Mentoring Software Market Outlook:

Mentoring Software Market size was valued at USD 1.53 billion in 2025 and is likely to cross USD 4.92 billion by 2035, expanding at more than 12.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of mentoring software is assessed at USD 1.7 billion.

The reason behind the growth is impelled by growing online education across the globe. Over the past ten years, there has been a noticeable increase in the number of people pursuing online learning as people have been able to acquire new skills owing to growing usage of the internet, the availability of many online learning systems including Udemy, Coursera, Lynda, Skillshare, and Udacity which are often less expensive than conventional classroom-based courses, and are easily accessible from any computer or mobile device. For instance, with more and more corporations requiring their staff to complete coursework online, the e-learning market is predicted to expand by more than 14% a year.

The growing innovations in mentoring software are believed to fuel the mentoring software market growth. Artificial intelligence (AI)-powered mentoring tools are software programs that combine users' social and educational circumstances to generate a personalized and well-curated learning program to improve the process of mentoring, personalize mentor-mentee matching, and help mentees and mentors alike acquire important skills.

Key Mentoring Software Market Insights Summary:

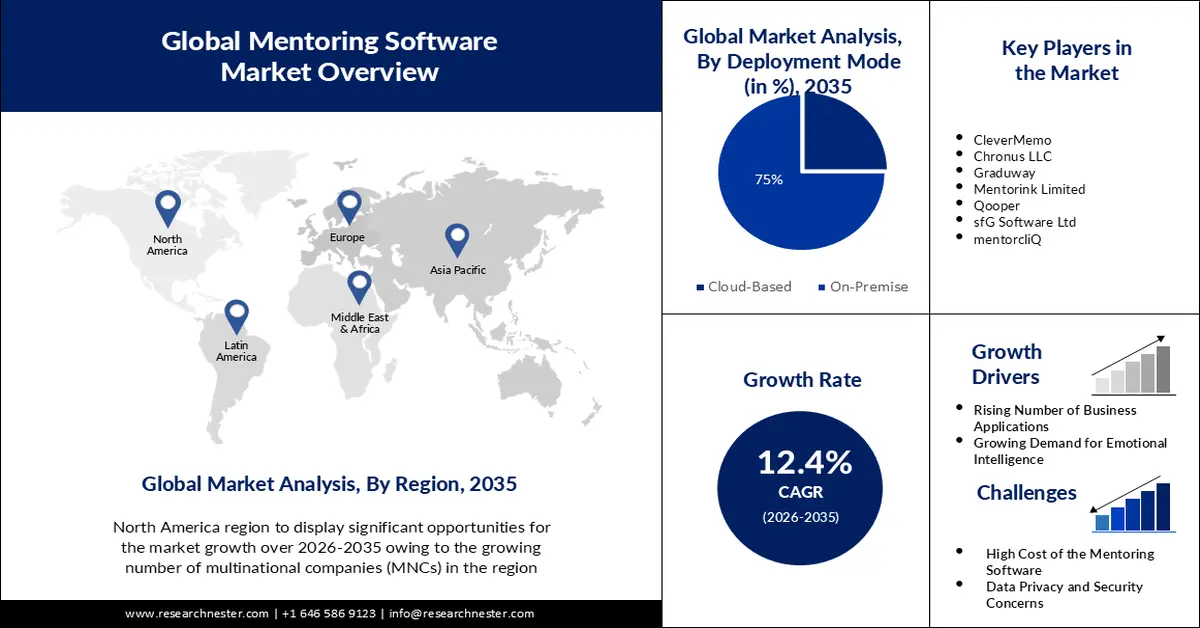

Regional Insights:

