Metal Bellows Market Outlook:

Metal Bellows Market size was valued at USD 2.41 billion in 2025 and is set to exceed USD 4.36 billion by 2035, expanding at over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of metal bellows is estimated at USD 2.54 billion.

The market is expected to grow due to the rapid industrialization that is spreading throughout emerging economies throughout the forecast period. Less than 20% of the world's population lives in the 63 developed economies that make up the world today.

In addition to these, opportunities for the metal bellows sector are anticipated to arise from the development of highly efficient metal bellows that can tolerate high temperatures and pressure during the projected period. Furthermore, during the course of the forecast period, rising R&D expenditures by major players in the creation of novel materials will propel further growth in the worldwide metal bellows market.

Key Metal Bellows Market Insights Summary:

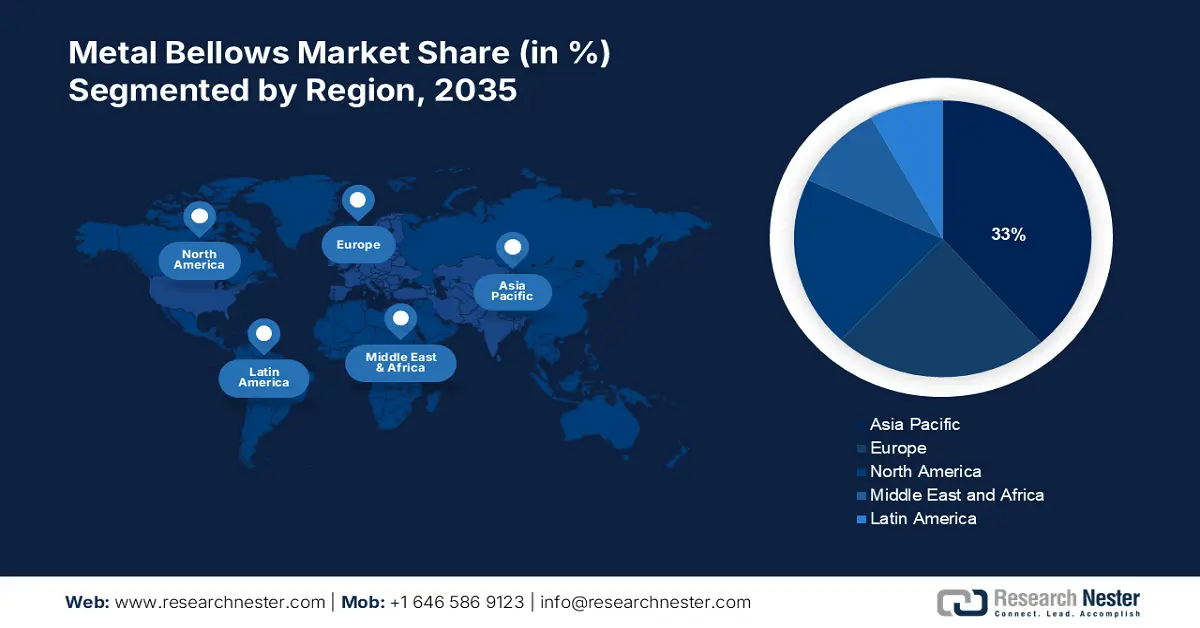

Regional Highlights:

- Asia Pacific metal bellows market will hold more than 33% share, fueled by demand from aerospace, auto, and petrochemical sectors, forecast period 2026–2035.

- Europe market will capture a 28% share, driven by widespread use of metal bellows in aerospace and military applications, forecast period 2026–2035.

Segment Insights:

- Aerospace & defense segment in the metal bellows market is forecasted to achieve 60% growth by the forecast year 2035, driven by the rising demand for air travel, which increases the need for high-performance aircraft components.

- The stainless-steel alloys segment in the metal bellows market is expected to command a 58% share by 2035, driven by the widespread availability of welded stainless-steel metal bellows and their resistance to low temperatures.

Key Growth Trends:

- Increasing Need in the Automobile Industry

- Expanding Oil and Gas Industry

Major Challenges:

- The market's expansion is being hindered by the higher price of metal bellows in comparison to non-metallic bellows.

- Throughout the course of the projection period, fluctuations in the price of raw materials are probably going to hinder metal bellows market expansion.

Key Players: Duraflex Inc., EnPro Industries Inc., Meggitt PLC, MW Industries, Inc., USA Bellows Inc., BOA Holding GmbH, Freudenberg Group, Smith Group, Hyspan Precision Products Inc, Witzenmann GmbH.

Global Metal Bellows Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.41 billion

- 2026 Market Size: USD 2.54 billion

- Projected Market Size: USD 4.36 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 16 September, 2025

Metal Bellows Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Need in the Automobile Industry- The growing demand in the automotive sector are driving the market for Metal Bellows. The car sector, which uses metal bellows extensively in fuel delivery systems, exhaust systems, and suspension components, has had a significant impact on the metal bellows market. Government-imposed strict global emission rules are the main cause of the increased demand in this industry. Metal bellows are essential for improving exhaust system performance and assisting in the reduction of emissions. The trend toward electric vehicles has also increased demand for metal bellows in parts like powertrains and battery cooling systems. Over 10 million EVs are currently on the road. Annual sales of plug-in electric vehicles exceed 6 million. Significantly, in 2022, well-known automakers like Tesla and Volkswagen added metal bellows to their electric vehicles, highlighting enhanced thermal management and durability.

