Metabolic Panel Testing Market Outlook:

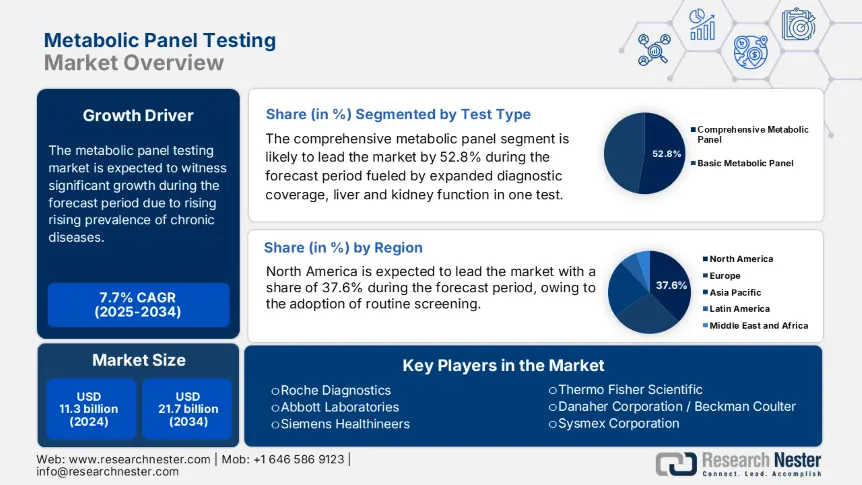

Metabolic Panel Testing Market size was valued at USD 11.3 billion in 2024 and is projected to reach USD 21.7 billion by the end of 2034, rising at a CAGR of 7.7% during the forecast period (2025-2034). In 2025, the industry size of metabolic panel testing is evaluated at USD 12.2 billion.

The global market is fueled by the rising prevalence of chronic diseases, including kidney disorders, liver dysfunction, and diabetes. As per the CDC report, nearly 37.7 million people in the U.S. are experiencing diabetes, and 96.5 million adults are prediabetic. These two populations in the U.S are strictly made to follow the metabolic panel screening. Further, the National Kidney Foundation has stated that 1 in 4 people in America are at high risk of kidney disease, making demand for these diagnostic and treatment surgeries. Moreover, the increasing conditions of liver disorder, endocrine dysfunction, and electrolyte imbalances provide an expanded utilization of tests mainly among aging and health issues-related populations.

On the supply chain side, the metabolic panel testing services depend on the seamless coordination among the analyzer manufacturers, regent production, and electronic consumable sourcing. As per the U.S. Census Bureau trade data, most of the diagnostics reagents and instruments are imported, which is nearly USD 6.7 billion from Switzerland and Germany. The producer price index in the U.S rose by 3.5% YoY for medical and diagnostic laboratory, while the consumer price index increased by 3.1% for medical care commodities in April 2025. In the research, development, and deployment, NIH allocated USD 1.5 billion in 2024 in diagnostic-based research. In 2024, intra-EU commerce in diagnostic kits grew 7.9% year over year, according to European Commission customs statistics, demonstrating the bloc's robust demand and unified sourcing practices.