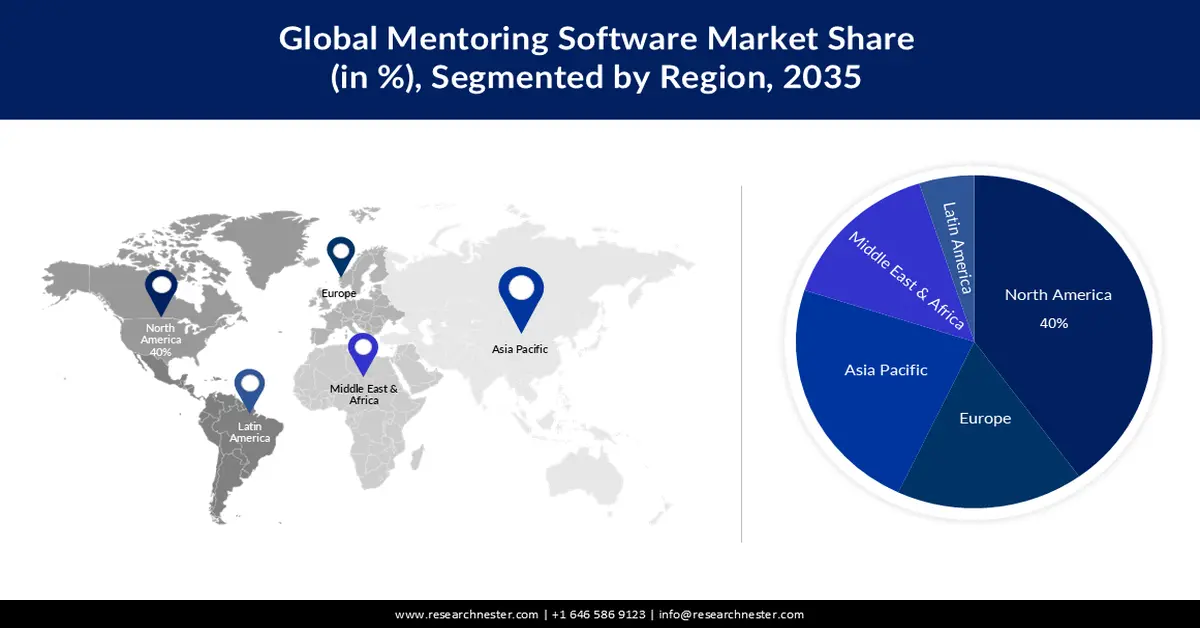

- North America is projected to capture a 40% share of the mentoring software market by 2035, driven by the rising presence of multinational corporations and their growing reliance on structured mentoring programs.

- The Asia Pacific region is expected to secure the second-largest share by 2035, supported by expanding IT sector investments and accelerated digital transformation initiatives across emerging economies.

Segment Insights:

- The on-premise segment is anticipated to command a 75% share in the coming years, propelled by its ability to offer enhanced data security and full organizational control over confidential mentorship information.

- The SMEs segment is projected to attain a notable market share, fueled by increasing adoption of structured mentorship programs across business centers and educational institutions to enhance leadership and career development outcomes.

Key Growth Trends:

- Rising Number of Business Applications

- Growing Demand for Emotional Intelligence

Major Challenges:

- High Cost of the Mentoring Software

- Data Privacy and Security Concerns

Key Players: CleverMemo, Chronus LLC, Graduway, Mentorink Limited, Qooper, sfG Software Ltd, mentorcliQ, Oracle, almabase.

Global Mentoring Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.53 billion

- 2026 Market Size: USD 1.7 billion

- Projected Market Size: USD 4.92 billion by 2035

- Growth Forecasts: 12.4%

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, Singapore, Thailand, Australia, Mexico

Last updated on : 21 November, 2025

Mentoring Software Market - Growth Drivers and Challenges

Growth Drivers

- Rising Number of Business Applications - Mentorship app development is designed for enterprise applications to serve as a mentoring platform to cultivate talent within companies, and to link users with seasoned mentors who can impart knowledge, wisdom, and insights across a range of disciplines.

- Growing Demand for Emotional Intelligence- Both the mentor and the mentee will gain from developing emotionally intelligent abilities before or during a mentoring program since it enhances their skill set, and raises self-awareness. By 2030, there will be more than a 25% increase in demand for emotional intelligence. Moreover, work performance is influenced by emotional intelligence in around 55% way.

- Surging Employment Turnover- Employer turnover is costing businesses money; therefore, firms are learning the advantages of putting in place a consistent mentorship program to promote staff growth, engagement, and retention.

- Increasing Adoption of Mentorship Programs- Mentoring software makes it simple for program administrators to design and manage mentoring programs that can improve the personal and professional lives of both mentors and mentees, making them an excellent investment for organizations.

