Meningitis Imaging Market Outlook:

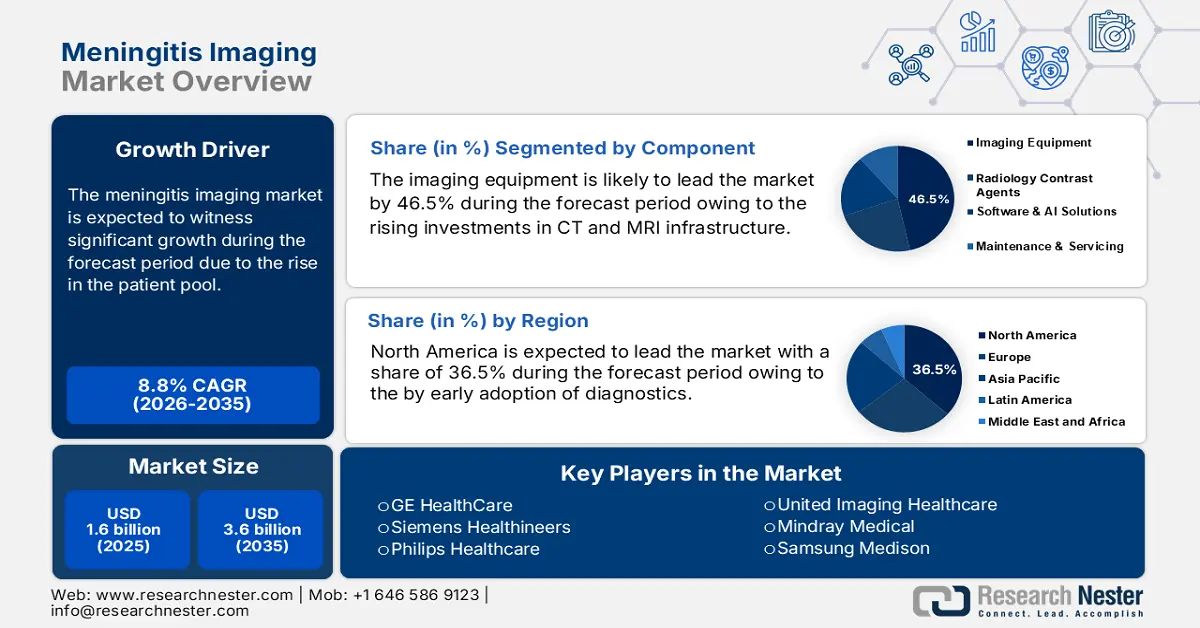

Meningitis Imaging Market size was valued at USD 1.6 billion in 2025 and is projected to reach USD 3.6 billion by the end of 2035, rising at a CAGR of 8.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of meningitis imaging is evaluated at USD 1.7 billion.

The global meningitis imaging market is driven by an increasing patient base, mainly in low- and middle-income nations where bacterial and viral meningitis is a key source of neurological disability. The Meningitis Research Foundation report in 2024 depicts that more than 2.3 million cases of meningitis are reported worldwide in 2021, and nearly 83.02% of the global burden comes from the lower-middle-income countries. In the U.S., the CDC surveillance report depicts that emergency visits due to meningitis-related imaging increased over the past decade in response to increased awareness and policies for early intervention.

The OEC statistics in 2023 depict that the global trade of MRI devices accounted USD 6.2 billion in 2023, up 6.88% compared to 2022. Further, Germany is the leading exporter of MRI devices, accounting for USD 1.79 billion, followed by the U.S. and China. Governments are increasingly interested in regionalizing assembly lines as a way to lower dependence on limited trade partners. In the same year, the leading importer of MRI machines is the Netherlands, importing worth USD 597 million. This demand is surging the supply chains for medical imaging equipment, radiology components, and contrast agents.

Key Meningitis Imaging Market Insights Summary:

Regional Insights:

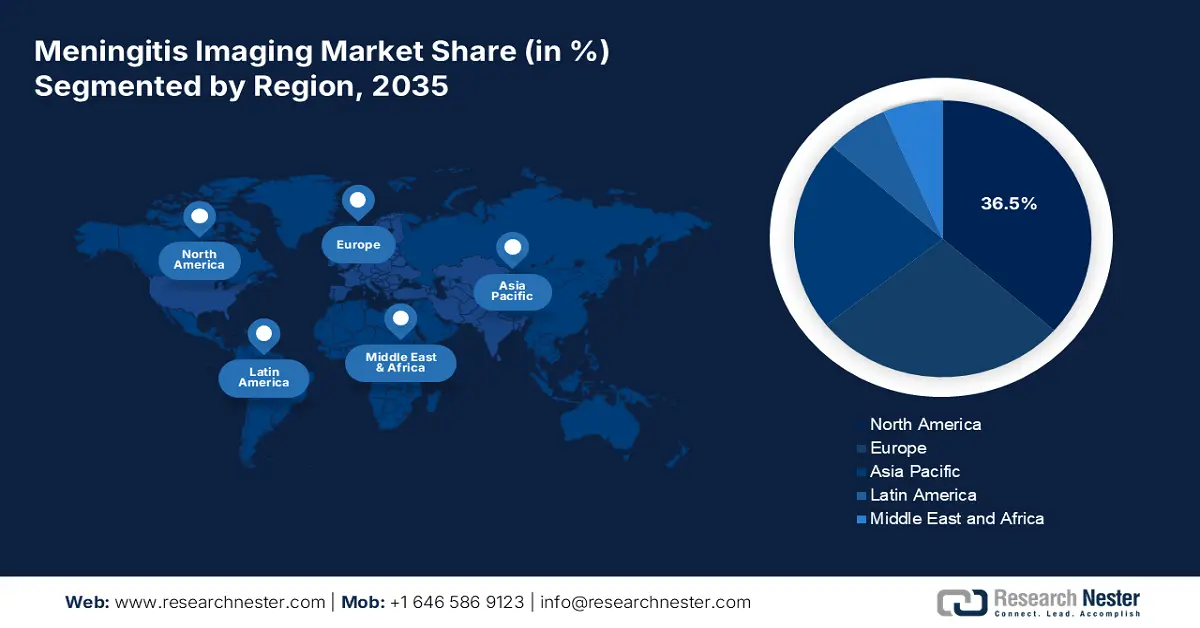

- North America is anticipated to command a 36.5% share of the Meningitis Imaging Market by 2035, owing to early adoption of diagnostic technologies, robust government support, and the integration of MRI, CT, and PET neuroimaging systems within emergency departments.

- Asia-Pacific region is expected to witness the fastest expansion through 2026–2035, attributed to rising disease awareness, healthcare infrastructure advancement, and increasing government healthcare expenditure.

Segment Insights:

- Imaging Devices segment is projected to hold a 46.5% share by 2035 in the Meningitis Imaging Market, driven by continuous investment in CT and MRI facilities across high- and middle-income countries to enhance early neurological diagnosis of meningitis and its complications.

- Hospitals segment is anticipated to maintain its lead by 2035, propelled by the centralization of diagnostics, adoption of advanced radiological equipment, and integration into national infectious disease management frameworks.

Key Growth Trends:

- Increase in patient registration and disease occurrence

- Import/Export and imaging equipment availability

Major Challenges:

- Logistics disparities in emerging nations

Key Players: GE HealthCare, Siemens Healthineers, Philips Healthcare, United Imaging Healthcare, Mindray Medical, Samsung Medison, Medtronic Imaging, Esaote S.p.A, Agfa-Gevaert Group, NeuroLogica Corporation, Carestream Health, Trivitron Healthcare, iGene Laboratory Sdn Bhd, Curatif Imaging Solutions, BPL Medical Technologies, Canon Medical Systems, Fujifilm Healthcare, Hitachi Healthcare, Shimadzu Corporation, Nihon Kohden Imaging.

Global Meningitis Imaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.6 billion

- 2026 Market Size: USD 1.7 billion

- Projected Market Size: USD 3.6 billion by 2035

- Growth Forecasts: 8.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 25 September, 2025

Meningitis Imaging Market - Growth Drivers and Challenges

Growth Drivers

- Increase in patient registration and disease occurrence: As per the European Centre for Disease Prevention and Control report in April 2024, the region has recorded 110 death cases of invasive meningococcal disease, in 30 EU member states. In Germany, the rising disease burden among patients demands an increase in imaging diagnostics, based on the improvement in reporting and access to primary care. Further, North America shows a significant growth, based on the NLM report in November 2023, with nearly 1.33 cases per 100 000 individuals of bacterial meningitis is occurred requiring for imaging-related meningitis evaluations yearly in the U.S. The rising patient pool continues to fuel the meningitis imaging market demand for scalable neuroimaging infrastructure in inpatient and emergency settings.

- Import/Export and imaging equipment availability: According to the U.S. International Trade Commission, Japan, Germany, and Netherlands diagnostic imaging system imports increased year-on-year in 2024. Trade growth has been pivotal in regions like Southeast Asia and Sub-Saharan Africa, where the meningitis burden is still high. Shortages of equipment, delays in semiconductors, and increased import duties on imaging parts, however, have surged prices up, with implications for rollout in poor countries. Strategic investment in home-based assembly lines and diversified supply chains will play a critical role in stabilizing supply and reducing diagnostic bottlenecks.