-

Expanding Oil and Gas Industry- Due to its difficult operating circumstances, the oil and gas sector is a major driver of the metal bellows market. In this industry, metal bellows are essential for pipeline expansion joints, control valves, and pressure sensors, among other vital applications. Renewing investments in the oil and gas sector are the result of rising oil prices as well as more exploration and drilling activity. The need for robust and corrosion-resistant parts is said to be the cause of this increase in demand, making metal bellows essential. Manufacturers in the metal bellows industry have also been presented with new growth potential by the exploration of deep-sea deposits and the boom in shale gas.

- Widespread Use in a Variety of Industries Driving the Metal Bellows Market- There are several advantages that metal bellows have over non-metallic bellows. Consequently, there is a global rise in demand for metal bellows. Metal bellows are used in many industrial settings, such as pipe junctions, where it is normal for any elastic vessel to contract when pressure is applied from the other side. Furthermore, metal bellows are used in vacuum technology as flexible sealing elements. Vacuum sealing and vacuum valve stem seals are the two main applications.

Challenges

-

Risk of Product Failure and Low-Quality Product Penetration Restricting Market Growth- The majority of businesses supply welded metal bellows in response to customer requests. Because bellows are small parts, high temperatures at welded joints, where the additional heat may weaken the metal, might cause them to break down or fail. The metal's diminished strength significantly shortens the bellows' lifespan and raises the material's volatility. The environment in which bellows are utilized determines how effective they are in sealing, which serves as a restraint on market expansion. The introduction of substandard products into the market is having a detrimental effect on it.

-

The market's expansion is being hindered by the higher price of metal bellows in comparison to non-metallic bellows.

- Throughout the course of the projection period, fluctuations in the price of raw materials are probably going to hinder metal bellows market expansion.

Metal Bellows Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 2.41 billion |

|

Forecast Year Market Size (2035) |

USD 4.36 billion |

|

Regional Scope |

|

Metal Bellows Market Segmentation:

Material Segment Analysis

Based on material, stainless-steel alloys segment is anticipated to hold 58% share of the global metal bellows market by 2035. Global demand is rising as a result of the widespread availability of welded stainless-steel metal bellows and their resistance to low temperatures. Bellows made of stainless steel are ideal for use in power transmission systems, industrial controllers, and electrical interrupters because of their natural flexibility and resistance to pressure. Global production of stainless steel was estimated to be 55.3 million metric tons in 2022.

End Use Segment Analysis

Based on end use industry, aerospace & défense segment is expected to hold 60% share of the global metal bellows market by 2035. In aerospace applications, metal bellows are essential, especially for fuel systems, environmental control systems, and aircraft engines. Passengers' increasing desire for air travel has resulted in a substantial increase of the aerospace sector. The requirement for new aircraft has surged due to the rising demand for air travel, which in turn has raised demand for high-performance and dependable parts like metal bellows. According to a PwC research, the aerospace and defense sector reported revenues of USD 741 billion in 2022 a mere 3% increase from 2021 and USD 67 billion in operating profit an 8% increase.

Our in-depth analysis of the global metal bellows market includes the following segments:

|

Product Type |

|

|

Material |

|

|

End Use Industry |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Metal Bellows Market Regional Analysis:

APAC Market Insights

Metal bellows market in Asia Pacific region is expected to hold largest revenue share of about 33% during the forecast period. Due to increased demand in a variety of end-use industries, such as aerospace, military and defense, petrochemical, automotive, and power and energy, the Asia-Pacific region now has a sizable market share. In India, the yearly production of automobiles India sold 3.89 million passenger cars overall in FY23, whereas 47,61,487 automobiles were exported during the same time period. The automobile industry employs about 19 million people directly and indirectly and contributes roughly 7.1% of the country's GDP, up from 2.77% in 1992–1993 to the present. The welded metal bellows market in the area is growing as a result of the revival of auto assembly factories in China and the rise of several industrial and automotive sectors in other nations.

European Market Insights

Metal bellows market in Europe region is anticipated to hold second largest revenue share of about 28% during the forecast period. With crucial parts widely used in numerous applications across the European aerospace and military industries, including as aircraft engines, avionics, and fuel systems, metal bellows hold the second-largest market share in Europe. Europe's total military spending increased significantly, hitting USD 418 billion in 2021 a 3.0% increase from 2020 and a significant 19% increase from 2012.

Metal Bellows Market Players:

- Technoflex Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Duraflex Inc.

- EnPro Industries Inc.

- Meggitt PLC

- MW Industries, Inc.

- USA Bellows Inc.

- BOA Holding GmbH

- Freudenberg Group

- Smith Group

- Hyspan Precision Products Inc

- Witzenmann GmbH

Recent Developments

- MW Industries, Inc. (MWI), a well-known international producer with a focus on parts needed for engines, machinery, and complex subassemblies, has successfully acquired Ameriflex, Inc. A reputable manufacturer of flexible metal hoses, flanges, precision metal bellows, and other vacuum-specific goods, Ameriflex, Inc., was integrated as part of this strategic move.

- An extension of the 2017 agreement was made between Satair and Senior Metal Bellows regarding distribution. The new deal covers all of Senior Metal Bellows's commercial aerospace aftermarket products, including compressors, bellows, thermal valves, accumulators, feedthroughs, and much more. It also covers the aftermarket for Europe and Asia.

- Report ID: 5748

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Metal Bellows Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.