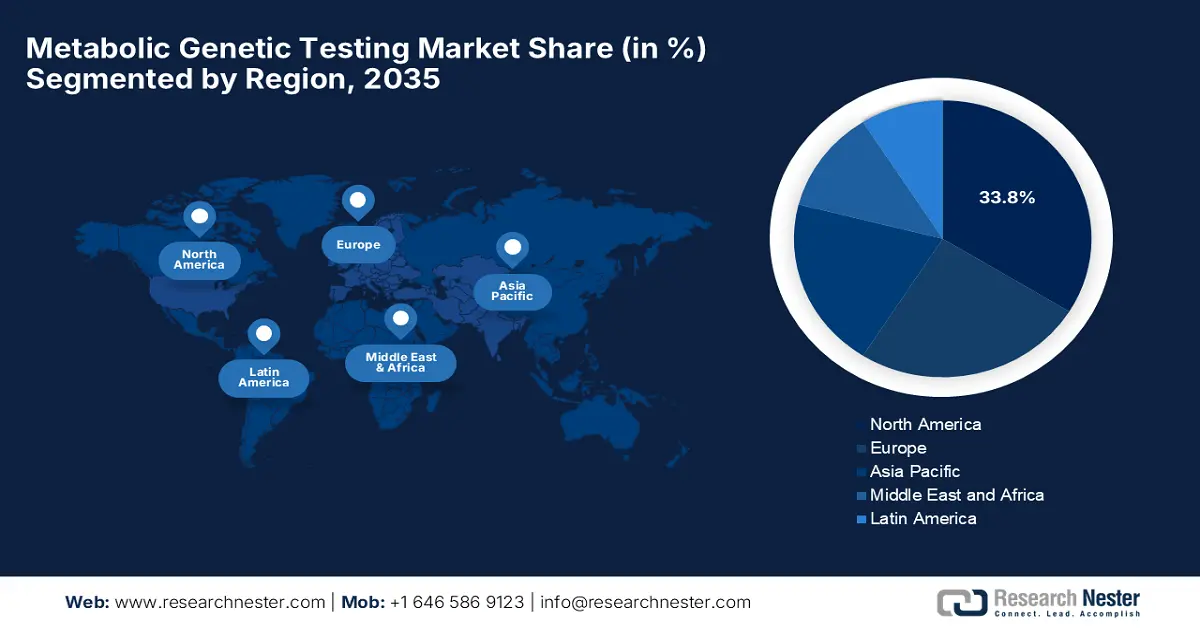

Metabolic Genetic Testing Market - Regional Analysis

North America Market Insights

North America is likely to dominate the global market by capturing the largest share of 33.8% by the end of 2035. The high healthcare spending, advanced medical infrastructure, and presence of key industry players are the key factors propelling this leadership. In October 2025, GeneDx reported that, along with a consortium of national partners, it launched BEACONS, which marks the first U.S. multi-state initiative to explore integrating genomic sequencing into newborn screening, efficiently backed by a USD 14.4 million NIH grant. Besides, the study will enroll up to 30,000 newborns across 10 states to assess the feasibility and impact of screening for the genetic conditions that are treatable at birth.

The U.S. holds a dominant position in the market, effectively attributed to its extensive healthcare expenditure and the country’s emphasis on personalized medicine and the integration of advanced diagnostic technologies. This can be exemplified by the U.S. FDA’s article published in December 2023, wherein it states the formation of a new Genetic Metabolic Diseases Advisory Committee to evaluate medical products targeting rare genetic metabolic disorders. It also stated that this expert panel will offer independent scientific and policy recommendations on treatments under review, addressing the complex challenges of drug development for these often life-limiting conditions.

Canada also closely follows the U.S. in the metabolic genetic testing market, owing to the aspect of increasing awareness of metabolic disorders and advancements in genetic research. In this regard, EasyDNA in January 2025 notified that it had launched its DNA Methylation Health Report, offering personalized health insights based on over 9,000 genetic markers. The test analyzes numerous fields such as digestion, metabolism, hormonal balance, stress, and inflammation, providing recommendations including required nutrients and suggested blood tests.

APAC Market Insights

Asia Pacific is recognized as the fastest-growing region in the metabolic genetic testing market from 2026 to 2035. This rapid progression is readily propelled by the push towards precision medicine, increasing awareness of genetic disorders, and deploying large genomic initiatives. On the other hand, the emergence of newborn screening and molecular diagnostics has been adopted broadly, which is further encouraging direct-to-consumer genetic testing, especially in urban settings. Further, the government programs and public health systems are supporting early disease detection and personalized care, which raises demand.

China is likely to garner the leadership role in the regional metabolic genetic testing market owing to its strong investment in genomic research, strong domestic manufacturing capabilities, and national precision medicine plans. In July 2025, BGI Group announced that it showcased its advancements in genetic metabolic testing as part of its broader precision health strategy at the 2025 China International Supply Chain Expo. Also, their high-throughput, AI-powered gene testing solutions included tools for diagnosing genetic metabolic disorders, integrating genomics with metabolomics.

India in the metabolic genetic testing market is expanding beyond its limits since healthcare providers and labs are deploying more comprehensive test panels, covering rare genetic disorders, newborn screening, and metabolic panels. In July 2025, MedGenome, a leading genetic diagnostics firm in the country, reported that it raised USD 47.5 million in Series E funding to expand its genomics and integrated diagnostics offerings across India. The company has a CAP-accredited lab in Bangalore, wherein it offers over 1,300 genetic tests, including solutions, hence making it suitable for standard market growth.

Cost Analysis of Newborn Screening for Inherited Metabolic Disorders Using Tandem Mass Spectrometry (MS/MS) in China (10-Year Data)

|

Cost Parameter |

MS/MS Screened Group |

|

Total Lifetime Cost per Patient (CNY) |

1,000,452 |

|

Total Lifetime Cost per Patient (USD) |

143,515 |

|

Incremental Cost-Effectiveness Ratio (ICER) |

67,417 CNY per QALY gained |

|

|

(USD 9,671 per QALY gained) |

|

Benefit-Cost Ratio (BCR) |

4.23 (return of 4.23 CNY per 1 CNY invested) |

|

Cost-Effectiveness Probability |

100% (MS/MS group cost-effective vs non-screened) |

Source: NIH, 2025

Europe Market Insights

The metabolic genetic testing market in Europe is portraying notable growth, primarily fueled by the increasing awareness of genetic disorders and the escalating investments in precision medicine initiatives. For instance, in March 2024, CENTOGENE reported that it had extended its strategic partnership with Takeda to continue providing diagnostic genetic testing for patients with lysosomal storage disorders such as Fabry disease, Gaucher disease, and Hunter syndrome, hence denoting a positive market outlook.

Germany is growing exponentially in the regional metabolic genetic testing market, successfully backed by its robust healthcare system and strong focus on genetic research and innovation. Besides the increased government funding for rare disease research, and rising number of specialized genetic testing centers is also contributing towards market progression. Furthermore, the high adoption rates, growing patient awareness are appreciably driving demand for accurate detection of metabolic genetic disorders.

The U.K. in the metabolic genetic testing market is highly propelled by the ongoing advancements in genomics and precision medicine, alongside government initiatives supporting rare disease diagnostics. In June 2022, Metabolon, Inc. declared that it had partnered with King’s College London to analyze metabolomics data from the TwinsUK registry, which is one of the largest and most detailed adult twin cohorts across all nations. Therefore, this collaboration aims to uncover new biomarkers and deepen understanding of the interaction between genetics, environment, and the microbiome in human health.