- Rapid Digital Transformation- Particularly in this age of remote work and digital transformation, digital mentoring is an effective means of providing assistance and growth for an organization's staff and assisting underprivileged students in acquiring the skills necessary to be successful in the workforce.

Challenges

- High Cost of the Mentoring Software - Depending on the functionality and scalability of the software, the average cost of mentoring software can differ significantly which worries every potential client.

- Data Privacy and Security Concerns- Since mentoring software handles and retains private data, employees with malicious intent or dissatisfaction may use their security clearances to breach networks and systems.

- Scarcity of technical workers for operating the software

- Lack of awareness related to the Software is expected to limit the Adoption

Mentoring Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.4% |

|

Base Year Market Size (2025) |

USD 1.53 billion |

|

Forecast Year Market Size (2035) |

USD 4.92 billion |

|

Regional Scope |

|

Mentoring Software Market Segmentation:

Deployment Mode Segment Analysis

The On-Premise segment is estimated to gain a robust market share of 75% in the coming years. Selecting the deployment mode cloud /on-premise can have an impact on data security therefore, for any company, on-premise software can be the best choice since it enables total control over the protection of the data, and is especially important for handling confidential mentorship data. On-premise solutions are accessed via a desktop program and deployed on the servers of the company and can easily connect mentoring software in line with the special structure of the company.

On-premise systems frequently provide higher processing rates and lower latency which is especially helpful for mentoring programs. Moreover, large businesses may find on-premise implementation especially appealing owing to their high levels of control.

Additionally, a cloud-based solution for managing mentoring programs was created to assist enterprises in managing groups whereby mentors and mentees may communicate, publish assignments and events, access resources, create objectives, and monitor their development. Furthermore, a cloud-based mentorship program emphasizes personal growth and reports to keep programs focused and motivated, which also helps mentoring programs flourish and makes it possible for organizations to place their personnel in productive mentorships at any size.

Organization Segment Analysis

The SMEs segment is set to garner a notable share shortly. Numerous establishments, including business centers and universities, provide complimentary business mentorship initiatives to gain business confidence by working with seasoned mentors since it can be very helpful to anyone who wants to improve their leadership abilities, business acumen, and general career growth and has several advantages that can assist in reaching company objectives.

A small or medium-sized firm, may not have a supervisor who can provide employee engagement and motivation programs, this gap can frequently be filled by a mentor, who serves as a coach to offer assistance, inspiration, affirmation, and support and may assist in defining essential duties and guiding company's goals.

Our in-depth analysis of the global mentoring software market includes the following segments:

|

Organization |

|

|

Deployment Mode |

|

|

Verticals |

|

|

Program |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mentoring Software Market - Regional Analysis

North American Market Insights

The mentoring software market in North America industry is poised to dominate majority revenue share of 40% by 2035, impelled by the growing number of multinational companies (MNCs). The three largest multinational corporations with American headquarters are Apple Inc., Alphabet Inc., and Microsoft Corporation which greatly benefit the U.S. economy. For instance, with more than 715 businesses, the United States is the nation with the highest number of global enterprises which amounts to around 32% of all MNCs with headquarters in the United States.

APAC Market Insights

The APAC mentoring software market is estimated to be the second largest, during the forecast timeframe led by the growing funding in the information technology sector. For instance, India is expected to spend over USD 124 billion on IT in 2024, a 10% rise from 2023. Particularly, in 2022, the IT services segment—which encompasses managed and consulting services—saw the second-highest growth in spending driven by digital initiatives in the public sector and investments in telecom, and tech outsourcing.

Mentoring Software Market Players:

- Xinspire, LLC.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CleverMemo

- Chronus LLC

- Graduway

- Mentorink Limited

- Qooper

- sfG Software Ltd

- mentorcliQ

- Oracle

- almabase

Recent Developments

- Oracle announced the AI-powered dynamic solution in Oracle Cloud HCM that helps organizations to better understand, manage, and grow the skills of their workforce.

- Graduway announced the acquisition of VineUp to take advantage of innovative technology for alumni networking and mentoring software.

- Report ID: 4289

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mentoring Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.