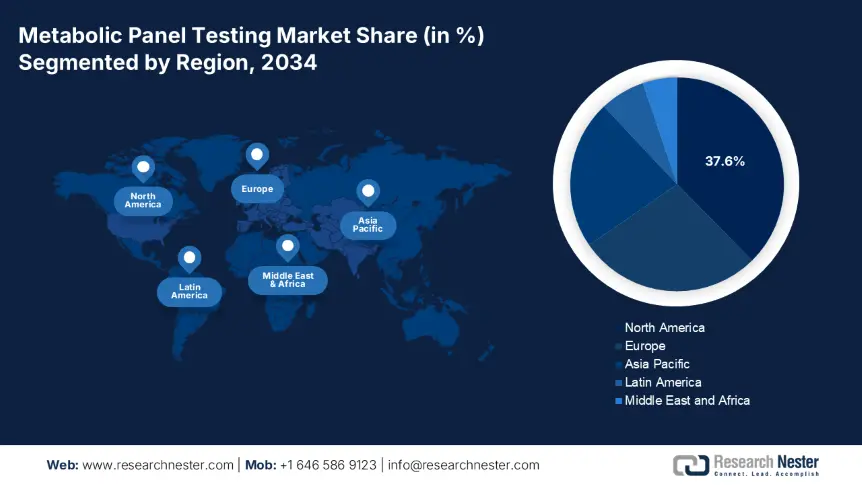

Metabolic Panel Testing Market - Regional Analysis

North America Market Insights

North America dominates the metabolic panel testing market and is projected to hold the market share of 37.6% at a CAGR of 7.1% by 2034. The market is driven by a rise in chronic cases, adoption of routine screening, and favorable reimbursement ecosystems. Moreover, the rising diabetic cases and kidney-related diseases in 2024 have impacted over 133.3 million people in the U.S., demanding testing in both primary and tertiary care. Further encouraging continued use are higher government payouts via Medicare and Medicaid. NIH and CIHI funding aid local innovation and test standardization among urban and rural labs. As the U.S. and Canada prioritize telehealth and preventive care, the adoption of metabolic panel tests is expected to rise with point-of-care analyzers and home-based diagnostics.

The U.S. market for metabolic panel testing is driven by increased incidences of chronic diseases and continued federal healthcare spending. As of 2024, more than 133.4 million adults live with diabetes, kidney disease, or other related metabolic disorders, which all necessitate regular BMP and CMP testing. Medicare funding for the market has increased by 15.6% from 2020 to 2024, reaching USD 800.5 million due to the enhancements in the reimbursement under coverage for preventive care. Medicaid increased diagnostic coverage by 10.6%, with USD 1.6 billion spent in 2024. The NIH and AHRQ spent more than USD 1.7 billion on diagnostic R&D, with metabolic test innovation a prime focus. Increased dependence upon automated laboratory platforms and telehealth-associated diagnostics has led key players to develop fast, mobile analyzers that can interface with EHR systems.

Asia Pacific Market Insights

The APAC region is the fastest-growing sector in the metabolic panel testing market and is projected to hold the market share of 22.6% with a CAGR of 8.4% by 2034. The market experiences a drastic shift due to rising chronic illness, healthcare modernization, and expanding public diagnostic infrastructure. The test volumes in the market are rising due to the increase in cases such as kidney disease, diabetes, and electrolyte imbalances. In addition to modern hospital facilities in metropolitan areas, the government's Healthy China 2030 program in China has extended the coverage of metabolic tests to rural areas. On the other hand, the local manufacturers are supported with local R&D to enhance the public funding, test accessibility, and national research priorities across AMED, NMPA, and MoHFW.

China is leading the metabolic panel testing market in Asia Pacific and is projected to have an 8.2% market share by 2034. China’s expenditure on metabolic diagnostics increased by 15.5% according to the statistics of the National Medical Products Administration, to cater to the healthcare priority of the government. On the other hand, 1.8 million people were diagnosed with metabolic conditions in 2023, indicating a surge in diagnostic demand. Under the Healthy China 2030 initiative, the automation of urban labs was obviously intensified. 181 newly built country hospitals had diagnostic services. These investments are evidence of a strong national policy to decentralize and modernize metabolic testing capability across the Chinese health system.

APAC Metabolic Diagnostics Government Investment & Policy Table (2021–2025)

|

Country |

Policy / Program Name |

Launch Year |

Government Focus / Investment |

|

Australia |

National Genomics and Diagnostics Roadmap |

2022 |

AUD 500.4 million allocated for diagnostic innovation and lab modernization across states. |

|

Japan |

Health Japan 21 (Phase II) Expansion |

2023 |

¥3.7 billion invested in metabolic and chronic disease diagnostics under MHLW & AMED programs. |

|

India |

Ayushman Bharat Digital Mission (ABDM) |

2021 |

$2.5 billion budgeted to digitize diagnostics, including metabolic panel access via PMJAY scheme. |

|

South Korea |

Bio-Health Innovation Strategy |

2024 |

₩1.9 trillion committed to AI-based diagnostics and lab automation through MoHW. |

|

Malaysia |

MyHealth Integrated Community Screening Program |

2023 |

RM 280.5 million invested in public metabolic and chronic disease screening across rural clinics. |

Europe Market Insights

Europe metabolic panel testing market is expanding and is expected to hold the market share of 27.8% at a CAGR of 6.9% by 2034. The market is driven by the enhanced reimbursement structures, national chronic disease programs, and government-supported lab modernization. The rises in diseases such as diabetes, kidney dysfunction, and cardiovascular diseases are boosting the market across all the member states. Further, 30.4% of the elderly population in the EU experience metabolic disorder, highlighting strategic relevance of early diagnostics. The European Health Union assigned €2.8 billion under Horizon Europe to enhance the inter-member lab standardization and cross-border diagnostic innovation. The EU healthcare infrastructure makes the market more attractive for diagnostic testing and developing service providers.

Germany has the largest revenue share in Europe, with the Federal Ministry of Health (BMG) registering expenditure on diagnostic services in 2024, including metabolic testing, of €4.4 billion. This is a 12.3% increase in demand since 2021. Initiatives such as the Gesundheitsziele.de program incorporate metabolic testing into primary care using the DRG reimbursement scheme. Germany's health system provides broad access to testing at both public and private laboratories, and the German Medical Association (BÄK) reports a 9.8% rise in chronic disease screening from 2022 to 2023. Furthermore, the National Digital Health Strategy funding is enhancing lab interoperability and real-time reporting of diagnostics.

Europe Government Investment & Policy Initiatives (2021–2025)

|

Country |

Initiative / Policy |

Funding or Budget Allocation |

Launch Year |

|

UK |

NHS Diagnostic Recovery & 100 Community Diagnostic Centres Plan |

£2.7 billion investment into lab and diagnostic infrastructure |

2021 |

|

Spain |

Strategic Plan for Health and Innovation (PERTE Salud de Vanguardia) |

€1.9 billion to integrate advanced diagnostics incl. metabolic testing |

2022 |

|

Italy |

National Recovery and Resilience Plan (PNRR) – Mission 6 Health |

€15.8 billion total for health, incl. digital diagnostics |

2021 |

|

France |

Ma Santé 2022 & France 2030 health diagnostics innovation package |

€7.9 billion allocated to modernize diagnostics and lab automation |

2022 |