- Surging out of pocket spending: On average, the U.S. patients spend USD 1,119, based on common wealth fund report in January 2023 in meningitis-based imaging services, mainly MRIs, due to the high deductible health plans. CMS reports have depicted that apart from insurance coverage, diagnostic imaging remains as primary contributor to medical debt in low income households. Further, out of pocket cost for contrast-enhanced MRIs are rising YoY, minimizing access among the underinsured population. These trends focus the need for mobile radiology and cost effective imaging packaging in semi urban and rural areas.

Meningitis Imaging Market Value for MRI Equipment From 2022 to 2025

|

Year |

Value (INR Cr) |

|

2022 |

1425 |

|

2023 |

1471 |

|

2024 |

1519 |

|

2025 |

1571 |

Source: Competition Commission of India, August 2024

Annual Meningitis Cases in 2021

|

Country |

Cases |

|

India |

421,775 |

|

Nigeria |

335,986 |

|

Pakistan |

135,962 |

|

Ethiopia |

123,077 |

|

China |

68,619 |

|

Brazil |

36,541 |

Source: Meningitis Research Foundation, 2024

Challenges

- Logistics disparities in emerging nations: The WHO report states that low-income countries in Africa in meningitis imaging centers do not have operational MRI/CT scanners, primarily because of inadequate import infrastructure and the unavailability of spare parts. This hinders dependable device deployment by international manufacturers. Delays in customs clearance and also the unavailability of trained biomedical engineers further hinder affect timely installation and maintenance of equipment. Consequently, many rural hospitals use outdated or mobile diagnostic units, which lowers image quality and diagnostic precision.

Meningitis Imaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.8% |

|

Base Year Market Size (2025) |

USD 1.6 billion |

|

Forecast Year Market Size (2035) |

USD 3.6 billion |

|

Regional Scope |

|

Meningitis Imaging Market Segmentation:

Component Segment Analysis

Imaging devices is estimated to have a value share of 46.5% by 2035. This dominance is because continuous investment in the CT and MRI facilities in both high- and middle-income countries in an attempt to facilitate early neurological diagnosis of meningitis as well as its complications. The growth in meningitis imaging is driven by advancements in imaging systems, integration of artificial intelligence for enhanced diagnosis, and rising investments in the healthcare sector. The growth is further driven by bases of installed legacy systems aging and being replaced as part of national digital healthcare programs.

End user Segment Analysis

Hospitals dominate the end-user segment and is propelled by their centralization of diagnostics, ease of use of advanced radiological equipment, and inclusion in national infectious diseases management guidelines. According to the CDC report in May 2025, meningococcal disease incidence escalated dramatically in 2023 and 2024, reporting 503 cases in 2024. These increased trends highlight the significance of meningitis imaging in public health response and clinical diagnosis.

Imaging Modality Segment Analysis

Magnetic resonance imaging is the leading segment in the image modality segment. Magnetic Resonance Imaging (MRI) leads the segment because of its greater sensitivity in examining meningeal inflammation, abscesses, and complications such as hydrocephalus or ventriculitis. U.S. National Library of Medicine highlights the efficiency of MRI in diagnosing early bacterial and viral meningitis when clinical symptoms prove to be ineffective. In addition, the National Institute of Biomedical Imaging and Bioengineering (NIBIB) was allocated a budget of about USD 419.5 million in FY2023, an increase of 2.1% from FY2022, for research on imaging technologies, such as MRI optimization.

Our in-depth analysis of the meningitis imaging market includes the following segments:

|

Segment |

Subsegments |

|

Imaging Modality |

|

|

End user |

|

|

Disease Type |

|

|

Trade |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Meningitis Imaging Market - Regional Analysis

North America Market Insights

North America is the dominating region in the meningitis imaging market and is projected to hold share of 36.5% by 2035. The market is driven by early adoption of diagnostics, government support, and tech-enabled healthcare infrastructure. The inclusion of MRI, CT, and PET neuroimaging within emergency rooms, fueled by CDC guidelines for meningitis detection, is a strong growth driver. As per the NLM report in November 2023, 5 cases were found in the U.S. regarding fungal meningitis and have undergone spinal anaesthesia-related surgical procedures. The extensive use of imaging diagnostics in the screening of meningitis also picked up pace in both nations.

The U.S. meningitis imaging market is driven by strong federal investments and a technology-intensive healthcare environment. The CDC and AHRQ extended infectious disease imaging guidelines within hospitals from 2022 to 2024, helping in the diagnosis of early-stage meningitis. The NLM report in November 2023 stated that approximately 4,100 bacterial meningitis cases occur in the US, with an overall incidence of about 1.0 to 1.33 cases per 100,000 people. Viral meningitis cases (enteroviral) number around 75,000 annually, making up over half of all meningitis cases. The rising cases drives the market in the region.

