Mercaptan Market Outlook:

Mercaptan Market size was valued at USD 2.13 billion in 2025 and is likely to cross USD 3.44 billion by 2035, registering more than 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of mercaptan is assessed at USD 2.22 billion.

The mercaptan market is expanding owing to the increasing demand for chemical insecticides, fertilizers, and other agricultural products. The use of pesticides and fungicides is rising due to the growing need to raise crop productivity and the rising demand for food products spurred by the increasing human population. The Food and Agriculture Organization (FAO) reported that Between 2009 and 2050, the world's population is predicted to grow by 2.3 billion people or more than a year and a third. Increasing global food production by almost 70% between 2005–07 and 2050 would be necessary to feed the 9.1 billion people that will inhabit the planet by then. This, in turn, is boosting the use of compounds based on mercaptan. Furthermore, it is anticipated that the adoption of contemporary farming techniques and the shift to more efficient and environmentally responsible crop protection strategies will create new opportunities for advanced agrochemical formulations.

Mercaptans, particularly methyl mercaptan, are key intermediates to produce agrochemicals like insecticides, fungicides, and herbicides. As agricultural practices intensify worldwide to meet growing food demands, the need for efficient pesticides continues to rise, fostering increased trade and production. Therefore, growing import and export activities are expanding the mercaptan market.

|

Country |

Export Value of Pesticides (in USD billion) |

Country |

Import Value of Pesticides (in USD billion) |

|

China |

12 |

Brazil |

7.06 |

|

U.S. |

5.36 |

U.S. |

3.01 |

|

India |

4.35 |

Canada |

2.24 |

|

France |

4.06 |

France |

2.23 |

|

Germany |

3.94 |

Germany |

1.78 |

Source: OEC

The Observatory of Economic Complexity (OEC) revealed that pesticides ranked as the 96th most traded product worldwide, with a total trade of USD 49.2 billion in 2022. Pesticide exports increased 13.6% between 2021 and 2022, from USD 43.3 billion to USD 49.2 billion. Pesticide commerce accounts for 0.21% of global trade. According to the Product Complexity Index (PCI), pesticides are ranked 539th.

Key Mercaptan Market Insights Summary:

Regional Highlights:

