cutting tools because many parts and components are made from high strength alloys, composites, ceramic etc., and often require machining under difficult conditions. Since there are calls from industries to use light and reinforcing materials in their products, there is also the increased need for such materials. For instance, the tensile strength of weld joints that were produced from Al-Si wires is close to 280MPa, which is still lower than the strength of AA2024 that is typically used in the aerospace industry which is over 400MPa.

Challenges

- Fierce rivalry and saturation of the market- This is because of many big players and entry of new players with new technologies that have entered the market. In this way, the metal cutting tools market share and the clients’ preferences remain under serious pressure from manufacturers. The market saturation aspect is derived from the fact that metal cutting tools are extensively used across automotive industries, aerospace industries, construction industries and machinery industries among others.

- Price fluctuations for raw materials- The cost of raw materials varies over time and with it many producers of metal cutting tools are affected. This in turn pushes up the prices of the manufactured metal cutting tools as a result of the high costs of raw materials. This results in low demand for the metal-cutting tools hence slowing down of the market. This also complicates production scheduling and control over the manufacturing stocks and long delivery time.

Metal Cutting Tools Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 74.35 billion |

|

Forecast Year Market Size (2035) |

USD 131.9 billion |

|

Regional Scope |

|

Metal Cutting Tools Market Segmentation:

By Product Segment Analysis

By 2035, lathe segment is expected to dominate over 48% metal cutting tools market share. The segment growth can be attributed to the growing needs of the automobile manufacturing sector, along with the rising use of CNC machine . The benefits including efficient and massive production and long-life operations of the CNC Lathes are factors that will favor the demand for metal cutting tools. The data shows that in 2020, the Taiwanese companies manufactured 69000 CNC machines.

By Application Segment Analysis

In metal cutting tools market, automative segment is predicted to account for around 32% revenue share by 2035. The segment growth can be attributed to the establishment of automobile components and accessories required for new-generation and luxurious cars has helped in defining the market development to a large extent.

Gearboxes with superior gear system, clutch plates and modern disc brakes and other allied automotive parts have helped in expanding the market’s need for efficient metal cutting tools. Moreover, factors that drive such needs are the increasing demand for industrial machinery such as aerospace, construction and food and beverages. The auto-component industry in India, being one of the most competitive industries witnessed increased market for auto components aftermarket with a growth of 15 % during the year 2022-23 to reach USD 10.33 billion.

By Tool Segment Analysis

By the end of 2035, Indexable segment is anticipated to account for metal cutting tools market share of more than 56%. The segment growth can be attributed to their cost-effectiveness due to their replaceable inserts. For making high-volume machining operations, manufacturers go with indexable tools as it reduces their tooling costs over time. It offers greater flexibility and versatility than complex tools, allowing them to handle a wider range of tasks and products. Indexable tooling can reduce tool storage and set-up time, making it more efficient.

Our in-depth analysis of the metal cutting tools market includes the following segments:

|

Product |

|

|

Application |

|

|

Tool |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Metal Cutting Tools Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to dominate majority revenue share of 34% by 2035. The market growth in the region is also expected on account of increasing demand from the construction, automotive and food and beverage packaging industries. According to a report, in 2019, Asian countries dominated 50% of the world’s CNC machinery. Growing government initiatives to promote electric vehicles and rising popularity of CNC machines is driving the market growth.

China has achieved monumental iron and steel production and today is the world’s largest steel producer with an annual crude steel production volume of more than 81.7 billion metric tons in 2022. While China accounts for the highest consumption of steel, exports are also significant to the Chinese steel market. It topped the world market of steel exporting countries in 2023 and surpassed over 68 million metric ton quantities.

Japan's metal cutting tools market is undergoing gradual growth, due to its automotive and industrial machinery being the main source of demand for metal cutting tools. Also, the increasing popularity of electric vehicles and the need for precision are other reasons to drive the demand for metal-cutting equipment.

North American Market Insights

The North America region will also encounter huge growth for the metal cutting tools market during the forecast period and will hold the second position owing to the dynamic and indispensable part of machine manufacturing. With a rich history dating back to the Industrial Revolution, they have grown tremendously and have become a staple of a wide range of products in many industries. These are manufactured primarily to produce metal pieces, and the use of these tools covers a wide range of industries from aerospace and automotive to construction, energy, and medical device manufacturing. They play an important role in the precision manufacturing process of steel products and are critical to the functioning of everyday products.

In 2022, in the United States, the consumption of cutting tools has been identified to be USD 196.4 million as pointed by the U.S Cutting Tool Institute and The Association for Manufacturing Technology. Metal cutting tools market is characterized by continuous improvements in tool materials and coatings, enhancing durability and efficiency.

Metal Cutting Tools Market Players:

- Sandvik AB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kennametal Inc.

- OSG USA, INC.

- CERATIZIT S.A.

- KYOCERA Corporation

- MAPAL

- Mitsubishi Motors North America, Inc.

- BIG KAISER Precision Tooling Inc.

- Guhring, Inc.

- ISCAR LTD.

In addition, industries have a crucial role in executing the metal-cutting process. These industries equipped with modern technological requirements, skilled workforce, and high-quality mechanical structures make users convenient. The following are the few major players in the metal cutting tools market:

Recent Developments

- Sandvik AB has signed an agreement to acquire Spanish company Prezis, a solution provider for cutting tools is a comprehensive drilling, reaming, milling, and tooling system. With the acquisition of Prezis, Sandvik will establish its automotive supplier intensity of market sub-segments. The company profile will include Sandvik Coromant, a division within Sandvik Manufacturing and Machining Solutions.

- Guhring, Inc., new SpyroTec countersinks, featuring three different convex cutting-edges and a unique spiral-fluted geometry, provide a 60% reduction in energy 60% reduction in energy delivery, and a 50% reduction in radial power.

- Report ID: 6147

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Metal Cutting Tools Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.