APAC Market Insights

The Asia-Pacific is the fastest-growing region in the meningitis imaging market is anticipated to hold a considerable share by 2035. The market is driven by increasing disease awareness, enhanced healthcare infrastructure, and growing government healthcare budgets. Advances in MRI and CT systems, also in AI-driven diagnostics, are boosting rates of early detection of meningitis. As per the WHO report published in 2025, the common cause of death in the South East Asia region is bacterial meningitis with 23%. Industry leaders are actively investing in R&D on safe and affordable vaccines against meningitis.

The meningitis imaging market in China is expanding rapidly. The China CDC report in 2025 states that over the past two decades, the total cases of meningococcal meningitis reached 6,431. The burden of meningococcal meningitis remains the same among the people in China. In addition, the report highlights the need for meningococcal disease vaccination and serogroup B meningococcal vaccine development within the region. Additionally, greater availability of diagnostic tests has resulted in earlier meningitis case detection, improved outcomes for the patient, and decreased hospitalization rates.

India’s Electromedical Equipment Import Data from 2020 to 2025

|

|

FY2020-21 |

FY2021-22 |

FY2022-23 |

FY2023-24 |

FY2024-25 |

|

Electromedical equipment (including ventilators and diagnostic imaging equipment) |

3,569 |

5,441 |

4,884 |

5,408 |

5,284 |

|

Surgical Instruments |

104 |

169 |

210 |

205 |

263 |

Source: Medical Dialogues, April 2025

Europe Market Insights

Europe meningitis imaging market is expected to account for a major share in 2035. Increasing rates of infection, early diagnosis programs, and the funding support by the EU are fueling the market. Improvements in the neuroimaging technologies like MRI and CT-based CSF diagnostics, together with the government's higher investments in digital healthcare infrastructure, are fueling the penetration of the market. with a focus on meningitis. In addition, the ECDC report in April 2024 indicates that almost 1,149 cases of meningococcal disease were recorded, emphasizing the need for advanced meningitis imaging. National health bodies such as the UK NHS, Germany's BMG, and France's HAS are conforming to EU directives to reduce diagnostic delays.

Germany's meningitis imaging market is the largest share holder in the Europe. As per the Federal Ministry of Health report in August 2025, €4.4 billion is allocated to the healthcare sector, parts of which includes in the adoption of advanced meningitis imaging technologies. The demand of the region is combined with the expanding patient access and rising neurological disorder incidence, is expected to position Europe as a dominant player in the global meningitis imaging market by 2035.

Key Meningitis Imaging Market Players:

- GE HealthCare

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens Healthineers

- Philips Healthcare

- United Imaging Healthcare

- Mindray Medical

- Samsung Medison

- Medtronic Imaging

- Esaote S.p.A

- Agfa-Gevaert Group

- NeuroLogica Corporation

- Carestream Health

- Trivitron Healthcare

- iGene Laboratory Sdn Bhd

- Curatif Imaging Solutions

- BPL Medical Technologies

- Canon Medical Systems

- Fujifilm Healthcare

- Hitachi Healthcare

- Shimadzu Corporation

- Nihon Kohden Imaging

The global meningitis imaging market is very competitive and is fueled by the rising incidence of meningitis cases and advancements in diagnostic imaging technologies. Key players in the market, such as Siemens Healthineers, GE HealthCare, and Canon Medical Systems, are utilizing AI-based imaging tools, cross-functional neurology systems, and integrated diagnostic platforms to gain a competitive edge. Regional expansion, substantial R&D investments, and strategic collaborations are the methods adopted by key players to dominate the meningitis imaging market. Further, startups in the Asia Pacific, mainly in South Korea, Malaysia, and India, are focusing on cost-effective imaging solutions customized for public healthcare systems.

Here is a list of key players operating in the meningitis imaging market:

Recent Developments

- In July 2025, NEOSONICS released a portable ultrasound device applying high-frequency sound waves and AI deep learning algorithms for non-invasive detection of infant meningitis. Clinical trials showed sensitivity of 94% and specificity of 95%, significantly reducing the need for lumbar punctures and accelerating infant meningitis diagnosis in resource-limited settings.

- In January 2025, Siemens Healthineers introduced MAGNETOM Flow MRI which is an AI-based 1.5 Tesla magnetic resonance imaging (MRI) platform. The integration of AI reduces the scan times and improves image quality and resolution.

- Report ID: 8126

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Meningitis Imaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.