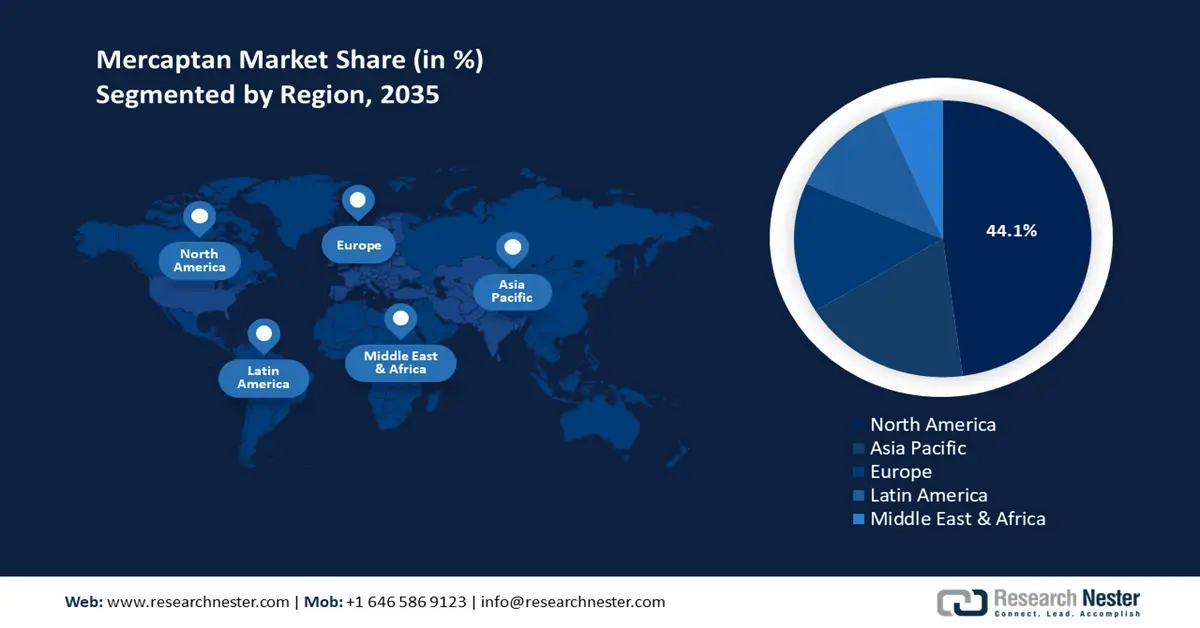

- North America leads the Mercaptan Market with a 44.1% share, propelled by robust agricultural, pharmaceutical, and energy production sectors, ensuring strong growth through 2026–2035.

Segment Insights:

- The Methyl Mercaptan segment is projected to hold a notable share by 2035, driven by rising demand for methionine in poultry and oil & gas sectors.

- The Animal Feed segment of the Mercaptan Market is anticipated to achieve over 55.4% share by 2035, propelled by the growing need for quality livestock nutrition and feed efficiency.

Key Growth Trends:

- Recent advances in the applications of mercaptan

- Surging demand for natural gas

Major Challenges:

- High production costs

- Environmental and health-related concerns

- Key Players: Chevron Phillips Chemical Company LLC, Arkema S.A., Huntsman International LLC, Evonik Industries AG, Jiande Lvke Chemical Industry Co., Ltd., Finetech Industries Limited, Sigma-Aldrich, DuPont de Nemours, Inc., Solvay S.A., Akzo Nobel N.V..

Global Mercaptan Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.13 billion

- 2026 Market Size: USD 2.22 billion

- Projected Market Size: USD 3.44 billion by 2035

- Growth Forecasts: 4.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 13 August, 2025

Mercaptan Market Growth Drivers and Challenges:

Growth Drivers

- Recent advances in the applications of mercaptan: R&D expenditures enable producers to find novel chemical formulas and enhanced mercaptan properties that will be utilized in a variety of applications, such as specialty chemicals, flavors, and pharmaceuticals. As a result of their special reactivity and capacity to easily produce pivotal intermediates, mercaptans are being investigated in the pharmaceutical industry for their potential as active pharmaceutical ingredients (APIs) and as a source of reagents for drug synthesis. This opens the door to creating novel therapeutic compounds and refining existing formulations. Furthermore, their distinctive scents make them beneficial in the taste and fragrance industries, particularly when developing flavor profiles for food and beverage items. R&D's search for these compounds and the justification for it will provide novel flavoring agents that are tailored to shifting customer preferences.

- Surging demand for natural gas: Mercaptan is primarily composed of methane (CH4), a colorless and odorless compound known for its flammability. To enhance safety and facilitate leak detection, the natural gas industry intentionally adds organosulfur chemicals, which impart a distinct odor to the otherwise undetectable gas. Three main classes of these odorants are employed: cyclic compounds such as tetrahydrothiophene (THT), alkyl mercaptans like t-butyl mercaptan (TBM), and alkyl sulfides (or thioethers) such as dimethyl sulfide (DMS).

Among these, mercaptans play a crucial role in odorizing natural gas. Although mercaptan is also colorless and odorless, its pungent scent—which resembles that of rotten cabbage or garlic—makes it an effective warning agent. This organic gas is composed of sulfur, hydrogen, and carbon and naturally occurs as a waste product of metabolism in all living organisms, including humans. Natural gas has numerous applications worldwide, from energy production to transportation, cooking, and fuel heating. Attributable to its adaptability, there is substantial support for its expanding use in energy portfolios, particularly as a transition fuel between renewable energy sources and other fossil fuels. Therefore, these factors have increased the consumption and production of natural gas escalating the mercaptan market.

According to the U.S. Energy Information Administration, natural gas consumption is rising more than twice as fast in non-OECD countries compared to OECD countries, driven by economic growth, particularly in non-OECD Asia. From 2012 to 2040, non-OECD regions are projected to see a 2.5% annual increase in consumption, while OECD growth will be 1.1%. As a result, non-OECD nations are expected to account for 76% of the global increase in natural gas use, with their share rising from 52% in 2012 to 62% in 2040. Moreover, industries such as petrochemicals, refining, and manufacturing also rely on mercaptans for applications such as polymerization and as intermediates, amplifying mercaptan market growth alongside the natural gas boom.

