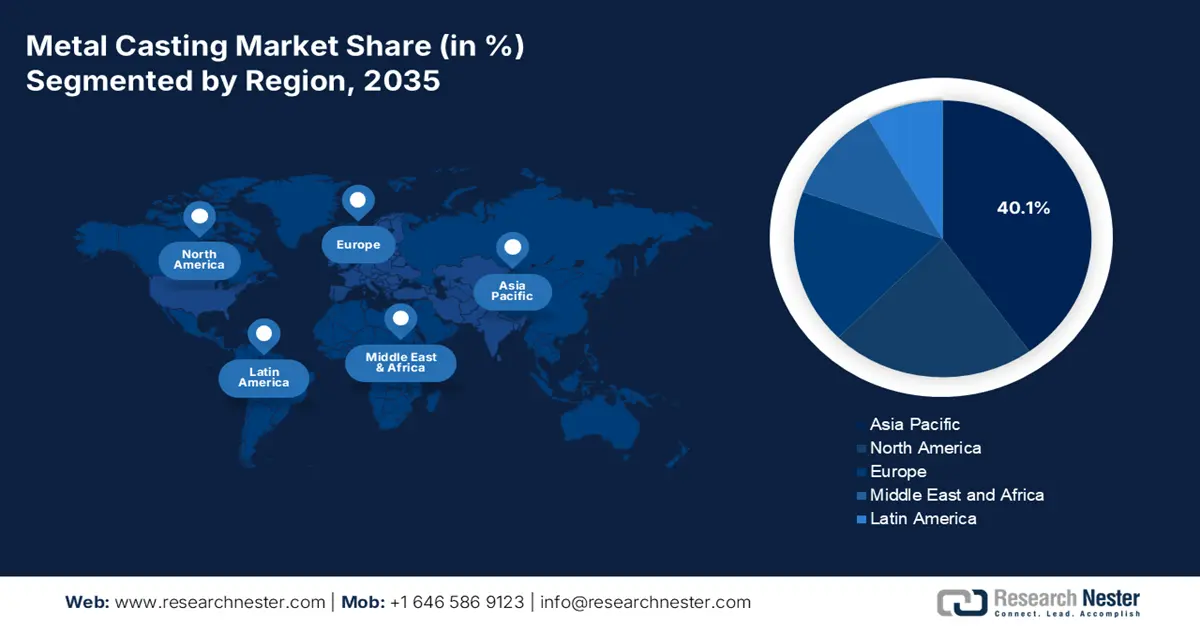

Metal Casting Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is expected to lead the metal casting market with the largest revenue share of 40.1% during the projected years from 2026 to 2035, attributed to the use of simulation-based methods for casting, which increases product quality and manufacturing productivity. The Asian Productivity Organization notes that efficiency in the manufacturing industry in the Asia Pacific region has increased labor productivity by an average of 3.5% in 2018-23 because of the implementation of modern technologies such as casting simulation software. This is a technological tool that minimizes cast defects, optimizes the design of molds, and yields more, which is sustainable manufacturing. The United Nations Industrial Development Organization notes that the ongoing increase in productivity in the manufacturing industries, such as metal casting, is essential in fulfilling the increased demand in the region, as far as automotive, aerospace, and heavy industries are concerned. These are geared towards regional development objectives of enhancing the industrial competitiveness and sustainability that will establish the Asia Pacific as a significant player in the world growth of the metal casting market.

China’s market is predicted to have the largest revenue share between 2026 and 2035 in the APAC region. This is based on its large industrial base and its consistent approach to developing its infrastructure, as well as the demand created by growing automotive and machinery manufacturing. In addition, various government initiatives that promote modernization and environmental sustainability in foundries have further supported China's strong position. In addition, the policies of the government that encourage the modernization of foundries, the use of modern technologies in casting, as well as digitalization, contribute to a further increase in productivity and sustainability in casting activities. For example, the National Institute of Standards and Technology (NIST) report also indicates that China has already created at least 33 MICs by 2025, as a result of its Ministry of Industry and Information Technology (MIIT). The centers specialize in major advanced manufacturing technologies applicable in such fields as aerospace, electric vehicles, robotics, and semiconductors. The MICs promote industry-academia-government collaboration, digitalization, simulation technologies, and green practices of manufacturing. Additionally, 3D printing and simulation software saves the lead time and enhances efficiency, which has been the foundation of leading China in the metal casting industry worldwide. For instance, the researchers of the Huazhong University of Sciences and Technology in Hubei Province invented a new metal 3D printing method known as intelligent micro casting and forging. It is a combination of both processes (metal casting and forging) that has significantly enhanced the strength and reliability of metal molds as well as minimized cost and lead times by computer-controlled modelling.

The metal casting market in India is likely to grow with the fastest CAGR within the Asia Pacific region, owing to the rising investment in infrastructure, the rapid growth of the automotive sector, and sustained government support for the implementation of green technologies in their manufacturing operations. The Indian government has been funding research and development into advanced casting materials and processes through both the Ministry of Chemicals and Fertilizers and the Department of Science & Technology (DST). This is likely to accelerate India's emergence as a rapidly developing player in the metal casting market.