Challenges

- High production costs: According to the U.S. EPA, methyl mercaptans are the most prevalent thiol found in gas emissions from biosolids. Mercaptans are thiols that contain a sulfur molecule. Thiol chemicals are specialized compounds with sulfur atoms that are used in a variety of manufacturing, pharmaceutical, and agricultural fields. However, the high production and end-product pricing costs are impeding their mercaptan market penetration. Furthermore, thiol chemicals' high production costs are a result of their complex manufacturing procedures, as well as the need for specialized tools and raw materials. Because thiol chemicals like mercaptans are expensive, some industries and geographical areas cannot afford them, which limits overall demand and mercaptan market expansion.

- Environmental and health-related concerns: Methyl mercaptan is a dangerous chemical that burns easily and is highly toxic. Poisoning with methylene mercaptan can cause unconsciousness, breathing problems, and even death. It is believed to affect red blood cells, causing anemia, and it can damage the kidneys and liver. It irritates the soft tissues of living organisms, including the nasal tube and eyes. In addition to its potential health risks, it is one of the world's most combustible gases and contains several dangerous substances that can damage the environment. Therefore, these factors will hinder the growth of the mercaptan market.

Mercaptan Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 2.13 billion |

|

Forecast Year Market Size (2035) |

USD 3.44 billion |

|

Regional Scope |

|

Mercaptan Market Segmentation:

Type (Methyl Mercaptan, Ethyl Mercaptan, Propyl Mercaptan, Butyl Mercaptan, Octyl Mercaptan, Dodecyl Mercaptan)

The methyl mercaptan segment in mercaptan market will gain a notable share during the assessed period. The segment growth can be attributed to its rising demand in poultry and oil & gas industries. The blood, brain, and tissues of living things, including people, animals, and plants, contain the chemical compound methyl mercaptan. Additionally, it is present in many foods, including cheese, asparagus, and almonds. Organosulfur is a volatile chemical compound that contains sulfur and is methyl mercaptan.

The most prevalent form of mercaptan utilized in animal nutrition is methyl mercaptan, which is also used to produce methionine. As a nutritional supplement, methionine is mostly used in the feed for cattle and poultry. Therefore, a rise in the demand for meat, especially poultry, is expected to propel the mercaptan market. According to the FAO, it is estimated that by 2030, chicken meat will account for 41% of all protein derived from meat sources, marking a 2-percentage point increase from previous levels. In comparison, the global shares for other types of meat are lower: beef is projected at 20%, pig meat at 34%, and sheep meat at just 5%.

Application (Pesticides, Jet Fuels & Plastics, Natural Gas, Food & Nutrition, Animal Feed, Others)

Animal feed segment is projected to dominate mercaptan market share of over 55.4% by 2035. As one of the primary precursors for the import of methionine, methyl mercaptan is a crucial technique for raising the caliber of animal feed. One of the most essential nutrients for the growth, reproduction, and general health of livestock is methionine, an essential amino acid. As the world population is increasing there will be an enormous focus on serving high-quality sources of protein, especially from animals then this underlines the necessity for effective feed additives. Moreover, the movement towards more intensive livestock farming practices has increased feed requirements and the need for additives that can support rapid weight gain while efficiently converting feed. Therefore, these factors altogether are accelerating the growth of the animal feed segment.

Our in-depth analysis of the mercaptan market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mercaptan Market Regional Analysis:

North America Market Statistics

North America in mercaptan market is anticipated to account for around 44.1% revenue share by 2035. The market growth can be ascribed to the robust agricultural, pharmaceutical, and energy production sectors that comprise the region’s well-established chemical manufacturing industry. This industry generates significant demand for mercaptans, which serve as essential intermediates. The rising need for mercaptans, particularly ethyl mercaptan—used for odorization in natural gas distribution—is largely driven by the increasing consumption of natural gas. Additionally, commercial demand is further propelled by regulatory mandates necessitating the incorporation of odorants into natural gas. The landscape is characterized by a competitive environment fostering the development of innovative applications related to mercaptans, influenced by the presence of renowned chemical corporations and entrepreneurial innovation.

Correspondingly, the requirement for dependable odorants like mercaptan grows as the U.S. makes more investments in the construction of pipelines and storage facilities. For instance, in August 2020, the U.S. Department of Energy announced USD 33 million in financing for 10 projects under the Rapid Encapsulation of Pipelines Avoiding Intensive Replacement (REPAIR) initiative of the Advanced Research Projects Agency-Energy (ARPA-E). To repair existing cast iron and bare steel pipes, REPAIR teams created new, sturdy pipes inside of old ones using a technique known as natural gas transmission pipeline retrofitting.

The need for mercaptan has also increased due to the increase in natural gas demand brought on by the growth in residential and commercial development activity. The use of mercaptan as an odorant is essential to preserving a safe and effective gas distribution system as more residences and commercial buildings switch to natural gas for cooking, heating, and other uses. Also, businesses in the gas and chemical sectors are spending money on R&D to increase the production efficiency of mercaptan, guaranteeing a steady supply to satisfy the expanding demands of different industries.

Furthermore, Canada is a major producer and exporter of natural gas, therefore, the country requires mercaptans to ensure safety and compliance with regulatory standards. Additionally, the increasing development of infrastructure for gas processing and distribution fuels the mercaptan market demand. Also, the growth of Canada’s oil sands and petrochemical industries, where mercaptan is used in refining processes and as chemicals.

APAC Market Analysis

Asia Pacific mercaptan market is expected to grow at a significant rate during the projected period. The primary drivers of this expansion are increased government investment, expanded production capacity, collaboration among significant regional businesses, and strong end-use sector demand.

China has helped the mercaptan market in the region grow as one of the largest producers and users of agrochemicals. Moreover, as China expands its natural gas production and consumption to transition to cleaner energy sources, the need for mercaptans as odorizing agents in gas safety systems has surged. Additionally, the country’s robust petrochemical and refining industries use mercaptans as intermediates in processes like polymerization and catalyst development. Government investments in expanding natural gas pipelines, LNG terminals, and chemical manufacturing facilities further fuel the mercaptan market’s growth.

Furthermore, India is experiencing an increasing demand for butyl mercaptan from various sectors such as petrochemicals, agrochemicals, and pharmaceuticals. Butyl mercaptan is extensively used as an intermediate in chemical synthesis and in the production of pesticides and herbicides, which are in high demand to support India’s agriculture sector. Also, limited domestic production capacity and reliance on international suppliers to meet the growing demand for butyl mercaptan drive its import growth consequently fueling the mercaptan market. India received 70 shipments of butyl mercaptan between March 2023 and February 2024 (TTM), according to Volza's India Import statistics. Ten foreign exporters provided these imports to seven Indian consumers, representing a 40% increase over the previous 12 months. 13 shipments of Butyl Mercaptan were imported by India during this time, in February 2024 alone. This represents a sequential increase of 550% from January 2024 and a 333% year-over-year increase from February 2023.

Key Mercaptan Market Players:

- Chevron Phillips Chemical Company LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Arkema S.A.

- Huntsman International LLC

- Evonik Industries AG

- Jiande Lvke Chemical Industry Co., Ltd.

- Finetech Industries Limited

- Sigma-Aldrich

- DuPont de Nemours, Inc.

- Solvay S.A.

- Akzo Nobel N.V.

The mercaptan market will continue to grow as a result of major companies in the industry making significant investments in R&D to broaden their product ranges. Key market developments include new product releases, contractual agreements, mergers and acquisitions, increased investments, and cooperation with other organizations. Market participants are also engaging in several strategic actions to broaden their presence. The mercaptan sector needs to provide affordable products to grow and thrive in a more competitive and expanding mercaptan market environment.

Recent Developments

- In October 2024, Evonik celebrated 50 years of methionine production in Antwerp, which now serves as the European hub for MetAMINO (DL-methionine), an essential amino acid used in animal feed, alongside the Wesseling site in Germany. The company used the occasion to celebrate and engage with EU policymakers.

- In April 2023, Adisseo, one of the world's leading feed additive firms, announced plans to establish a new powder methionine plant with an annual production capacity of 150 tons in Fujian Province, China. The overall investment is projected to be approximately USD 68 million.

- Report ID: 7098

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mercaptan Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.