In addition, India's foundry industry, manufacturing in excess of 9 million metric tons per year, is the third largest casting producer in the world, and the MSME sector constitutes approximately 80% of the units. The Kolhapur foundry cluster in Maharashtra also supplies 600,000 tons, approximately 8% of the total castings in India, used by major automotive OEMs and other industries. National and international agencies are helping to boost productivity and sustainability in these energy-consuming foundries through energy efficiency and modernization. Such development and organized promotion show the growing significance of metal casting in the industrial and export environment of India.

North America Market Insights

By 2035, the North American metal casting market is expected to grow with a revenue share of 22.3%, attributed to the increasing demand in the automotive, aerospace, construction, and industrial machinery sectors, which drives this growth. The region comprised approximately 2,950 establishments, of which more than 80% are small businesses that directly employ 225,000 individuals and generate cast products worth well above 18 billion annually. With the help of the Metal Casting Industry of the Future program sponsored by the U.S. Department of Energy, technologies that are more energy efficient, advanced research, and increased productivity, lower scrap, and improved environmental results are making North America a leader in metal casting innovation and competitiveness across the globe. This is the continuous technological development and intensive industrial foundation that drives the continuous growth of the metal casting market of North America. North America's transportation sector is extremely important; for instance, in 2024, there were about 16,107,023 vehicles totaling 10,562,188 units in the U.S., 1,342,647 units in Canada, and 4,202,642 vehicles in Mexico. This substantial production of automotive parts is the foundation of the expansion of the metal casting market in North America because the pressure of cast metal usage in transportation and production is increasing, and new technology will be developed, and the market will be expanded throughout the region.

The U.S. market is expected to dominate the North American region over the projected years by 2035, mainly driven by the growth of the automotive and construction sectors. The Environmental Protection Agency went into the US commercial markets to leverage new sustainable chemical processes in 2023, and as a result, over 51 new sustainable chemical processes were established that lowered hazardous waste processes from 2021. In addition, the U.S. metal casting sector is a valuable industry worth over 50 billion dollars and directly employs more than 160,000 individuals and an extra 300,000 individuals throughout its supply chain, which makes it important in the manufacturing process. The U.S. has more than 1,900 foundries that are located in major states such as Ohio, California, and Michigan, and is ranked as the third largest foundry for casting production and second in productivity per plant. This strong industrial foundation and labor force is the foundation for the development of metal casting as a very important component of various industries like the auto industry, aviation industry, and infrastructure.

The market in Canada is anticipated to expand steadily, owing to the investments to promote clean energy and sustainable manufacturing from the government. In similar programs in the Canadian chemical industry (Responsible Care) that guide towards continuous, progressive improvement in health, safety, and environmental achievements, the plans showcase goals on how to continue guiding the metal casting sector in the slow evolution towards more sustainable and responsible behaviors. Additionally, METEALTec R&D group (NRC Canada) is the origin of the initiative, which contributes to the development of the Canadian metal casting industry through the establishment of technological advancement in the manufacturing process, new materials, and sustainability. With 23 active industrial members and yearly research and development funding approximated at 2.5 million dollars, METALTec is spearheading productivity, digitalization, and minimization of footprint on the environment throughout the metal fabrication sector, which fortifies the Canadian markets. Furthermore, according to the USITC report, it is a critical partner in supplying heavy iron construction castings to the U.S., given that the country records great export volumes throughout the period of review. The export orientation of the Canadian casting industry and compliance with the antidumping duty orders underscore the fact that it is a part and parcel of the North American metal casting supply chains, and this aspect is an indicator of strong market growth due to the increased demand in the infrastructure and utilities sectors.

Europe Market Insights

The European metal casting market is anticipated to witness an upward trend during the projected years from 2026 to 2035, owing to the rise of ferrous castings and other casting production in the region. The industry comprises approximately 6,000 foundries that discovered approximately 10.7 million tons of ferrous castings in 2021, which increased by 17.6% year-on-year. With a casting production value throughout the continent of 12%, the industry has about 260,000 employees and generates castings worth around 41 billion euros. The automotive, general engineering, and construction markets contribute to the growth of the market, and the prospects are changing towards the use of lightweight materials such as aluminum and magnesium castings.

Additionally, the UK steel industry generated 2.0 billion in the UK economy (0.1% of the UK economy and 1.2% of manufacturing output). It consisted of approximately 1100 businesses and subsidized 33400 jobs in 2019. The industry is important despite the global rivalry and domestic pricing, as the government is concerned with procurement policy, decarbonization, and energy price reimbursement to maintain growth and competitiveness in the metal casting and steel industry. The sector in Germany has an annual output of more than 638,000 tons of die castings made of aluminum, of which a major share are of the non-ferrous castings. It is the largest metal casting market in terms of revenues in Europe, which has the automotive and engineering industries.